ID: PMRREP35554| 197 Pages | 7 Aug 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

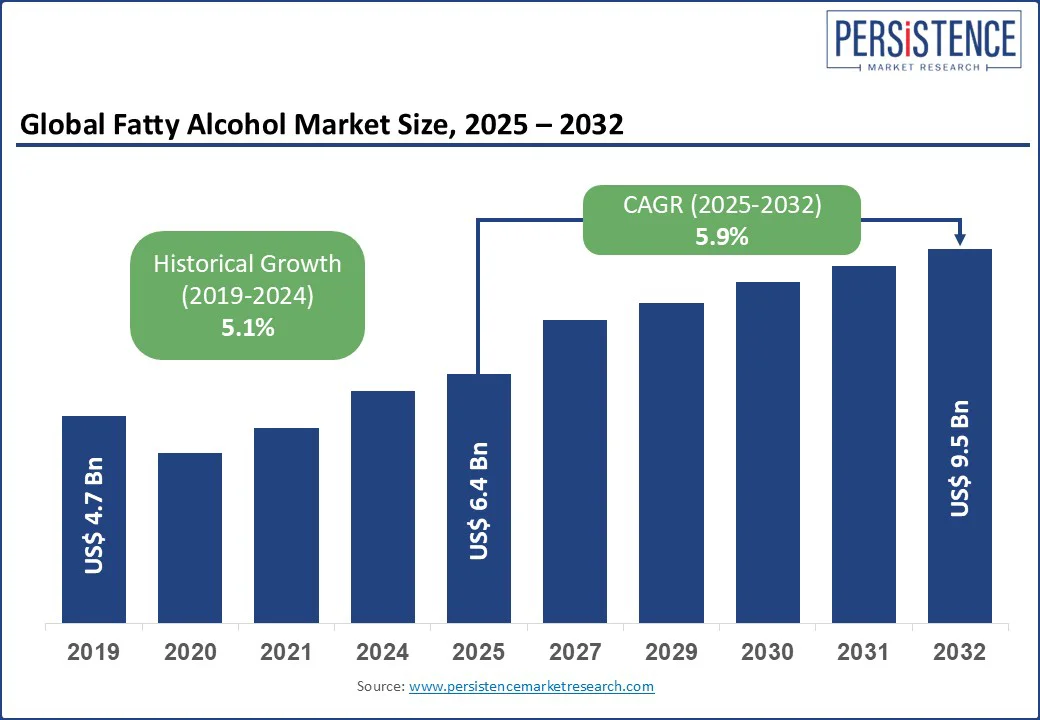

The global fatty alcohol market size is likely to be valued at US$ 6.4 Bn in 2025 and is estimated to reach US$ 9.5 Bn in 2032, growing at a CAGR of 5.9% during the forecast period 2025 - 2032. The global fatty alcohol market growth is driven by rising demand for bio-based surfactants and rise in consumption across personal care, home care, and industrial sectors. Fatty alcohols, long-chain aliphatic alcohols derived from natural fats, oils, or petrochemicals, serve as key ingredients in emulsifiers, detergents, lubricants, and cosmetics.

The shift toward sustainability and environmentally friendly formulations has led to increased adoption of natural fatty alcohols, in skin and hair care products. Growth is further supported by expanding production capacities in Asia Pacific, along with technological advancements in oleochemical processing. Price volatility for feedstocks and regulatory constraints on palm oil use influence market dynamics during the forecast period.

Key Industry Highlights:

|

Market Attribute |

Key Insights |

|

Fatty Alcohol Market Size (2025E) |

US$ 6.4 Bn |

|

Market Value Forecast (2032F) |

US$ 9.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.1% |

The integration of oleo-based fatty alcohol ethoxylates into specialized surfactant blends propels demand in high-performance cleaning and personal care formulations. Manufacturers are actively adopting renewable palm kernel oil-derived fatty alcohols as sources to meet sustainable sourcing mandates. Leading consumer brands are launching custom-designed bio-based emulsifiers with low skin irritation profiles, increasing reliance on fatty alcohol inputs. Meanwhile, processing enhancements such as catalytic hydrogenation of natural feedstocks improve yield efficiency and cost competitiveness.

The rising consumption of eco-friendly personal care emulsifier ingredients by the middle-class population in Asia Pacific fuels fatty alcohol uptake, particularly in emerging markets such as India and China. Regulatory frameworks such as REACH and extended producer responsibility are pushing the formulators toward traceable, biodegradable oleochemical alcohols and displacing petrochemical alternatives. The collaborations among fatty alcohol suppliers and detergent formulators have build the demand for C13-segment natural detergent alcohols, which combines cleaning power with eco-credentials. Finally, innovation in microbial fermentation of long-chain fatty alcohols creates opportunities in premium pharmaceutical and skincare segments.

Natural fatty alcohol producers face pressure from synthetic fatty alcohol cost arbitrage, as low-cost petrochemical alternatives often undercut oleochemical pricing. This dynamic limits the uptake of organic C13-C15 natural alcohols in premium surfactants, reducing margins. Extraction inefficiencies in vegetable oil based feedstock processing elevate production waste and diminish yield compared to synthetic routes.

In personal care, formulators hesitate to switch to bio-derived long-chain emulsifier alcohols when performance benchmarks such as foaming and shelf stability favor synthetic grades. This slows the adoption of renewable C16+ fatty alcohol substrates in high-end cosmetics. In cleaning detergents, bulk buyers frequently favor stably priced petrochemical alcohol ethoxylates over natural mid-cut alcohol precursors, dampening demand elasticity.

In specialty surfactants, the players have invested in microbial fermentation-derived fatty alcohol biosurfactants to achieve gentler, skin-friendly emulsifiers. This niche segment opens growth for sophorolipid-based glycolipid alcohol blends in high-end personal care, driven by increased adoption of biodegradable surfactants. Companies can capitalize on fermentation-sourced long-chain fatty alcohol precursors for cosmetic formulations, leveraging microbial platforms to tailor molecular profiles and reduce dependency on palm kernel oil.

In industrial applications, demand is increasing in the Asia Pacific region for oleo-based C11–C14 detergent alcohols with strong environmental credentials, driven by eco-conscious institutional buyers. This accelerates opportunities for plant-derived mid-cut fatty alcohol ethoxylates customized for low-VOC cleaning agents in markets such as India and China. Growing interest in precision-engineered bio-alcohols from microbial synthesis supports entry into premium lubricant and plasticizer niches, where sustainability and performance converge.

The fatty alcohol market is primarily segmented into natural fatty alcohols and synthetic fatty alcohols. Natural fatty alcohols dominate the global landscape with an estimated 58% market share, owing to the increasing push for plant-based and biodegradable raw materials across cosmetics, personal care, and home care. These alcohols, derived from renewable sources such as palm oil and coconut oil, are preferred for their low toxicity, environmental compatibility, and favorable regulatory positioning. Their growth is strongly tied to the global movement toward sustainable consumer products and circular supply chains.

Unsaturated fatty alcohols are the fastest-growing segment due to their paramount use for specialty chemicals, cosmetic formulations, and emollients. Their molecular structure offers better skin penetration and conditioning properties, making them popular in high-end personal care products. Growth is further driven by the rising demand for plant-derived, multifunctional ingredients in clean-label formulations. This segment is gaining traction, especially in Asia Pacific and Europe, where the adoption of natural and functional ingredient is surging.

By application, soaps and detergents currently represent the largest share of the fatty alcohol market, accounting for 44% of the total share in 2025. This dominance stems from their essential role as raw materials in the production of alcohol ethoxylates and sulfates key surfactants in laundry detergents, dishwashing liquids, and surface cleaners. As the global hygiene and sanitation sector continues to expand, particularly after the pandemic, the demand for fatty alcohols in this segment remains resilient. Bulk producers in Asia Pacific heavily rely on mid-chain alcohols such as C12-C14 due to their excellent foaming and wetting properties.

The personal care and cosmetics segment is the fastest-growing application area, driven by rising consumer awareness of natural ingredients and growing demand for clean beauty products. Fatty alcohols such as cetyl, stearyl, and behenyl alcohols are widely used in moisturizers, hair conditioners, sunscreens, and makeup products for their texture-enhancing and skin-conditioning benefits. New product launches featuring “plant-based” or “palm-free” claims further boost their appeal. While industrial uses such as lubricants and plasticizers are more niche, they are slowly gaining momentum with the advent of bio-lubricants and green polymer additives.

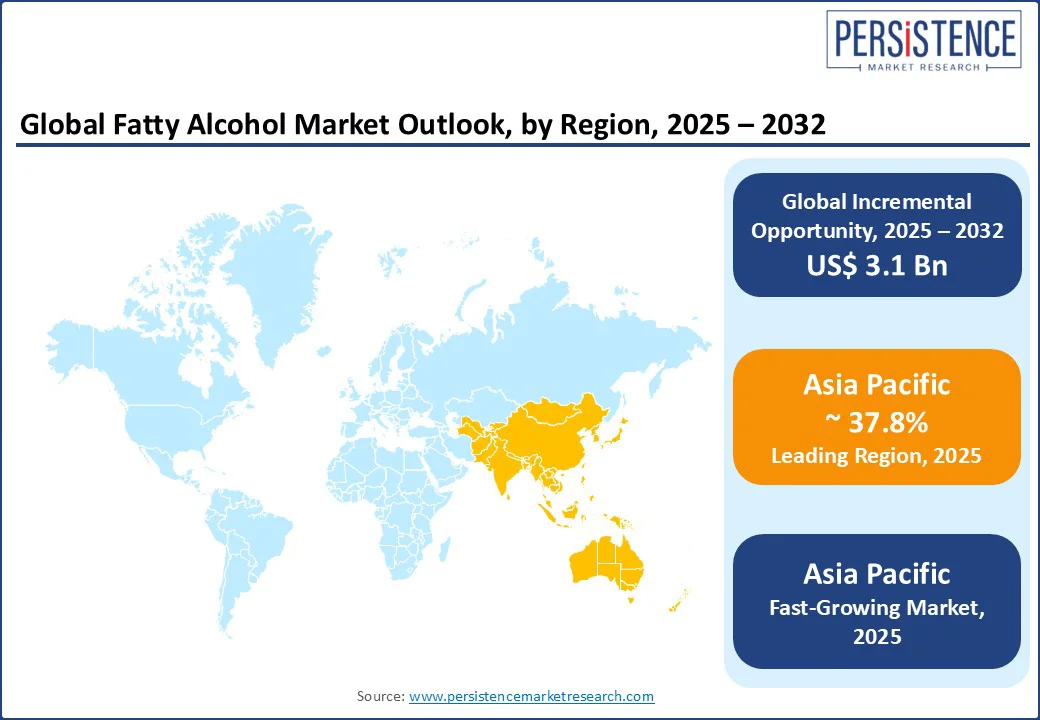

Asia Pacific is projected to hold the largest market share of approximately 37.8% in 2025. The region benefits from the abundant availability of palm kernel and coconut oil, making it a hub for natural fatty alcohol production. The region is also the fastest growing, as it is expected to grow at a CAGR of over 7.1% from 2025 to 2032. Countries including Malaysia, Indonesia, and the Philippines are key feedstock suppliers, while China and India lead in downstream consumption. China's fatty alcohol market alone contributes to nearly one-third of Asia Pacific’s regional demand, and has become a significant exporter of mid-chain alcohols (C12-C14), primarily used in detergents and surfactants.

India is anticipated to the fastest-growing market in the region, with growth fueled by rapid urbanization, increasing disposable incomes, and the surge in local manufacturing in the personal care and pharmaceutical sectors. The Indian government's push for self-reliance under the, ‘Make in India’ scheme has encouraged local production of fatty alcohol derivatives, especially for cosmetics, hygiene products, and pharma excipients. Major local players are expanding capacity to reduce reliance on imports and enhance domestic oleochemical value chains.

Japan and South Korea also contribute significantly to the premium segment of fatty alcohol applications, particularly in skincare, sunscreens, and anti-aging formulations. The demand here leans toward high-purity, long-chain alcohols behenyl and stearyl alcohol, aligned with rising consumer preference for luxury and dermatologically safe ingredients.

North America represents a mature but steadily growing market. The U.S. dominates regional consumption, holding over 75% market share in North America. The region’s growth is fueled by rising demand for eco-friendly surfactants, the push toward sustainable ingredient sourcing, and increasing use of bio-based fatty alcohols in cosmetic formulations, particularly in lotions, creams, and hair conditioners.

The U.S. personal care and home care industries are major consumers of C16–C18 long-chain alcohols, specifically cetyl and stearyl alcohol, which are widely used as thickening agents, emollients, and stabilizers. Consumer preference for clean-label and palm-free products is shifting the landscape in favor of fermentation-based fatty alcohols and sugar-derived feedstocks, opening up new investment avenues. Companies such as Procter & Gamble Chemicals, BASF Corporation, and Sasol North America are actively investing in sustainable sourcing models and local production to minimize import dependency.

North America is also seeing an increased use of fatty alcohols in pharmaceutical coatings, capsule lubricants, and specialty lubricants, adding diversity to its application base. Europe leads in sustainable chemical innovation, with its market dynamics strongly shaped by strict REACH regulations and heightened consumer awareness of environmental impacts. Ongoing market consolidation and joint ventures between oleochemical producers and personal care giants further enhance competitiveness.

Europe continues to maintain a stable and regulated growth trajectory. Germany, France, and the U.K. are key contributors, with Germany leading the regional market owing to its strong base of pharmaceutical and personal care product manufacturers. Europe is at the forefront of sustainable chemical innovation, and its market dynamics are deeply influenced by stringent REACH regulations and high consumer awareness about environmental impact.

Fatty alcohols in Europe are increasingly being sourced from palm-free and RSPO-certified feedstocks, with growing interest in coconut oil- and algae-based alcohols. Cosmetic companies are actively reformulating to meet consumer demand for natural and transparent ingredients. The region’s demand centers around high-purity long-chain fatty alcohols, particularly in dermaceutical-grade creams, vegan skincare, and natural deodorants.

In addition to personal care, Europe shows steady demand in industrial and pharmaceutical sectors, where fatty alcohols serve as lubricants, plasticizer intermediates, and capsule fillers. Regional manufacturers such as Croda International, Emery Oleochemicals, and Vantage Specialty Chemicals are investing in low-carbon technologies and establishing local supply chains to reduce their environmental footprint.

The global fatty alcohol market is moderately fragmented, with a mix of large multinational chemical corporations and regionally focused oleochemical producers. Leading players such as Sasol Limited, BASF SE, Wilmar International, KLK OLEO, and Musim Mas Holdings command a significant share of the market through strategic integration, feedstock control, and advanced production capabilities. These companies often leverage their scale, global distribution networks, and R&D infrastructure to meet diverse end-user demands across personal care, detergents, and industrial applications.

The smaller players Kao Corporation, Ecogreen Oleochemicals, and several regional SMEs in Southeast Asia and Europe contribute to the market through agile operations, niche product portfolios, and quick responsiveness to shifting customer trends. These companies increasingly target the high-margin cosmetic and pharmaceutical-grade fatty alcohol segments, using natural fermentation and clean-label formulations as key differentiators.

The global fatty alcohol market is projected to reach approximately US$ 6.4 Bn in 2025, driven by rising demand in personal care and household applications.

The fatty alcohol market is expected to grow to US$ 9.5 Bn by 2032.

Key trends include the shift toward natural and sustainable fatty alcohols, bio-based production from palm kernel and coconut oil, and innovations in personal care formulations using mild surfactants.

The natural fatty alcohol segment holds the largest share due to its dominance in detergents and cosmetics. Among chain lengths, C12–C14 mid-chain alcohols lead the volume share.

The market is anticipated to grow at a CAGR of around 5.9% from 2025 to 2032, driven by rising demand for sustainable and multi-functional surfactants.

The key players include KLK OLEO, Wilmar International, Sasol Limited, BASF SE, and Emery Oleochemicals.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Alcohol Type

By Chain Length

By Application

By Source

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author