ID: PMRREP35820| 185 Pages | 4 Nov 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

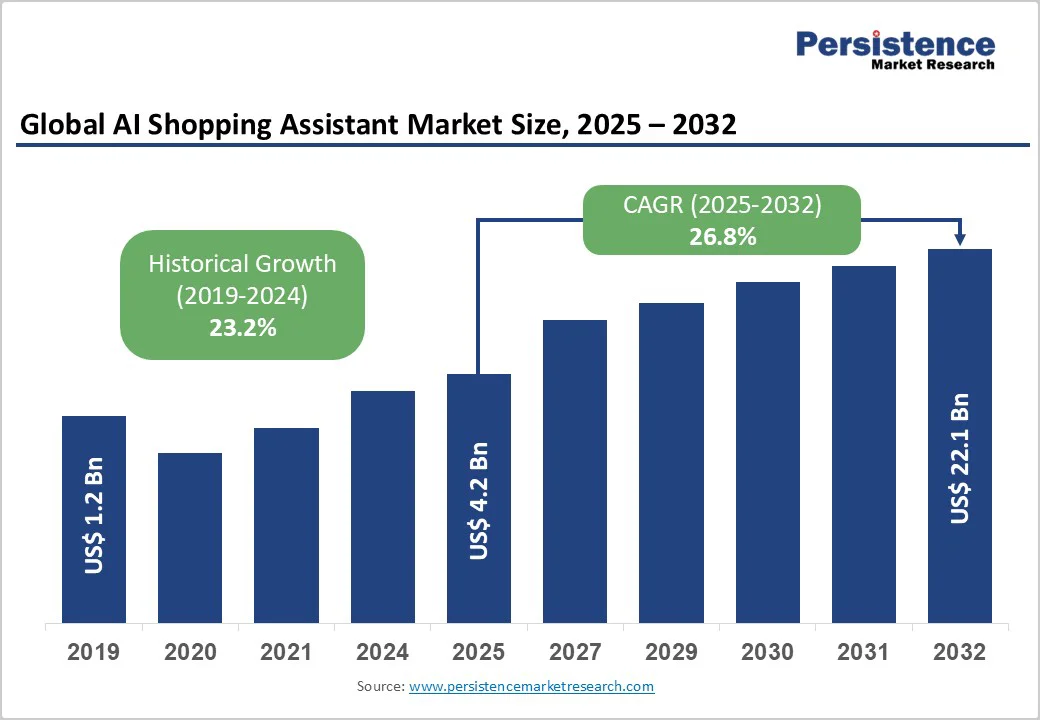

The global AI shopping assistant market size is likely to be valued at US$4.2 Billion in 2025 and is estimated to reach US$22.1 Billion in 2032, growing at a CAGR of 26.8% during the forecast period 2025 - 2032, driven by increasing demand for fast, personalized, and convenient online shopping experiences.

The surge in voice commerce shows how hands-free technology is changing buying behavior.

| Key Insights | Details |

|---|---|

| AI Shopping Assistant Market Size (2025E) | US$4.2 Bn |

| Market Value Forecast (2032F) | US$22.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 26.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 23.2% |

AI shopping assistants are becoming popular as they simplify the product discovery process by instantly filtering through thousands of options to match user preferences. This reduces browsing time and helps shoppers make quick and confident purchase decisions. The addition of voice-based interfaces has further improved accessibility.

Users can now shop while driving, cooking, or performing other tasks. For instance, Amazon Alexa and Google Assistant have seen a rise in shopping-related commands, especially for household essentials and repeat purchases. This hands-free convenience is turning AI assistants into everyday shopping tools, enabling users to make purchases on the go without the need to navigate multiple screens or apps.

AI shopping assistants integrated with Augmented Reality (AR) features are transforming online shopping by allowing customers to visualize products in their actual surroundings. Retailers such as IKEA and Wayfair have introduced AI-based AR assistants that let users virtually place furniture in their rooms before buying.

This visual preview reduces uncertainty about size, color, and fit- factors that often lead to product returns. According to Shopify’s 2024 report, AR-assisted shopping increased conversion rates by up to 30% while reducing return rates by 50%. As more brands adopt this feature, visual AI assistance is emerging as a key driver for consumer satisfaction and trust in online retail.

AI shopping assistants rely heavily on collecting personal and payment data to deliver personalized recommendations, which often raises privacy and security concerns among consumers. Instances of chatbots leaking user information or generating unauthorized purchase suggestions have made shoppers wary of sharing sensitive data.

For example, a 2024 U.S. consumer study found that over 60% of users hesitated to connect payment details to AI-powered shopping tools due to potential misuse. Strict data protection rules in Europe have also increased compliance costs for retailers. Hence, companies deploying these assistants must strike a balance between personalization and user trust by ensuring transparent data handling and robust encryption.

Despite major developments in Natural Language Processing (NLP), AI shopping assistants still struggle to understand complex or nuanced queries, especially those involving regional slang, multi-product comparisons, or highly specific requests. This often results in irrelevant product recommendations or incomplete answers, pushing users back to manual search or human agents.

For instance, users of early beta versions of Amazon’s Rufus in 2024 reported inconsistent responses when searching for niche technical products. Such errors reduce user confidence and highlight that AI tools still require extensive human training, contextual fine-tuning, and retail-specific datasets to achieve reliability across diverse product categories and languages.

AI shopping assistants can manage end-to-end customer interactions, from answering post-purchase queries to tracking deliveries and suggesting reorders, without human intervention. This automation not only reduces response times but also enables support teams to focus on complex or emotionally charged issues that require human judgment.

For instance, Walmart’s AI Super Agents now autonomously resolve most customer inquiries about returns and order status. Similarly, Shopify’s AI assistant Sidekick helps merchants manage inventory and recommend products for restocking. As natural language models become more context-aware, AI assistants are evolving from passive helpers into proactive retail partners capable of managing entire purchase cycles.

The surging use of voice-activated technology presents a key growth avenue for AI shopping assistants. As smart speakers and voice-enabled smartphones become part of daily routines, shoppers are extensively using them for hands-free browsing and purchases.

In 2024, Google Assistant and Amazon Alexa recorded a rise in shopping-related voice queries, especially in categories such as groceries and home essentials. Retailers, including Tesco and Carrefour, have begun integrating their product catalogs with these assistants, enabling users to add items to their carts or reorder essentials with simple voice commands.

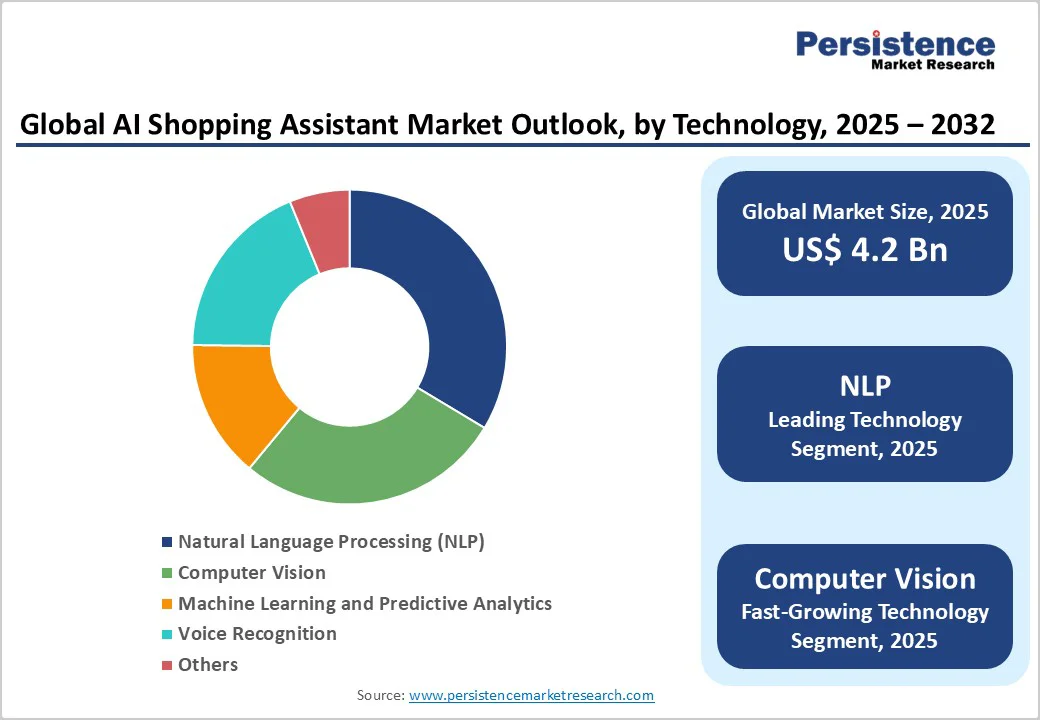

NLP is estimated to dominate with approximately 33.6% of the share in 2025, as it allows users to communicate naturally, using everyday language, rather than rigid commands. This makes interactions intuitive and conversational. The use of large language models, including GPT-4 and Gemini, has further improved accuracy in handling complex shopping requests. By interpreting multi-step queries and personalizing results in real time, NLP has become the foundation for smooth, human-like shopping experiences.

Computer vision is gaining momentum as AI shopping assistants increasingly rely on image-based searches and visual recognition. Shoppers now upload pictures to find similar products, a feature widely popularized by Google Lens and Pinterest Lens. Zalando and Myntra use image recognition tools that identify clothing styles, colors, and patterns, making product matching far more precise than keyword-based searches.

Product discovery and search will likely account for around 34.2% of the share in 2025, since they directly improve customer convenience. Consumers often face decision fatigue when browsing large online catalogs, and AI-based discovery tools simplify this process through personalized recommendations and contextual search. This capability increases conversion rates while improving user satisfaction. As discovery is the first step in every shopping journey, it continues to dominate AI use cases in retail.

Virtual try-on technology has become a key AI application, bridging the gap between online and physical shopping. Fashion and beauty retailers use AR to let users preview products before purchasing. Sephora’s Virtual Artist and L’Oréal’s ModiFace, for instance, allow customers to test cosmetics digitally. This feature boosts consumer confidence, especially in high-return categories such as apparel and accessories.

E-commerce platforms are poised to capture nearly 39.6% of the market in 2025, as they handle massive product inventories and daily customer interactions. These platforms use AI to personalize search results, optimize pricing, and automate customer service. The competitive nature of online retail pushes leading companies to improve user experience constantly, and AI assistants help reduce cart abandonment and increase conversion.

Fashion and apparel retailers are emerging as key end users of AI shopping assistants, as their customers rely heavily on visual appeal, fit, and style recommendations. These retailers use AI to deliver personalized styling advice, visual search, and virtual try-on experiences. For instance, H&M uses AI chatbots to suggest outfit combinations, while Nike employs AI to recommend shoe sizes based on past purchases.

In 2025, North America is expected to lead with nearly 37.5% of the market share, as AI shopping assistants shift from experimental chatbots to full-scale commercial tools integrated into e-commerce ecosystems. Leading U.S. retailers such as Walmart and Amazon have built their own proprietary systems. Walmart’s Super Agents, launched in 2024, can manage real-time queries, recommend products, and even handle customer service tasks.

Target and Best Buy are also piloting voice and chat-based AI assistants to improve online and in-store experiences. In addition, Klarna’s AI-powered shopping assistant has gained traction in North America, reducing customer service workloads by over 60%. The region is seeing increased collaboration between AI developers and retailers, with OpenAI, Microsoft, and Google providing retail-specific AI models to deliver personalized shopping experiences.

In the Asia Pacific, the use of AI shopping assistants is expanding steadily, pushed by mobile-first consumers and the dominance of super apps. China-based giants, including Alibaba and JD.com, have integrated AI assistants that provide product comparisons, live shopping support, and personalized recommendations based on user behavior. Alibaba’s Taobao Wenwen uses generative AI to answer customer questions and suggest products during live commerce sessions.

In Japan and South Korea, retailers are using AI chatbots LINE and KakaoTalk to connect directly with shoppers and handle order tracking or customized offers. Southeast Asian platforms such as Lazada and Shopee are adopting multilingual AI assistants to handle high-volume customer interactions, especially during big sale events. Also, India’s Flipkart and Myntra have started experimenting with AI-based fashion advisors that suggest outfits through conversational interfaces.

In Europe, the focus is on ethical AI, transparency, and personalization within regulatory limits. Retailers are cautious but proactive in deploying AI shopping assistants that comply with GDPR and ensure data privacy. Klarna, based in Sweden, is leading the region’s innovation. Its AI assistant manages millions of daily interactions and is available in over 20 markets across Europe. Domestic retailers such as ASOS and Tesco are testing AI assistants that help shoppers with style recommendations and grocery planning, respectively.

France-based Carrefour has launched an AI chatbot integrated into its e-commerce site to provide recipe suggestions linked to available products. Modern consumers are also increasingly open to using AI shopping tools, provided they are transparent about data usage. Europe’s focus on responsible AI, language diversity, and cross-border e-commerce is shaping assistants that emphasize trust, cultural adaptation, and user control rather than aggressive upselling.

The global AI shopping assistant market is becoming increasingly crowded, with leading tech players and retailers investing heavily to dominate this landscape. Amazon has taken a strong lead with its AI assistant Rufus, integrated into its shopping app in 2024, which helps users find, compare, and buy products using natural language.

These big players have a key advantage since they control large product databases, transaction data, and established user bases, allowing them to train smart models and personalize shopping experiences at scale.

The AI shopping assistant market size is projected to reach US$4.2 Billion in 2025.

Increasing demand for personalized shopping experiences and retailers’ growing emphasis on automating customer support are the primary drivers of market growth.

The AI shopping assistant market is poised to witness a CAGR of 26.8% from 2025 to 2032.

The use of multilingual AI tools and the rising emphasis on ethical AI are the key market opportunities.

Amazon, Google, and Microsoft are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By Deployment Mode

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author