ID: PMRREP32687| 189 Pages | 26 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

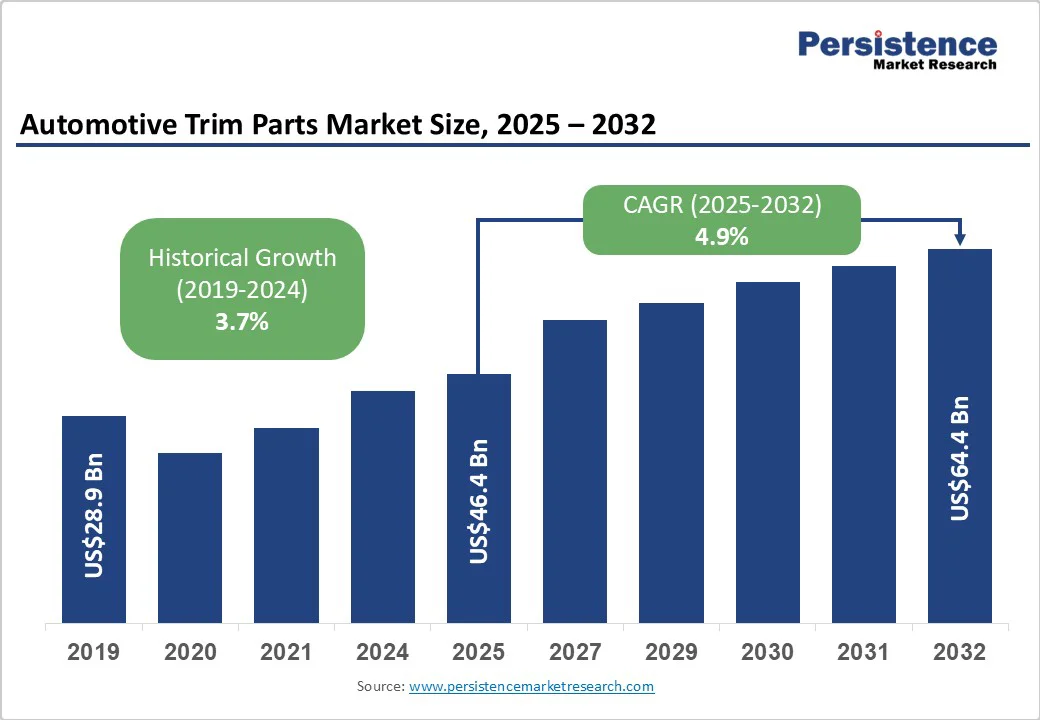

The global automotive trim parts market is expected to be valued at US$46.4 billion in 2025 and is projected to reach US$64.4 billion, growing at a CAGR of 4.9% during the forecast period from 2025 to 2032. Increasing adoption of materials such as carbon fiber, aluminum, and advanced polymers to enhance fuel efficiency and reduce emissions.

| Key Insights | Details |

|---|---|

|

Automotive Trim Parts Market Size (2025E) |

US$46.4 Bn |

|

Projected Market Value (2032F) |

US$64.4 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

4.9% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

3.7% |

The automotive industry operates cyclically, with production levels influenced by economic conditions, customer confidence, and overall market demand. During periods of economic prosperity and stability, consumers are more inclined to make substantial purchases, such as automobiles, resulting in heightened demand for vehicles and ultimately increasing production volumes among automotive manufacturers.

The evolution of consumer preferences and customized automobiles drive the need for automotive trim components. Consumers often seek distinctive and tailored automobile features, encompassing both design and utility.

Trim elements, encompassing interior components such as dashboard materials and seat covers, as well as exterior components like grilles and body panels, are essential in fulfilling customization requirements.

As urbanization progresses, a burgeoning middle class with escalating purchasing power is expanding globally, particularly in developing nations. The demographic transition leads to increased demand for automobiles, thereby enhancing vehicle manufacturing.

In 2024, Adient introduced a new line of sustainable interior fabrics made from 100% recycled polyester, addressing environmental concerns and consumer preferences for eco-friendly materials.

New-age consumers frequently perceive their automobiles as an extension of their personal identity. Customization enables individuals to articulate their uniqueness and cultivate a distinctive driving experience.

Automotive trim parts are essential in this context, including interior elements like upholstery and dashboard materials and exterior features such as grilles, trims, and body panels. Manufacturers offer an increasing selection of materials and finishes for trim elements, allowing consumers to choose from numerous textures, colours, and patterns.

Interior trim components may be fabricated from many materials, including leather, wood, metal, or synthetic alternatives, and external trim components may present possibilities in finishes such as chrome, matte, glossy, or textured surfaces.

Customization encompasses not only aesthetics but also technological functionalities. Automotive trim components now incorporate sophisticated technologies, such as touchscreens, ambient illumination, and intelligent controls. Consumers can personalize their vehicle's tech features, boosting comfort and convenience with personalized interfaces and functionality embedded into trim components.

Plastics, frequently used in automotive trim components for their adaptability and lightweight characteristics, may experience price fluctuations due to variations in petroleum costs or changes in demand. Similarly, metals and sophisticated composites, renowned for their durability and performance features, may be subject to market-driven price fluctuations or geopolitical factors.

Abrupt escalations in material costs directly result in elevated production expenses for automobile trim components, presenting a significant challenge to manufacturers due to potential reductions in profit margins. The automotive sector operates in competitive markets where cost reduction is crucial for sustainability and profitability.

When raw material costs surge abruptly, producers frequently face the challenge of either absorbing the elevated costs, which may erode profitability, or passing on the increased costs to customers, thereby affecting market competitiveness.

Several key manufacturers are investing some portion of their total revenue in research & development activities for new technological and material advancements in the automotive industry. They also conduct research and development on new products and enhancements to existing automotive components.

Companies are establishing new research & development centers in key countries to drive the company's growth. Such research and development investments enable manufacturers to overcome intense competition and gain a significant competitive advantage in the industry. Many manufacturers are working to develop innovative, lightweight materials for vehicle components, aiming to lower manufacturing costs.

The automotive trim parts market is divided into exterior and interior based on product. Out of these, the interior product type segment dominates the market with 68% share in 2025. Interior trim products utilize modern materials, including premium plastics, composites, and cutting-edge textiles. The materials provide improved durability, aesthetics, and weight reduction, enhancing the overall attractiveness of the car interior.

The rising demand for connected automobiles has incorporated sophisticated electronics and communication elements into interior trim components. Touchscreens, infotainment systems, and other advanced technologies augment the user experience, rendering the interior a fundamental element of technological innovation.

Incorporating haptic feedback technology and touch-sensitive surfaces in interior trim components enhances interactivity and user-friendliness. The trend corresponds with the increasing focus on intuitive controls and avant-garde interior designs.

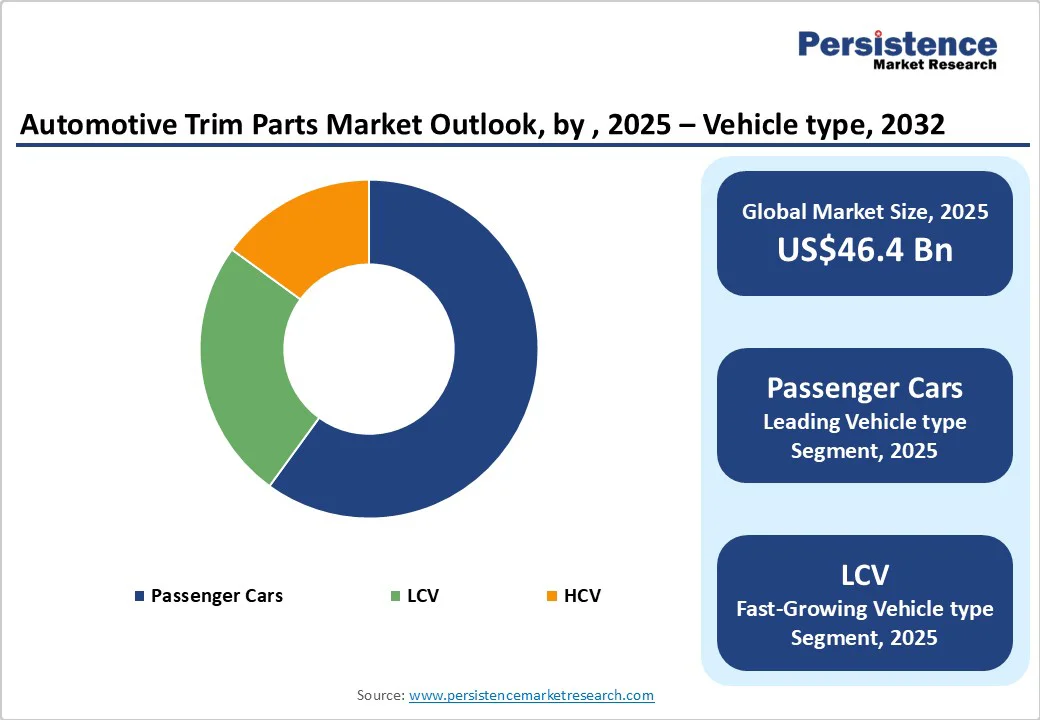

Based on vehicle type, the market is classified into passenger cars, LCV and HCV. Among these, the passenger cars vehicle dominates the market with 60% share in 2025. The increase in global passenger car sales is a key element driving the need for automotive trim parts. The demand for visually appealing and helpful trim components increases as more individuals own passenger automobiles.

Automobile makers are constantly developing interior designs to captivate buyers. Interior trim parts, including seats, dashboard panels, and door trims, are influenced by advancements in materials, textures, and ergonomic designs to produce aesthetically pleasing and comfortable interiors.

Many buyers in the passenger vehicle sector desire personalized and configurable options. Interior trim parts, including diverse colour selections, material alternatives, and design variations, enable vehicle owners to customize their vehicles according to personal preferences.

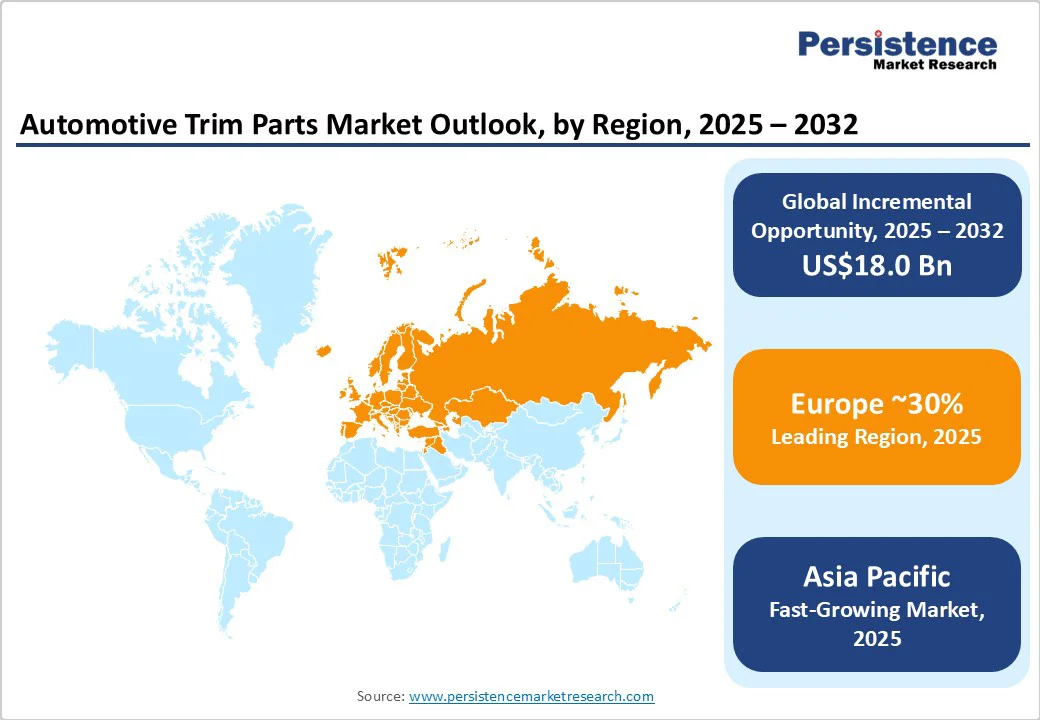

Europe possesses a robust and influential automobile sector with a rich heritage of invention and design superiority. Europe manufactured more than 18 million motor vehicles, establishing itself as a global leader, as the European Automobile Manufacturers' Association reported. Consequently, this vigorous car industry results in a substantial demand for premium interior trim components.

European consumers generally emphasize aesthetics and a luxurious ambiance in their vehicle interiors. The European Consumers Organization reported that 78% of European car customers regarded interior design and material quality as essential determinants in vehicle purchases.

Customer desire drives the demand for premium materials, including leather, sophisticated polymers, and aesthetically pleasing sustainable alternatives. Consequently, indicating an increased desire for trimmings with significant aesthetic value in nations of Europe.

The global automotive trim parts market is highly competitive, driven by technological advancements, material innovations, and evolving consumer preferences. Key players such as Faurecia, Adient, Grupo Antolin, Toyota Boshoku, and Magna International focus on developing lightweight, durable, and sustainable trim materials.

Leading companies heavily invest in research and development to enhance aesthetics, customization, and functionality in interior and exterior trim parts. Emerging market participants leverage innovations like 3D printing and recycled materials to offer cost-effective solutions.

Regional players in Asia Pacific and Europe are gaining prominence due to increasing vehicle production and demand for premium interiors. Mergers and acquisitions among OEMs and component manufacturers intensify competition as companies aim to expand market share and technological capabilities.

Trim refers to a particular version of an automotive model with a particular set of configuration.

Trim parts may be leather steering wheel, door lining, car roof lining decorations, seat trim, etc.

The market is anticipated to be valued at US$ 61.43 Bn by 2031.

The market is projected to exhibit a CAGR of 4.9% over the forecast period.

Continental AG, Toyoda Gosei Corp, Magna International Inc., are some of the key players in the market.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By Material Type

By Vehicle Type

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author