ID: PMRREP4221| 199 Pages | 4 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

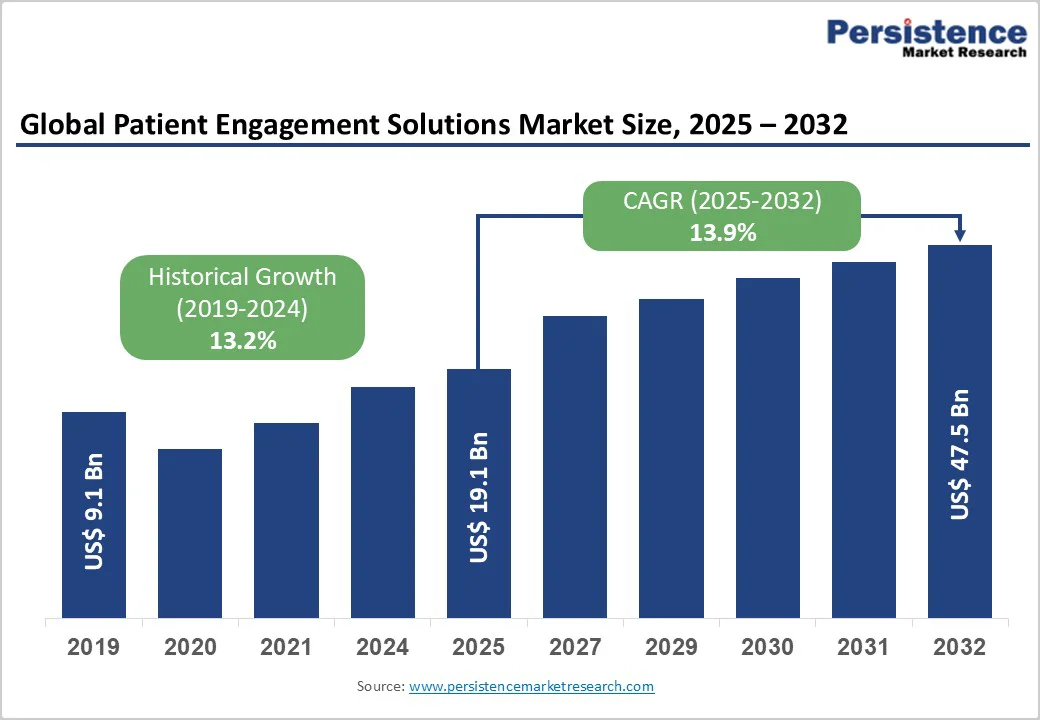

The global patient engagement solutions market size is valued at US$19.1 billion in 2025 and is projected to reach US$47.5 billion by 2032, growing at a CAGR of 13.9% between 2025 and 2032.

The primary drivers include the rising adoption of digital health technologies and a shift toward patient-centric care models that enhance communication and outcomes.

| Key Insights | Details |

|---|---|

| Patient Engagement Solutions Market Size (2025E) | US$19.1 Bn |

| Market Value Forecast (2032F) | US$47.5 Bn |

| Projected Growth CAGR (2025 - 2032) | 13.9% |

| Historical Market Growth (2019 - 2024) | 13.2% |

The rapid use of mobile health apps, telehealth platforms, and digital monitoring tools is significantly accelerating growth in the patient engagement solutions market. Healthcare providers now rely on these technologies to enable instant communication, remote consultations, and continuous tracking of patient health conditions.

This shift is especially important as chronic diseases such as diabetes, hypertension, and cardiac disorders continue to rise worldwide, increasing the need for consistent patient follow-ups.

The adoption of digital platforms has increased by more than 30% in recent years, mainly due to the demand for efficient and convenient care delivery. These tools help improve adherence to treatment plans, reduce unnecessary hospital visits, and lower overall healthcare costs. As a result, both patient satisfaction and provider efficiency increase, creating a strong foundation for long-term market expansion.

A major shift from traditional provider-focused systems to patient-centric care models is driving strong demand for engagement solutions globally. Governments and healthcare authorities are introducing supportive policies that encourage patient participation in decision-making, ultimately improving treatment outcomes.

Organizations such as the World Health Organization promote shared decision-making and personalized education, thereby strengthening the need for digital engagement tools.

The patient-centric care can increase treatment compliance by up to 25%, especially when supported by secure messaging, personalized reminders, and interactive health content.

The growing use of smart wearable devices for fitness and health monitoring also aligns with value-based care strategies, where providers are rewarded for delivering better outcomes rather than higher service volumes. This approach supports preventive healthcare, allowing patient engagement tools to play a vital role in managing long-term health needs efficiently.

The initial cost of implementing patient engagement solutions remains a major barrier for many healthcare providers, especially small and mid-sized facilities.

Setting up these systems often requires significant spending on software, hardware, IT integration, data management, and staff training. In many cases, total implementation expenses can reach several million dollars per healthcare organization, making adoption difficult in resource-constrained environments. Emerging regions face added challenges due to weak digital infrastructure, inconsistent internet connectivity, and limited technical expertise.

Interoperability issues between modern engagement platforms and older legacy systems increase complexity and delay operational benefits. Providers must carefully evaluate financial risks versus long-term advantages, slowing overall market penetration. These factors collectively restrict large-scale deployment and limit the speed at which providers can adopt advanced engagement technologies.

Data protection continues to be a key concern for healthcare organizations deploying patient engagement platforms. Regulations such as HIPAA in the U.S. and GDPR in Europe impose strict requirements on how patient information must be stored, accessed, and shared.

Any non-compliance can lead to heavy penalties and loss of patient trust, making providers cautious about adopting new systems. Reports indicate that data breaches still affect more than 100 million medical records each year globally, increasing pressure to maintain robust cybersecurity measures.

Many healthcare systems lack the specialized expertise needed to implement advanced security frameworks, further complicating adoption. Cloud-based platforms, although efficient, raise additional concerns about unauthorized access, encryption standards, and third-party vulnerabilities. As a result, providers are required to invest in high-level security features, which can delay digital transformation initiatives and slow market adoption.

The integration of artificial intelligence (AI) into patient engagement solutions is creating major growth opportunities by enabling more personalized and proactive healthcare experiences. AI-powered chatbots, predictive analytics tools, and recommendation engines help deliver customized care plans tailored to individual patient needs.

The AI-based engagement can improve interaction rates by up to 40%, particularly for chronic disease management programs. The rise of personalized medicine further increases demand for platforms that can deliver targeted content through mobile apps and digital portals.

Collaboration between technology companies and healthcare providers is accelerating innovation, giving rise to virtual health assistants, smart reminders, and automated follow-up systems. These advancements support better health outcomes, reduce administrative workloads, and significantly enhance the efficiency of care delivery.

As patient preferences shift toward digital, on-demand engagement, AI-backed solutions offer strong revenue potential for market players.

The rapid expansion of telehealth and remote monitoring solutions presents a strong opportunity for growth in patient engagement technologies. Following the pandemic, patients and providers have increasingly adopted virtual care models, making digital engagement tools essential to routine healthcare.

Remote monitoring devices, such as connected blood pressure monitors, glucometers, and wearable trackers, allow providers to monitor patient health in real time, especially for chronic conditions.

The remote monitoring is expected to grow at over 15% annually, supported by government approvals for home-based care and rising demand among aging populations. Integrated engagement platforms that combine video consultations, data sharing, and smart alerts offer significant value to both providers and patients.

Increased funding from health authorities and expanded partnerships between med-tech companies and hospitals further strengthen market opportunities, driving strong growth through 2032.

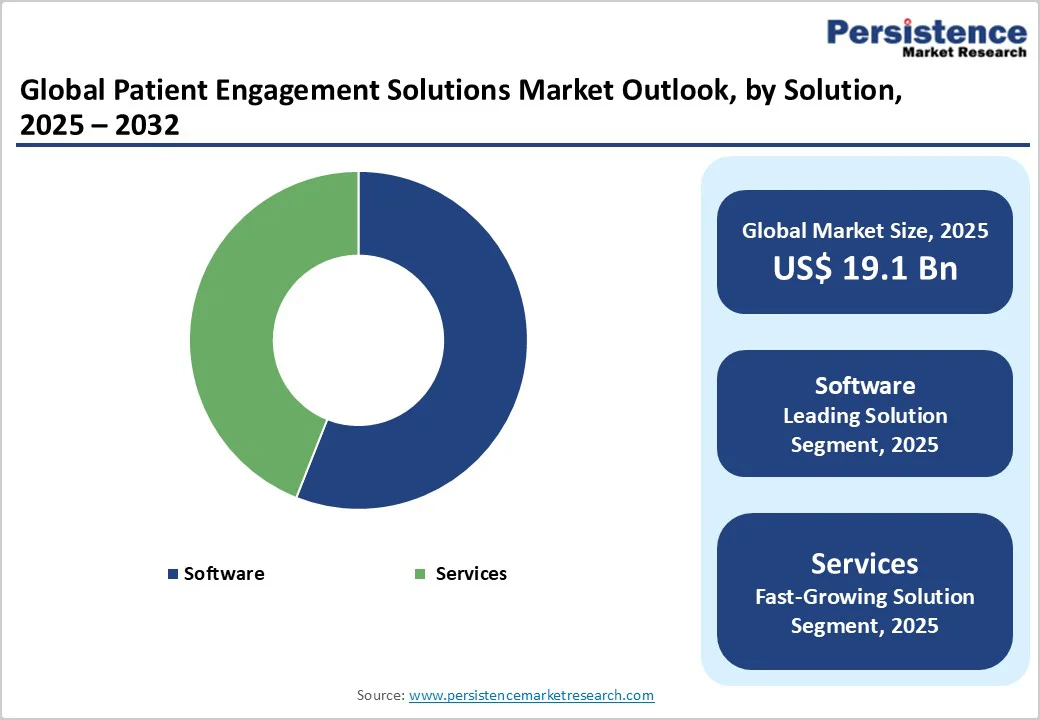

The Software segment leads the patient engagement solutions market with nearly 59% share because it offers flexible and integrated platforms that support communication, data management, and workflow efficiency. Both integrated and standalone software tools provide smooth access to electronic health records and secure messaging, both of which are essential in modern healthcare.

Around 70% of hospitals now prefer EHR-linked software due to its scalability. This dominance is further supported by the software’s ability to power mobile apps and analytics, reducing administrative work and improving coordination between care teams.

Cloud deployment dominates the market with about 70% share, mainly due to its flexibility, cost savings, and ease of scaling compared to traditional systems. Cloud-based platforms allow instant updates and remote access, which is essential for healthcare teams working across multiple locations.

Cloud adoption can lower maintenance expenses by up to 77%, making it highly attractive for organizations expanding telehealth services. Improved security features have also increased trust in cloud solutions, encouraging broader adoption across hospitals, clinics, and digital health providers.

Health Management is the leading application segment, accounting for approximately 29% of market share, driven by rising demand for chronic disease tracking and preventive healthcare. This segment relies on digital portals and mobile apps that provide patient education, reminders, and continuous health monitoring.

These tools can help reduce hospital readmissions by up to 20%, making them valuable for value-based care models. The segment’s growth is also supported by the increasing use of wearables, which offer personalized insights and support better long-term health outcomes.

Hospitals & Health Systems hold around 40% market share and remain the largest users of patient engagement solutions. They depend on these tools to manage large patient volumes, coordinate care, and improve discharge processes.

Digital platforms help streamline appointment scheduling, deliver automated reminders, and collect feedback, which has been shown to increase patient satisfaction by about 25%. Regulatory requirements for patient-centered care also encourage hospitals to invest in advanced engagement software. Their ability to handle complex acute and chronic cases strengthens this segment’s leading position in the market.

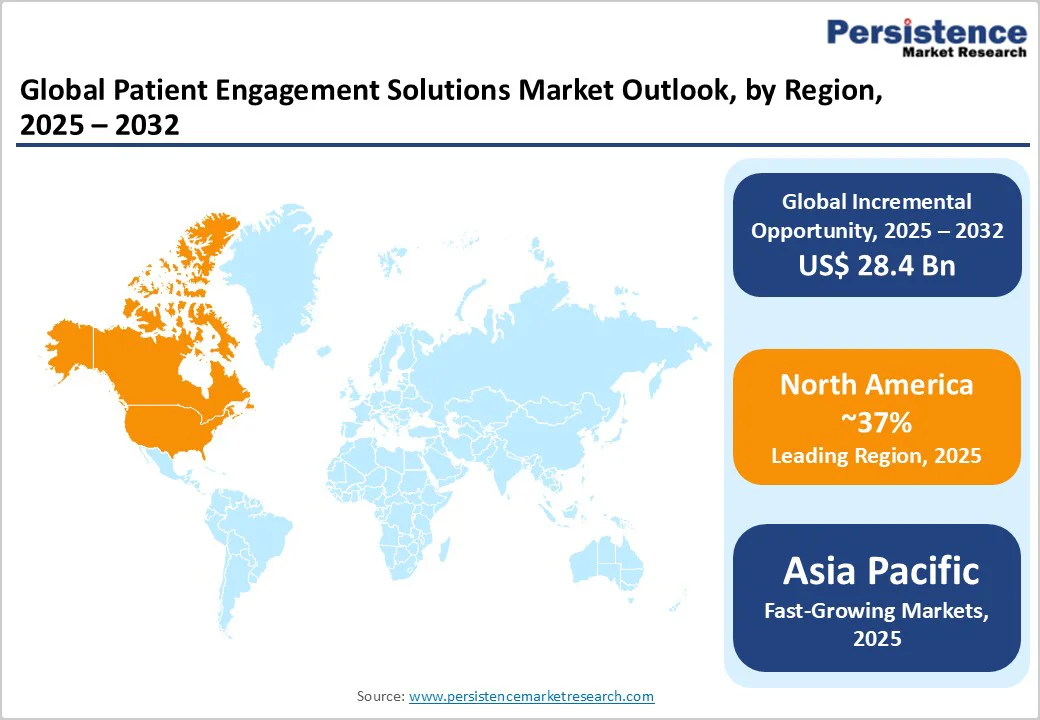

North America leads the global patient engagement solutions market due to its advanced healthcare infrastructure, strong digital adoption, and strict data protection frameworks such as HIPAA. The U.S. is the largest contributor, with more than 90% of healthcare providers using some form of engagement tool integrated with EHR systems.

The region strongly supports telehealth and remote monitoring, driven by value-based care programs initiated by organizations like the Centers for Medicare & Medicaid Services.

Partnerships between healthcare providers and technology companies continue to accelerate AI adoption, enabling personalized communication and predictive care planning. Engagement tools also support outpatient clinics by enhancing workflow efficiency, reducing wait times, and improving patient satisfaction across the care continuum.

Unified regulations, national eHealth strategies, and rising investments in digital healthcare transformation shape Europe’s patient engagement landscape.

Countries such as the U.K., Germany, and France are leading adopters, supported by GDPR-compliant frameworks that focus on secure and interoperable healthcare systems. Growth in the U.K. is especially strong, with patient engagement technologies expanding at nearly 20% CAGR, aided by large-scale NHS digital programs.

European Commission data shows that patient portal adoption has reached up to 85% in several developed nations, driven by telemedicine expansion and digital scheduling systems.

Pilot programs in Spain and the U.K. have demonstrated 15% reductions in readmission rates through effective use of engagement platforms. Europe continues to enhance cross-border data sharing and digital health integration, strengthening overall access to coordinated and high-quality care.

Asia Pacific is the fastest-growing region in the patient engagement solutions market, supported by strong digitalization efforts, large patient populations, and growing healthcare investments in China, Japan, and India. China’s push for digital health, including 5G-powered monitoring and AI-enabled platforms, has increased adoption at a significant rate annually.

India is expanding rapidly through initiatives such as the Ayushman Bharat Digital Mission, which aims to digitally connect more than 500 million citizens to accessible preventive care.

Japan’s aging population has created high demand for home healthcare and remote monitoring solutions, driving nearly 40% growth in related tools. ASEAN countries are also adopting cost-effective cloud-based engagement platforms to improve access in rural and underserved areas. The region’s strong manufacturing capabilities support rapid scaling of devices and software, reinforcing Asia Pacific’s position as a major growth hub.

The patient engagement solutions market is moderately consolidated, with a handful of key players holding significant shares through strategic acquisitions and R&D investments. Companies focus on expanding via partnerships for AI enhancements and cloud integrations, differentiating through user-centric designs and interoperability.

Emerging models emphasize subscription-based services and outcome-linked pricing, fostering innovation in telehealth. This structure encourages collaboration, with leaders investing billions in scalable platforms to capture growth in value-based care.

The market is expected to reach US$ 47.5 Bn by 2032, growing from US$ 19.1 Bn in 2025 at a CAGR of 13.9%.

The shift toward patient-centric care models, supported by regulations and digital health adoption, drives demand by improving outcomes and reducing costs.

Software leads with 56% share, due to its integration with EHRs and support for mobile communication tools.

North America dominates, thanks to advanced infrastructure and policies like HIPAA promoting secure engagement platforms.

AI advancements for personalized medicine offer potential to enhance adherence and predictive care through integrated platforms.

Major Players include McKesson Corporation, Cerner Corporation, Epic Systems Corporation, and Koninklijke Philips N.V., focusing on innovative software and services.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Solution

By Deployment

By Application

By End-user

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author