ID: PMRREP35044| 190 Pages | 2 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

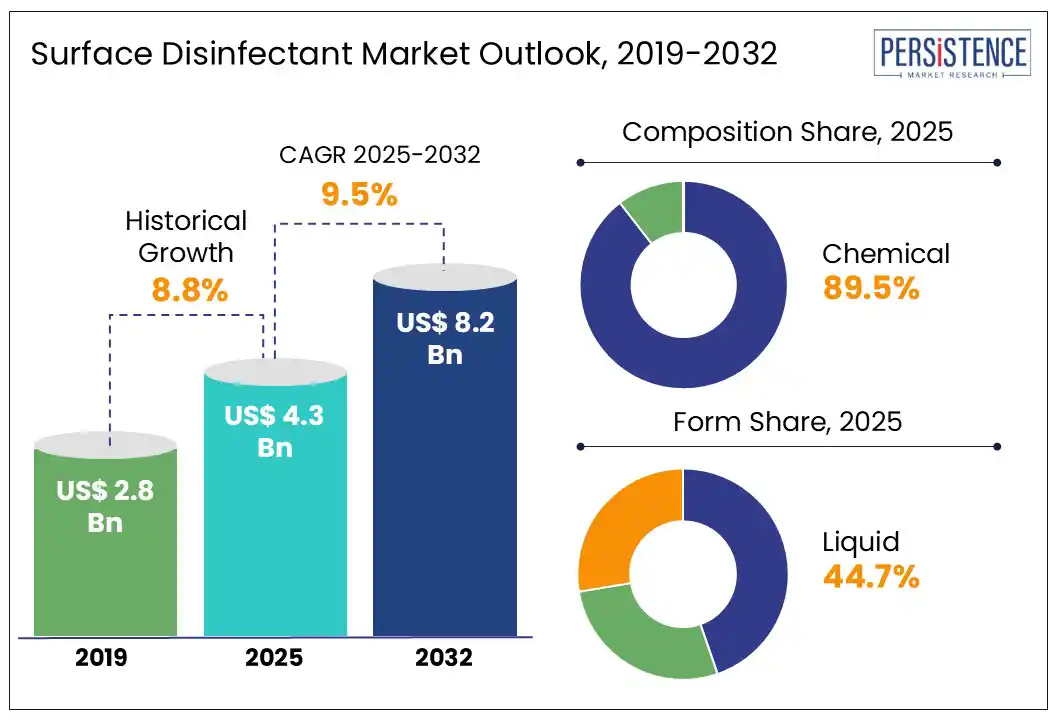

The surface disinfectant market size is likely to be valued at US$ 4.3 Bn in 2025 and is estimated to reach US$ 8.2 Bn in 2032, growing at a CAGR of 9.5% during the forecast period 2025-2032.

Surface disinfectants have gradually evolved from routine cleaning agents to strategic tools across critical industries, finds Persistence Market Research. No longer confined to hospitals and households, these formulations now anchor hygiene protocols in food factories, airports, public transport systems, and schools. With regulatory frameworks such as the U.S. EPA’s List N and the EU’s Biocidal Products Regulation tightening efficacy and residue benchmarks, manufacturers are racing to innovate. The market is moving toward enzyme-based, biodegradable wipes made for allergy-sensitive environments and hospital-grade hydrogen peroxide sprays engineered for zero downtime disinfection.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Surface Disinfectant Market Size (2025E) |

US$ 4.3 Bn |

|

Market Value Forecast (2032F) |

US$ 8.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

9.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.8% |

Surging prevalence of Healthcare-Associated Infections (HAIs) is expected to push the surface disinfectant market growth in the foreseeable future. This is particularly evident in hospitals and long-term care facilities where environmental contamination is a persistent transmission vector. As per the Centers for Disease Control and Prevention (CDC), on any given day, one in 31 hospital patients has at least one HAI. Such incidents have triggered effective disinfection protocols, mainly on high-touch surfaces such as bed rails, infusion pumps, overbed tables, and electronic monitoring devices.

Hospitals are responding by integrating disinfectants with proven efficacy against Multi-Drug-Resistant Organisms (MDROs) such as MRSA and Clostridioides difficile into routine cleaning workflows. A 2023 pilot program at a tertiary hospital in South Korea, for instance, showed a 32% reduction in MRSA surface contamination after switching from chlorine-based cleaners to hydrogen peroxide-based surface disinfectants used via electrostatic sprayers. This case study has since influenced procurement practices in other regional facilities, leading to surging adoption of broad-spectrum, low-residue formulations.

Concerns over health hazards such as respiratory issues, skin and eye irritation, and allergic reactions are significantly hampering the widespread adoption of traditional surface disinfectants. Various studies have pointed to the risks associated with prolonged exposure to Quaternary Ammonium Compounds (QACs), bleach, and alcohol-based disinfectants. For example, a 2023 study published in Environmental Health Perspectives linked frequent occupational use of QACs in hospital cleaning staff to an increased incidence of work-related asthma and chronic bronchitis symptoms.

Such concerns are not limited to hospital settings. In the U.S., the National Institute for Occupational Safety and Health (NIOSH) has flagged eye and skin irritation from sodium hypochlorite and peracetic acid as recurrent causes of complaints among janitorial and facility maintenance personnel. In addition, consumer feedback on hypersensitivity and allergic reactions is changing product development strategies. Data from the EU’s RAPEX indicates that chemical disinfectants were among the main five categories flagged for causing skin and eye irritation in 2023.

Strict food safety standards and increasing scrutiny from regulatory bodies are creating opportunities for cleanroom disinfectant manufacturers targeting the food processing sector. Agencies such as the U.S. Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and Australia’s Department of Agriculture have tightened disinfection guidelines for food contact surfaces. It is further pushing demand for high-efficacy, residue-free disinfectants.

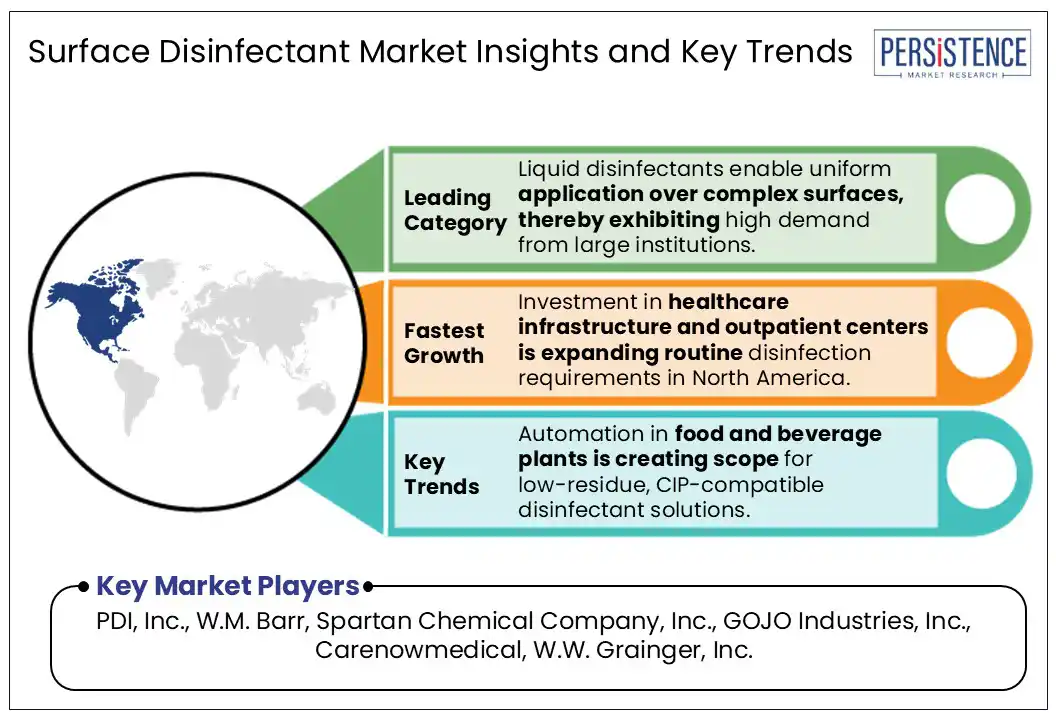

Food processing facilities are under constant pressure to mitigate risks of microbial contamination in high-throughput environments such as meat cutting zones, conveyor belts, and cold storage areas. Also, the global trend toward automation in food production is boosting demand for disinfectants that are compatible with Clean-in-Place (CIP) and automated misting or fogging systems. In Japan, for instance, beverage bottling plants are adopting alcohol-free, enzyme-based surface disinfectants to meet both hygiene and environmental requirements. These products are designed to clean without corroding stainless steel equipment or affecting product quality.

In terms of composition, the market is bifurcated into chemical and bio-based. Among these, the chemical segment is predicted to account for nearly 89.5% of share in 2025, backed by their rapid action and broad-spectrum efficacy. Hydrogen peroxide, chlorine, and QAC-based disinfectants are widely adopted as they are capable of inactivating various pathogens within short contact times. Despite the rise of bio-based alternatives, the established performance history of chemical disinfectants continues to reinforce their dominance.

Bio-based surface disinfectants are gaining momentum owing to increasing consumer demand for non-toxic, environmentally friendly alternatives. In the European Union, the Biocidal Products Regulation (BPR) has tightened safety assessments for chemical disinfectants. It has further prompted institutions such as education, hospitality, and eldercare to shift toward safe, residue-free options. Workplace safety regulations in food processing and eldercare sectors have also contributed to adoption.

Based on form, the market is trifurcated into liquid, wipes, and sprays. Out of these, the liquid segment is poised to hold approximately 44.7% of the surface disinfectant market share in 2025 due to its superior surface coverage, ease of application, and compatibility with both manual and automated disinfection protocols. Its fluid nature allows it to penetrate irregular surfaces, corners, and micro-cracks more effectively than sprays or wipes. It is also available in both ready-to-use and concentrate formats, which makes it cost-effective for bulk usage in commercial cleaning services.

Wipes, on the other hand, are expected to exhibit a steady growth rate through 2032 with their ability to deliver precise, single-use hygiene control in high-touch, fast-paced environments where conventional liquid formats are overused. Hospitals, for instance, are increasingly relying on pre-saturated disinfectant wipes to minimize cross-contamination risks between patient zones. A 2023 online survey conducted across hospitals in the U.K. found that over 68% of infection control departments preferred wipes for cleaning bed rails, infusion pumps, and touchscreen medical devices. This is due to their portability, standard dosing, and reduced risk of overwetting electronic surfaces.

In 2025, North America is speculated to account for about 35.7% of share due to increasing demand from institutional settings. While household usage has normalized post-COVID-19, sectors such as healthcare, food processing, and public transportation continue to account for steady demand. This is due to regulatory mandates and surging hygiene protocols. The U.S. Environmental Protection Agency (EPA), for example, continues to update its List N, which includes disinfectants approved for use against emerging pathogens, influencing institutional procurement patterns.

The U.S. surface disinfectant market is witnessing the development of fragrance-free and residue-free surface disinfectants targeted toward hypersensitive environments. Companies such as Diversey Holdings and CloroxPro are introducing new low-toxicity formulations with rapid contact times. Demand for disinfectants in the country is also being influenced by green cleaning policies adopted by schools and federal agencies. New York’s Green Cleaning Law, for instance, requires the use of environmentally sensitive cleaning and disinfecting products in K-12 schools. It is further accelerating demand for hydrogen peroxide-based solutions over conventional quats.

In Europe, chemical disinfectants, including QACs, alcohols, and chlorine derivatives dominate the market. Under regulatory pressure, however, enzyme-based alternatives are emerging as the most prominent category. Regulatory frameworks such as REACH and the BPR are pushing the shift toward green, low-residue disinfectants. Markets in Germany, the U.K., and the Netherlands are leading adoption of such eco?friendly products?owing to strict mandates in healthcare, food safety, schools, and transit.

In the U.K., rising demand for biodegradable, alcohol-free bleach alternatives has spurred innovation in peracetic acid-based disinfectants. The country is also pioneering long-lasting and multifunctional disinfectants suitable for high-traffic locations. A few companies are focusing on launching specialized formulations that are safe for sensitive equipment.

Asia Pacific is mainly propelled by evolving regulatory standards, rising awareness of hygiene, and the ongoing development of healthcare infrastructure. Increasing prevalence of HAIs, especially in densely populated countries such as India, Indonesia, and China, is creating new opportunities. In these countries, government bodies are promoting stringent hygiene protocols across public and private healthcare, thereby bolstering demand for disinfectants.

China leads Asia Pacific in terms of both production and consumption of surface disinfectants. It is attributed to large-scale manufacturing capabilities and expansion of hospital disinfectant products and services, particularly in Tier 2 and Tier 3 cities. India is also emerging as a significant market, augmented by investments in affordable healthcare and rising adoption of hygiene products beyond urban centers. Enzyme-based and bio-based disinfectant sprayers are gaining popularity in the country, providing alternatives to traditional QACs. The latter still holds a prominent share but is facing increased scrutiny over potential residue-related safety concerns.

The surface disinfectant market is highly competitive with key companies differentiating themselves through technological innovation, sustainability initiatives, and sector-specific product development. Leading players are leveraging their global distribution networks and investing in hospital-grade disinfectants with superior hydrogen peroxide, hypochlorous acid, and QACs to cater to healthcare and food industries. In response to the rising scrutiny of chemical exposure, a few players are introducing biodegradable or plant-based surface disinfectants. They are hence creating a niche, yet a rapidly expanding segment focused on eco-conscious consumers and institutions.

The market is projected to reach US$ 4.3 Bn in 2025.

Investment in healthcare infrastructure and consumer shift toward hospital-grade home cleaning products are the key market drivers.

The market is poised to witness a CAGR of 9.5% from 2025 to 2032.

Development of alcohol-free disinfectants and expansion of pharmaceutical manufacturing are the key market opportunities.

PDI, Inc., W.M. Barr, Spartan Chemical Company, Inc., and GOJO Industries, Inc. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Composition

By Form

By Application

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author