ID: PMRREP4357| 199 Pages | 2 Feb 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

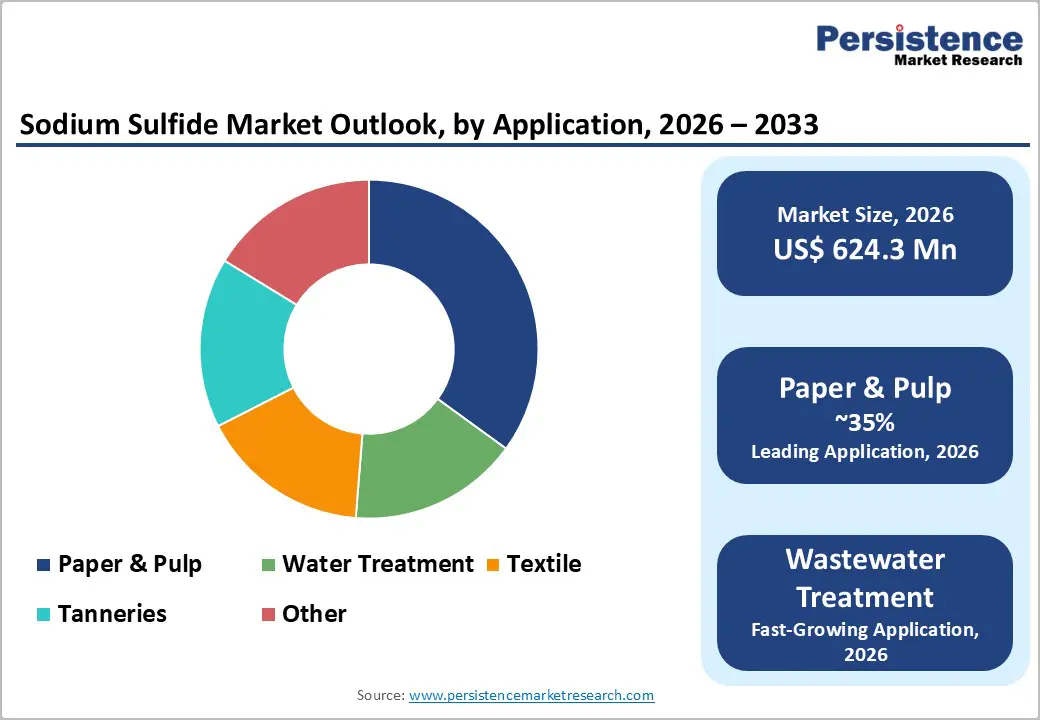

The global sodium sulfide market size is supposed to be valued at US$ 624.3 million in 2026 and is projected to reach US$ 835.7 million by 2033, growing at a CAGR of 4.3% between 2026 and 2033.

Robust demand from the paper & pulp and water treatment sectors drives this expansion, supported by stringent environmental regulations and industrial growth in emerging economies. Global paper production reached 420 million tons in 2023, necessitating chemicals such as sodium sulfide for lignin removal in kraft pulping processes. The compound's cost-effectiveness compared to alternative chemical treatments, coupled with technological improvements in manufacturing processes that enhance product purity and reduce environmental impacts, further contributes to positive market dynamics.

| Key Insights | Details |

|---|---|

| Sodium Sulfide Size (2026E) | US$ 624.3 Mn |

| Market Value Forecast (2033F) | US$ 835.7 Mn |

| Projected Growth CAGR (2026 - 2033) | 4.3% |

| Historical Market Growth (2020 - 2025) | 3.6% |

The growth of global paper production and recycling initiatives is increasing demand for sodium sulfide as a crucial delignification agent in the Kraft process. As an essential reducing agent, sodium sulfide plays a key role in converting wood chips into cellulose fibers by dissolving lignin bonds, directly enhancing fiber quality and paper strength. From 2020 to 2025, wood pulp production increased by 2.5% annually, with sodium sulfide facilitating effective lignin separation to produce high-quality cellulose fibers.

The demand for global packaging, coupled with rising tissue product consumption and a focus on sustainable recycling, is significantly boosting the Pulp and Paper Processing Chemicals market. Additionally, emerging markets in Southeast Asia and Latin America are constructing new Kraft pulping facilities to fulfill regional packaging requirements, ensuring continued procurement of sodium sulfide and supporting long-term market growth through 2033.

Industrial wastewater treatment represents a rapidly growing application segment for sodium sulfide, driven by increasingly stringent environmental discharge regulations across major industrial regions. Sodium sulfide is an effective precipitant for heavy metals such as lead, mercury, cadmium, and chromium by converting dissolved ions into insoluble sulfides, which are subsequently removed by sedimentation or filtration.

Research by the National Institutes of Health indicates that this process achieves approximately 90% removal efficiency for cadmium in effluent streams. The global Water & Wastewater Treatment Chemicals market is expanding as regulatory authorities, including the U.S. Environmental Protection Agency and international bodies, enforce stricter discharge standards. Consequently, industries such as electroplating, metal finishing, mining, and chemical processing are increasingly adopting sodium sulfide to ensure compliance, thereby accelerating its global demand.

Sodium sulfide poses significant handling challenges due to its corrosivity and the potential release of toxic hydrogen sulfide upon contact with acids or moisture. The Environmental Protection Agency (EPA) has implemented stricter 2024 sulfur dioxide (SO2) national ambient air quality standards, necessitating enhanced infrastructure for the handling and disposal of sulfur compounds. In Europe, regulations such as the ZDHC Wastewater Guidelines Version 2.2 and the proposed EU Critical Chemicals Act impose rigorous testing and compliance requirements on chemical manufacturers. These regulations require specialized storage solutions, protective equipment, and extensive employee training, thereby increasing operational costs for end users.

Furthermore, assessments by Environment and Climate Change Canada have revealed significant environmental impacts of sodium sulfide, particularly concerning aquatic ecosystems and human health. The chemical’s reactivity necessitates strict containment measures during transportation and storage, which may limit its use at smaller industrial facilities. Such complexities create barriers to market entry and encourage the search for safer alternative chemicals.

Sodium sulfide production is highly dependent on the reliable availability of key raw materials, including sulfur, sodium hydroxide, and natural gas for energy. Fluctuations in the global sulfur market, influenced by petroleum refining activities and variations in sulfuric acid output, significantly affect production economics. Recent supply chain disruptions have exposed vulnerabilities in raw material procurement, particularly for manufacturers reliant on international sourcing.

Furthermore, price volatility in caustic soda markets, combined with rising energy costs, continues to compress profit margins and create pricing uncertainty for downstream consumers. These supply-side challenges constrain market growth, particularly in regions lacking integrated chemical manufacturing infrastructure or reliable access to competitively priced feedstocks.

Industry players are increasingly investing in research and development to create advanced sodium sulfide formulations with reduced iron content and superior purity, enabling applications in specialty chemicals and pharmaceutical intermediates. Notably, Tessenderlo Group introduced low-ferric sodium sulfide grades in 2022, underscoring the sector’s focus on innovation. These high-purity variants support critical applications, including sulfur-based pharmaceutical compounds, specialty textile dyes, and precision water-treatment processes.

The development of crystalline and anhydrous forms with enhanced stability and minimal impurities is opening new opportunities in electronics, specialty chemicals, and advanced materials manufacturing. Companies that achieve technological leadership in ultra-pure sodium sulfide can command premium pricing and penetrate high-value segments, as sustainability and performance requirements drive next-generation product strategies through 2033.

The leather tanning and processing industry presents considerable growth opportunities for sodium sulfide suppliers, particularly in India, China, Bangladesh, and Vietnam, where leather goods manufacturing is expanding rapidly. Sodium sulfide is the primary dehairing agent, breaking down keratin to remove hair from animal hides during pre-tanning preparation. India's leather industry, particularly in Tamil Nadu and Uttar Pradesh, is among the largest exporters globally, with production volumes rising due to increased sourcing by international fashion brands.

Tanneries seek low-iron sodium sulfide formulations with less than 30 parts per million of iron to mitigate environmental impact and enhance leather quality. As demand for leather footwear, automotive upholstery, and luxury goods grows among emerging middle-class populations, sodium sulfide consumption for tanning applications is projected to outpace market growth through 2033, creating significant opportunities for environmentally compliant suppliers.

Crystal sodium sulfide holds a leading position in the product type segment, representing approximately 40% of global market share as of 2024. Its dominance is attributed to several advantages, including ease of handling, reduced dust generation during industrial operations, and superior storage stability compared to alternative forms. Typically formulated with 60% sodium sulfide and controlled moisture content, crystal variants are particularly suited for leather tanning applications, where precise dosing and consistent chemical performance are essential for uniform hide processing. This form also ensures efficient dissolution in industrial equipment while minimizing exposure risks associated with powdered chemicals.

Furthermore, crystalline sodium sulfide exhibits excellent shipping characteristics and extended shelf life, thereby simplifying inventory management for distributors and end users. Large-scale production facilities in China, notably in Sichuan and Shaanxi provinces, cater to both domestic and international markets.

The paper and pulp application segment accounts for the largest share of the global sodium sulfide market, representing approximately 35% of total consumption. This significant presence underscores the essential role of sodium sulfide in Kraft pulping processes, where it serves as a component of white liquor, aiding delignification of wood chips and the liberation of cellulose fibers. Prominent pulp manufacturing companies, such as International Paper, Stora Enso, and Suzano, maintain substantial procurement volumes of sodium sulfide to ensure uninterrupted Kraft pulping operations. The growth trajectory of this segment is closely linked to the increasing demand for global packaging materials.

Furthermore, the advancement of circular economy principles is driving increased paper recycling, which in turn creates additional consumption opportunities for sodium sulfide in deinking processes associated with recovered fiber processing. This trend is expected to generate continued demand within the pulp and paper ecosystem through 2033.

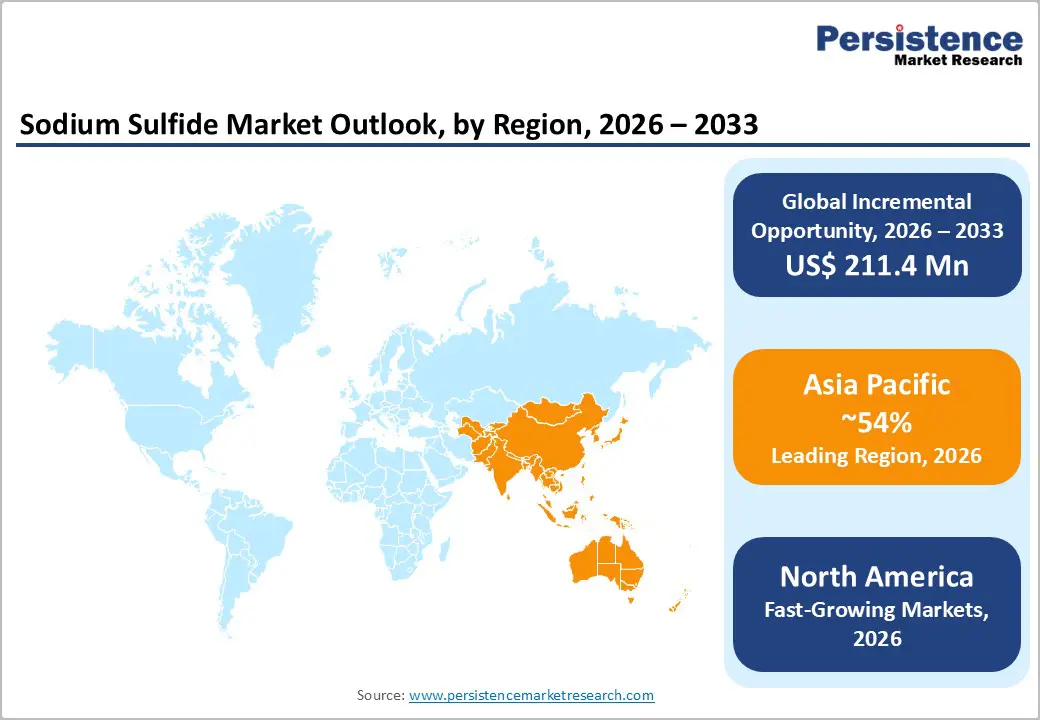

The U.S. maintains a strong presence in the North American market, supported by a well-established pulp and paper manufacturing infrastructure, primarily in southeastern states such as Georgia, Alabama, and Florida, as well as significant operations in the Pacific Northwest. U.S. production emphasizes high-purity grades amid enforcement of the Clean Water Act. USGS tracks 150,000 tons of annual consumption, led by paper mills in the Southeast.

The demand for sodium sulfide reflects the maturity of the kraft pulping industry and the established relationships between chemical producers and paper manufacturers. In March 2024, Grillo-Werke AG announced plans to expand capacity in North America to address rising demand from both the pulp and paper sectors and water treatment applications. The regulatory framework in North America, guided by the U.S. Environmental Protection Agency, plays a vital role in market dynamics, enforcing safety guidelines, wastewater discharge standards, and workplace exposure limits. This promotes high product quality and environmentally responsible practices.

Germany leads Europe in sodium sulfide consumption, owing to its strong chemical manufacturing and paper production facilities operated by companies such as UPM-Kymmene and Sappi. The regional market adheres to REACH regulations, ensuring safety, environmental compliance, and consistent product quality across member states.

France, Spain, and the U.K. are also key markets, particularly in water treatment, as municipalities implement advanced heavy-metal removal technologies in line with EU directives. The focus on circular economy principles boosts demand for high-purity, low-ferric sodium sulfide formulations in leather processing and textiles. Additionally, the rise of eco-friendly dyeing methods among European textile manufacturers creates opportunities for specialty sodium sulfide variants with reduced environmental impact.

Asia-Pacific is the dominant regional market, with China and India serving as both major production centers and leading consumption markets. The region accounts for approximately 54% of global sodium sulfide demand, driven by vertically integrated leather tanning, textile manufacturing, and chemical processing industries. China's dominance stems from extensive manufacturing infrastructure in Guangxi, Sichuan, and Shaanxi provinces, which operates large-scale production facilities serving both domestic and international markets.

Southeast Asian nations, including Vietnam, Indonesia, and Thailand, are experiencing accelerated demand growth as multinational corporations establish paper manufacturing facilities, leather-processing operations, and textile production plants to serve regional markets while accessing lower labor and operational costs. Government initiatives promoting industrial development, particularly China's investments in expanded sodium sulfide production capacity announced in August 2023, underscore regional commitment to supporting downstream manufacturing sectors.

The sodium sulfide market exhibits moderate consolidation, characterized by several multinational chemical manufacturers maintaining significant market positions alongside numerous regional producers serving localized demand. Market leaders pursue vertical integration strategies, controlling raw material sourcing, production processes, and distribution networks to optimize cost structures and ensure reliable supply capabilities. Companies differentiate through product quality specifications, particularly iron content levels for leather tanning applications and purity grades for specialty chemical synthesis. Strategic partnerships with downstream industries, including pulp manufacturers, tanneries, and wastewater treatment facility operators, enable customized product development and long-term supply agreements that strengthen customer relationships and reduce demand volatility.

The global sodium sulfide market is projected to reach US$ 835.7 Mn by 2033, expanding from US$ 624.3 Mn in 2026 at a CAGR of 4.3% during the forecast period.

Market growth is primarily driven by escalating demand from the pulp and paper industry for Kraft pulping processes, stringent environmental regulations mandating industrial wastewater treatment for heavy metal removal, and expanding leather tanning operations across emerging Asian economies.

Crystal sodium sulfide dominates the product type category with approximately 40% market share, favored for its superior handling characteristics, storage stability, and precise dosing capabilities in industrial applications, including leather tanning and chemical manufacturing.

Asia Pacific commands the largest regional market share at approximately 54% of global demand, driven by extensive manufacturing infrastructure in China, India, and Southeast Asian nations across leather tanning, textile processing, and pulp production industries.

Significant opportunities include expanding leather processing industries in India, China, Bangladesh, and Vietnam, alongside technological advancements in low-ferric and high-purity formulations enabling applications in specialty chemicals, pharmaceutical intermediates, and advanced water treatment protocols.

Key market players include Solvay S.A., Nippon Chemical Industrial Co., Ltd., Tessenderlo Group, Sichuan Shenhong Chemical Industry Co., Ltd., Shaanxi Fuhua Chemical Co., Ltd., TIB Chemicals AG, and Grillo-Werke AG, among others operating across global and regional markets.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author