ID: PMRREP33182| 195 Pages | 22 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

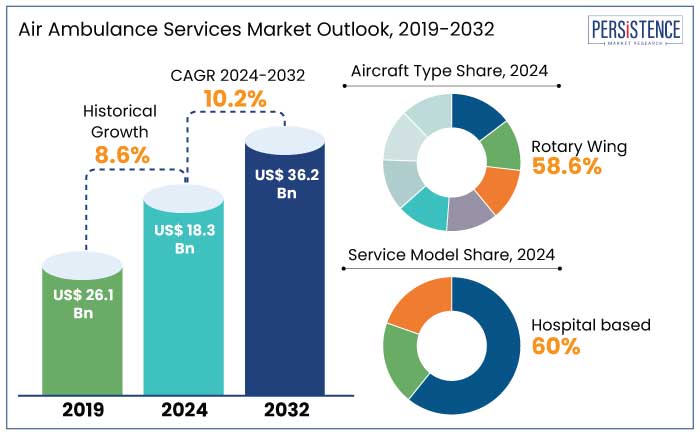

The global air ambulance services market size is likely to be valued at US$ 18.3 Bn in 2025 and is estimated to reach US$ 36.2 Bn in 2032, growing at a CAGR of 10.2% during the forecast period 2025-2032. Demand for air ambulance services is no longer confined to remote rescue missions. It is now spurred by a surge in inter-facility transfers, organ transplant logistics, and disaster response operations. Air ambulance services have emerged as a significant element in the emergency care chain. These airborne ICUs are reshaping how and where novel care can be delivered.

As climate emergencies intensify and global medical tourism expands, the role of air ambulances is evolving beyond rapid transport to include onboard interventions supported by critical care teams.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Air Ambulance Services Market Size (2025E) |

US$ 18.3 Bn |

|

Market Value Forecast (2032F) |

US$ 36.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

10.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.6% |

The surging number of organ transplantation cases is directly pushing the air ambulance services market growth by necessitating rapid and secure transport of both organs and recipients across long distances. Organs such as heart, lungs, and liver have narrow ischemic windows, making air transport significant for ensuring viability. Countries, including India, are increasingly using green corridors and dedicated helicopters to fast-track organ movement.

The rise in climate-related natural disasters such as floods, cyclones, and wildfires is also expanding the role of air ambulances in rapid medical evacuation and trauma response. In 2023 alone, Australia’s Royal Flying Doctor Service responded to a 28% spike in emergency retrievals during bushfire season. Similarly, in Turkey’s earthquake-hit regions in early 2023, approximately 1,715 injured people were transported by air to hospitals. These events underline the increasing reliance on air ambulance equipment and services for isolated medical emergencies as well as national disaster response strategies.

Potential weather-related delays and limited landing infrastructure are significantly constraining the efficiency and reliability of air ambulance services. This is mainly evident in regions with extreme climates or complex terrains. Adverse conditions such as low visibility, heavy snowfall, thunderstorms, or high winds often tend to ground aircraft or delay response times. This further affects patient survival in time-critical scenarios.

In urban areas, weather is often considered less of a barrier as dense infrastructure restricts safe landing zones. In 2023, London’s Air Ambulance reported that 12% of its potential dispatches were redirected or aborted due to unsafe or unavailable landing spots in central boroughs, even with trained pilots and designated zones. These constraints are prompting investment in new technologies such as satellite-aided navigation, autonomous weather assessment systems, and VTOL aircraft. These features are anticipated to enable precision urban landings.

The integration of drone technology into medical logistics is opening strategic opportunities for air ambulance services by enabling fast, cost-effective, and targeted delivery of significant supplies. Drones can be dispatched autonomously or semi-autonomously to transport blood units, vaccines, and defibrillators across congested urban zones, isolated communities, or disaster-hit regions. In Rwanda, for example, Zipline’s drone network has completed over 750,000 deliveries of medical supplies by 2024. This has reduced delivery times from several hours to under 30 minutes in various rural districts.

In India, the Indian Council of Medical Research (ICMR) and Drone Federation of India jointly ran trial missions in 2023 for drone-based blood transport across mountainous areas of Arunachal Pradesh. It offered a blueprint for micro-logistics support to air ambulances, which can then focus on patient transport while drones handle supporting payloads. For air ambulance service providers, this shift allows them to reallocate manned missions for high-acuity patient transfers while drones manage logistical support.

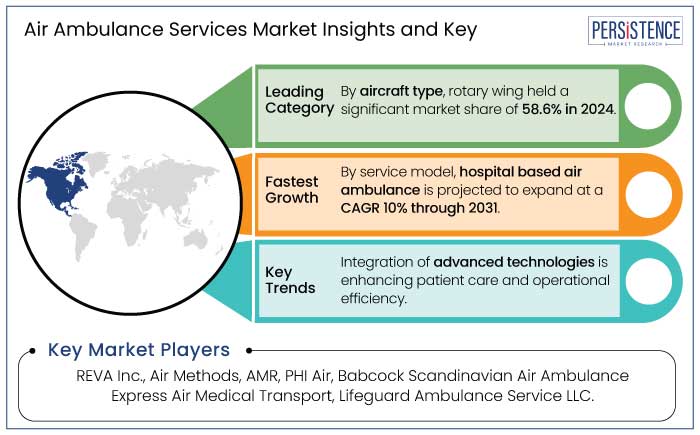

In terms of aircraft type, the market is bifurcated into rotary-wing and fixed-wing. Among these, the rotary-wing segment is poised to hold approximately 58.6% of the air ambulance services market share in 2025 due to its vertical takeoff and landing capability. This enables direct access to accident scenes, rooftops, and remote areas where fixed-wing aircraft cannot operate. The high flexibility is important in time-sensitive emergencies such as road accidents, strokes, or cardiac arrests, especially in dense urban centers or geographically constrained regions. Modern medical helicopters are also increasingly equipped with specialized interiors that allow onboard treatment similar to mobile intensive care units.

Fixed-wing aircraft are gaining traction owing to their suitability for long-distance and international patient transfers. These aircraft offer superior range, speed, and cabin space compared to helicopters. It enables them to carry multiple medical personnel, specialized equipment, and even patient companions without compromising care standards. Increasing preference for fixed-wing services is also tied to global medical tourism and the emphasis on transporting patients between countries with better healthcare infrastructure.

Based on service model, the market is divided into hospital-based and community-based. Out of these, the hospital-based segment will likely account for around 60.4% of share in 2025, backed by its ability to ensure continuity of care, fast mobilization of critical resources, and rapid integration with trauma protocols. This model deploys aircraft and medical crews directly from tertiary care facilities, allowing real-time access to specialists, laboratory data, and patient records before and during transport. Such a setup significantly reduces handoff errors and treatment delays, which is particularly vital in stroke, cardiac arrest, or severe trauma cases.

The community-based model, on the other hand, is seeing decent growth owing to its operational flexibility, broad geographic reach, and partnerships with regional EMS systems and insurers. This model is typically operated by private companies stationed at strategic bases to serve multiple hospitals across counties or states. This enables quick deployment in rural and underserved areas where hospital-based aircraft is not often stationed. Community-based providers are further integrating GPS-aided dispatch and satellite-based telemedicine to enhance routes and remain operational in challenging terrains.

In 2025, North America is expected to account for nearly 38.2% of share due to high service penetration. The U.S. air ambulance services market will likely witness steady growth with private equity-backed operators scaling through acquisitions and integrated service models. They operate large, strategically located fleets capable of both emergency response and inter-facility transfers. Reimbursement disputes with insurers and surprise billing controversies, however, have led to policy changes. The federal No Surprises Act is estimated to transform profit models and compel providers to renegotiate payer agreements.

In Canada, the scenario is different due to the publicly funded healthcare system. Provincial governments typically contract air ambulance services through centralized agencies or specific operators. The market is less fragmented and more focused on service quality, rural accessibility, and integration with ground Emergency Medical Services (EMS). Innovation in Canada is also leaning toward hybrid rotor-wing and fixed-wing deployments to handle both urban emergencies and vast remote areas.

In Europe, the market is being pushed by strong government involvement, coordinated emergency networks, and the role of cross-border collaborations under the EU Civil Protection Mechanism. Germany and Norway have some of the most innovative air ambulance infrastructures, with organizations operating highly specialized Helicopter Emergency Medical Services (HEMS). As of 2024, Filderstadt-based DRF Luftrettung reported operating over 30 helicopters and completing more than 38,000 missions annually. It has also invested huge sums in night-vision-capable aircraft to improve round-the-clock coverage.

The U.K. is dominated by charitable organizations, including The Air Ambulance Service and London’s Air Ambulance, which mainly depend on donations and regional NHS partnerships. These services are undergoing rapid digitization, with the country introducing AI-supported dispatch systems to lower response time disparities between urban and rural areas. France and Italy are integrating air ambulance operations into their national civil protection frameworks. They are primarily focusing on disaster response and mountainous region coverage.

In Asia Pacific, the market is unevenly developed, with rapid innovations in Japan, Australia, and India contrasting with limited infrastructure in Southeast Asia. Japan's Doctor-Heli system remains a benchmark, with over 50 helicopters deployed across nearly all prefectures. In 2023, the program had crossed 100,000 missions since inception, backed by public health insurance and local hospital networks. Australia also maintains a significant system through organizations such as the Royal Flying Doctor Service (RFDS). It conducted over 92,000 patient transports in 2023 alone, covering vast, sparsely populated areas with fixed-wing aircraft.

India’s market is evolving through partnerships between hospitals and private aviation firms. Players such as Air Rescuers and ICATT have extended their footprint significantly since the pandemic, with ICATT reporting a 40% increase in missions in 2023. It was augmented by demand from Tier-2 and Tier-3 cities lacking tertiary care facilities. The country’s government also introduced initiatives under PM Gati Shakti to integrate emergency air services with regional airports and highways. Indonesia and the Philippines, however, rely on military or ad hoc private charters for medical evacuations due to the geographic spread of islands.

The global air ambulance services market is fragmented and region-specific, characterized by various large healthcare providers and small-scale operators. In North America and Europe, competition is intensifying as private companies, hospital-affiliated services, and insurance-backed players seek to capture share through fleet modernization. Reputed companies are dominating with extensive fleets and integrated medical staff, while regional firms are competing by providing customized international repatriation and long-haul medical flights. In emerging countries, however, the competitive field is relatively sparse due to infrastructure limitations and high operational costs.

The air ambulance market is projected to reach US$18.3 Bn in 2025.

Increasing incidence of cardiac emergencies and expanding elderly population with critical care requirements are the key market drivers.

The air ambulance services market is poised to witness a CAGR of 10.2% from 2025 to 2032.

Deployment of drones for last-mile delivery of vaccines and adoption of hybrid air-ground emergency networks are the key market opportunities.

Air Methods, Babcock Scandinavian Air Ambulance, and PHI Air Medical are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Aircraft Type

By Service Model

By Service Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author