ID: PMRREP12454| 300 Pages | 15 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

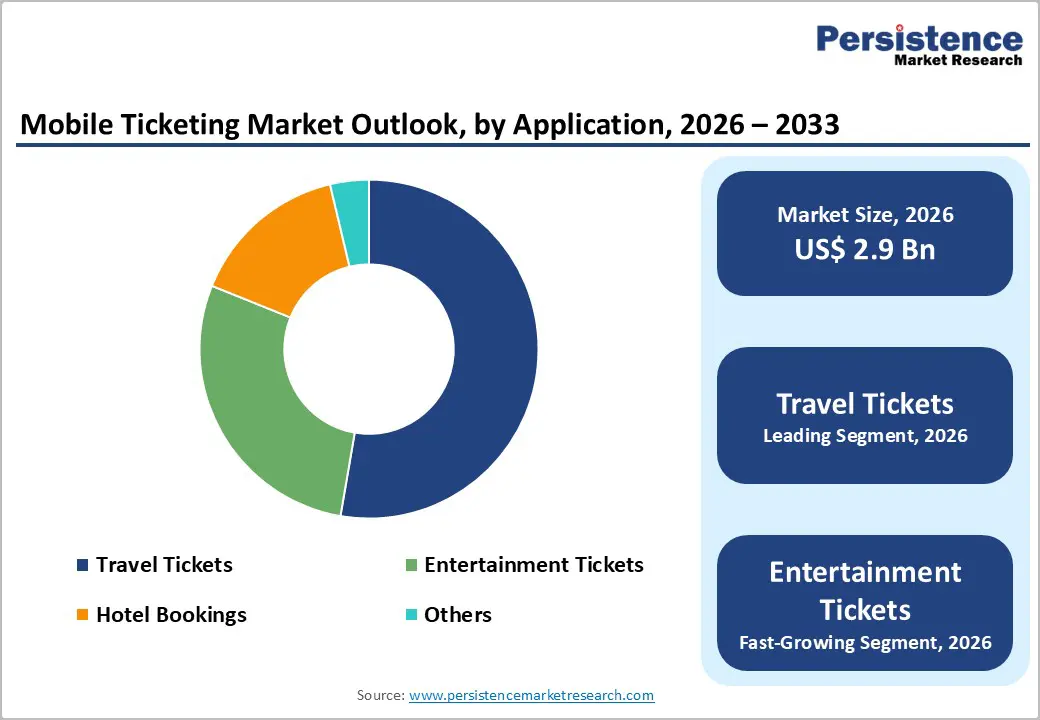

The global Mobile Ticketing Market size is projected to reach US$2.9 Billion in 2026 and is anticipated to expand to US$7.6 Billion by 2033, demonstrating growth at a CAGR of 14.6% between 2026 and 2033. This substantial expansion reflects accelerating digital transformation across transportation, entertainment, and hospitality sectors driven by smartphone proliferation and consumer preference for contactless transactions. Rising integration with digital payment wallets, coupled with government-led smart city initiatives and enhanced mobile infrastructure, continues to drive market acceleration across all geographic regions and application segments.

| Key Insights | Details |

|---|---|

|

Mobile Ticketing Market Size (2026E) |

US$ 2.9 billion |

|

Market Value Forecast (2033F) |

US$ 7.6 billion |

|

Projected Growth CAGR (2026-2033) |

14.6% |

|

Historical Market Growth (2020-2025) |

12.9% |

Market Drivers

Accelerating Smartphone Penetration and Mobile Wallet Integration

Global smartphone penetration exceeding 70% in developed markets and 50%+ in emerging economies creates an expanding addressable user base for mobile ticketing applications. Mobile device ubiquity enables seamless ticket purchasing, storage, and validation directly through smartphones, eliminating physical ticket requirements. Integration with digital payment wallets including Apple Pay, Google Pay, Alipay, and WeChat Pay streamlines transaction processes, reducing friction in purchasing workflows. Payment provider collaboration exemplified by Amazon Pay's partnership with Delhi Metro enabling direct QR-based ticket booking through e-commerce platforms demonstrates ecosystem convergence enhancing user accessibility. The 68% market share dominance of application-based solutions reflects consumer preference for comprehensive mobile platforms offering personalized recommendations, real-time updates, push notifications, and loyalty program integration. Biometric authentication technologies, including fingerprint and facial recognition embedded within mobile devices, further enhance security while maintaining transaction simplicity.

Convenience, Contactless Preference, and Post-Pandemic Behavioral Shifts

Mobile ticketing eliminates operational friction inherent to physical ticket distribution, including queue management, ticket printing, and counter operations, substantially improving user experience across transportation and entertainment sectors. Contactless transaction demand accelerated significantly following pandemic-driven safety concerns, with consumers demonstrating sustained preference for touch-free interactions exceeding pre-pandemic baselines. Real-time booking capability enabling purchase completion within seconds aligns with modern consumer expectations for instant gratification and immediate access. Integration of trip planning, live vehicle tracking, and route optimization within unified applications transforms mobile ticketing from transaction tool to comprehensive mobility solution. Data analytics integration enables predictive recommendations, personalized offers, and targeted promotions, enhancing engagement and customer lifetime value. SMS-based mobile ticketing, while representing 10.8% CAGR growth, addresses infrastructure-constrained markets where data connectivity limitations inhibit application-based adoption, ensuring market accessibility across diverse economic contexts.

Market Restraints

Data Privacy, Cybersecurity Vulnerabilities, and Regulatory Compliance Complexity

Mobile ticketing platforms accumulate comprehensive user datasets including travel patterns, payment information, personal identifiers, and behavioral preferences, creating substantial regulatory compliance obligations under GDPR, CCPA, and emerging regional data protection frameworks. Cybersecurity incidents targeting ticketing platforms expose customer financial data, generating reputational damage and consumer trust erosion. Blockchain integration and biometric authentication, while enhancing security, increase implementation complexity and costs, particularly for smaller operators. Regulatory compliance costs, including data localization requirements mandated by countries including India and Russia, necessitate infrastructure investments exceeding viability thresholds for market entrants. Fraud prevention requirements, including multi-factor authentication and AI-powered anomaly detection, create ongoing operational expenses constraining profitability, particularly within price-sensitive markets.

Infrastructure Limitations, Payment Method Fragmentation, and Regional Interoperability Challenges

Emerging markets display inconsistent internet infrastructure quality, with rural and semi-urban areas experiencing connectivity gaps inhibiting app-based ticket adoption. Payment method fragmentation requiring support for diverse digital wallets, bank transfers, mobile money systems, and cryptocurrency variations complicates implementation and testing processes. Interoperability challenges emerge where multiple operators (transit agencies, airlines, entertainment venues) maintain incompatible ticketing systems, fragmenting user experience and reducing cross-platform benefits. Limited smartphone penetration in specific demographics, including elderly populations and low-income segments, restricts addressable market expansion. Terminal velocity limitations in SMS-based systems, handling significantly lower transaction volumes than application-based alternatives, constrain market scalability within technology-dependent regions.

Market Opportunities

Entertainment and Live Events Segment Expanding at Significant Pace

Entertainment ticketing, expanding at 16.2% CAGR, exceeds broader market growth rates driven by post-pandemic demand recovery, festival proliferation, and sports event expansion across emerging markets. Ticketing platform integration with artist management, venue operations, and audience engagement tools creates comprehensive ecosystem opportunities. Dynamic pricing algorithms enable revenue optimization, automatically adjusting ticket prices based on demand indicators, time-to-event proximity, and capacity utilization metrics. Secondary ticketing marketplaces, including resale platforms eliminating institutional friction, expand total addressable market through price discovery mechanisms benefiting both organizers and consumers. AI-powered event recommendation engines personalize discovery experiences, incrementally increasing conversion rates among lookalike audience segments. Integration with hospitality services, including hotel bookings and transportation coordination, creates bundled offerings justifying premium pricing and enhancing customer lifetime value.

Integration with Mobility-as-a-Service (MaaS) Platforms and Multi-Modal Travel Ecosystems

Mobile ticketing integration with comprehensive urban mobility solutions coordinating buses, trains, ride-sharing, e-bikes, and taxi services within unified digital interfaces creates substantial value proposition differentiation. MaaS platform integration enables trip planning optimization across transport modes, fare consolidation for seamless multi-leg journeys, and integrated payment processing through single transaction. Examples including Singapore's contactless payment systems, London's Oyster integration, and Sweden's SL app demonstrate ecosystem maturity and revenue expansion potential. Future convergence with autonomous vehicle fleets, drone delivery verification, and smart city IoT sensors expands addressable market beyond traditional transportation. Corporate mobility programs leveraging mobile ticketing for employee commuting optimization present substantial B2B opportunity segments.

Ticketing Type Analysis

Application-based mobile ticketing commands a dominant 68% market share, driven by integrated features, superior user experience, and ecosystem depth supporting loyalty, personalization, and real-time engagement. Native apps deliver optimized performance, offline ticket access, biometric authentication, and push notifications. Platforms such as redBus, ixigo, Paytm, and airline or railway apps build loyalty through differentiation, analytics-led personalization, dynamic pricing, group bookings, social sharing, and premium tiers that expand revenue while anchoring ticketing within broader digital travel and entertainment ecosystems globally today.

SMS-based mobile ticketing grows at 10.8% CAGR, addressing markets constrained by data access, smartphone capability, or digital literacy. SMS and USSD workflows enable basic phones, reduce operator costs, and broaden inclusion. KSRTC’s millions of UPI-linked transactions highlight scalable, low-friction adoption across underserved and intermittently connected regions and emerging transit networks.

Application Analysis

Travel ticketing dominates with a 53% market share across airline, railway, bus, and ferry segments. Airline ticketing leverages mature GDS and direct carrier platforms, delivering high conversion rates and premium revenues that justify app investments. Railway ticketing leads transaction volumes, especially in India, where Indian Railways moves over 23 million passengers daily and RailOne targets 40% mobile bookings by March 2026. Bus ticketing benefits from high frequency, price sensitivity, and reduced friction, with redBus scaling 350,000 routes and bookings globally.

Entertainment ticketing is the fastest-growing segment at 16.2% CAGR, driven by post-pandemic events, sports expansion, and festival growth. Dynamic pricing, secondary marketplaces, and premium experiences enhance monetization. Integration with hotel bookings, corporate events, conferences, and trade shows broadens platform utility through analytics, registration management, resale discovery, and ecosystem-led revenue diversification.

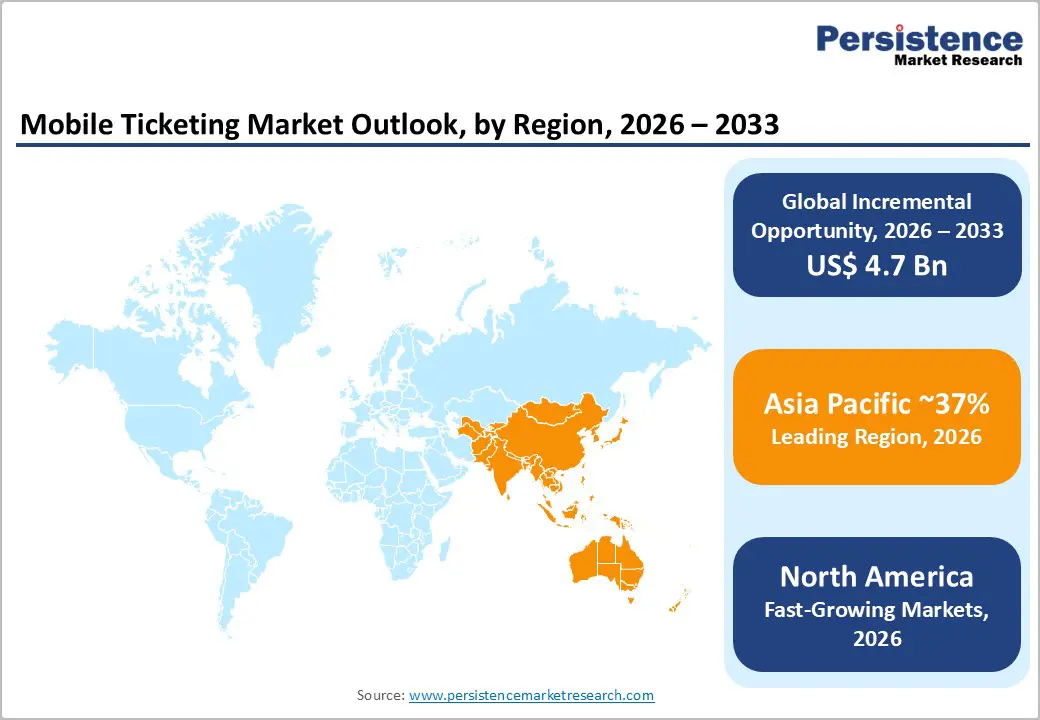

North America

North America reflects a mature mobile ticketing market growing at 14.2% CAGR, driven by upgrades and category expansion rather than new adoption. Advanced mobile infrastructure, smartphone penetration above 85%, and integrated digital payments enable frictionless transactions. Ticketmaster’s 63% market share highlights incumbent strength through venue relationships and Live Nation integration. Eventbrite’s Instant Payouts and Tap to Pay innovations enhance organizer liquidity. Premium festivals, sports diversification, and high purchasing power sustain demand, while regulations on resale and bots shape compliance costs.

Competitive intensity is high, with differentiation relying on technology innovation, partnerships, and vertical integration. Ecosystem expansion across hospitality, transport, and loyalty remains active. StubHub’s March 2025 IPO and subscription-based VIP access models illustrate ongoing capital investment, recurring revenues, and profitability optimization despite market maturity characteristics and sustained platform competition regionally.

Europe

Europe grows at roughly 14.6% CAGR while holding about 25% global share, reflecting varied maturity across Western and Eastern markets. Western Europe, led by Germany, the United Kingdom, and France, mirrors North America with high smartphone penetration, advanced payments, and strong contactless preference, evidenced by the UK’s 45% plus contactless usage. Eastern Europe, including Poland and Balkan states, shows lower digital adoption, creating expansion opportunities through infrastructure upgrades, operator education, and broader smartphone penetration initiatives across emerging regional transit ecosystems.

Growth drivers include sustainable transport investments, aviation recovery, and entertainment venue modernization. Partnerships between platforms, transit authorities, and venues enable multimodal integration. Premium services such as VIP access, flexible rebooking, and loyalty programs expand margins. GDPR and EU digital services regulations raise compliance costs but strengthen trust and governance credibility.

Asia-Pacific

Asia-Pacific leads mobile ticketing with 37% global share and growth far outpacing other regions. China’s Alipay and WeChat Pay ecosystem, processing over seven trillion dollars in 2024, normalized mobile payments and accelerated ticketing adoption. Government-led smart transport programs and rail modernization support regional growth above 18% CAGR. India’s RailOne launch unifies 23 million daily rail passengers, targeting 40% mobile bookings by March 2026. ASEAN markets like Vietnam, Thailand, and Indonesia post 25% plus growth, supported by urbanization and smartphone penetration.

Growth drivers include smart city programs, airline modernization, entertainment expansion, and hospitality digitalization. Cost-efficient operations enable competitive pricing for mass adoption. Local champions redBus, ixigo, and Paytm intensify competition against global platforms. Cross-border travel recovery, rural mobility, sports events, and experiential travel niches sustain demand momentum across the region throughout.

Strategic Developments

Business Strategies

Market leaders pursue ecosystem expansion, technology innovation, and geographic scale through consolidation, partnerships, and feature-rich applications. Differentiation centers on AI recommendations, dynamic pricing, biometric security, and fraud prevention. Revenue models shift toward subscriptions, loyalty programs, and enterprise B2B, corporate mobility, and white-label ticketing solutions beyond consumer-focused transportation and entertainment.

The global Mobile Ticketing Market reached US$1.4 Billion in 2020 and is projected to achieve US$2.9 Billion in 2026, expanding to US$7.6 Billion by 2033.

Growth is driven by smartphone penetration above 70%, post-pandemic demand for contactless transactions, deep digital wallet integration, government-led smart city programs, and cost efficiencies from eliminating physical ticketing infrastructure.

The Mobile Ticketing Market is anticipated to expand at CAGR of 14.6% between 2026 and 2033.

Key opportunities include fast-growing entertainment ticketing (16.2% CAGR), Asia-Pacific scale expansion, Mobility-as-a-Service integration, hotel booking convergence, and enterprise corporate mobility solutions.

Leading players include Ticketmaster, Eventbrite, StubHub, AXS, redBus, Paytm, Masabi, SeatGeek, Ticketek, ixigo, See Tickets, Dice, TickPick, Vivid Seats, and TodayTix, shaping global competition through scale, innovation, and regional dominance.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Ticketing Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author