ID: PMRREP14263| 198 Pages | 1 Oct 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

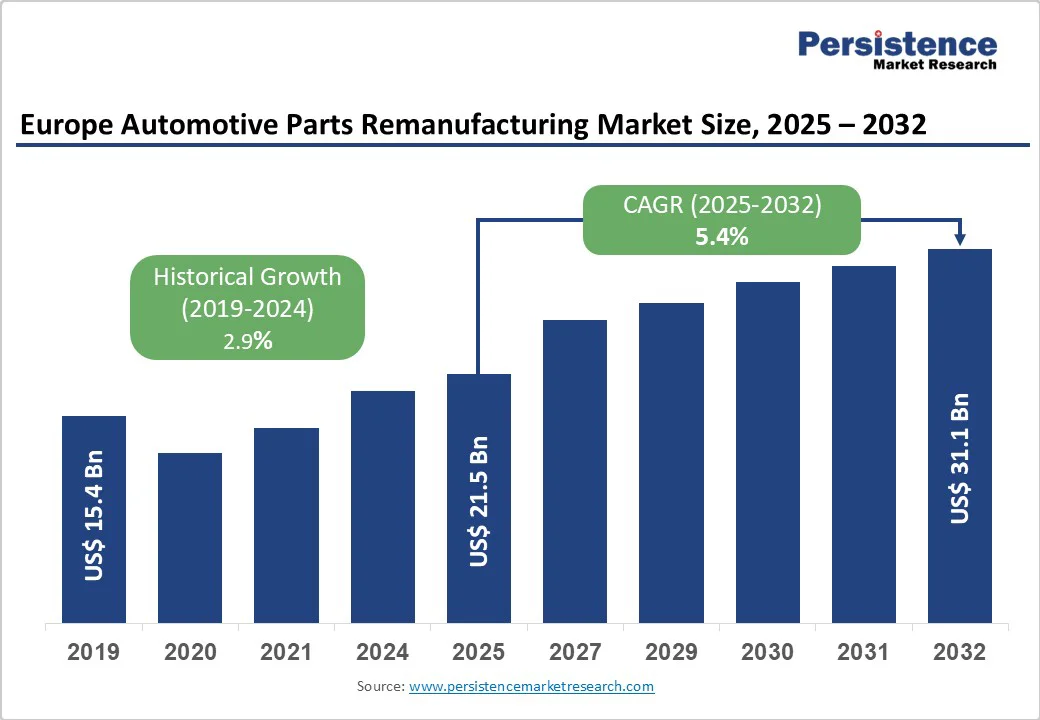

Europe automotive parts remanufacturing market size is likely to value at US$ 21.5 billion in 2025 and is expected to reach US$ 31.1 billion by 2032, growing at a CAGR of 5.4% in the forecast period from 2025 to 2032.

This growth is driven by demand for cost-effective, sustainable alternatives to new parts and regulatory support for circular economy practices.

| Key Insights | Details |

|---|---|

| Europe Automotive Parts Remanufacturing Market Size (2025E) | US$ 21.5 Bn |

| Market Value Forecast (2032F) | US$ 31.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 2.9% |

Europe’s Automotive Parts Remanufacturing Market is gaining momentum under the EU’s Green Deal and Circular Economy Action Plan, which prioritizes waste reduction, extended product lifecycles, and climate neutrality by 2050.

Policies such as Extended Producer Responsibility (EPR) are making manufacturers accountable for full product lifecycles, while incentives and subsidies drive investment in sustainable remanufacturing. At the same time, automation, robotics, and data analytics are elevating efficiency, ensuring remanufactured parts meet or exceed OEM standards, and boosting consumer trust.

According to the European Remanufacturing Network, the region’s remanufacturing industry could reach €100 billion by 2030, creating nearly 600,000 jobs. This growth underscores how regulatory push, technological innovation, and consumer preference for eco-friendly, cost-effective solutions are jointly transforming the market into a cornerstone of Europe’s sustainability and competitiveness agenda.

Strong policy support exists, yet the European automotive parts remanufacturing market faces hurdles due to varying regulatory standards across member states. Differences in environmental and safety regulations complicate compliance, raising operational challenges and limiting cross-border scalability.

Certification inconsistencies delay product approvals, slowing market entry and affecting competitiveness. This regulatory fragmentation discourages heavy investment in remanufacturing infrastructure, thereby constraining growth potential.

Consumer perception also presents a challenge. Remanufactured parts are often viewed as less reliable than new components. Shifting this mindset demands sustained investment in technology and quality assurance, placing added pressure on smaller manufacturers. In 2023, a survey by the European Remanufacturing Council revealed that only 45% of vehicle owners expressed willingness to purchase remanufactured parts, highlighting the need for increased awareness and trust-building initiatives.

The European automotive parts remanufacturing market is set for rapid growth, driven by rising demand for sustainable and cost-effective vehicle maintenance. With growing environmental awareness, both consumers and fleet operators are turning to remanufactured components to reduce carbon footprints while maintaining performance. Government initiatives promoting circular economy principles further encourage this shift, creating significant opportunities for remanufacturers to expand and attract eco-conscious customers.

Advancements in digital technologies like IoT, AI, and blockchain enhance traceability, quality control, and supply chain efficiency, while collaborations with OEMs offer new avenues for scalable, remanufacturing-friendly product innovations.

In 2024, the European Commission report highlighted that partnerships facilitating shared expertise and resources increased remanufacturing capacity by 30% within three years, accelerating market adoption. This collaborative ecosystem, combined with supportive policies and technology integration, positions the market for substantial long-term growth.

The engine and related parts segment leads the market with a dominant 37.9% share, driven by its essential role in vehicle performance and frequent replacement needs. It is growing steadily at a 5.6% CAGR, supported by advancements in remanufacturing technologies that ensure high-quality standards while offering cost-effective, sustainable alternatives to new components. The segment continues to benefit from rising demand for durable, eco-friendly solutions.

The electricals and electronics segment is the fastest-growing, expanding at a 6.3% CAGR. Growth is fueled by the surge in electric and hybrid vehicles across Europe, increasing the need for remanufactured batteries, control modules, and sensors.

Technological innovations such as precision diagnostics and automation have further improved quality and efficiency, accelerating adoption. In early 2025, a leading European automotive supplier reported a 12% increase in sales of remanufactured engine components, highlighting growing adoption driven by improved quality and cost efficiency.

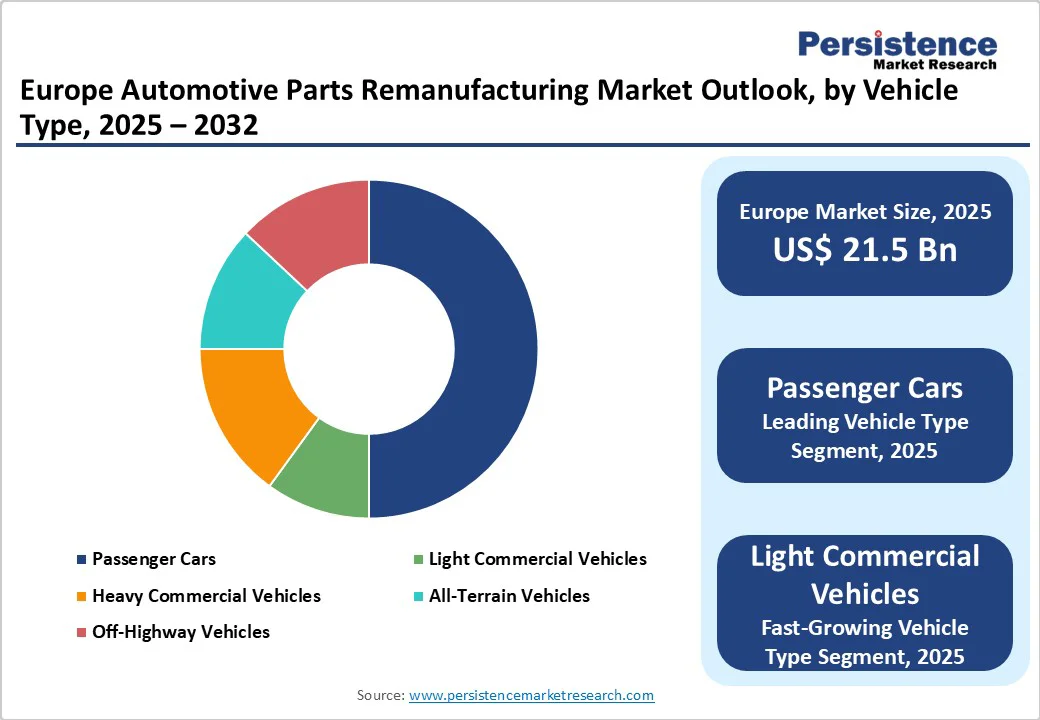

Passenger cars lead the vehicle type segment with a 41.6% share and a steady CAGR, driven by their widespread presence on European roads and growing consumer preference for affordable, eco-friendly remanufactured parts. This segment benefits from increasing regulatory focus on emissions and sustainability, encouraging vehicle owners to extend the lifespan of their vehicles through high-quality remanufactured components. Such trends support the shift toward more sustainable automotive practices across the region.

Heavy commercial vehicles are experiencing the fastest growth, driven by rising operational costs and long vehicle lifecycles. Fleet operators increasingly turn to remanufactured parts to reduce expenses without sacrificing performance, with advanced remanufacturing technologies meeting the strict safety and reliability standards required for this segment.

According to a 2024 report by the European Federation of Road Transport Associations (ERF), remanufactured parts usage among heavy commercial vehicle fleets surged by 15%, reflecting strong growth due to operational cost savings and sustainability incentives.

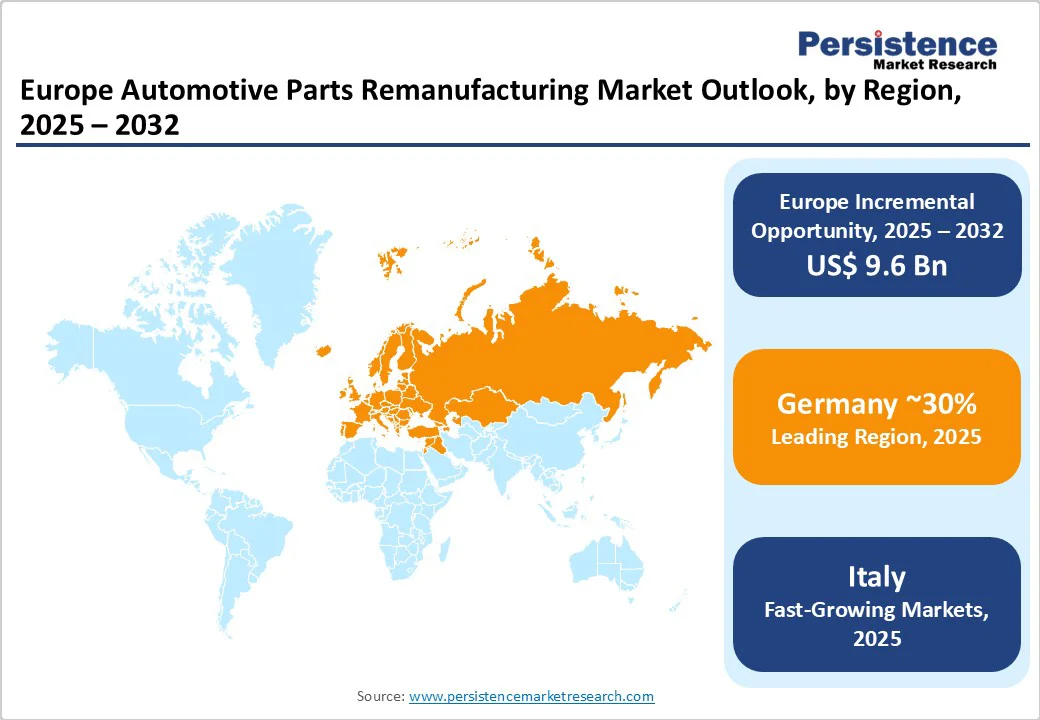

Germany leads Europe automotive parts remanufacturing market with a significant 32.3% share, driven by its status as Europe’s largest automotive manufacturing hub. The country’s robust automotive ecosystem, including global OEMs and extensive suppliers, fuels strong demand for remanufactured components, especially in high-value areas such as engine and transmission parts.

Germany’s commitment to sustainability and circular economy principles, supported by strict environmental regulations and advanced remanufacturing technologies, ensures high-quality parts that meet OEM standards. Additionally, its leadership in electric vehicle adoption is increasing demand for remanufactured electrical components, further boosting growth.

Supportive government policies, such as the Circular Economy Act, promote resource efficiency and extended producer responsibility, reinforcing sustainable lifecycle management. Combined with consumer preference for eco-friendly and cost-effective parts, Germany remains the key driver in automotive parts remanufacturing in Europe.

In 2023, ZF Friedrichshafen AG expanded its remanufacturing plant operations in Germany, focusing on electronic components and advanced mechatronics. The company reported a 36% rise in remanufactured electronic control units and an additional 28% increase in demand for adaptive cruise modules. This expansion supports their strategy of integrating remanufactured solutions into electric and hybrid

Italy commands a notable 10.7% share of Europe’s automotive parts remanufacturing market, fueled by its vibrant vehicle fleet and strong sustainability focus. The country’s expanding commercial vehicle sector, especially light commercial vehicles, drives demand as cost-conscious fleet operators seek durable, affordable parts.

A well-established aftermarket network of small and medium enterprises specializes in remanufacturing engine, transmission, and brake components, bolstering Italy’s role as a key remanufacturing hub. Growing environmental awareness among consumers and businesses also supports the uptake of remanufactured parts, aligning with European Green Deal goals.

Italy’s regulatory framework promotes circular economy practices through incentives and subsidies, while regional initiatives foster innovation in remanufacturing technologies. Its strategic European location enhances market access and supply chain efficiency. With rising electric and hybrid vehicle adoption, Italy’s remanufacturing sector is poised for further growth, particularly in electrical components.

Spain Accelerates Market Growth with High CAGR and Emerging Sustainability Focus

Spain is experiencing strong growth in the European automotive parts remanufacturing market, with a notable 6.1% CAGR. This expansion is driven by increasing vehicle ownership and a growing fleet of passenger and commercial vehicles. Rising consumer awareness about sustainability and cost savings is boosting demand for remanufactured parts, particularly in electrical and engine components.

Spain’s focus on the circular economy aligns with EU environmental policies, creating a favorable environment for remanufacturing. Additionally, the country’s transition to electric and hybrid vehicles is fueling demand in key segments.

Government incentives and regulations further support the sector by encouraging resource efficiency and extending component lifecycles. Innovation hubs in regions such as Catalonia and Andalusia enhance technological advancements, positioning Spain as a promising market for long-term remanufacturing growth in Europe.

In 2023, Spain produced 2.45 million cars, making it the 8th largest automobile producer in the world and the 2nd largest car manufacturer in Europe after Germany. This high production volume drives demand for automotive parts remanufacturing, as a significant number of vehicles require maintenance and component replacement.

Europe automotive parts remanufacturing market is becoming more competitive, fueled by investments in automation, AI, and 3D printing to boost efficiency and quality. Manufacturers are broadening product portfolios and strengthening supplier partnerships to create agile, cost-effective supply chains.

Localized remanufacturing hubs further cut lead times and emissions while supporting circular economic goals. This integrated approach not only drives regulatory compliance but also positions companies to meet rising demand for sustainable alternatives, especially in remanufactured components for electric and hybrid vehicles.

Europe automotive parts remanufacturing market is set to reach US$ 21.5 Bn in 2025.

The market is driven by Strict EU environmental regulations, circular economy policies, and technological advancements that boost remanufacturing demand across Europe.

Europe automotive parts remanufacturing industry is estimated to rise at a CAGR of 5.4% from 2025 to 2032.

Growing electric vehicle adoption, rising demand in Eastern Europe, and supportive sustainability initiatives offer strong growth opportunities within Europe.

The major players dominating the Europe Automotive Parts Remanufacturing Market are ZF Friedrichshafen AG, Robert Bosch GmbH, Caterpillar Inc., Valeo SA, AB Volvo.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Vehicle Type

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author