ID: PMRREP3514| 199 Pages | 14 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

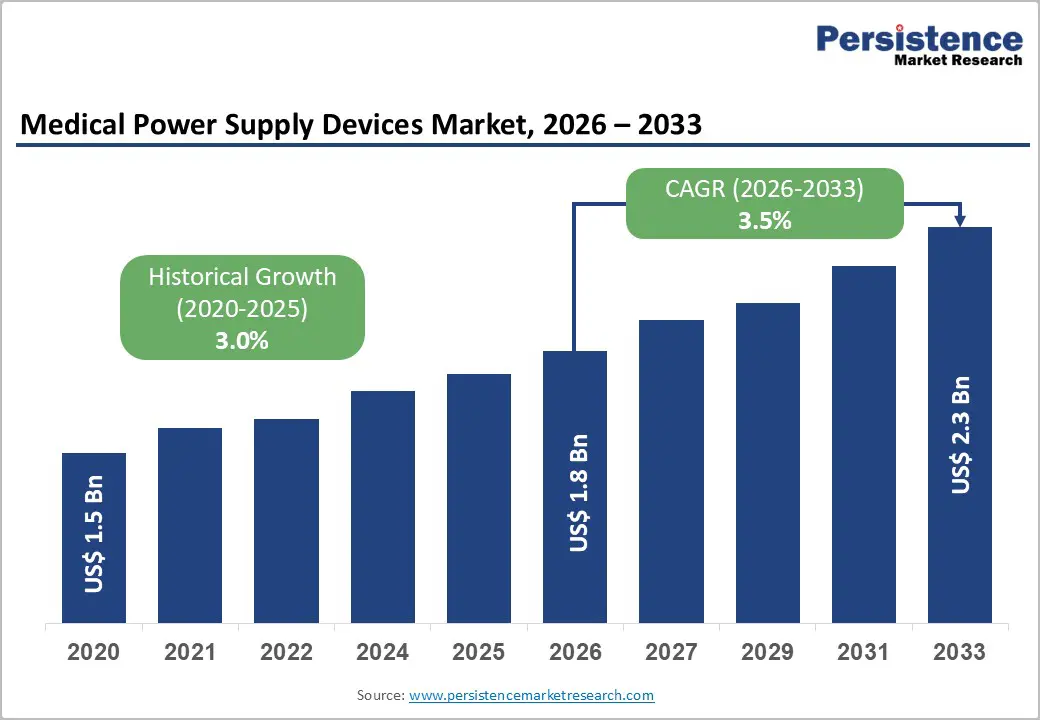

The global medical power supply devices market is estimated to grow from US$ 1.8 Bn in 2026 to US$ 2.3 Bn by 2033. The market is projected to record a CAGR of 3.5% during the forecast period from 2026 to 2033.

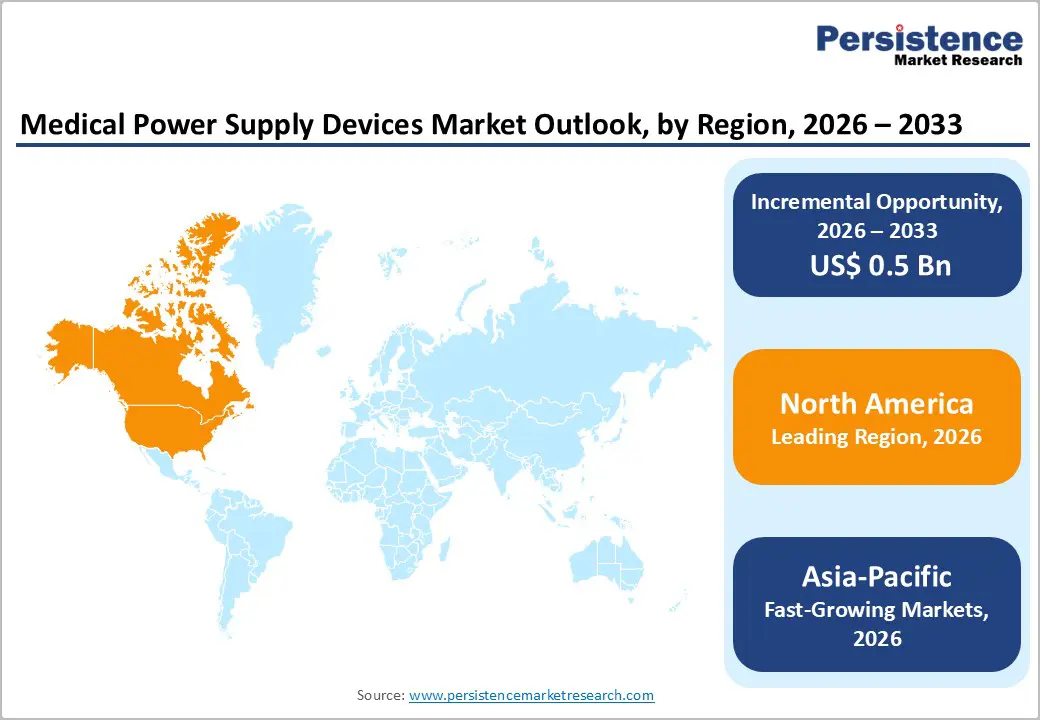

The global medical power supply devices market is growing steadily, fueled by increasing cardiovascular disease prevalence, emergency admissions, and demand for precise diagnostics. North America leads, supported by advanced healthcare infrastructure and early technology adoption, while Asia-Pacific is the fastest-growing region, driven by expanding facilities, rising patient volumes, better access, and greater awareness of early diagnosis.

| Global Market Attributes | Key Insights |

|---|---|

| Global Medical Power Supply Devices Market Size (2026E) | US$ 1.8 Bn |

| Market Value Forecast (2033F) | US$ 2.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 3.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.0% |

Driver: Growing emergency and critical care admissions

A key driver of the medical power supply devices market is the growing volume of emergency department (ED) visits and critical care admissions, which increases demand for reliable power solutions in acute care settings. In the United States alone, there were 155.4 million ED visits in 2022, with 17.8 million resulting in hospital admissions and 3.1 million leading to critical care unit admission. Such high emergency utilization underscores the need for uninterrupted, high performance medical power supplies to support critical diagnostic and life support equipment in EDs and ICUs.

The sustained rise in emergency care demand reflects broader trends in chronic and acute disease prevalence that pressure hospital infrastructure. For example, ED visit rates increased from 40 visits per 100 people in 2020 to 47 visits per 100 people in 2022, indicating higher utilization of emergency services over time. The proportion of circulatory disease related ED visits, including heart attacks and strokes, has remained elevated, further driving the need for robust power systems in critical diagnostic and treatment devices. These trends highlight the reliance on medical power supplies to ensure stable operation of life saving and rapid response equipment.

Restraints: High cost of advanced medical power supply devices

The high cost of advanced medical devices, including power supply systems integrated in diagnostic and therapeutic equipment poses a significant restraint on adoption, particularly for smaller hospitals and facilities in budget constrained settings. In the United States, hospitals’ total supply costs, which include medical devices and related equipment, have nearly doubled from approximately $30.2 billion in 2017 to $57 billion in 2023, rising on average about 6.5 percent annually. This increase reflects broader inflation in device acquisition and associated technology costs that challenge healthcare budgets. Higher upfront procurement prices and maintenance expenses for advanced power electronics contribute to financial strain.

Medical devices and equipment represent a major portion of hospital capital expenditure, and expensive technology adoption can constrain investment in supporting infrastructure. In 2023, medical supply expenses including devices, consumables, and surgical equipment, totaled $146.9 billion, accounting for a growing share of hospital budgets that must also cover staff, facility operations, and clinical services. Many advanced diagnostic tools requiring sophisticated power systems, such as imaging and monitoring devices, command high prices (e.g., MRI systems costing millions), which can delay or limit procurement decisions in resource limited institutions. These financial barriers reduce the pace of modernization and constrain market growth in price sensitive regions.

Opportunity: Growth of portable and external power supply devices

The increasing prevalence of home health care and chronic disease management presents a substantial opportunity for portable and external medical power supply devices. In the United States, about 3 million patients received home health care services in 2020 through roughly 11,400 home health agencies, highlighting expanding non hospital medical care delivery. Portable diagnostic and monitoring devices used in home settings require reliable external power solutions to operate effectively, enabling continuity of care outside traditional clinical environments. This trend supports greater integration of compact power supplies that ensure device usability in decentralized care settings.

An aging population further underscores this opportunity: adults aged 65 and older comprised 17 percent of the U.S. population in 2020, with projections rising to 22 percent by 2040, indicating a growing cohort that often needs ongoing health monitoring and care at home. As older adults increasingly prefer to remain in their homes, medical equipment that supports remote monitoring and treatment becomes essential. Portable and external power supplies enable these devices to function reliably in residential environments, facilitating continuous patient monitoring, improved health outcomes, and reduced pressure on acute care facilities.

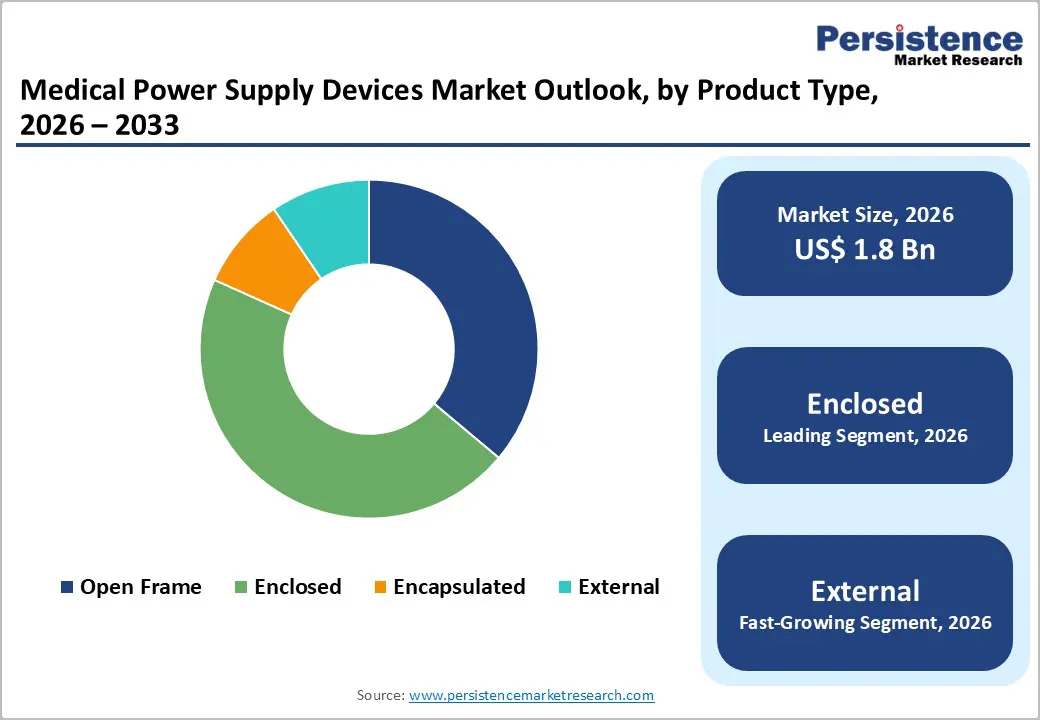

By Product Type, Enclosed Medical Power Supply Dominates the Medical Power Supply Devices Market

Enclosed Medical Power Supply occupies 45.6% share of the global market in 2025, because they deliver high reliability, safety, and environmental protection essential for critical healthcare equipment. These units are fully housed, shielding sensitive components from dust, moisture, and physical contact, which enhances durability and reduces failure risk in demanding clinical settings. Enclosed designs are widely used in MRI, CT, ultrasound, and patient monitoring systems where stable power and protection against electrical hazards are mandated by standards like IEC 60601 1, which defines stringent safety requirements for medical electrical equipment. Compliance with such standards ensures low leakage current and reinforced insulation, safeguarding patients and operators while enabling regulatory approval and widespread adoption in hospitals and diagnostic centers.

By Function, AC-DC Power Supply Device dominates due to reliable mains-to-DC conversion, powering critical hospital devices safely

AC DC power supply devices dominate the medical power supply devices market because most medical equipment operate on mains electricity and require conversion to stable DC power for internal electronics. In the United States there were 6,093 registered hospitals in 2023, with millions of diagnostics, imaging, and life support devices in use that depend on AC DC conversion for reliable performance and compliance with safety standards such as IEC 60601 1. Hospital electrical systems are standardized around 120/240 V AC mains, making AC DC units essential for powering devices such as ventilators, infusion pumps, and monitoring systems that require regulated DC voltages. The widespread reliance on mains powered equipment in clinical environments underpins the dominance of AC DC power supplies in medical settings.

North America Medical Power Supply Devices Market Trends

North America dominates the medical power supply devices market with 38.3% share in 2025, because of its high healthcare expenditure, extensive healthcare infrastructure, and rapid adoption of advanced medical technologies. The United States spends about 16.6 percent of GDP on healthcare, supported by over 6,100 hospitals, reflecting deep investment in diagnostic, monitoring, and life support equipment that rely on robust power supply solutions. Strong insurance coverage, government initiatives like the HITECH Act for health IT adoption, and well established regulatory systems encourage early uptake of innovative medical devices. Canada’s universal system and rising hospital investment further enhance demand. These factors combine to create a region with superior capacity to invest in and utilize medical power supply technologies.

Europe Medical Power Supply Devices Market Trends

Europe is a key region in the medical power supply devices market due to its high healthcare investment, strong medical technology ecosystem, and extensive healthcare infrastructure. Countries in the EU spend an average of about 10 percent of GDP on healthcare, with substantial portions directed toward advanced medical technologies and devices. Europe accounts for a significant share of the world’s medical technology market, with the medical device sector contributing roughly 7.7 percent of total healthcare expenditure, indicating robust demand for connected and reliable power systems for clinical equipment. Moreover, Europe operates millions of hospital beds and comprehensive outpatient services, supporting wide adoption of devices that depend on stable power supplies, while consistent public funding and regulatory frameworks further drive medical equipment procurement and innovation.

Asia-Pacific Medical Power Supply Devices Market Trends

Asia Pacific is the fastest growing region in the medical power supply devices market due to rapid expansion of healthcare infrastructure and rising health expenditure across major economies. Per OECD data, health spending per capita in many Asia Pacific countries has been increasing faster than GDP growth, reflecting escalating investment in medical services and equipment. Hospitals account for about 44 % of total health spending in the region, indicating strong demand for clinical technologies that rely on reliable power supplies. Additionally, governments in China, India, and other nations are expanding hospital networks and upgrading acute care capacity to serve aging populations and high non communicable disease burdens. These structural enhancements and increased device adoption underpin accelerated market growth in the region.

The medical power supply devices market is competitive, dominated by global and regional players offering enclosed, open-frame, AC DC, and DC DC solutions. Key companies focus on reliability, safety certifications, energy efficiency, and regulatory compliance. Innovation in compact, portable, and external power supplies drives differentiation, while strategic partnerships, acquisitions, and regional expansion intensify market competition globally.

Key Industry Developments:

The global medical power supply devices market is projected to be valued at US$ 1.8 Bn in 2026.

Rising chronic diseases, emergency admissions, portable device demand, technological advancements, and healthcare infrastructure expansion drive growth.

The global medical power supply devices market is poised to witness a CAGR of 3.5% between 2026 and 2033.

Opportunities include portable devices, external power supplies, AI integration, remote monitoring, home healthcare, and emerging markets.

Astrodyne TDI, SL Power Electronics, XP Power, Power Box, Delta Electronics, CUI Inc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Function

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author