ID: PMRREP35995| 200 Pages | 5 Jan 2026 | Format: PDF, Excel, PPT* | Packaging

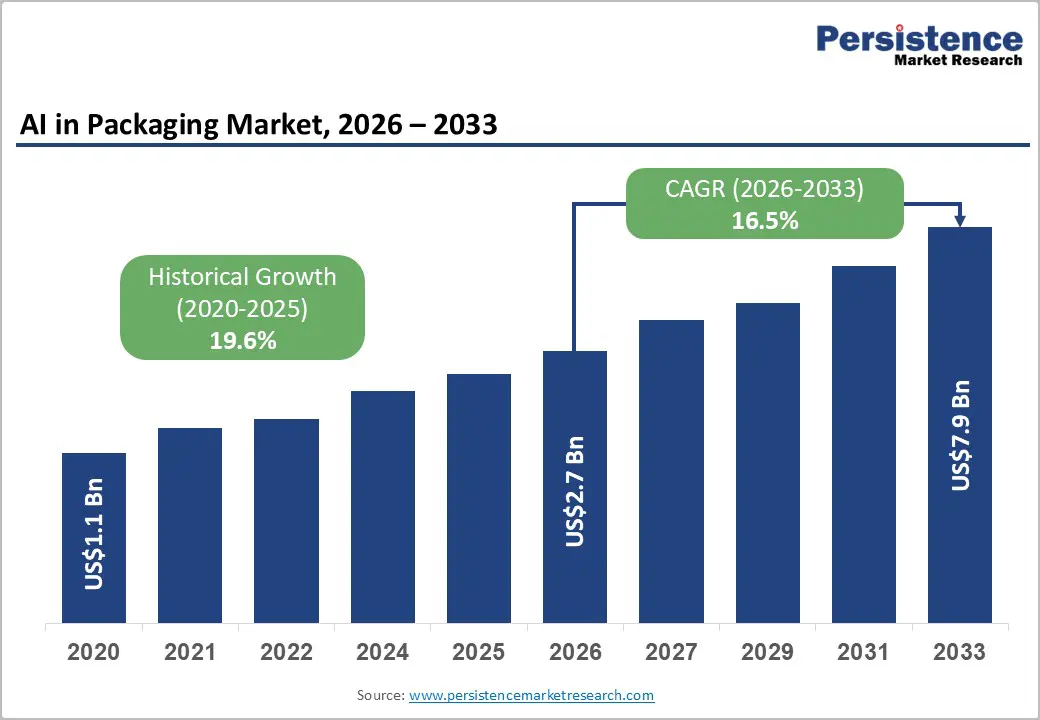

The global AI in packaging market size is likely to be valued at US$2.7 billion in 2026 and is expected to reach US$7.9 billion by 2033, growing at a CAGR of 16.5% between 2026 and 2033, driven by the adoption of artificial intelligence across packaging design, quality inspection, logistics, and sustainability functions.

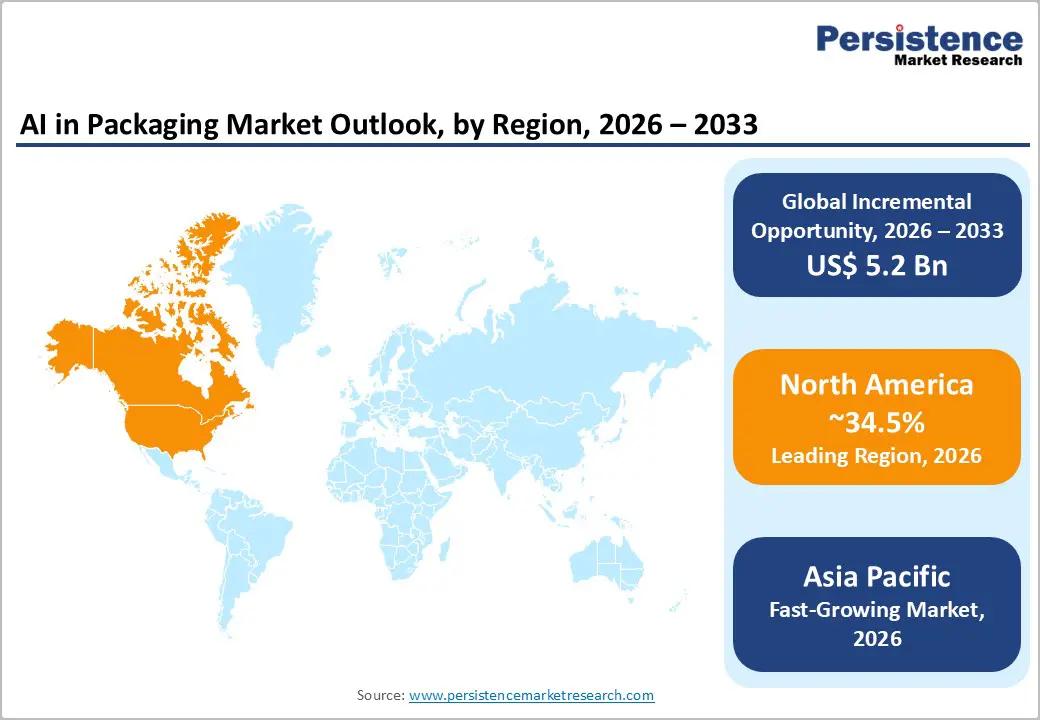

Rising automation in manufacturing, increasing regulatory pressure on quality and traceability, and expanding e-commerce packaging volumes are key structural drivers. North America currently leads market adoption, while Asia Pacific represents the fastest-growing region due to manufacturing scale and digital transformation initiatives. Technology convergence between machine learning, computer vision, and cloud computing continues to reshape packaging value chains.

| Key Insights | Details |

|---|---|

| AI in Packaging Market Size (2026E) | US$2.7 Bn |

| Market Value Forecast (2033F) | US$7.9 Bn |

| Projected Growth (CAGR 2026 to 2033) | 16.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 19.6% |

Automation-driven quality control is a primary growth catalyst for AI adoption in packaging operations. High-volume sectors such as food, beverages, and consumer goods require defect detection rates exceeding 99% to comply with safety and labeling regulations. Industry data from food safety authorities and packaging associations indicate that packaging defects contribute to over 20% of product recalls globally, creating significant financial and reputational risk.

AI-enabled computer vision systems reduce inspection error rates by 30-50% compared with manual checks, while enabling continuous, real-time monitoring. As production speeds exceed 1,000 units per minute in large facilities, human inspection becomes structurally inefficient. AI systems address this scalability gap, improving yield consistency and reducing waste. The market impact is strongest in regions with advanced manufacturing automation, particularly North America, Germany, and Japan.

Rapid expansion of e-commerce logistics has increased demand for AI-driven packaging optimization and smart warehousing. According to international trade and logistics organizations, global e-commerce parcel volumes are growing at high-single-digit rates annually, placing pressure on packaging efficiency, damage prevention, and fulfillment speed. AI systems optimize carton sizing, automate labeling accuracy, and support predictive demand planning. Machine learning algorithms improve warehouse picking accuracy and packaging throughput, reducing fulfillment costs by an estimated 10-15% in large distribution centers. This driver is particularly relevant for omnichannel retailers and third-party logistics providers integrating packaging intelligence into broader supply chain digitization strategies.

Government regulations on product traceability, labeling accuracy, and sustainability reporting are reinforcing AI deployment in packaging. Food safety authorities, pharmaceutical regulators, and environmental agencies increasingly require digital traceability across packaging lifecycles.

AI-enabled data capture and analytics support compliance with serialization, tamper detection, and recycling mandates. In pharmaceuticals, AI systems reduce labeling errors that can lead to compliance violations. Environmental regulators in Europe and parts of Asia are also encouraging AI-based waste sorting and recycling technologies. This regulatory alignment provides long-term structural demand for AI integration rather than short-term cyclical growth.

The upfront cost of AI deployment remains a key barrier, particularly for small and mid-sized packaging converters. AI systems require investments in sensors, computing infrastructure, software licenses, and workforce training. Industry estimates suggest that full-scale AI inspection systems can require capital expenditures exceeding US$250,000 per production line. Integration challenges with legacy equipment further slow adoption. Many packaging facilities operate mixed-age machinery, increasing customization costs. This restraint is most pronounced in emerging markets and among contract packaging firms operating on thin margins.

AI performance depends heavily on data quality and skilled personnel, which remain uneven across regions. Inconsistent data labeling and insufficient training datasets reduce algorithm accuracy. Cybersecurity risks also increase as packaging systems become connected to enterprise networks. Packaging firms face difficulty recruiting AI specialists with domain expertise, particularly in operational technology environments. These challenges can delay ROI realization and limit scalability, especially in regulated industries where system validation is mandatory.

AI-based recycling and waste-sorting technologies represent a high-growth opportunity within the packaging ecosystem. Environmental agencies estimate that less than 20% of global plastic packaging waste is effectively recycled, largely due to sorting inefficiencies. AI-enabled machine vision systems improve material identification accuracy, supporting circular economy targets.

Cloud-based AI deployment lowers entry barriers for mid-tier packaging companies. Subscription-based models reduce upfront capital requirements while enabling scalability. Cloud AI solutions are particularly attractive in regions with strong digital infrastructure and supportive data governance frameworks.

As cloud adoption expands, AI vendors can target underserved segments, increasing the total addressable market. This opportunity aligns with broader industrial digitalization trends supported by government-led smart manufacturing initiatives.

Generative AI tools enable rapid packaging design iteration, customization, and brand differentiation. These systems reduce design cycles by up to 40% while allowing data-driven consumer personalization. Brand owners increasingly demand shorter product cycles, creating commercial potential for AI-driven design automation, especially in consumer goods and cosmetics.

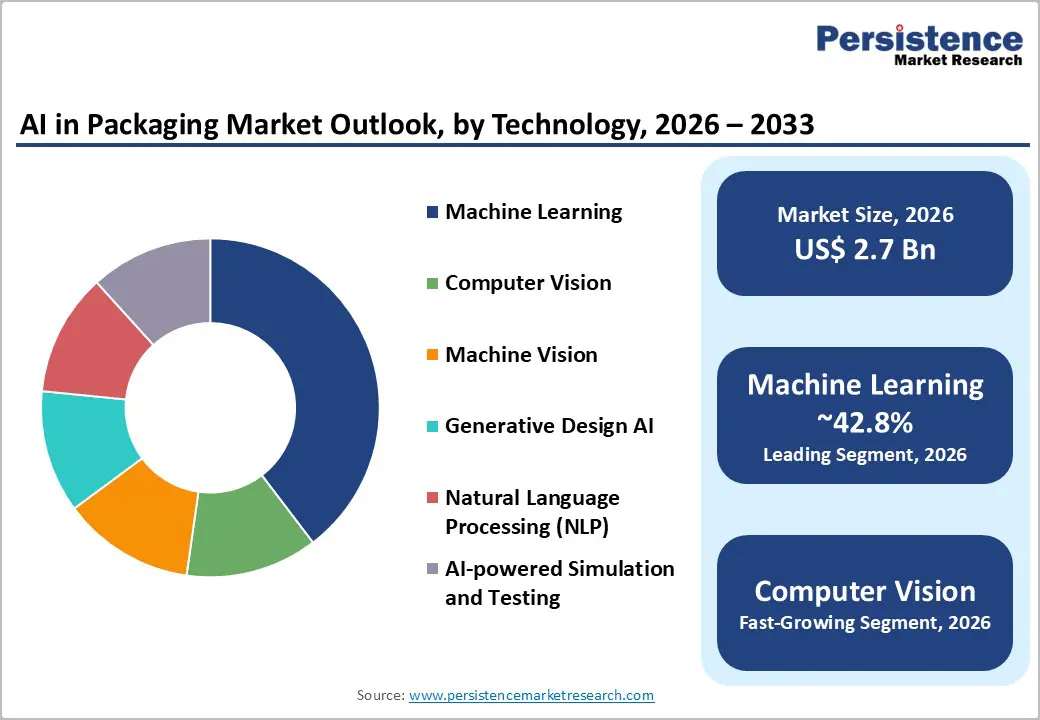

Machine learning is expected to remain the leading technology segment, accounting for approximately 42.8% of revenue. Its dominance reflects broad adoption across automation, predictive maintenance, and quality assurance applications within high-throughput packaging environments. Machine learning models process large volumes of operational data to identify defect patterns, predict equipment failures, and optimize line efficiency. Large food and beverage manufacturers deploy these systems to maintain consistent output across multi-shift operations. At the same time, pharmaceutical packaging lines rely on machine learning for batch-level compliance monitoring and anomaly detection. Predictive analytics further reduces unplanned downtime, supporting cost containment and regulatory adherence.

Computer vision is anticipated to be the fastest-growing technology segment over the forecast period, supported by rising demand for automated inspection and real-time defect detection. Declining sensor costs, improved camera resolution, and advancements in deep learning-based image recognition reinforce growth. Key applications include seal integrity verification, label accuracy checks, contamination detection, and dimensional inspection. For example, vision-based AI systems are increasingly used in blister packaging and flexible packaging lines to ensure consistency at high speeds. Machine vision platforms and AI-powered simulation tools are also gaining traction for virtual testing, line calibration, and process optimization. Generative design AI and natural language processing remain emerging technologies, primarily adopted for packaging design automation, regulatory documentation, and workflow standardization.

Quality inspection is expected to lead, holding a 31.4% share of revenue in 2026. Stringent regulatory compliance requirements and the high financial impact of recalls and non-conformance drive this leadership. AI-enabled inspection systems are widely adopted in food, pharmaceutical, and consumer electronics packaging, where defect tolerance is extremely low. These systems reduce false positives, improve detection accuracy, and enable real-time corrective actions at the production line level. In pharmaceutical packaging, AI-based inspection supports serialization, tamper detection, and labeling accuracy, directly addressing regulatory scrutiny from health authorities.

Smart warehousing is anticipated to be the fastest-growing application segment, reflecting accelerated logistics automation and the sustained expansion of e-commerce fulfillment networks. AI systems optimize packaging workflows, inventory placement, carton selection, and order sequencing, improving throughput and reducing handling errors. Large retailers and third-party logistics providers increasingly integrate AI-driven warehousing with packaging operations to enhance speed and accuracy. Supply chain optimization applications are also expanding, particularly in regions pursuing digital manufacturing and logistics modernization. AI-based recycling systems are gaining momentum in markets with sustainability mandates. At the same time, packaging design and customization applications continue to grow steadily as brand owners leverage data-driven insights to improve differentiation and responsiveness to consumer demand.

North America is estimated to lead with a 34.5% market share in 2026, supported by early industrial AI adoption, advanced manufacturing infrastructure, and strong regulatory enforcement. The U.S. accounts for the majority of regional demand, driven by large-scale food, pharmaceutical, and consumer goods packaging operations that require high throughput and strict quality control. Regulatory frameworks enforced by agencies such as the U.S. Food and Drug Administration (FDA) emphasize traceability, labeling accuracy, and contamination prevention, reinforcing the deployment of AI-enabled inspection and monitoring systems across packaging lines.

Key growth drivers include sustained investment in factory automation, a mature AI vendor ecosystem, and widespread adoption of cloud-based industrial platforms. Major automation and technology providers such as Rockwell Automation, Cognex, and Siemens have expanded AI-powered vision and analytics solutions tailored for packaging environments in the U.S. In recent years, several North American food and beverage manufacturers have partnered with AI software providers to deploy predictive inspection and anomaly detection systems, reducing recall risks and unplanned downtime. Cloud hyperscalers such as Amazon Web Services and Microsoft also play a central role by enabling scalable AI deployment for mid-sized packaging firms through subscription-based models.

Investment activity in the region remains focused on compliance-ready, scalable AI solutions that can integrate with legacy equipment while meeting cybersecurity and data governance requirements. Canada contributes to regional growth through government-backed AI research initiatives and the adoption of smart manufacturing technologies, particularly in sustainable packaging and recycling applications. Overall, North America’s leadership reflects a combination of regulatory pressure, technological readiness, and capital availability.

Europe represents a mature yet steadily expanding market for AI in packaging, led by Germany, the U.K., and France. Growth is shaped by regulatory harmonization across the European Union, with strong emphasis on sustainability, recycling efficiency, and product traceability under frameworks such as the EU Circular Economy Action Plan and packaging waste directives. These policies have accelerated the adoption of AI-based quality inspection, material sorting, and recycling systems across the region.

Germany leads Europe in industrial automation and smart factory integration, supported by its strong base in machinery and packaging equipment manufacturing. Companies such as Bosch Rexroth and Siemens have introduced AI-enabled machine vision and predictive maintenance solutions specifically designed for high-speed packaging lines. In the U.K., AI adoption is more concentrated in smart logistics, e-commerce packaging optimization, and data-driven design applications, reflecting the country’s strong retail and fulfillment infrastructure. France has emerged as a key market for AI-based packaging design, traceability, and sustainability analytics, supported by collaborations between packaging firms and digital technology providers.

Public-private partnerships play a significant role in Europe’s market development. EU-funded research programs and national innovation grants support the deployment of AI in manufacturing modernization and recycling infrastructure. As compliance requirements for waste reduction and traceability tighten, AI-based recycling systems and digital labeling solutions are gaining commercial traction, positioning Europe as a global reference point for AI-driven regulation in packaging.

Asia Pacific is likely to be the fastest-growing regional market for AI in packaging, driven by rapid industrialization, expanding e-commerce, and government-led digital manufacturing initiatives. The economies of China, Japan, India, and ASEAN collectively underpin growth, benefiting from large-scale manufacturing capacity and rising demand for automation-driven efficiency. Governments across the region actively support AI adoption through smart manufacturing policies, industrial digitization programs, and investments in digital infrastructure.

China leads the region in production volume and deployment scale, with AI increasingly integrated into packaging lines for food, beverages, and consumer goods to improve quality consistency and throughput. Domestic automation and technology providers are deploying computer vision and machine learning systems to address labor shortages and rising quality expectations. Japan emphasizes precision packaging, robotics integration, and defect minimization, aligning AI adoption with its advanced manufacturing standards. Companies such as Keyence and FANUC play a critical role in supplying vision-based inspection and robotics-enabled packaging solutions.

India and Southeast Asia represent long-term growth markets as packaging capacity expands and regulatory oversight strengthens. Rising pharmaceutical production in India is driving demand for AI-enabled inspection, serialization, and compliance monitoring systems. In ASEAN countries, growth is closely linked to e-commerce fulfillment, smart warehousing, and export-oriented food packaging. As quality standards tighten and automation investment increases, the Asia Pacific is expected to account for a growing share of global AI in packaging deployments over the forecast period.

The global AI in packaging market is moderately fragmented, with leading players holding an estimated 40-45% combined share. Competition centers on technology capability, integration expertise, and industry specialization. Global AI firms compete alongside packaging equipment manufacturers offering integrated solutions.

Leading players prioritize innovation, platform scalability, and regulatory alignment. Differentiation focuses on integrated AI ecosystems, cloud deployment, and industry-specific solutions. Subscription-based business models and strategic partnerships are becoming more prominent.

The global AI in packaging market is projected to be valued at US$2.7 billion in 2026.

By 2033, the AI in packaging market is expected to reach US$7.9 billion.

Key trends include increased deployment of AI-based quality inspection systems, rapid growth of computer vision for defect detection, expanding use of cloud-based AI platforms, integration of AI in smart warehousing and logistics, and rising adoption of AI-enabled recycling and sustainability solutions driven by regulatory mandates.

Machine learning is the leading technology segment, accounting for an anticipated 42.8% market share, driven by its widespread use in automation, predictive maintenance, and quality assurance across high-volume packaging industries.

The AI in packaging market is projected to grow at a CAGR of 16.5% between 2026 and 2033.

Major players include Siemens AG, Rockwell Automation, ABB Ltd., Cognex Corporation, and Tetra Pak.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By Applications

By End-user

By Deployment

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author