ID: PMRREP28363| 199 Pages | 2 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

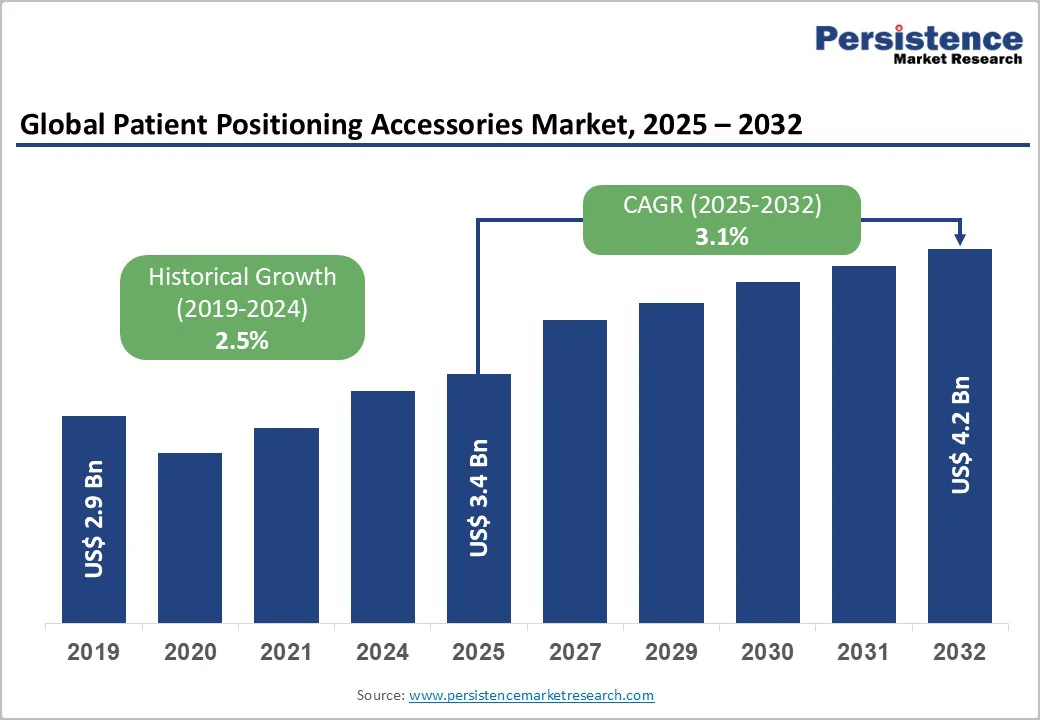

The global patient positioning accessories market size is valued at US$ 3.4 billion in 2025 and projected to reach US$ 4.2 billion growing at a CAGR of 3.1% during the forecast period from 2025 to 2032.

Patient positioning devices help establish and maintain the patient’s fixed and defined position over a course of radiotherapy treatment sessions and surgical procedures. These are devices that are used to help patients maintain the defined position with comfort. Moreover, rising incidence of surgeries related to accidents and cancer therapies along with increasing adoption of treatment provides abundant opportunities for the growth of the patient positioning accessories market through the forecast period.

| Key Insights | Details |

|---|---|

|

Patient Positioning Accessories Market Size (2025E) |

US$ 3.4 Bn |

|

Market Value Forecast (2032F) |

US$ 4.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

2.5% |

Increase in the number of medical procedures, as a result of high prevalence of chronic diseases, is one of the significant factors driving the demand for medical products. A high number of diseases invites more attention on diagnostic and therapeutic procedures. These diagnostic and therapeutic procedures include radiology as a primary diagnosis, along with surgeries as a rehabilitation measure.

There is also a trend of installing the latest equipment in patient stabilization at patients’ facilities in high-income countries in order to increase their official ranking, thus fuelling the market growth. With the increase in the treatment-seeking rates of patients, the use of patient positioning accessories will grow in the coming years, and eventually, this market is expected to grow during the forecast period.

When a specific treatment is required during emergencies like road traffic accidents and immediate surgeries, a very small percentage of the population has access to diagnostic or other advanced care. Even if many countries have programs for expansion and modernization, less developed resources are available to them. Hence, even these basic stabilization instruments, that are crucial for the patient’s comfort and safety, are not available.

In Africa, only a small percentage of population has access to medical diagnostic & imaging equipment. These include the use of such patient comforting accessories at their primary healthcare-seeking places. Only few pieces of equipment are available per million population. Weak economic conditions in a country also delay investment in medical infrastructure there, which overall limits the positioning accessories market. There is currently a shortage of trained and qualified personnel in many parts of the world. This shortage obstructs the market growth of patient positioning accessories. Lancet Oncology also estimates that another 215,000 specialists will be needed by 2035.

In most developing countries, health-related infrastructure and trained human resources are lacking or poorly developed. There is an enormous need for trained oncologists, medical physicists, and radiation therapists, which limits market growth.

The rapid progression of radiation therapy technologies is creating a strong opportunity for the patient positioning accessories market. As treatment systems become more sophisticated, such as image-guided radiotherapy, stereotactic radiosurgery, and proton therapy, there is a growing need for positioning devices that offer higher precision, improved compatibility, and greater stability. Modern radiotherapy requires patients to remain completely still while ensuring the targeted delivery of radiation to affected areas. This increases the demand for customized cushions, immobilization masks, body molds, and table supports that can align with new-generation machines.

The close relationship between radiotherapy and positioning accessories means that every upgrade in treatment systems drives parallel growth in accessory requirements. Clinics and hospitals prefer accessories that enhance accuracy, reduce patient movement, and improve comfort during lengthy or repeated treatment sessions.

Additionally, advancements in radiation diagnostics such as high-resolution CT, MRI, and PET systems, are boosting the adoption of improved positioning aids to ensure consistent imaging quality and reproducible patient setup. The shift from conventional radiological methods to advanced treatment and diagnostic modalities supports higher investment in superior positioning products. Together, these developments create a strong opportunity for manufacturers to introduce innovative, device-compatible, and ergonomically designed solutions to meet evolving clinical needs.

The surgical tables segment accounted for around 30% of the total patient positioning accessories market in 2024, reflecting its critical role across operating rooms. Surgical tables are central to every clinical specialty, as they provide the foundation for maintaining correct posture, stability, and accessibility throughout procedures. Ensuring patient safety during surgery is essential, and improper positioning can lead to complications such as nerve damage, pressure injuries, or compromised physiological function. As a result, hospitals and surgical centers rely heavily on advanced table systems designed to support different body types, surgical positions, and procedure complexities.

Modern surgical tables offer improved flexibility, easy adjustability, and compatibility with a wide range of positioning accessories, enhancing their adoption across orthopedics, neurology, cardiovascular, gynecology, and general surgery. Their ability to facilitate smooth transitions before, during, and after surgery also improves workflow efficiency and patient comfort. Furthermore, the rising number of complex and minimally invasive procedures boosts the need for tables that provide precise articulation and stability. With continuous upgrades in operating room infrastructure, the demand for high-performance surgical tables remains strong, making this segment a vital contributor to the overall patient positioning accessories market.

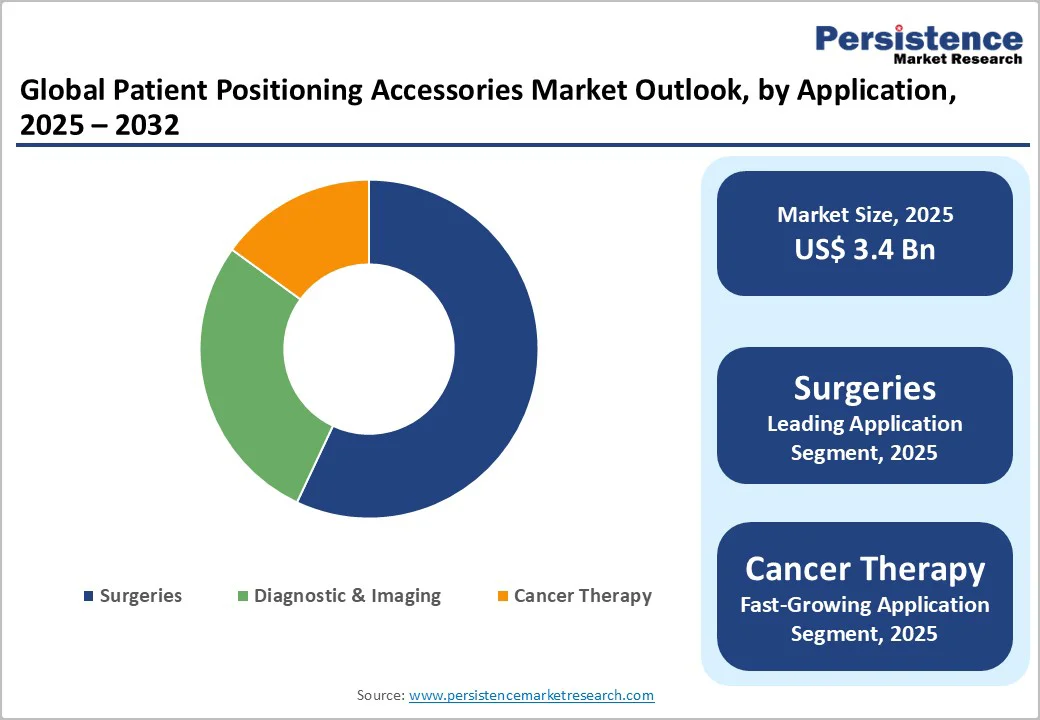

Surgeries held the largest share of the patient positioning accessories market, accounting for around 57% in 2024, primarily driven by the global rise in surgical procedures. The increasing prevalence of chronic and infectious diseases continues to push the demand for operative interventions, thereby strengthening the need for reliable positioning systems. Additionally, the growing number of road traffic accidents and the surge in radio diagnostic procedures further support market expansion, as these cases frequently require precise patient monitoring and stabilization.

Within surgical settings, positioning accessories such as masks, overlays, cushions, and immobilizers are routinely used to enhance procedural accuracy, improve safety, and ensure optimal therapeutic outcomes. High procedure volumes in orthopaedics, oncology, neurology, and cardiovascular care significantly reinforce product utilization. Moreover, the accelerating shift toward minimally invasive and image-guided surgeries increases the need for advanced support devices that offer greater stability, ergonomic positioning, and reduced intraoperative risks.

Overall, the strong surgical load, combined with advancements in medical imaging and operating room technologies, continues to make surgeries the dominant application segment, driving sustained demand for patient positioning accessories across healthcare facilities.

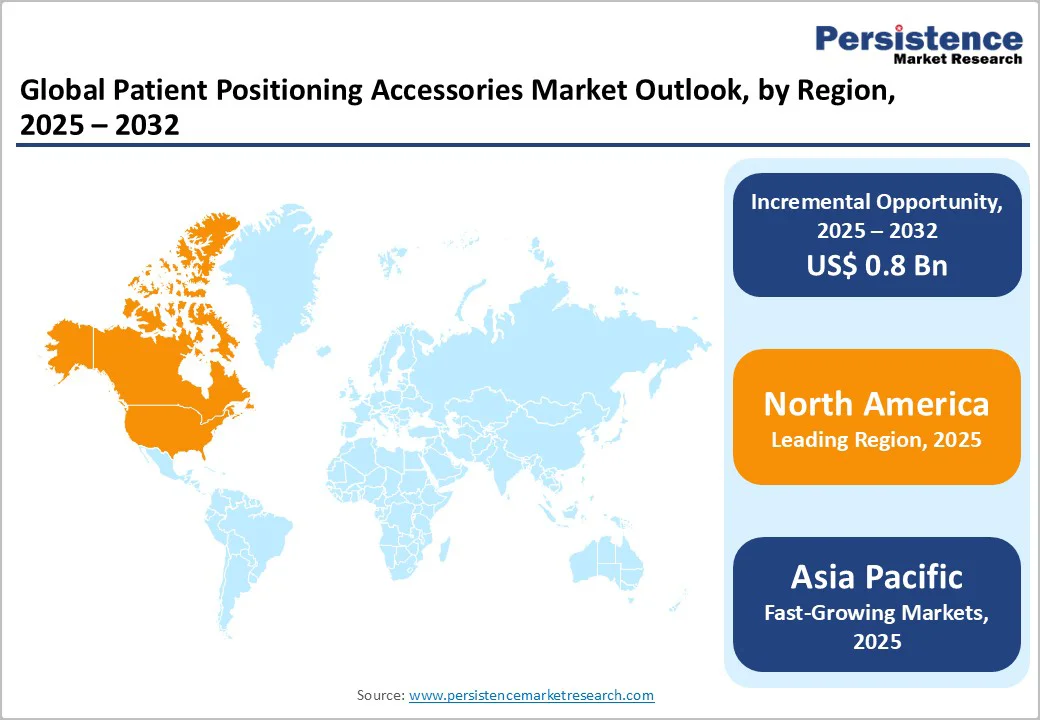

The U.S. dominated the North American patient positioning accessories market with a 91.8% share in 2024, a trend expected to continue through the forecast period. The country’s strong market position is supported by the high volume of diagnostic and surgical procedures, along with rapid integration of advanced, automated positioning systems across hospitals and specialty centers. Continuous technological upgrades in radiology, oncology, and surgical departments have increased the need for precise, reliable accessories that enhance patient stability and safety.

In addition, U.S. healthcare stakeholders including government bodies, insurers, and providers are moving toward cost-efficient care models. This shift has encouraged greater adoption of solutions that reduce procedural risks, improve workflow efficiency, and lower overall treatment costs. Approvals and commercial availability of new positioning products have further boosted demand, as hospitals increasingly invest in accessories that support complex interventions and refine patient outcomes. Together, these factors strengthen the region’s technological edge and reinforce steady market expansion.

The Asia Pacific region is witnessing strong growth in patient positioning accessories, driven primarily by rising cancer prevalence and expanding diagnostic and treatment infrastructure. In China, increasing cases of lung, breast, prostate, and other cancers have significantly raised the need for imaging and radiotherapy procedures. With nearly 3.24 million new cancer cases estimated in 2024, the demand for radiotherapy equipment and supporting accessories particularly immobilization and stabilization tools continues to escalate. This surge has created substantial opportunities for manufacturers offering precise and reliable positioning solutions.

India is also becoming a key growth contributor, supported by population expansion, and increasing burden of chronic diseases such as cancer, diabetes, and respiratory disorders. Government-led initiatives aimed at improving healthcare accessibility and strengthening biopharma and medical infrastructure are further driving demand for modern diagnostic and treatment equipment. The growing acceptance of advanced clinical procedures across public and private hospitals has amplified the use of positioning accessories in oncology, surgery, and critical care. Collectively, these factors are shaping a favourable growth environment for the patient positioning accessories market across the Asia Pacific region.

To strengthen their product lines around the globe, leading manufacturers are developing innovative products. Similarly, several major competitors in the patient positioning accessories industry have engaged in consolidation activities to speed up research and development. Various companies are focused on collaborations with other companies with products in advanced stages of development to enable quicker approval and distribution channels of their products.

The global patient positioning accessories market is projected to be valued at US$ 3.4 Bn in 2025.

Increasing global surgical volumes and demand for precision in diagnostic and imaging procedures are key growth drivers.

The global patient positioning accessories market is poised to witness a CAGR of 3.1% between 2025 and 2032.

AI-integrated accessories, sustainability initiatives, and growth of specialty and ambulatory care centers represent significant opportunities.

Major players include CIVCO Radiotherapy, Klarity Medical Products, CDR Systems, Elekta AB, Qfix, and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn and Volume (if Available) |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author