ID: PMRREP25867| 200 Pages | 2 Feb 2026 | Format: PDF, Excel, PPT* | Food and Beverages

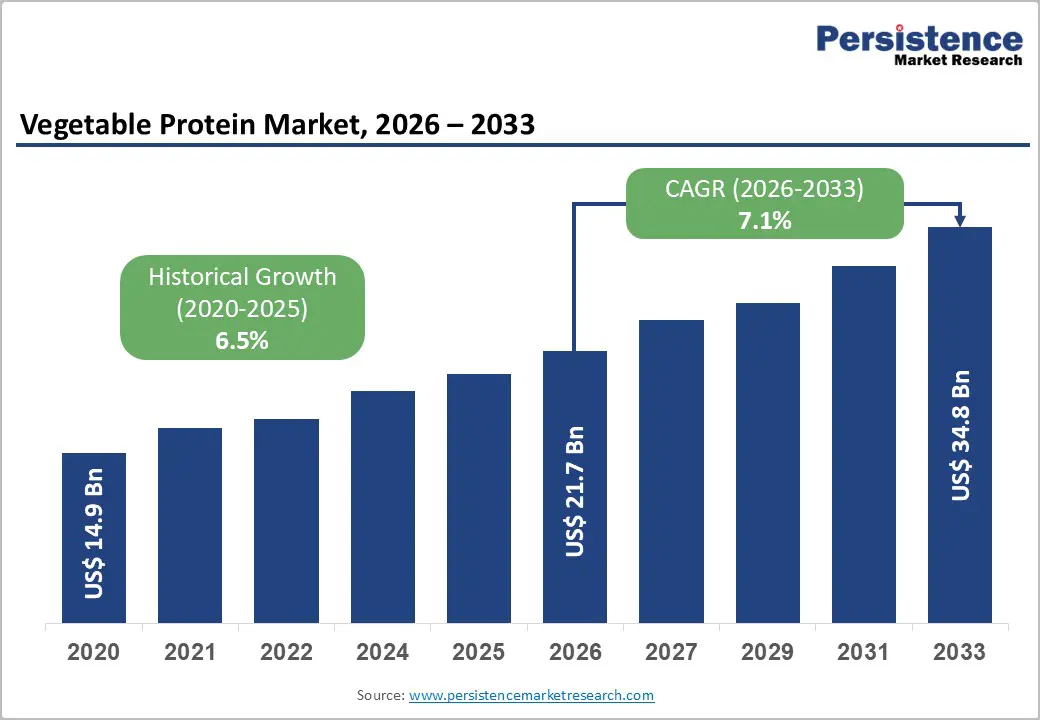

The global vegetable protein market size is likely to be valued at US$21.7 billion in 2026 and is projected to reach US$34.8 billion by 2033, growing at a CAGR of 7.1% during the forecast period between 2026 and 2033, driven by a systemic shift in consumer dietary patterns, where plant-derived proteins are no longer viewed merely as substitutes but as primary nutritional staples.

The growth of the market is driven by three key macro trends: a growing consumer focus on health and wellness, rising environmental concerns about the carbon footprint of livestock farming, and the widespread adoption of flexitarian and plant-based diets in both developed and emerging economies.

| Global Market Attributes | Key Insights |

|---|---|

| Vegetable Protein Market Size (2026E) | US$21.7 Bn |

| Market Value Forecast (2033F) | US$34.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.5% |

Demographic aging, rising prevalence of lifestyle-linked chronic conditions, and intensifying preventive health awareness are structurally driving the demand for nutrient-dense, low-cholesterol protein alternatives. Institutional evidence, including WHO-aligned dietary correlations, reinforces plant-based nutrition’s association with lower non-communicable disease incidence, strengthening its clinical credibility. The clean-label transition is also reshaping formulation priorities, favoring non-GMO, minimally processed pea and rice proteins with favorable allergen and digestibility profiles. As ingredient transparency tightens, vegetable proteins are increasingly positioned as functional inputs delivering bioavailable amino acid profiles while mitigating inflammation-linked risks associated with certain animal proteins, reinforcing their value proposition across regulated food systems.

Demand expansion reflects durable behavioral recalibration rather than cyclical dietary experimentation, with health-led consumption intent translating into sustained volume uplift. Post-pandemic immune health prioritization has further elevated plant protein relevance within mainstream nutrition frameworks, accelerating adoption beyond niche wellness channels. Large food manufacturers are integrating protein fortification across bakery, snacks, and beverage portfolios, materially expanding the addressable market. Regulatory rigor in North America and Europe around health-claim substantiation is reinforcing scale advantages, enabling compliant players to convert consumer education investments into higher trial rates, repeat purchases, and defensible category positioning.

Structural price premiums remain the primary restraint limiting mass-market penetration of plant-based proteins despite favorable long-term demand fundamentals. Plant-based meat, milk, and egg alternatives continue to trade at materially higher prices than animal-derived equivalents, reflecting elevated processing complexity, specialized equipment requirements, and smaller-scale manufacturing economics. Heightened consumer cost sensitivity following sustained food inflation has reinforced price elasticity effects, with recent volume contractions indicating that affordability outweighs sustainability messaging during budget-constrained cycles. Producers face constrained strategic optionality, as aggressive price normalization risks margin dilution, while premium positioning restricts addressable demand in cost-sensitive segments. Although process innovations, such as enzyme-assisted extraction, demonstrate measurable efficiency gains, long commercialization timelines and capital intensity delay near-term cost reductions.

Cargill completes its US$75 million Aarhus pea protein facility to scale global production and address manufacturing cost barriers. The investment signals industry prioritization of localized processing and scale-driven cost optimization, leveraging advanced extraction systems to compress unit economics. Such capacity expansions are positioned to structurally narrow prevailing price differentials, thereby reinforcing competitive advantages for large operators capable of translating capital deployment into sustainable price competitiveness.

Current source concentration around soy, pea, and wheat creates a clear opportunity for differentiated alternative proteins to address unmet functional and nutritional requirements. Emerging sources such as fava bean, lentil, chickpea, and ancient grains are gaining traction in high-value applications due to favorable amino acid compositions, reduced allergenicity, and compatibility with non-GMO and organic positioning. Accelerated adoption in infant nutrition, hypoallergenic foods, and premium sports nutrition reflects structurally higher willingness to pay for functional specificity rather than commodity protein content. Historical expansion trends in niche protein categories signal sustained demand pull rather than experimental substitution, reinforcing their commercial viability.

Strategic advantage increasingly accrues to manufacturers deploying modular extraction platforms capable of rapid source switching and portfolio diversification. This flexibility enables faster alignment with evolving customer specifications and regulatory preferences, reducing dependency on single-crop supply chains. Precision fermentation further expands the opportunity frontier by enabling tailored protein functionality and customized amino acid profiles that exceed the limits of mechanical extraction. While capital-intensive and higher-risk, early positioning supports the capture of premium pricing before scale-driven commoditization compresses margins across alternative protein categories.

Soya protein is expected to remain the leading source segment, accounting for a 42% market share, supported by entrenched cost advantages, globally scaled processing infrastructure, and long-standing regulatory acceptance. Its complete amino acid profile and well-documented functional performance in emulsification, binding, and texturization continue to reinforce adoption in high-volume, cost-sensitive applications. Soya’s growth trajectory is projected to underperform the broader market, as consumer concerns about allergenicity, GMO perceptions, and flavor optimization constrain premium and clean-label penetration. As a result, soya is likely to retain revenue stability rather than incremental share gains, anchoring base demand while ceding innovation-led expansion to alternative sources.

Pea protein is the fastest-growing segment, driven by increasing demand for hypoallergenic, sustainable, and non-GMO plant-based proteins. Its low allergen profile and nitrogen-fixing cultivation make it particularly appealing to health-conscious and environmentally mindful consumers. Additionally, its high arginine and BCAA content make it ideal for sports nutrition and functional food applications. Products such as Roquette's NUTRALYS®, IFF's TRUPRO®, Ingredion's VITESSENCE®, and consumer brands such as Beyond Meat, Nutrabay, and Daily Harvest showcase its versatility in powders, bars, and hypoallergenic infant nutrition. A key trend is the rise of clean-label products, with formulations focusing on transparency, minimal processing, and ingredient traceability, further positioning pea protein as a top choice for emerging allergen-free and sustainable protein solutions.

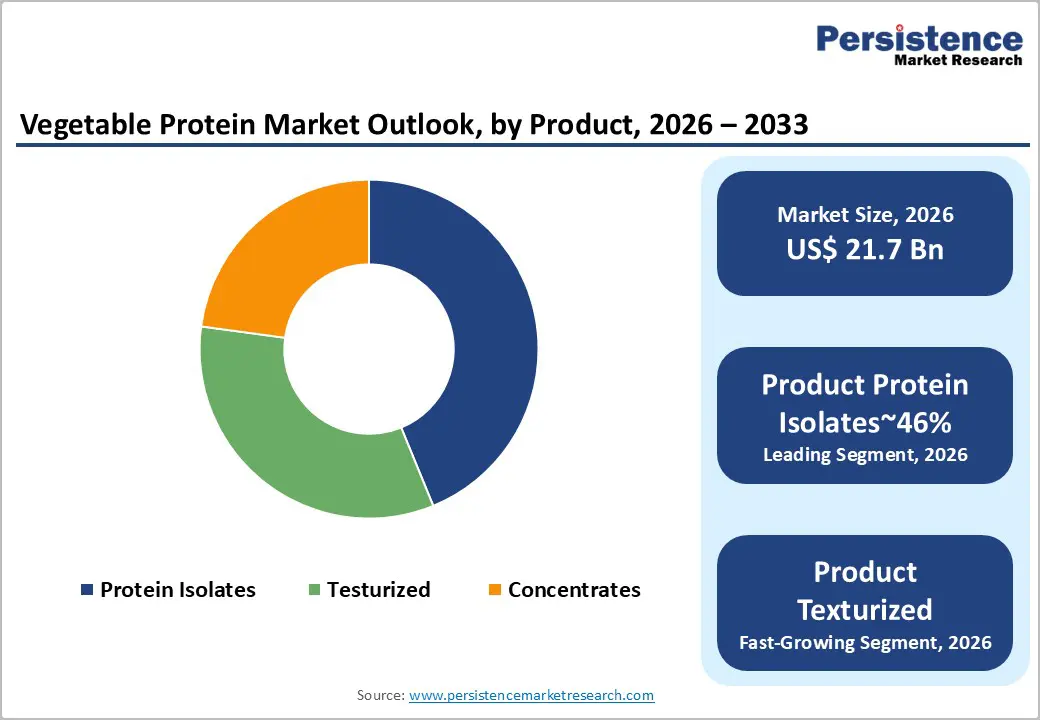

Protein isolates are expected to remain the leading product form, capturing 46% of the market share by 2026, driven by their high purity, functional efficiency, and versatility in premium formulations. Their high protein concentration allows lower inclusion rates while enhancing emulsification, texture control, and sensory optimization, making them ideal for applications in meat analogs, sports nutrition beverages, and regulated infant nutrition. These functional benefits help maintain strong pricing power over concentrates, positioning isolates as valuable ingredients that deliver higher margins, even at lower volumes. The widespread use of isolates in premium applications ensures steady demand and solidifies their role as the key value driver in form-based segmentation.

Textured Vegetable Protein (TVP) is expected to be the fastest-growing segment, driven by rising consumer demand for plant-based, meat-like products. High-moisture extrusion cooking (HMEC) technology allows for the creation of whole-muscle textures that replicate the bite and chew of chicken or beef, qualities that powdered proteins cannot achieve. Factors such as fiber strength, water absorption, and bulk density play a critical role in achieving the desired juiciness and sensory satisfaction. Notable products include GoodDot’s competitively priced TVP, Bob’s Red Mill retail TVP, and Cargill’s TEX PW80 M pea-wheat blend for ground-meat analogs. Trends driving this growth include the rise of the flexitarian diet, growing demand for ready meals and meat alternatives, and advancements in extrusion technology, all of which position TVP as a key growth driver while helping brands meet the sensory and nutritional needs of plant-forward consumers.

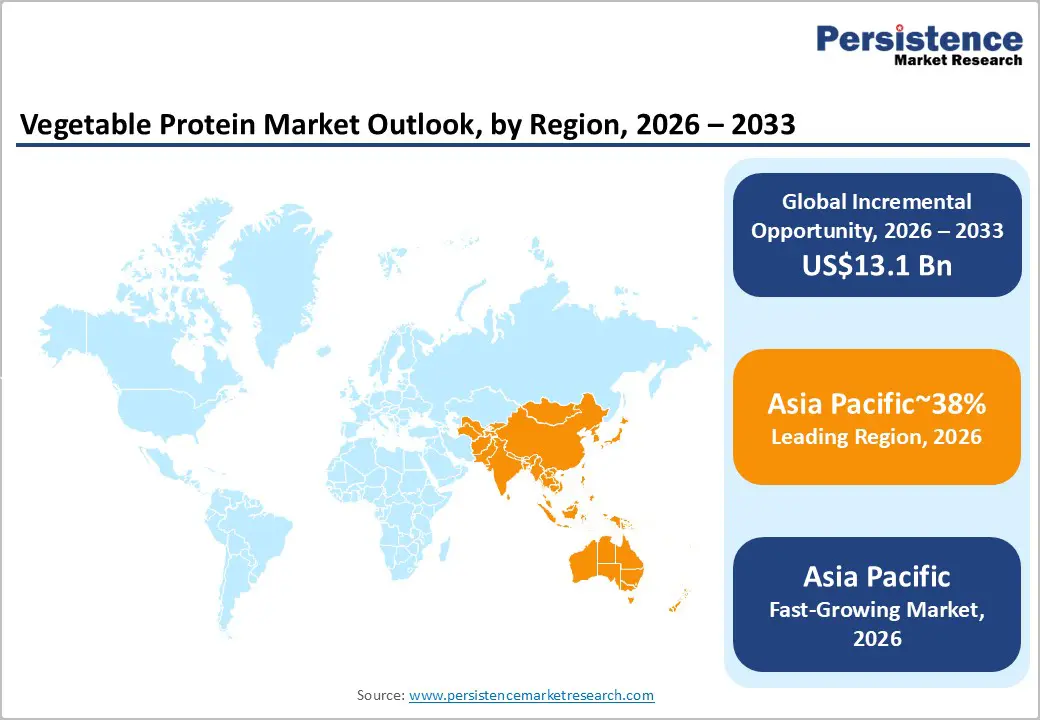

Asia-Pacific is expected to remain the leading regional market, accounting for a 38% share, underpinned by population scale, rapid urbanization, and structurally higher growth momentum. The region benefits from integrated agricultural and processing ecosystems, with strong soybean availability and expanding pulse cultivation supporting localized sourcing. Manufacturing economics remain a decisive advantage, as labor cost differentials and proximity to raw materials compress delivered ingredient costs relative to Western markets, reinforcing the region’s attractiveness for capacity expansion. This cost-led positioning continues to attract global capital deployment and accelerates scale-driven competitiveness.

Regulatory conditions support faster commercialization cycles, particularly in China, where oversight emphasizes traceability and food safety rather than extensive pre-market approvals for established ingredients. India’s framework similarly favors traditional plant-based inputs, aligning regulatory acceptance with domestic consumption patterns. Demand development remains uneven, with urban-centric retail penetration, fragmented foodservice channels, and nascent consumer education shaping adoption pathways. E-commerce expansion and policy-driven protein diversification are expected to progressively broaden market reach while sustaining elevated regional growth trajectories.

North America is expected to witness significant growth, reflecting a mature yet innovation-led market structure anchored in health-oriented consumer demand. Adoption is driven by younger demographics exhibiting higher trial and repeat rates, while clean-label expectations sustain premium positioning despite macroeconomic pressure. Foodservice channel integration plays a central role in volume acceleration, as plant-based menu expansion across quick-service and fast-casual formats broadens accessibility. Elevated investment intensity, with a meaningful share of product development budgets directed toward plant-based categories, reinforces the region’s role as an innovation testbed rather than a purely volume-driven market.

The regulatory environment provides relative clarity, with GRAS pathways and established dietary supplement frameworks supporting faster commercialization for core plant proteins. While state-level labeling and nutrition mandates introduce compliance complexity, they also reinforce scale advantages for incumbents with established regulatory infrastructure. Supply-side concentration incentivizes differentiation and technology collaboration, positioning North America as a high-value market where innovation velocity, not cost leadership, defines competitive advantage.

Europe is expected to account for an 18% share in 2026, reflecting a mature and relatively saturated market characterized by strong regulatory oversight, established vegetarian dietary norms, and sustainability-driven consumer demand. Regulatory frameworks and food culture provide baseline acceptance and premium positioning, supporting elevated average selling prices through organic, non-GMO, and regenerative certification claims. Compliance requirements create barriers that reinforce perceptions of quality and margin sustainability for established suppliers, while limiting the entry of emerging competitors pursuing novel sources or extraction methods. Clean-label preferences further consolidate premium pricing, with investments in supply chain transparency enabling differentiation and value capture.

Investment and competitive dynamics concentrate on capacity expansion and technological innovation, particularly in pea protein extraction, texturization, and precision fermentation platforms, reflecting strategic emphasis on functional performance and scalability. Consolidation activity aligns with scale and portfolio diversification imperatives, enabling incumbent players to leverage regulatory familiarity and supply chain integration. Overall, Europe’s market exhibits structural stability with moderate growth, where regulatory compliance, sustainability positioning, and technology adoption determine competitive advantage across established plant-based protein segments.

The global vegetable protein market is moderately consolidated, with the top five players controlling approximately 45–50% of total market share, led by ADM, Cargill, and DuPont (IFF) through expansive distribution networks and diversified product portfolios. Competitive advantage is primarily driven by scale, supply chain integration, and the ability to deliver consistent quality across multiple protein sources, ensuring stable revenue streams and market influence.

Market dynamics are evolving as specialized startups targeting pea, fava bean, and other niche protein segments increase fragmentation, prompting incumbents to pursue strategic mergers and acquisitions to defend positioning and expand technological capabilities. Forward-looking trends indicate continued consolidation in core segments, coupled with innovation-driven expansion in high-margin alternative protein sources, with differentiation increasingly dependent on functional performance, formulation versatility, and integrated supply chain solutions.

The global vegetable protein market is projected to be valued at US$21.7 billion in 2026 and is expected to reach US$34.8 billion by 2033.

Vegetable protein is gaining preference due to the growing health and wellness awareness, increasing adoption of flexitarian diets, and rising concerns over the environmental impact of animal-based protein sources.

The vegetable protein market is expected to grow at a CAGR of 7.1% between 2026 and 2033, supported by expanding applications across food, feed, and nutraceutical sectors.

The fastest growth opportunities are emerging in Asia Pacific, driven by rising protein consumption in China and India and increasing adoption of plant-based nutrition products.

Key players include Archer Daniels Midland, Cargill, Roquette Frères, Ingredion, Kerry Group, Wilmar International, DuPont Nutrition & Health, IFF, Bunge Limited, Glanbia, DSM, Tate & Lyle, and Burcon NutraScience.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Source

By Form

By Product

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author