ID: PMRREP33138| 195 Pages | 7 Aug 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

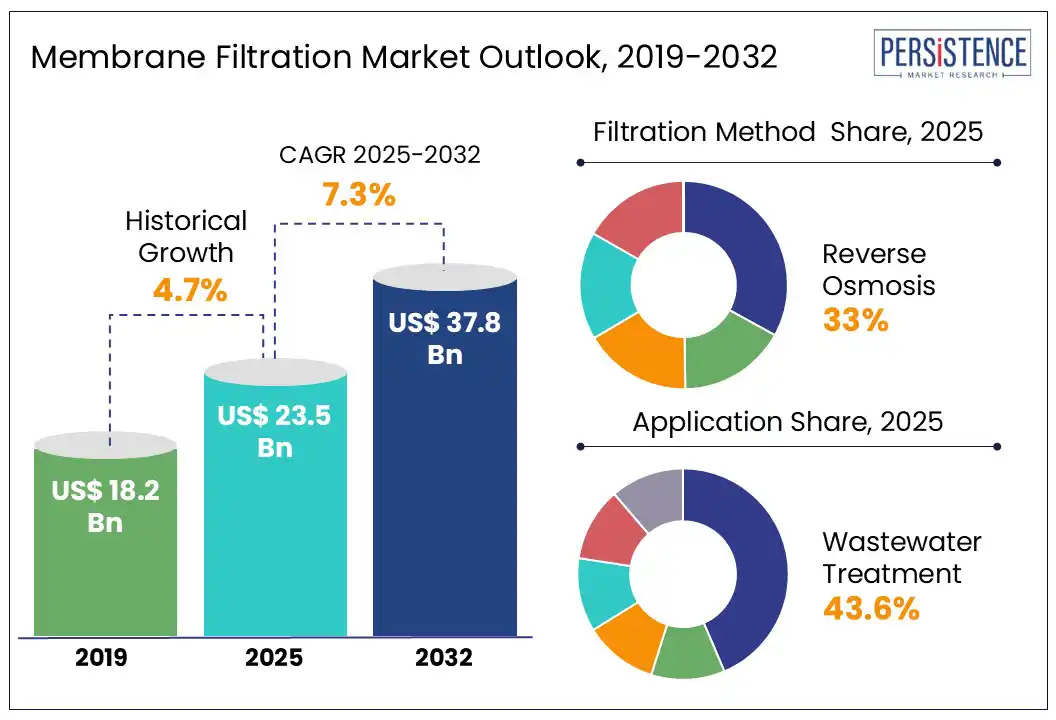

The global membrane filtration market size is likely to be valued at US$ 23.5 Bn in 2025 and is estimated to reach US$ 37.8 Bn in 2032, growing at a CAGR of 7.3% during the forecast period 2025 - 2032. Rising need for ultrapure water in pharmaceutical and laboratory applications, fueled by stringent regulatory standards and the rapid growth of biologics and injectable drug production has encouraged the market growth. Membrane filtration has become one of the most important technologies in the healthcare sector today. Its ability to isolate life-saving proteins in biopharmaceutical production and ensure ultrapure water for dialysis and injectable drugs is expected to boost demand.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Membrane Filtration Market Size (2025E) |

US$ 23.5 Bn |

|

Market Value Forecast (2032F) |

US$ 37.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.7% |

Increasing demand for ultrapure water in pharmaceutical manufacturing and laboratory research is pushing the membrane filtration market growth. In pharmaceutical facilities, ultrapure water is essential for the formulation of injectables, cleaning of significant equipment, and as a component in cell culture media. As per a 2024 report by the International Society for Pharmaceutical Engineering (ISPE), more than 85% of biopharmaceutical companies are actively upgrading or have already upgraded their water purification systems. They aim towards meeting stringent standards set by the United States Pharmacopeia (USP) and the European Pharmacopoeia (Ph. Eur.).

In laboratory settings, ultrapure water is important for molecular biology, genomics, and analytical chemistry workflows. Membrane filtration plays a key role in delivering water with resistivity up to 18.2 megaohm-centimeter, especially in high-precision applications, including liquid chromatography-mass spectrometry. The push for sustainability in water usage is also encouraging pharmaceutical companies to adopt membrane systems that support water reclamation and recycling. Various companies are launching closed-loop membrane filtration systems that reduce water wastage by over 40%, meeting environmental compliance goals.

The potential for membrane fouling, which is caused by proteins and particulate buildup is a key limitation in the adoption of membrane filtration in healthcare. Fouling not only reduces membrane performance over time but also necessitates frequent cleaning or replacement. This adds to operational downtime and increases maintenance costs. For instance, in continuous bioprocessing systems where sterile filtration is important, even minor fouling events can compromise product sterility.

The issue is specifically problematic in reusable filtration systems such as those used in hospital-based water purification units and dialyzers. In these settings, membrane degradation from repeated chemical cleaning cycles shortens membrane lifespan and poses risks of leaching. The challenge of fouling is further magnified in systems handling complex biological fluids, including cell culture media, where clogging is accelerated by high protein loads.

The surge in biopharmaceutical production is creating novel opportunities for membrane filtration, mainly in upstream and downstream purification workflows. Biologics such as monoclonal antibodies, vaccines, and recombinant proteins require intricate purification processes involving multiple membrane steps. According to the IQVIA Institute, the global biopharma market crossed US$ 400 Bn in 2023, with over 60% of the pipeline now comprising biologics. This shift is pushing demand for specialized biopharmaceutical membrane filtration systems capable of handling sensitive, high-molecular-weight biologics with minimal product loss.

Another emerging opportunity lies in single-use filtration systems, which are increasingly favored in modular and multiproduct biomanufacturing facilities. For instance, Cytiva and Pall Life Sciences have reported double-digit growth in their single-use membrane cartridge sales since 2022. It is attributed to high demand from flexible production plants in the U.S., South Korea, and Germany. These single-use systems eliminate cleaning validation, reduce cross-contamination risk, and support rapid changeovers between batches. Additionally, the emergence of novel gene therapies and mRNA vaccines is bolstering membrane innovation.

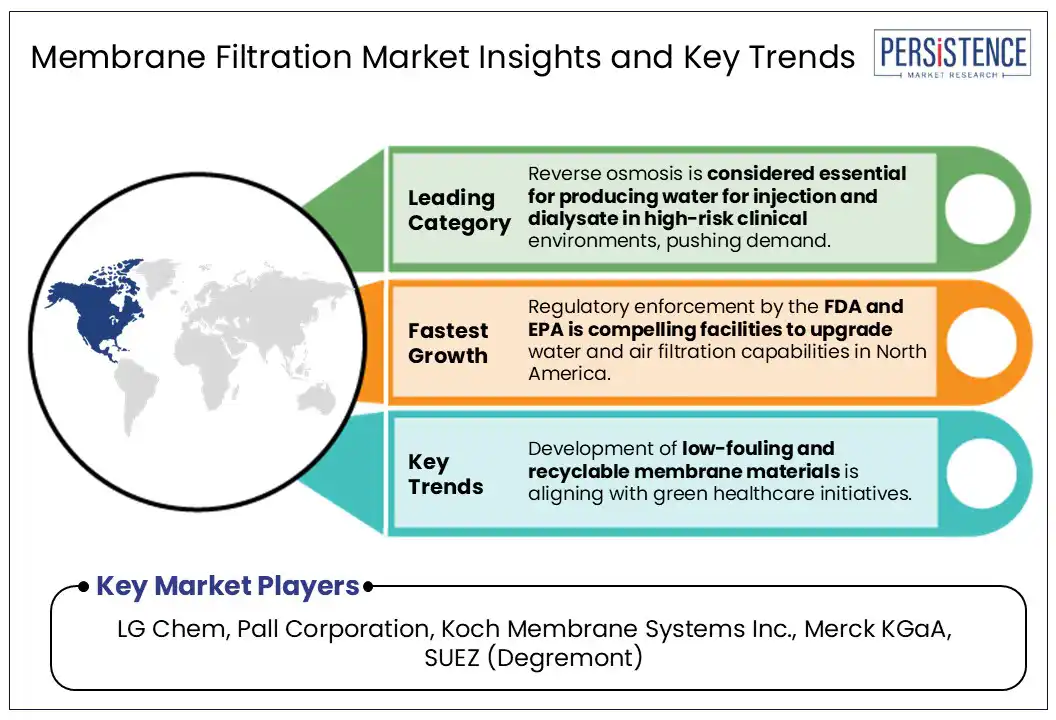

Based on filtration method, the market is divided into ultrafiltration, microfiltration, nanofiltration, chromatography, and reverse osmosis. Among these, the reverse osmosis segment is projected to hold around 33.0% of the membrane filtration market share in 2025 as it is capable of producing ultrapure water by removing up to 99.9% of dissolved salts, organic molecules, and microbial contaminants. This level of purity is essential for a range of clinical and pharmaceutical applications, especially in the preparation of water for injection. It operates under high pressure and utilizes semi-permeable membranes with pore sizes below 0.001 microns, allowing it to reject even minute ionic contaminants and endotoxins.

Microfiltration is estimated to showcase steady growth in the foreseeable future, backed by its ability to remove bacteria, cell debris, and large particulates while preserving the integrity of biologically active compounds. These characteristics make it ideal for the sterile filtration of pharmaceutical solutions and media clarification. Its pore size range, typically between 0.1 and 0.2 microns, is suitable for ensuring endotoxin-free, particle-free fluids without impacting proteins or nucleic acids.

By application, the market is segregated into sterilization, purification, bodily fluid analysis, wastewater treatment, and blood filtration. Out of these, the wastewater treatment segment will likely hold nearly 43.6% of the market share in 2025 amid increasing emphasis on the management and mitigation of pharmaceutical residues, pathogens, and Antibiotic-Resistant Genes (ARGs) commonly found in hospital effluents. These contaminants pose a direct threat to public health and environmental safety if released untreated into municipal water systems. Membrane bioreactors are increasingly being installed in healthcare facilities to meet tight effluent discharge standards.

Bodily fluid analysis has also become a key application on the back of increasing demand for non-invasive diagnostic tools and precision monitoring of diseases through liquid biopsies. Membrane-based separation plays a key role in isolating specific biomarkers from complex fluids. The fine pore size control in nanofiltration and ultrafiltration membranes allows for selective retention or passage of these biomolecules. It further enables their downstream detection with high sensitivity.

North America is predicted to account for around 35.0% of the market share in 2025 due to the region’s dominance in biologics manufacturing and strict regulatory demands for sterility. The U.S. membrane filtration market is poised to remain at the forefront with the emergence of monoclonal antibodies, cell and gene therapies, and mRNA-based drugs. Companies such as Pall Corporation and Repligen are investing huge sums in high-throughput, low-protein-binding membrane technologies to cater to single-use bioprocessing systems.

Recent developments show that medical membrane devices are increasingly gaining impetus in the U.S. healthcare manufacturing sector. Sartorius, for instance, has been actively accelerating membrane technologies such as its upcoming Sartopore Evolution line, aimed at phasing out Perfluoroalkyl and Polyfluoroalkyl Substances (PFAS)-containing membranes. In addition, the country is witnessing a surging application of membrane technology in dialysis centers. A gradual shift toward home dialysis in the U.S. is expected to create new avenues for compact, membrane-based systems.

Europe is being augmented by the region’s emphasis on GMP-compliant biomanufacturing and its push toward localizing production of significant therapeutics. Germany, Switzerland, and Ireland are emerging as membrane technology hubs due to their dense clusters of biologics and vaccine manufacturers. In 2023, for example, the European Medicines Agency (EMA) recommended 77 new medicines for marketing authorization, with 32 of those being biologics. This led to a high demand for membrane filtration systems for sterile processing, viral clearance, and protein purification.

Domestic players are at the forefront of sustainable membrane innovations. In the dialysis sector, Europe is shifting toward high-flux and ultrapure dialysis membranes to improve patient outcomes and reduce inflammatory responses. In addition, the continent’s tightening control over pharmaceutical water quality under the revised Annex 1 of the EU GMP guidelines has bolstered upgrades to membrane-based water purification systems. Pharmaceutical plants across Italy and Spain are hence adopting hybrid systems combining nanofiltration and reverse osmosis to meet these new microbial and endotoxin limits.

Increasing investments in domestic biopharmaceutical production and expanding dialysis patient pool are creating opportunities in Asia Pacific. China and India are leading this shift, supported by national initiatives such as China’s Made in China 2025 and India’s Production Linked Incentive (PLI) scheme for pharmaceuticals. These programs are prompting both local and multinational firms to establish or upgrade membrane-based sterile filtration and water purification systems in new manufacturing units.

The localization of lab-grade ultrapure water systems, particularly in research hubs such as Singapore and South Korea, is also fostering growth. Countries in Southeast Asia are beginning to adopt single-use membrane modules in biologics production to reduce validation complexity and contamination risks. It is evident from Malaysia’s National Pharmaceutical Regulatory Agency, which mandated strict microbial limits in injectable production in 2023. This highlights a region-wide transition from basic filtration setups to innovative membrane filtration systems.

The global membrane filtration market is characterized by specialized filtration companies, multinational conglomerates, and emerging biotech firms. Leading companies are dominating through strong research and development pipelines, extensive product portfolios, and global distribution networks. They are innovating membrane materials such as polyvinylidene fluoride to enhance biocompatibility, throughput, and resistance to fouling in various applications. Small-scale companies are targeting niche segments such as membrane-based point-of-care diagnostic devices or wearable dialysis systems.

The membrane filtration market is projected to reach US$ 23.5 Bn in 2025.

Increasing use of injectable biologics and surging prevalence of chronic kidney disease are the key market drivers.

The membrane filtration market is poised to witness a CAGR of 7.3% from 2025 to 2032.

The emergence of AI-enabled filtration systems and advances in recyclable membrane materials are the key market opportunities.

LG Chem, Pall Corporation, and Koch Membrane Systems Inc. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Filtration Method

By Module Design

By Membrane Material

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author