ID: PMRREP10975| 216 Pages | 29 Aug 2025 | Format: PDF, Excel, PPT* | Food and Beverages

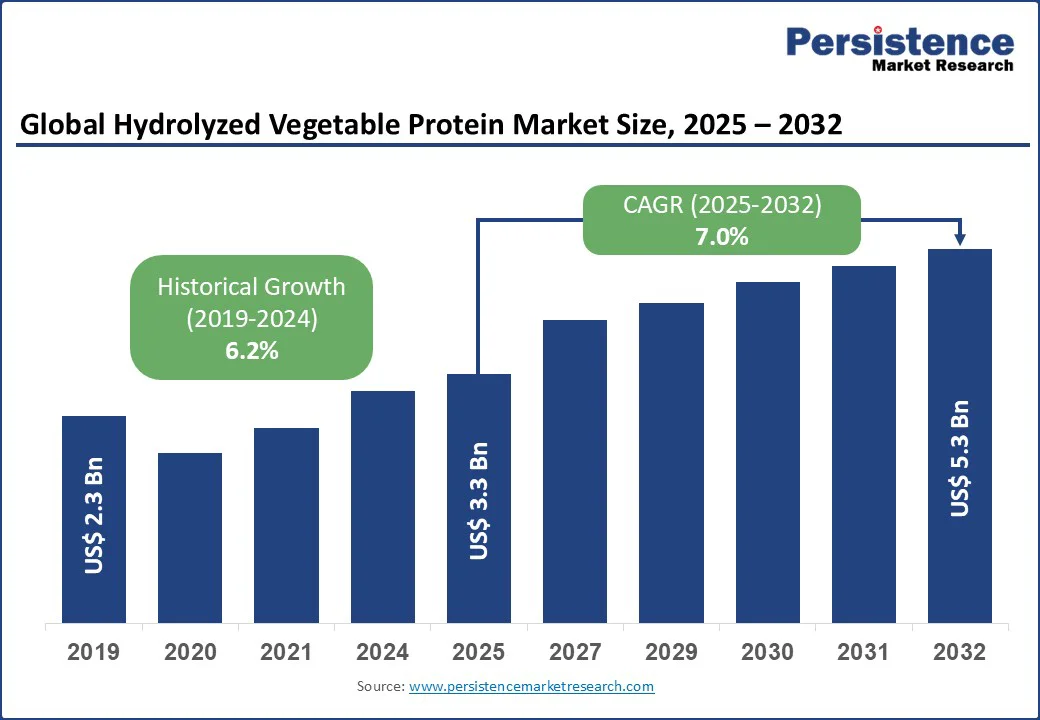

The global hydrolyzed vegetable protein market size is likely to value at US$3.3 Bn in 2025 and reach US$5.3 Bn by 2032, registering a CAGR of 7.0% during the forecast period from 2025 to 2032.

The industry has experienced steady growth, fueled by increasing consumer awareness of plant-based ingredients, rising demand for flavor enhancers in processed foods, and innovative Raw Material formulations by leading brands.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Hydrolyzed Vegetable Protein Market Size (2025E) |

US$3.3 Bn |

|

Market Value Forecast (2032F) |

US$5.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.2% |

The industry growth is propelled by increasing demand for plant-based ingredients and the growing use as flavor enhancers in processed foods. The global rise in vegan and vegetarian diets has driven demand for natural, plant-derived proteins such as HVP.

Urbanization and fast-paced lifestyles continue to drive demand for convenient, flavored processed foods. HVP is widely used in snacks, soups, and sauces for its ability to enhance taste and provide nutritional benefits. In markets such as the U.S., younger consumers are increasingly opting for plant-based alternatives to traditional flavorings such as MSG.

Government-backed nutrition programs further support market growth. In India, initiatives such as the National Nutrition Mission have promoted plant-based fortified foods through school-based and public health channels.

These programs underscore the importance of HVP in combating protein deficiencies among vulnerable groups, including children and pregnant women, thereby encouraging institutional adoption. The expansion of the food and beverage industry has further driven HVP demand. With global food processing reaching new heights, HVP serves as a cost-effective ingredient for improving taste profiles.

The industry faces challenges due to consumer concerns about MSG-such as effects and high raw material costs. Many consumers question the health benefits of HVP due to its potential glutamic acid content, similar to MSG, raising worries about headaches and allergies. A survey by the International Food Information Council found that a significant portion of U.S. consumers avoided Raw Materials with potential MSG associations, citing health risks. This skepticism restricts adoption among health-conscious demographics preferring natural alternatives.

High-raw material costs for clean-label and premium HVP also hinder growth. Incorporating high-quality raw materials such as organic soy or pea increases manufacturing expenses. For example, hydrolyzing proteins with enzymes can significantly raise raw material costs. These costs are often passed to consumers, limiting accessibility in price-sensitive markets such as rural India or Sub-Saharan Africa.

This industry presents strong opportunities through innovation and sustainable sourcing. Growing demand for clean-label, non-GMO HVP aligns with consumer preference for transparency and environmentally friendly ingredients.

Plant-based HVP variants are gaining traction, fueled by the rise of vegan and vegetarian diets. Companies can capitalize by creating advanced formulations that blend HVP with natural flavors, catering to both health-conscious and sustainability-driven consumers while meeting the evolving needs of food manufacturers.

Sustainable sourcing is another growth avenue. With global concerns about environmental impact, brands are adopting responsibly sourced proteins. In 2024, Cargill introduced sustainably sourced soy HVP in Europe, enhancing brand loyalty among eco-conscious consumers. In the Asia Pacific, companies such as Ajinomoto are exploring pea-based HVP, extending applications and reducing environmental footprint.

The rise of e-commerce is creating significant opportunities for the HVP market. Online platforms, including subscription-based services and direct-to-consumer channels, are becoming increasingly popular for purchasing plant-based ingredients.

Brands are capitalizing on this trend by using digital marketing strategies and personalized Raw Material recommendations to engage niche consumer groups, such as health enthusiasts and vegan families. This digital shift allows for broader market reach and enhanced consumer loyalty.

The hydrolyzed vegetable protein market is segmented into soy, corn, pea, and others. Soy dominates the segment, expected to account for approximately 48.2% of the hydrolyzed vegetable protein market share in 2025, due to its widespread availability and strong umami flavor profile. Brands such as Ajinomoto and Cargill have solidified their position through extensive sourcing and processing capabilities. Its versatility in food applications further drives adoption.

Pea is the fastest-growing segment, fueled by rising demand for allergen-free and sustainable alternatives. These proteins appeal to health-conscious consumers, particularly in urban areas, where they are used in snacks and supplements. Raw Materials fortified with pea HVP have gained traction for their clean-label appeal without compromising taste.

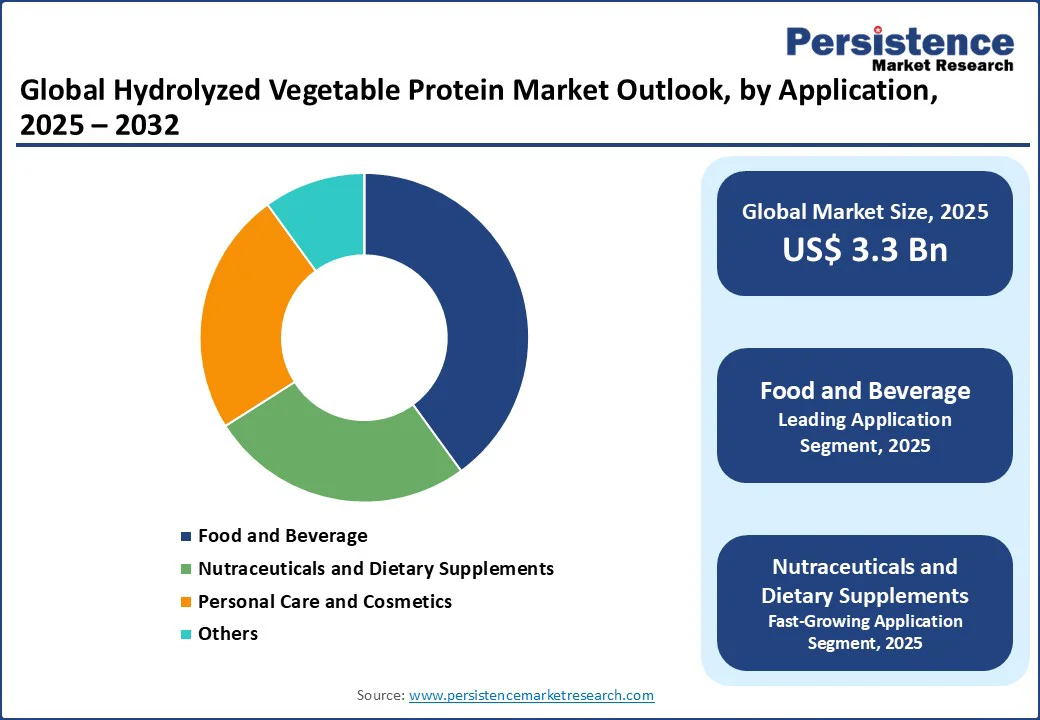

Food and Beverage leads the application, expected to account for 40% of the hydrolyzed vegetable protein market share in 2025. Their dominance stems from wide usage in processed foods, competitive pricing, and consumer preference for enhanced flavors. Companies such as Kerry Group and Tate & Lyle offer extensive HVP ranges for soups, sauces, and snacks.

Nutraceuticals and dietary supplements are the fastest-growing channel, driven by the convenience of health-focused Raw Materials and the rise of wellness trends. Platforms have expanded their HVP offerings in supplements, providing personalized recommendations. The shift toward health supplementation, accelerated by the COVID-19 pandemic, continues to boost this channel’s growth.

Food Grade leads the grades, expected to account for 70% of the hydrolyzed vegetable protein market share in 2025. Its dominance stems from strict regulatory compliance and widespread use in edible Raw Materials. Companies such as DSM and ADM provide high-purity food-grade HVP, ensuring safety for food applications.

Non-Food Grade is the fastest-growing segment, driven by increasing applications in personal care and animal feed. Affordable, versatile non-food grade HVP is enabling expansion into cosmetics and pet food, with the rise of plant-based trends further fueling demand.

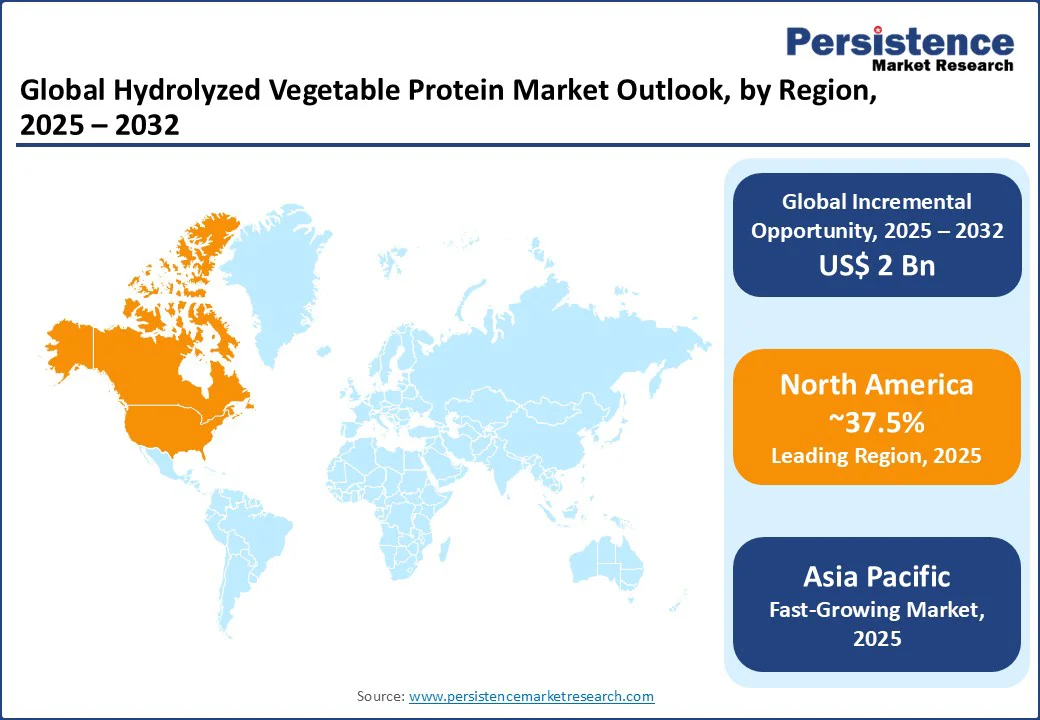

In North America, the U.S. dominates the sector, having a market share of approximately 37.5%. Driven by high consumer spending on health and wellness Raw Materials. The U.S. industry is experiencing strong growth, driven by evolving consumer preferences and rising health consciousness.

Soy-based and pea-based HVP continue to lead the category, supported by the increasing popularity of vegan diets and the demand for clean-label flavor enhancers. Leading brands such as Cargill and ADM are expanding their offerings in the food and beverage segment, while newer entrants are gaining traction with sustainable, non-GMO HVP.

Clean-label and organic options are becoming increasingly important to consumers. Brands such as Kerry Group and Griffith Foods are seeing growing popularity due to their natural ingredients and transparent formulations. Sustainability is also a major focus in the U.S. market, with companies introducing eco-friendly sourcing and committing to environmentally responsible practices. In the premium segment, ethical sourcing and transparency, such as the use of fair-trade ingredients, are emerging as key brand differentiators.

Europe’s hydrolyzed vegetable protein market is led by Germany, the U.K., and France, driven by stringent regulations and increasing consumer demand for clean-label Raw Materials. Germany maintains the largest market share, with a strong focus on soy and pea-based HVP.

The popularity of international brands such as DSM, along with local names, underscores this trend. Environmental policies under the EU’s Green Deal, along with restrictions on synthetic additives, are encouraging companies to adopt sustainable solutions, with formats gaining traction for food applications.

In the U.K., the industry is fueled by health-conscious millennials and Gen Z consumers who favor plant-based, low-allergen HVP. Brands such as Tate & Lyle and Roquette Frères are expanding their offerings, emphasizing transparency and natural profiles.

Meanwhile, France is witnessing steady growth in nutraceutical applications, with Raw Materials leading in consumer preference. Regulatory encouragement for nutrient fortification and environmentally friendly ingredients continues to support overall market growth across the region.

Asia Pacific is expected to grow at a CAGR of 8.5% from 2025 to 2032, led by India, China, and Japan. In India, food and beverage and nutraceutical applications dominate the industry, driven by affordability and strong support from government-backed nutrition programs.

Leading players such as Ajinomoto and Titan Biotech have broadened their portfolios with soy and pea-based options, effectively targeting both urban and rural demographics. The hydrolyzed vegetable protein market is bolstered by increasing health awareness and the ongoing trend of urbanization.

China’s sector is largely propelled by demand for flavor enhancers in processed foods. Prominent brands such as Aipu Food Industry and Kerry Group continue to lead the segment. The expansion of the middle class and growing interest in plant-based diets have significantly contributed to increased consumption, particularly in the food category.

The hydrolyzed vegetable protein market is highly competitive, with a mix of global giants and regional players vying for market share. Companies compete on Raw Material innovation, pricing, and distribution efficiency. The rise of plant-based and clean-label Raw Materials has intensified competition, as consumers demand transparency and sustainability. Digital marketing and partnerships with food processors are key strategies for brand differentiation.

The hydrolyzed vegetable protein market is projected to reach US$3.3 Bn in 2025.

Rising demand for plant-based ingredients, flavor enhancement needs, and government nutrition programs are the key market drivers.

The hydrolyzed vegetable protein market is poised to witness a CAGR of 7.0% from 2025 to 2032.

Innovation in clean-label Raw Materials and sustainable sourcing is the key market opportunity.

Ajinomoto Co., Inc., Kerry Group Plc., and Cargill Inc. are among the key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Raw Material Type

By Application

By Grade

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author