ID: PMRREP3377| 220 Pages | 18 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

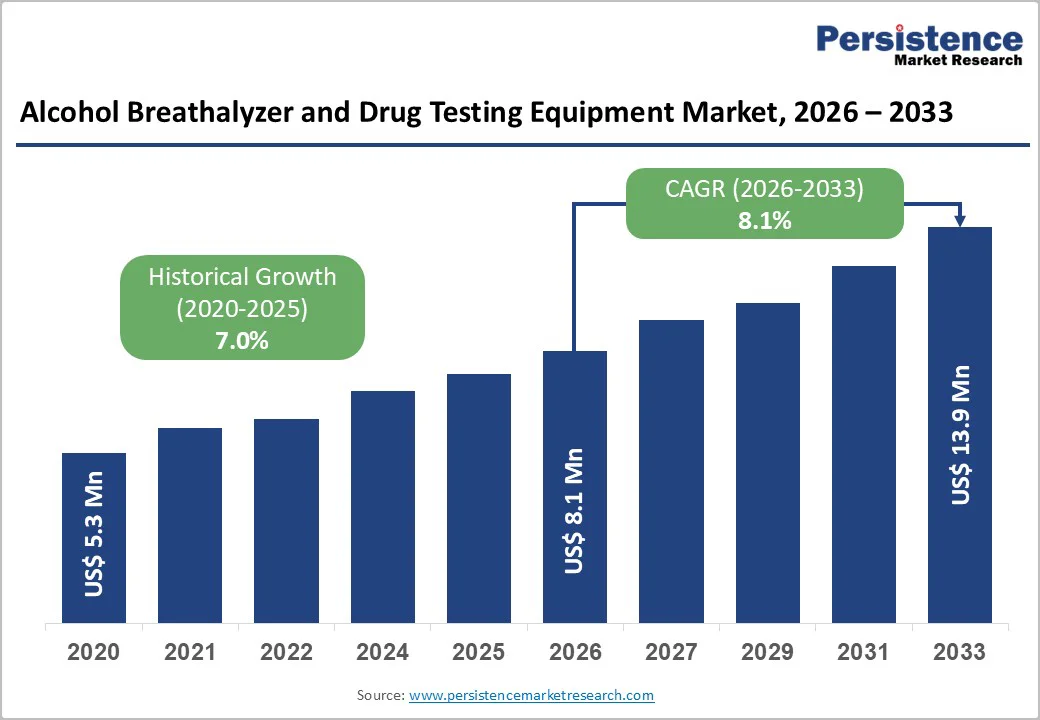

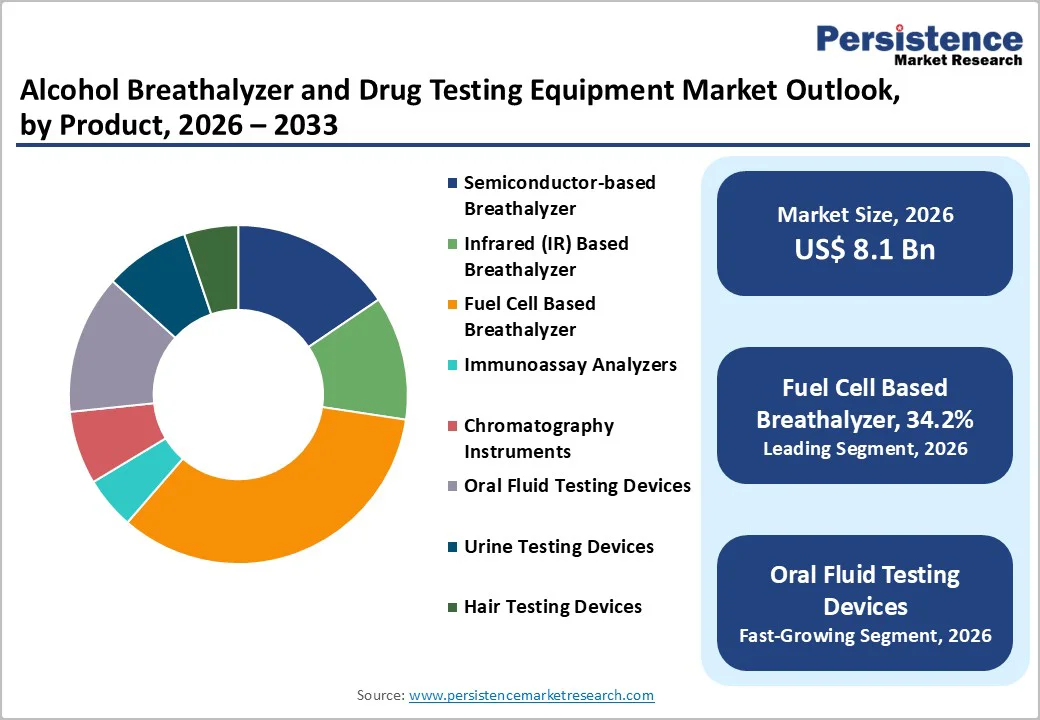

The global alcohol breathalyzer and drug testing equipment market size is estimated to reach US$ 8.1 billion in 2026 and is projected to reach US$ 13.9 billion by 2033, growing at a CAGR of 8.1% between 2026 and 2033. Alcohol and drug testing equipment are essential tools for accurately assessing intoxication levels resulting from alcohol or drug use across law enforcement, workplaces, healthcare, and rehabilitation settings.

These devices include breathalyzers, urine and oral fluid testing systems, hair testing devices, immunoassay analyzers, and chromatography instruments, each offering varying detection windows and precision levels. Their adoption continues to rise due to increasing road safety enforcement, workplace compliance requirements, and growing awareness around substance abuse monitoring. Together, these technologies support rapid, reliable screening and play a critical role in public safety and clinical decision-making.

| Key Insights | Details |

|---|---|

|

Global Alcohol Breathalyzer and Drug Testing Equipment Market Size (2026E) |

US$ 8.1 Billion |

|

Market Value Forecast (2033F) |

US$ 13.9 Billion |

|

Projected Growth (CAGR 2026 to 2033) |

8.1% |

|

Historical Market Growth (CAGR 2020 to 2025) |

7.0% |

The global alcohol breathalyzer and drug testing equipment market is primarily driven by the rising prevalence of alcohol-related road accidents and the increasing emphasis on public safety enforcement worldwide. Governments and law enforcement agencies are expanding roadside testing and workplace compliance initiatives to reduce fatalities and maintain safety standards.

For instance, in February 2024, the National Road Safety Council (NRSC) in Jamaica secured US$400,000 funding through the United Nations Road Safety Fund to procure speed-monitoring devices and breathalyzers for the Jamaica Constabulary Force (JCF), enabling faster, more accurate roadside screening. This investment underscores the growing reliance on advanced detection technologies to enhance enforcement efficiency.

Further emphasizing this trend, in May 2024, the Pan American Health Organization (PAHO), in partnership with NRSC, donated 52 alcohol breathalyzers (including 50 Intoxilyzer 300 and two Intoxilyzer 9000 units, valued at approximately US$55,000) to the Jamaican government. These devices, deployed across 20 checkpoints, have facilitated over 500 tests within a short period, improving roadside detection and enabling better compliance with safety regulations.

Overall, the global market growth is propelled by stringent DUI (driving under the influence) regulations, rising alcohol-impaired driving awareness, and continuous adoption of advanced, portable, and reliable alcohol testing technologies in both developed and emerging economies.

Despite growing demand, the global alcohol breathalyzer and drug testing equipment market faces several restraints that could limit rapid adoption. High equipment costs, especially for fuel cell–based and infrared breathalyzers, pose affordability challenges for smaller law enforcement agencies and private sector organizations in emerging markets. Additionally, calibration, maintenance, and consumables requirements increase operational complexity and long-term expenditures.

Accuracy and reliability concerns also hinder market expansion. Environmental factors such as temperature, humidity, and device handling can lead to inconsistent results, reducing confidence in roadside or workplace testing outcomes. Moreover, false positives from interfering substances in breath, oral fluid, or urine samples necessitate confirmatory testing, delaying results and increasing operational burden.

Regulatory and legal barriers further complicate deployment. Variations in certification standards across countries, as well as stringent evidence requirements for court-admissible results, limit cross-border adoption and standardization. For instance, certain portable devices must comply with multiple national standards before being accepted for official enforcement.

Overall, these factors—high costs, operational complexities, potential inaccuracies, and regulatory hurdles—collectively restrain the pace of market growth, particularly in emerging economies where budget and infrastructure limitations are more pronounced.

The global alcohol breathalyzer and drug testing equipment market presents significant growth opportunities driven by rising workplace safety awareness, technological innovations, and demand for rapid, non-invasive testing solutions. Increasing regulatory enforcement in road safety and occupational health is encouraging organizations to adopt portable and accurate alcohol and drug detection devices.

For example, in June 2025, Alco-Safe showcased a new saliva drug testing kit at the A-OSH Expo 2025 in Midrand, capable of detecting six different drugs within minutes. This portable, non-invasive solution is ideal for on-site occupational safety testing, highlighting the shift toward faster, more convenient diagnostic tools. Additionally, integration of artificial intelligence (AI), Internet of Things (IoT), and data analytics allows real-time risk monitoring and decision-making, further enhancing market potential.

Similarly, in August 2025, Lifeloc Technologies unveiled the SpinDetect™ Centrifugal Drug Analyzer at the International Association of Chiefs of Police Impaired Driving and Traffic Safety Conference in Chicago. The compact, automated system delivers lab-grade results from oral fluid samples in under 15 minutes, underscoring the growing demand for rapid, field-deployable devices. These innovations, combined with expanding adoption across law enforcement, private sector, and industrial safety programs, create ample opportunities for market expansion globally.

Fuel cell–based breathalyzers are expected to capture 34.2% of the global market by 2026, driven by their superior accuracy, long sensor life, and low cross-reactivity compared with semiconductor systems. Their reliability under variable temperatures and repeat-use scenarios has made them the preferred choice for police departments, workplace programs, and transportation authorities. Additionally, the growing global focus on road safety, increasing DUI enforcement campaigns, and adoption of evidential-grade instruments continue to reinforce demand for fuel cell–based platforms across both developed and emerging markets.

Alcohol detection is projected to hold 58.9% of the global market by 2026, supported by stringent drink-driving regulations, rising roadside screening programs, and mandatory workplace alcohol testing policies across transportation, mining, and industrial sectors. High global road-accident rates linked to alcohol consumption continue to push governments toward expanding monitoring infrastructure. Meanwhile, rapid, portable alcohol breathalyzers have become standard in law-enforcement checks, enabling faster assessment and large-scale screening, thereby sustaining the segment’s dominant share over drugs detection technologies.

Law enforcement agencies are expected to account for 42.4% of the global market by 2026, driven by the increasing frequency of sobriety checkpoints, rising adoption of fuel cell–based evidential devices, and government-led initiatives to curb alcohol-impaired driving. Police departments worldwide continue to invest in portable, rugged testing systems to support real-time roadside screening. Additionally, national road-safety campaigns and stricter penalties for driving under the influence have accelerated procurement of reliable alcohol and drug testing instruments, maintaining law enforcement as the largest end-user segment.

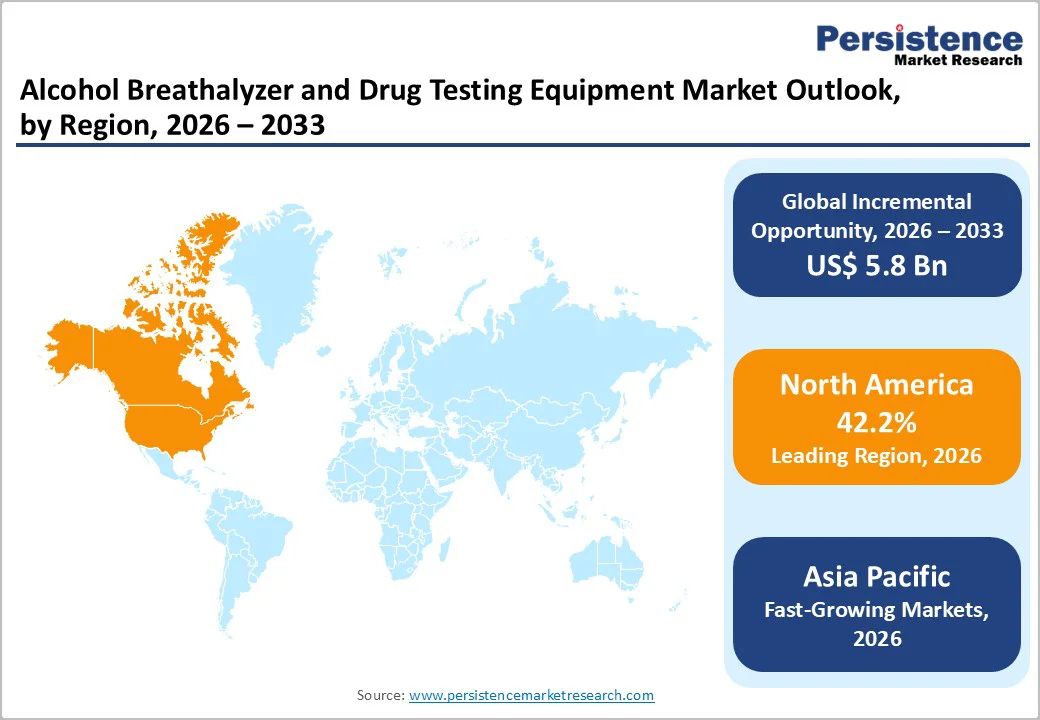

North America is projected to capture 42.2% of the global alcohol breathalyzer and drug testing equipment market by 2026, driven by rising substance use concerns, stringent workplace safety regulations, and increasing demand for advanced detection technologies. In January 2025, Cannabix Technologies Inc. reported significant updates to its Cannabix Marijuana Breathalyzer (“CMB”), enhancing the Breath Collection Unit to meet emerging regulatory requirements. This development addresses the growing need for reliable marijuana detection in workplaces, law enforcement, and public safety applications across the United States.

Workforce drug testing trends further emphasize market growth. The Quest Diagnostics Drug Testing Index™ highlights rising fentanyl use in the U.S. general workforce. In September 2025, the positivity rate for fentanyl in random workplace drug tests was 707% higher than pre-employment tests, with 60% of positive cases also involving other substances like marijuana or amphetamines. Federally mandated, safety-sensitive roles—including pilots, drivers, and nuclear plant employees—require routine testing under government agencies such as the Department of Transportation, Nuclear Regulatory Commission, and Department of Defense, further sustaining equipment demand.

Overall, North America’s market expansion is fueled by evolving drug use patterns, government-mandated testing, and the adoption of innovative, portable, and accurate alcohol and drug detection technologies across workplaces and law enforcement sectors.

Europe is projected to account for 30.4% of the global alcohol breathalyzer and drug testing equipment market by 2026, driven by high alcohol consumption, stringent road safety regulations, and growing public awareness of alcohol-related harm.

Europe is the heaviest drinking region globally, with over 20% of adults engaging in heavy episodic drinking. According to the European Commission 2024, alcohol contributes to 25% of all road deaths across the European Union, with drink-driving identified as one of the three leading causes of fatalities, alongside excessive speed and failure to wear seatbelts. Enforcement of strict alcohol regulations, along with initiatives by the European Transport Safety Council (ETSC), aims to reduce road deaths by promoting best practices and regulatory measures at both the EU and national levels.

In December 2024, the European Awareness Week on Alcohol Related Harm 2024 (AWARH24) highlighted the critical issue of alcohol-related harm, emphasizing mandatory labelling of alcoholic beverages to enable informed health decisions. Organized by Eurocare, the European Association for the Study of the Liver (EASL), and other key stakeholders in collaboration with the World Health Organization Regional Office for Europe, the campaign engaged Members of the European Parliament and policymakers to advocate for stricter alcohol control measures. These factors collectively drive demand for alcohol breathalyzers and drug testing equipment across Europe, supporting safety enforcement and public health initiatives.

The Asia Pacific market is rapidly expanding, projected to grow at a CAGR of 10.1% over the forecast period, driven by increasing road traffic incidents, stricter regulatory enforcement, rising awareness of occupational safety, and adoption of advanced alcohol and drug detection technologies.

Rapid urbanization and rising vehicle ownership have contributed to growing alcohol-related road accidents across the region. Governments are introducing stricter regulations and mandatory roadside testing programs to improve road safety. For instance, countries such as India, Australia, and Singapore have increased alcohol checkpoints and enhanced enforcement measures, encouraging the adoption of portable breathalyzers and drug testing devices.

Workplace safety initiatives further support market growth. In sectors such as manufacturing, logistics, and mining, companies are increasingly deploying drug and alcohol testing equipment to reduce accidents and ensure compliance with occupational health regulations. Technological advancements, such as portable fuel cell-based breathalyzers and rapid saliva drug testing kits, are driving demand due to their accuracy, convenience, and non-invasive nature. Integration with Internet of Things (IoT) and data analytics platforms enables real-time monitoring and compliance tracking, enhancing operational efficiency.

These combined factors, including regulatory mandates, rising safety concerns, and innovative detection solutions, are fueling the robust growth of the alcohol breathalyzer and drug testing equipment market across the Asia Pacific.

The global alcohol breathalyzer and drug testing equipment market is highly competitive, featuring established players and innovative startups. Key strategies include product launches, technological advancements, strategic partnerships, mergers and acquisitions, and geographic expansion. Companies focus on portable and rapid-testing solutions, integrating IoT and data analytics to enhance accuracy, usability, and workplace compliance, and driving differentiation in a crowded market.

The global alcohol breathalyzer market is projected to be valued at US$ 8.1 Billion in 2026.

Rising law-enforcement regulations, workplace compliance requirements, and growing public safety awareness drive global alcohol and drug testing demand drive market growth.

The global market is poised to witness a CAGR of 8.1% between 2026 and 2033.

Expansion in non-invasive testing, portable devices, and emerging markets presents growth potential for alcohol and drug testing equipment present major growth opportunities.

Major players in the global are Drägerwerk AG & Co. KGaA, Lion Laboratories, Lifeloc Technologies, Inc., Intoximeters, Andatech Safety Pacific Sdn Bhd, BACtrack, Abbott, and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author