ID: PMRREP35277| 170 Pages | 6 May 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

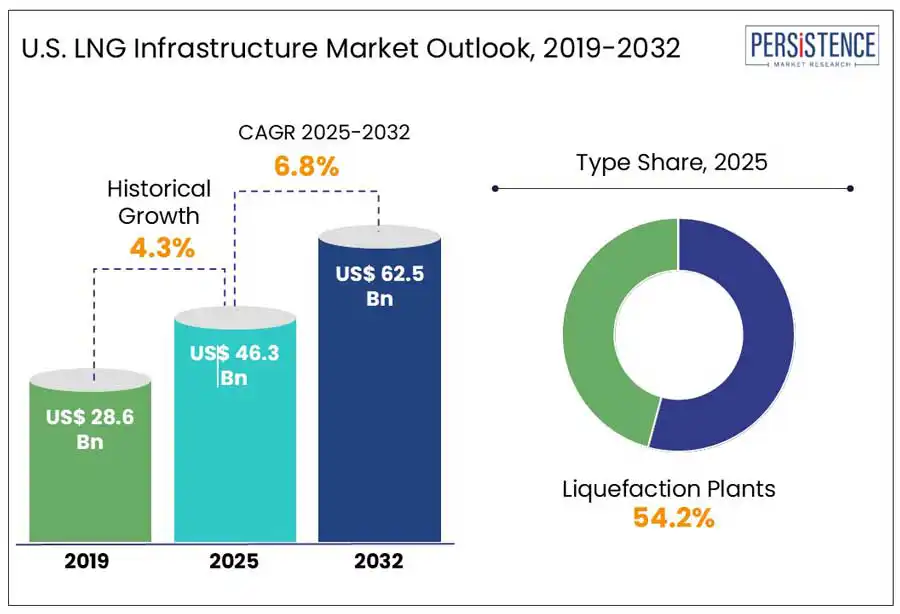

The U.S. LNG infrastructure market size is predicted to reach US$ 62.5 Bn in 2032 from US$ 46.3 Bn in 2025. It will likely witness a CAGR of around 6.8% in the forecast period between 2025 and 2032.

Increasing use of natural gas in a wide range of sectors, including power generation, to lower carbon emissions for a sustainable environment, is poised to boost the U.S. market. The easy availability of shale gas in the country has also raised investments in export facilities, accelerating demand for LNG infrastructure. The U.S. is predicted to be a significant exporter of natural gas to countries such as Vietnam, India, China, Thailand, and Bangladesh in the foreseeable future, creating new avenues for growth.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

U.S. LNG Infrastructure Market Size (2025E) |

US$ 46.3 Bn |

|

Market Value Forecast (2032F) |

US$ 62.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.3% |

The surging requirement to prevent bottlenecks between key LNG export terminals along the Gulf Coast and natural gas production basins such as Haynesville Shale and the Permian Basin is anticipated to push the U.S. LNG infrastructure market growth. These bottlenecks have led to significant investments in constructing and broadening new pipeline capacities to ensure smooth transportation of natural gas to cater to both international and domestic energy demands.

Kinder Morgan, for instance, has been active in addressing similar challenges in the Permian Basin. It extended the capacity of its Permian Highway Pipeline by 550 Mn cubic feet per day (MMcf/d) in December 2023. In the Haynesville Shale region, on the other hand, various projects are underway to improve connectivity to Gulf Coast LNG terminals. DT Midstream is planning to surge capacity to 1.9 Bcf/d from 1 Bcf/d by extending its Louisiana Energy Access Pipeline (LEAP) in three stages.

Community resistance and environmental scrutiny are expected to be a couple of factors hampering the market in the U.S. These issues are resulting in rising regulatory oversight, project delays, and legal challenges, highlighting the increasing focus on climate considerations and environmental justice. The U.S. Court of Appeals for the D.C. Circuit, for example, vacated the Federal Energy Regulatory Commission's (FERC) approval of the Rio Grande LNG project in Texas. It cited inadequate analysis of greenhouse gas emissions and environmental justice impacts.

Community opposition will also likely play a key role in limiting market growth. Representatives from the South Texas Environmental Justice Network and the Carrizo Comecrudo Tribe, for instance, met with Global Infrastructure Partners in June 2024. They expressed concerns over the Rio Grande LNG project’s effects on local ecosystems and indigenous lands. They stated that the facility is anticipated to emit greenhouse gases equivalent to 44 coal-fired power plants every year, threatening local tourism and fishing industries.

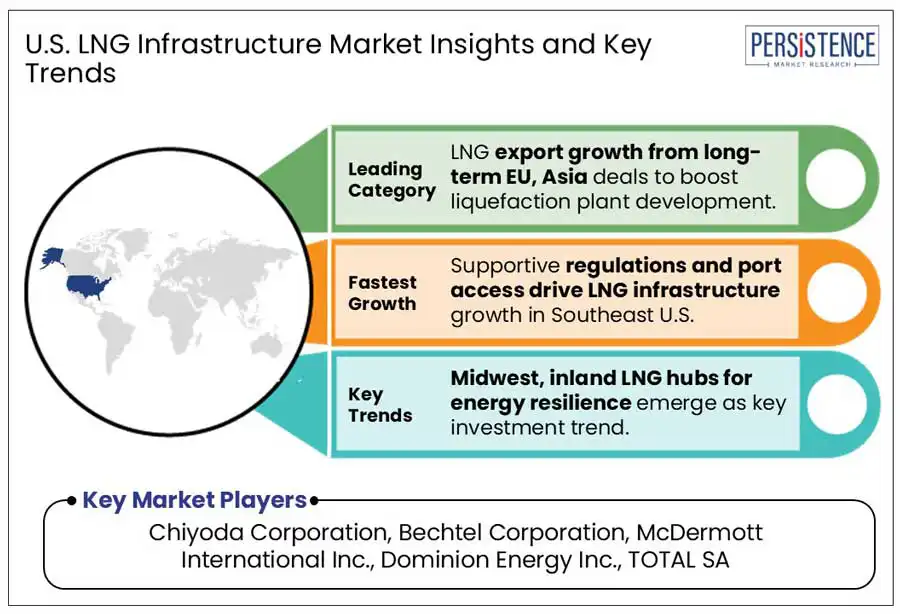

Long-term LNG contracts with leading economies in Europe and Asia Pacific, especially Germany, Japan, and India, are projected to create new growth opportunities in the U.S. India has recently emerged as a key player in the field of LNG. It obtained around 30% of all post-Final Investment Decision (FID) natural gas contracts signed globally between January and August 2024.

The prominent procurement strategy is propelled by the country’s aim to surge the share of natural gas in its energy mix from 6.2% to 15% by 2030. The U.S. exceeded Qatar in June 2024 as India’s significant LNG supplier, providing a record 851,000 tons in a single month. State-run organizations, including GAIL and Indian Oil Corporation (IOC) are also taking initiatives to bolster long-term investments and agreements in U.S.-based LNG projects to achieve diversified and stable energy sources.

Based on type, the market is bifurcated into liquefaction plants and regasification plants. Among these, liquefaction plants are expected to dominate by generating a share of approximately 54.2% in 2025, finds Persistence Market Research. The ability of liquefaction plants to convert abundant natural gas resources of the U.S. into export-ready LNG is predicted to spur growth. Rapid surge in the country’s natural gas production is also projected to increase investments in liquefaction plants. These enable companies to monetize surplus gas production that would otherwise require costly storage or lower domestic prices.

Regasification plants, on the other hand, are speculated to see decent growth in the forecast period. These have recently gained traction due to changing regional and domestic energy requirements, including energy resilience, peak-shaving, and niche industrial applications. These plants are finding renewed interest from sectors such as emergency preparedness, small-scale LNG distribution, and seasonal energy balancing in areas where pipeline connectivity is vulnerable or limited.

Compared to Gulf Coast, the West is estimated to remain relatively underdeveloped in terms of LNG infrastructure. This is attributed to logistical constraints, environmental opposition, and regulatory hurdles. This zone has witnessed several proposed LNG projects either delayed or cancelled. Stringent regulatory environment in states such as Oregon and California, where climate policies are far more aggressive and public opposition to fossil fuel infrastructure is robust, is limiting growth.

The Jordan Cove LNG project in Oregon, for example, was backed by Pembina Pipeline Corp. It was speculated to be a 7.5 Mn metric tons per annum (MTPA) export terminal with a 229-mile pipeline connecting to gas supplies. After around two decades of delays due to lack of necessary permits from the Oregon Department of Environmental Quality, legal battles with landowners, and regulatory challenges, Pembina officially canceled the project in 2021.

Southeast U.S. is predicted to account for about 33.7% of the U.S. LNG infrastructure market share in 2025. States such as Georgia and Louisiana have become major hubs for LNG export terminal developers. The proximity of these states to both international shipping routes and domestic gas supplies, specifically the Panama Canal, has made them highly attractive for infrastructure investment.

As of 2024, the Sabine Pass LNG terminal in Louisiana, which is operated by Cheniere Energy, for example, remains one of the most prominent LNG export facilities in the U.S. It has a capacity of 30 Mn MTPA and has undergone various expansions. Cheniere Energy is currently focusing on investing in its seventh liquefaction train under the Sabine Pass Stage 5 expansion plan. This strategy is expected to add up to 20 MTPA, with final investment decisions estimated by late 2025.

In the Southwest, New Mexico and Texas are considered the main states in terms of LNG infrastructure boom. This is due to their proximity to the Gulf of Mexico, well-established energy logistics networks, and abundant natural gas reserves. Texas hosts few of the country's most prominent LNG export facilities, with a concentration of pipelines and terminals clustered around the Gulf Coast. The state is often considered the anchor of the Southwest energy corridor owing to its significant role in both downstream LNG processing and upstream gas production.

New Mexico, while not a home to several LNG terminals itself, is assessed to be a key upstream contributor through its portion of the Permian Basin. Its regulatory reforms have strived to lower methane emissions to make its gas more appealing to international LNG buyers seeking clean sources. The state also rolled out stringent norms associated with leak detection and flaring in 2024, to help companies comply with Environmental, Social, and Governance (ESG) standards demanded by importers based in Asia Pacific and Europe.

The U.S. LNG infrastructure market is fragmented in nature. Renowned companies are focusing on collaborations and partnerships with international players to co-develop new projects to extend their geographical presence. A few other companies are aiming to obtain new contracts from government bodies to supply LNG to certain areas. This strategy would help them strengthen their position in the market.

The U.S. LNG infrastructure market is projected to reach US$ 46.3 Bn in 2025.

Increasing investments in export facilities and rising initiatives by companies to extend LNG networks are the key market drivers.

The market is poised to witness a CAGR of 6.8% from 2025 to 2032.

Rising production of natural gas and high demand for off-grid LNG supplies in remote areas are the key market opportunities.

Chiyoda Corporation, Bechtel Corporation, and McDermott International Inc. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author