ID: PMRREP35584| 196 Pages | 2 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

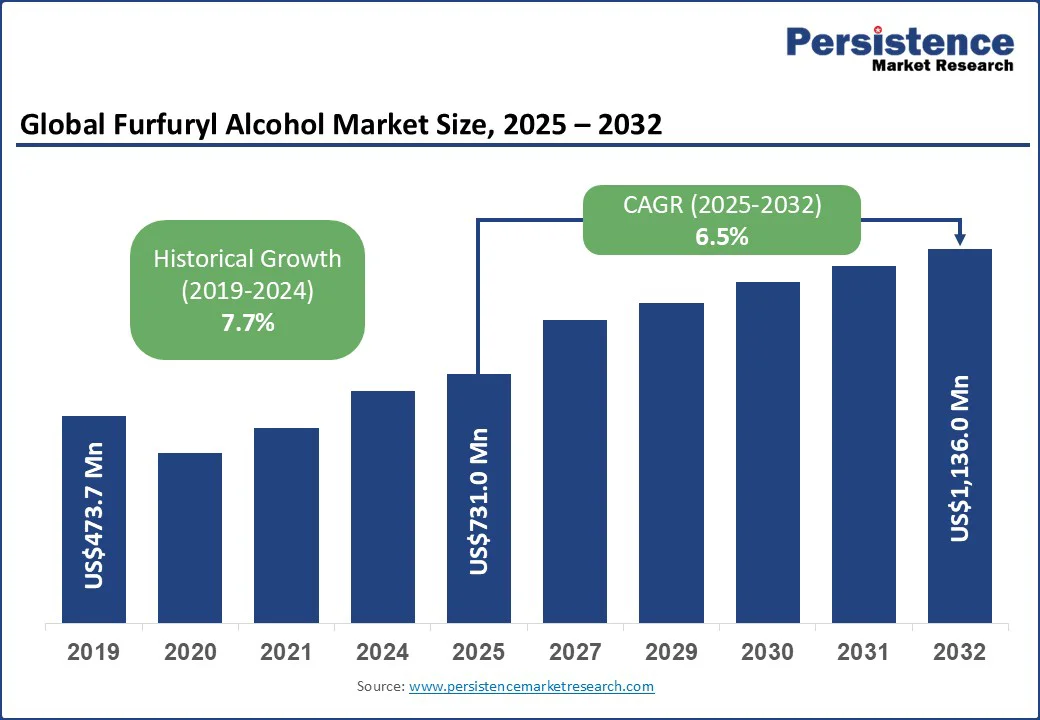

The global furfuryl alcohol market size is likely to be valued at US$731.0 Mn in 2025 and is expected to reach US$1,136.0 Mn by 2032 growing at a CAGR of 6.5% during the forecast period from 2025 to 2032.

The rising demand for eco-friendly foundry binders and bio-based chemicals, strongly stoked by stringent environmental regulations and green procurement policies worldwide, will propel the market in the forthcoming years.

Furfuryl alcohol, derived from renewable agricultural sources such as corncobs and sugarcane bagasse, is crucial for producing furan resins that form the backbone of high-performance molds in the foundry industry. These resins are key components for automotive and aerospace manufacturing. Its eco-friendly profile and use in green chemistry have made it an increasingly preferred material, as industries worldwide prioritize sustainable, bio-based chemicals and resin technologies.

The furfuryl alcohol market growth is propelled by the surge in sustainable infrastructure projects, regulatory support for eco-friendly binders, and the expansion of chemical applications in pharmaceuticals and construction. The shift among foundries in India and China to low-emission systems and German investments in advanced, water-resistant resins are some of the notable developments in automotive lightweighting, green procurement, and circular economy solutions. Companies leveraging renewable raw materials, process innovation, and market-driven R&D stand poised to capture growth in high-value sectors as furfuryl alcohol solidifies its role in the specialty chemicals space.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Furfuryl Alcohol Market Size (2025E) |

US$731.0 Mn |

|

Market Value Forecast (2032F) |

US$1,136.0 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

6.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.7% |

The key factor driving the furfuryl alcohol market is the accelerating demand for sustainable, high-performance binders in the foundry industry, particularly for automotive and aerospace metal casting applications.

As environmental regulations tighten and original equipment manufacturers (OEMs) seek greener manufacturing solutions, furfuryl alcohol-based furan resins have emerged as the natural choice for precision molds and cores, owing to their superior mechanical properties and bio-based origins.

For example, DynaChem South Africa’s 2024 launch of furfuryl alcohol binders replacing synthetic resins in automotive castings exemplifies the shift toward low-emission, renewable raw materials, directly impacting global purchasing decisions.

Chemical companies across Asia Pacific and Europe are ramping up investments in green chemistry solutions and advanced resin technologies, gaining additional support from the widespread adoption of green procurement policies in public infrastructure projects.

For example, according to a February 2025 article of the East Asia Forum, sustainable public procurement can speed up the green transition in the rapidly urbanizing Asia Pacific, where infrastructural investments worth US$1.7 Tn per year will be required. Green public procurement will be central to meeting these needs.

The price volatility of the primary raw material, furfural, derived from agricultural residues such as rice hulls, inhibits the momentum of the furfuryl alcohol market. This fluctuation in price stems largely from unpredictable crop yields and unreliable processing capacities, especially in dominant producing countries such as China and India, which creates significant supply chain disruptions and inflates production costs for downstream furfuryl alcohol manufacturers.

For instance, the inconsistent availability of furfural in 2023 hampered production and triggered price spikes, forcing foundries and resin producers to either absorb costs or switch to less sustainable synthetic alternatives with lower upfront pricing. This restraint is further exacerbated by the toxicity concerns associated with furfuryl alcohol that necessitate stringent handling protocols, limiting its use in consumer-facing applications without costly safety investments.

The surging demand for specialty chemicals from the foundry industry, combined with the accelerating adoption of green chemistry principles across multiple industrial sectors, is opening up new growth possibilities in the furfuryl alcohol market.

With foundries worldwide, and particularly in the emerging economies of India and China, transitioning to low-emission binder systems, furfuryl alcohol-based furan resins are becoming indispensable for producing high-precision, durable metal castings essential in automotive, aerospace, and heavy machinery manufacturing.

This rise is driven by stringent environmental regulations favoring bio-based, sustainable materials, aligning with growth in the construction sector, which is increasingly adopting specialty resins for water-resistant and high-durability applications.

Furthermore, the pharmaceutical sector is also exploring furfuryl alcohol as a viable intermediate in complex bioactive compound synthesis, and innovations in resin technology are enhancing product performance and cost-effectiveness, broadening market scope.

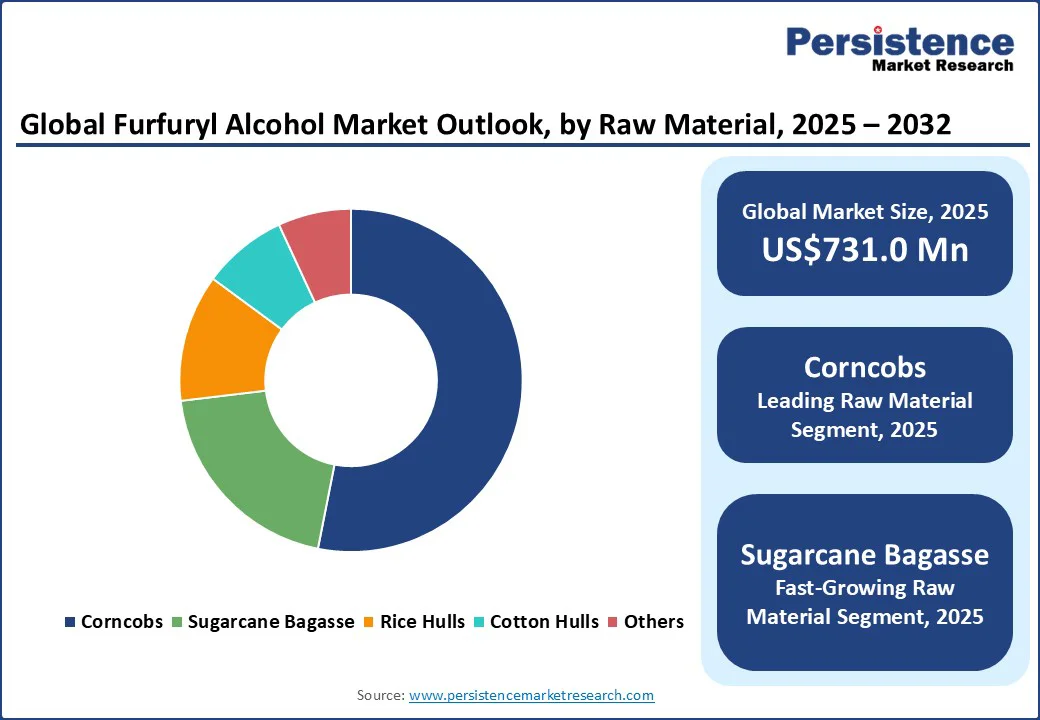

The leading segment in the raw material category in 2025 is likely to be corncobs, expected to command the largest share of approximately 53.1%. The dominance primarily hinges on the high cellulose content, cost-effectiveness, and consistent availability across major furfural-producing regions, including China and the U.S.

The abundant supply from agricultural residues makes them an economically viable and sustainable feedstock for furfuryl alcohol synthesis, supporting the steadily rising market demand for such materials.

A major driver is the increased focus on renewable raw materials in the furfuryl alcohol supply chain, aligning with the growing global demand for bio-based chemicals, sustainable industrial solvents, and green chemistry solutions. For example, China’s agricultural reforms in 2023 optimized corn residue collection and processing, boosting furfural yield from corncobs and lowering raw material costs.

Sugarcane bagasse is slated to register the highest CAGR of around 7.7% through 2032 is, mainly on account of massive sugarcane cultivation across Asia Pacific and Latin America that generates vast biomass waste with strong potential for furfural extraction. Sugarcane bagasse is rapidly emerging as a strategic feedstock for furfuryl alcohol, spurred by the increasing intensity of sustainability initiatives and industrial scalability in Brazil, India, and Thailand.

Public and private investments in advanced biomass-to-chemical technologies are accelerating, bolstered by government incentives supporting bio-refinery development, such as Brazil’s 2024 Renewable Bio-Based Chemicals Policy, which facilitates capital flow into sugarcane bagasse processing plants.

These developments are aiding the transition to eco-friendly chemical manufacturing, circular economy solutions, and renewable industrial inputs, making sugarcane bagasse a high-growth niche segment.

Standard grade is projected to capture the majority share of approximately 70% in 2025, owing to its extensive use in industrial applications such as foundry resins, adhesives, coatings, and corrosion inhibitors, where cost-effectiveness and adequate purity are critical.

The rapidly growing adoption of cost-effective bio-based materials in end-user industries such as automotive and construction is fueling the demand for standard-grade furfuryl alcohol, especially in the developing economies of Asia Pacific, where large-scale industrial production requires bulk volumes of standard-grade furfuryl alcohol.

The pharmaceutical grade segment is set to exhibit the highest CAGR through 2025-2032, estimated at a high CAGR, supported by the escalating demand for high-purity furfuryl alcohol in drug synthesis, pharmaceutical intermediates, and fine chemicals manufacturing. Stricter safety and purity regulations, especially in North America and Europe, are stimulating innovations and the adoption of pharmaceutical-grade furfuryl alcohol.

For instance, pharmaceutical companies are increasingly incorporating bio-based intermediates such as furan-derived alcohol to meet green chemistry mandates and reduce environmental footprints in active pharmaceutical ingredient (API) production. This trend also aligns with the growing attention on sustainable and regulatory-compliant raw materials, backed by advances in purification technologies and targeted R&D investments.

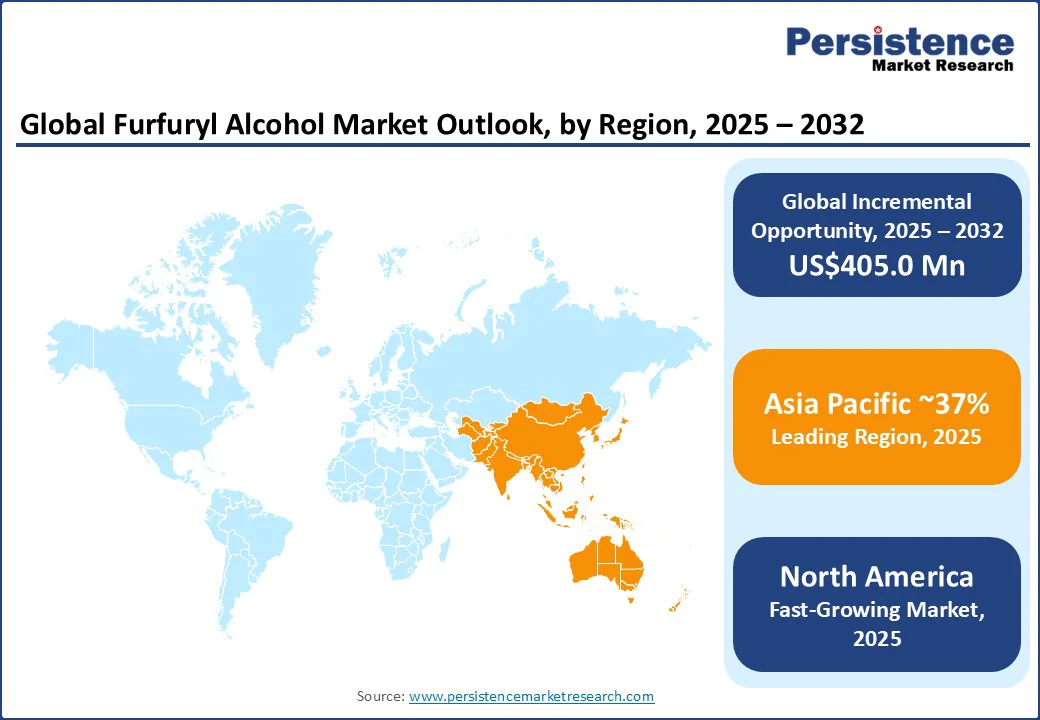

Asia Pacific is anticipated to hold nearly 37% of the market share in 2025, driven by the abundant availability of raw materials such as corncobs and sugarcane bagasse due to a well-established and robust agricultural sector across India, China, and Southeast Asia.

This factor can then be seen in combination with the high industrialization rates in countries such as China and India, which have strengthened the region’s overall foundry and resin manufacturing industries, supported by proactive government policies promoting green chemistry and sustainable bio-based chemical production.

For instance, China's heavy investments in biomass processing and export-driven resin manufacturing capitalize majorly on the demand for furfuryl alcohol from automotive, coatings, and adhesive sectors, making the region a crucial global production hub.

North America is slated to be the fastest-growing regional market, and is estimated to showcase a high CAGR from 2025 to 2032, largely influenced by stringent environmental regulations and a rising emphasis on sustainability, particularly in the automotive and construction sectors of the U.S.

The movement toward lightweight, durable materials that improve fuel efficiency, alongside regulatory pressures to reduce the emission of volatile organic compounds (VOCs), has propelled the adoption of furfuryl alcohol-based bio-resins and solvents. Innovations in eco-friendly materials and strong R&D infrastructure have further boosted this regional demand. The U.S. leads in market size within the region due to green procurement practices and expanding pharmaceutical applications.

The market in Europe is primarily driven by an increasingly stringent regulatory landscape centered on sustainability and carbon neutrality, with a focus on enabling the transition in hard-to-abate sectors such as chemicals. Germany, France, and other Western European countries are steering the regional market for furfuryl alcohol by deploying it extensively in the construction of green building projects and in automotive applications requiring advanced bio-based polymers.

Despite raw material sourcing constraints and cost pressures, Europe’s pledge to circular economy principles and highly stringent emissions standards will prove sufficient to ensure a positive market growth trajectory.

The global furfuryl alcohol market is highly competitive, with strategic emphasis on sustainable production, innovative formulations, and geographic expansion to meet the rising global demand for specialty chemicals. Leading players are aggressively investing in research and development to enhance production efficiency and develop low-toxicity, high-purity variants tailored to cater to the evolving industry needs in automotive, aerospace, pharmaceuticals, and construction.

For example, International Furan Chemicals B.V. stands out for pioneering sustainable manufacturing methods that reduce environmental impact while maintaining product quality, helping it secure a marquee market position.

Other companies, such as Hongye Chemical Co., Ltd. and Shandong Crown Chemical Co., Ltd., are leveraging the widespread distribution networks across Asia Pacific and Europe in a bid to gain greater ground in the market. The industry is also witnessing consolidation moves, where mergers and acquisitions enable firms to diversify product portfolios and improve scale economies, as well as future-proof their offerings to comply with the stringent environmental regulations.

The furfuryl alcohol market is projected to reach US$731.0 Mn in 2025.

The accelerating demand for sustainable, high-performance binders in the foundry industry, particularly for automotive and aerospace metal casting applications, is driving the market.

The furfuryl market is expected to grow at a CAGR of 6.5% from 2025 to 2032.

The surging demand for specialty chemicals from the foundry industry and the fast adoption of green chemistry principles across multiple industrial sectors are key market opportunities.

Key players include International Furan Chemicals B.V., Hongye Chemical Co., Ltd., and Shandong Crown Chemical Co., Ltd.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Raw Material

By Grade

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author