ID: PMRREP33892| 199 Pages | 21 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

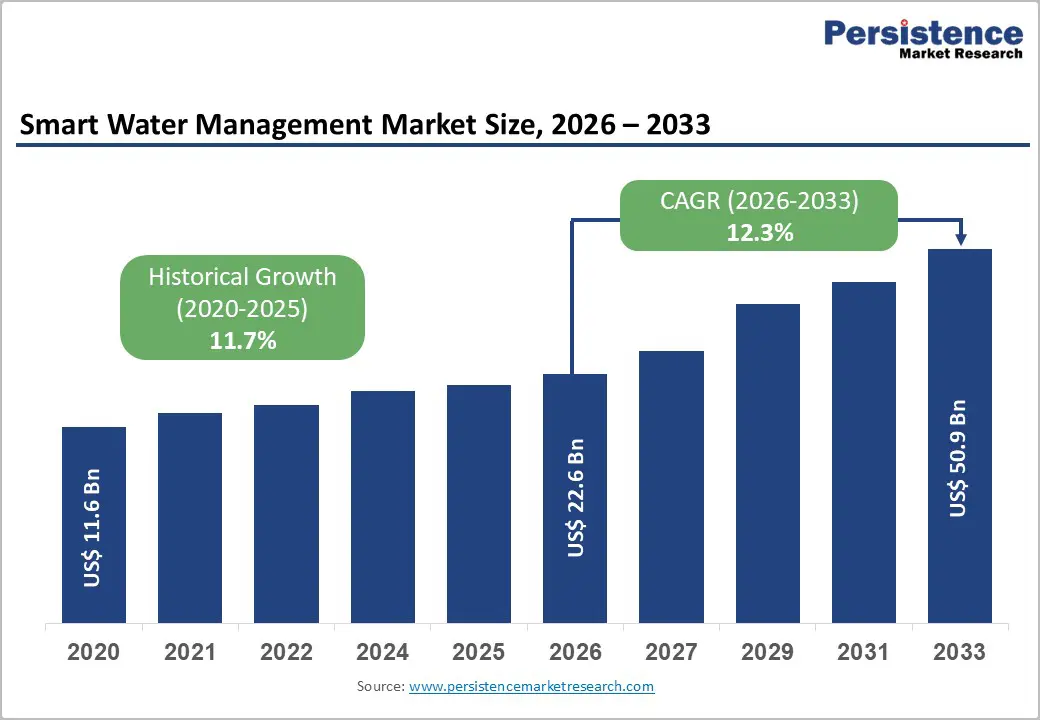

The global smart water management market is expected to be valued at US$ 22.6 billion in 2026 and projected to reach US$ 50.9 billion by 2033, growing at a CAGR of 12.3% between 2026 and 2033.

The market’s exceptional expansion is fundamentally driven by three converging imperatives: acute water scarcity and climate-induced droughts compelling governments and utilities to implement conservation mandates, aging water infrastructure characterized by non-revenue water (NRW) losses exceeding 30% in developing countries requiring digital modernization, and technological maturation of Internet of Things (IoT) sensors, cloud-based analytics platforms, and artificial intelligence enabling real-time monitoring, predictive maintenance, and autonomous control capabilities.

The convergence of regulatory pressures, including Europe’s Blue Deal narrative emphasizing smart water deployment, India’s Jal Shakti Abhiyan targeting water conservation, and substantial government infrastructure investments exceeding USD 55 billion in the United States alone create favorable market conditions for accelerated adoption across utility, commercial, and residential segments.

| Key Insights | Details |

|---|---|

| Smart Water Management Market Size (2026E) | US$ 22.6 billion |

| Market Value Forecast (2033F) | US$ 50.9 billion |

| Projected Growth CAGR(2026 - 2033) | 12.3% |

| Historical Market Growth (2020 - 2025) | 11.7% |

Non-revenue water (NRW) losses represent critical financial drains on utility operations, with US utilities alone losing approximately 6 billion gallons of treated water daily to infrastructure leaks, according to infrastructure analysis organizations. Developing country utilities experience NRW rates exceeding 30-50%, translating to billions of dollars in annual losses and environmental waste. Implementing smart water metering systems and advanced analytics platforms can reduce water losses by up to 30%, creating compelling economic justification for utility adoption.

The EPA’s Surveillance and Response System (SRS) framework emphasizes integrating advanced metering infrastructure (AMI) with predictive analytics to achieve real-time anomaly detection and automated leak identification. Utilities, including those in Malaysia, deploying acoustic leak detection across 3,000 kilometers of pipeline, identified and located 252 leaks within 17 months, achieving water savings of 25 million liters daily. The economic impact of NRW reduction provides an immediate return on investment through revenue recovery and operational cost reduction, accelerating smart water adoption, particularly among utilities facing aging infrastructure and financial constraints.

Government Regulatory Mandates and Infrastructure Investment Programs

Government mandates and substantial capital allocations drive the deployment of smart water technology, compelling utilities to implement conservation measures and modernize aging systems. The United States government allocated over USD 55 billion under recent legislation specifically for water system modernization, while India’s government committed nearly USD 50 billion to water projects under national programs, including AMRUT 2.0 and Jal Shakti Abhiyan.

Europe’s Water Reuse Directive and Blue Deal initiatives set targets for a 15% reduction in water use across member states, creating regulatory drivers for smart meter deployment. The Philippine government’s approval of extended concessions for Maynilad and Manila Water demonstrates its commitment to private-sector involvement in smart water infrastructure development. These regulatory frameworks and government investments create institutional demand for integrated smart water solutions that combine IoT-enabled sensors, SCADA systems, and analytics platforms, thereby directly driving market expansion for technology providers and solution integrators.

Despite strong adoption drivers, smart water management systems require substantial upfront capital investments, creating financial barriers for smaller utilities and budget-constrained municipalities. Advanced metering infrastructure (AMI) deployment encompasses expensive components, including smart meters, LPWAN communication networks (LoRaWAN, NB-IoT, RF mesh), meter data management systems (MDMS), SCADA system integration, and cybersecurity infrastructure. Comprehensive smart water deployment requires capital expenditures ranging from USD 500 million to USD 2+ billion for large utilities, creating financial constraints particularly in developing economies where utility budgets remain limited.

System integration complexity involves technical challenges across legacy SCADA platforms, workforce skill development requirements for advanced operational analytics, and extended project timelines. The U.S. Department of Energy’s Grid Modernization initiative acknowledges that data governance and integration challenges persist even as utilities continue operationalizing advanced metering data across enterprise systems, deterring smaller operators from comprehensive system adoption.

Cybersecurity Vulnerabilities and Data Privacy Regulatory Compliance Requirements

The proliferation of connected water infrastructure creates substantial cybersecurity vulnerabilities, as IoT-enabled smart metering systems collect granular consumer water usage data and trigger strict regulatory compliance requirements. European Union GDPR regulations and national-level data protection frameworks impose significant compliance obligations on utilities managing advanced metering infrastructure. Water utilities managing critical infrastructure face elevated risks of cyberattacks, with potential operational disruptions threatening service continuity and public health.

Michigan’s MPSC rules require utilities to implement comprehensive data privacy frameworks safeguarding consumer data against unauthorized third-party distribution. EU Cybersecurity Act (2019) implementation, adherence to IEC 62056 (DLMS/COSEM standard) and Open Metering System (OMS) interoperability requirements, and security certification processes increase deployment costs and project timelines, particularly for utilities lacking in-house cybersecurity expertise.

Smart city initiatives represent substantial market opportunities, with Asia Pacific governments prioritizing smart city investments to improve urban living standards, creating demand for integrated smart water management systems. China’s urban population is projected to exceed 70% by 2030, driving government investments in smart water infrastructure for densely populated municipalities managing extraordinary water stress. India’s government invested USD 241 million under the PM E-DRIVE Scheme, supporting infrastructure deployment, creating complementary demand for water supply optimization at utility facilities.

The convergence of smart city frameworks incorporating smart water management, smart energy systems, and intelligent transportation networks creates comprehensive digitalization opportunities where water utilities deploy integrated platforms capturing operational data across multiple infrastructure domains. India and ASEAN nations pursue municipal-scale smart water adoption through coordinated pilot programs demonstrating technology viability and consumer acceptance, with PPP models supporting 8.1% CAGR growth in water infrastructure spending through 2035.

Industrial and Commercial Segment Expansion Through Behind-the-Meter Water Management Systems

The commercial and industrial sector represents the fastest-growing opportunity segment, with organizations implementing behind-the-meter (BTM) water management systems for demand charge reduction, operational cost optimization, and sustainability reporting. Manufacturing facilities, data centers, hospitality operators, and food and beverage processors-characterized by heavy water consumption and exposure to time-of-use water pricing-increasingly deploy smart water monitoring systems for cost reduction and regulatory compliance. Control & automation technologies including SCADA systems and distributed control systems (DCS) are expanding at the fastest growth rates, enabling industrial water-intensive operations to optimize treatment processes, reduce chemical consumption, and achieve ESG and sustainability certifications.

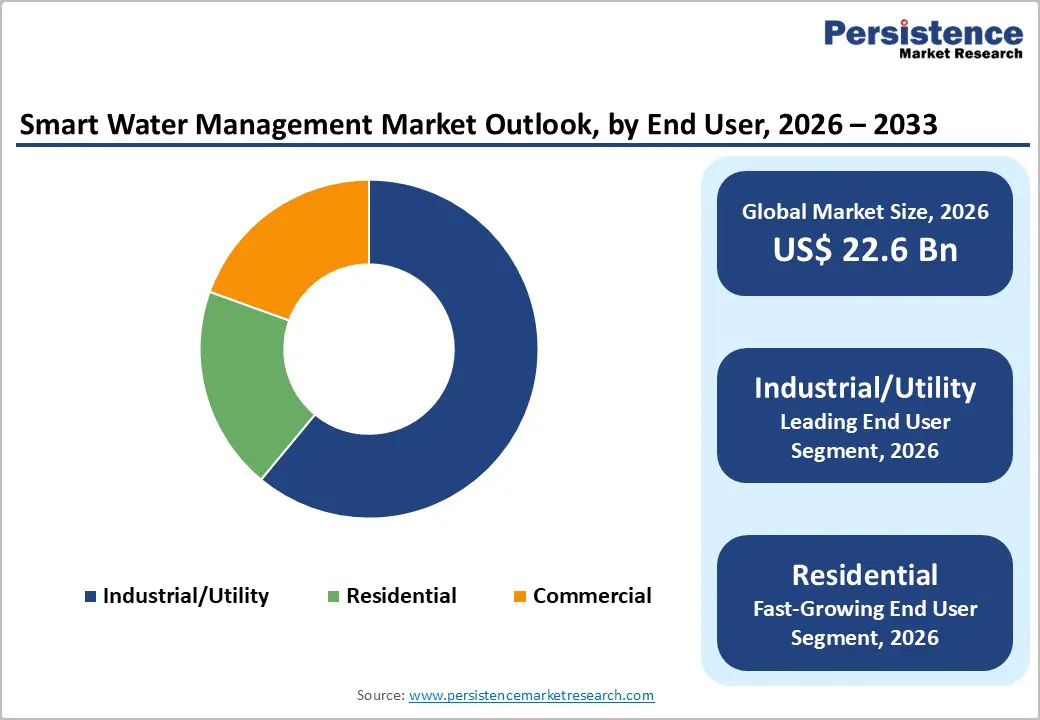

AI-powered anomaly detection systems that identify micro-leaks and unauthorized consumption provide an immediate return on investment through revenue recovery and operational cost reduction, accelerating adoption among cost-conscious industrial and commercial entities. The residential segment is expanding at 14.3% CAGR, driven by mass smart meter deployment programs, consumer water conservation awareness, smart home integration trends, and utility-led residential modernization initiatives across developed markets.

ICT & analytical software technologies, encompassing cloud-based analytics platforms, machine learning algorithms, and data visualization dashboards, capture approximately 41% market share, establishing dominance as critical enablers of smart water operational intelligence. This category includes advanced analytics platforms that provide real-time anomaly detection, predictive maintenance algorithms, and demand forecasting systems that transform raw meter data into actionable operational insights.

The AVEVA PI System enables utilities to perform predictive analytics, identifying potential leaks, while ESRI mapping tools assist in pinpointing hotspot locations for rapid intervention. IBM Intelligent Water platforms integrate data from thousands of meters with enterprise systems, enabling utilities to reduce operational costs and increase efficiency. The technology dominance reflects market recognition that advanced analytics represents a prerequisite for transforming IoT infrastructure investments into tangible operational improvements and cost reduction.

The industrial/utility end-user segment commands approximately 61% market share, representing the largest revenue category driven by utility-scale smart water infrastructure deployments across distribution networks and treatment facilities. Utility demand is fundamentally driven by regulatory compliance requirements, infrastructure modernization to address aging systems, and operational efficiency optimization through real-time monitoring and predictive maintenance.

SCADA system adoption in the industrial and utility segment is growing at the fastest rate during the forecast period, driven by increasing demand for automation, remote monitoring, and improved operational efficiency in complex water treatment processes. Industrial utilities, including those managing vast distribution networks spanning thousands of kilometers, prioritize smart infrastructure and ICT & analytical software integration for network-wide visibility, leak detection, and demand forecasting.

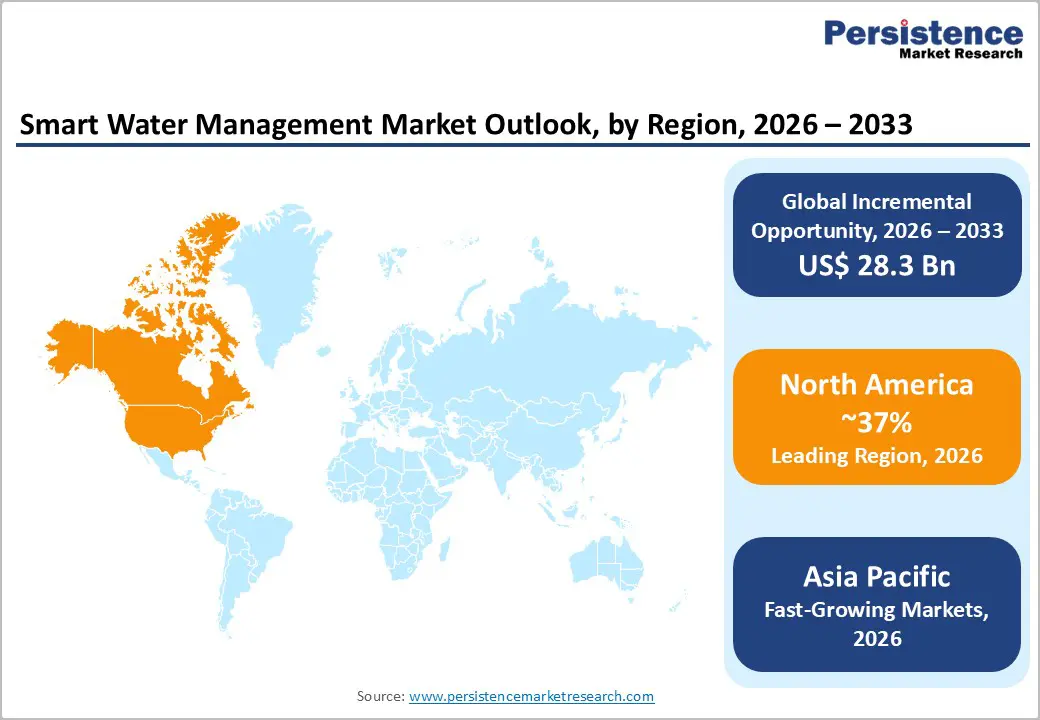

North America maintains leadership in smart water management adoption, commanding approximately 37% global market share through advanced infrastructure deployment and strong government support. The United States Environmental Protection Agency (EPA) actively promotes the deployment of smart water technology, with utilities across North America investing heavily in smart metering to address aging distribution infrastructure characterized by significant leakage. Water stress caused by unprecedented droughts in California and Texas has prompted state-level regulations and policies compelling utilities to improve water conservation and reduce distribution losses through technology adoption.

The U.S. Department of Energy’s Grid Modernization initiative emphasizes that advanced metering must support demand flexibility and grid modernization, driving utility procurement decisions. North American utilities increasingly recognize smart water metering as a critical tool for holistic network-level optimization and non-revenue water (NRW) loss reduction, with smart meter penetration in the region expanding rapidly as LPWAN connectivity costs continue declining. Advanced metering infrastructure (AMI) adoption is expanding at a 4% CAGR across North America, with utilities deploying comprehensive IoT sensor networks, cloud-based analytics platforms, and cybersecurity frameworks that meet FERC, DOE, and state regulatory requirements. The region’s mature regulatory framework, advanced technological ecosystem, and substantial utility capital budgets position North America for continued market leadership in smart water management deployment.

Europe represents a strategically important regional market, benefiting from comprehensive regulatory harmonization through EU water directives and Blue Deal initiatives that target a 15% reduction in water use across member states. The European Union’s Smart Metering European Framework establishes technical specifications ensuring interoperability across smart water systems, while EN 62056 series standards and IEC 62053 series metering accuracy requirements create a harmonized deployment environment. UK water companies submitted ambitious smart metering proposals for 2025-2030 periods, with upwards of 8 million smart water meters scheduled for deployment at £2 billion (USD 2.4 billion) investment.

Central and Eastern Europe (CEE) nations, including Poland, Hungary, and Czechia, accelerated smart metering deployment under Fit for 55 and REPowerEU targets, accessing EUR 1 trillion in green investments through Just Transition Mechanism and InvestEU funding mechanisms. The SCADA in water and wastewater management market in Europe is expected to grow at the fastest CAGR during forecast periods due to rising demand for automation, stringent environmental regulations, and increasing government investments aimed at modernizing infrastructure. European focus on environmental protection, sustainability reporting, and circular economy principles positions the region for rapid smart water adoption growth, with Germany, UK, France, and Spain leading deployment initiatives.

Asia Pacific emerges as the fastest-growing regional market, with smart water adoption projected to grow at exceptional rates, driven by extraordinary urbanization, acute water scarcity, and government smart city investments. China dominates regional deployment with substantial investments in smart water infrastructure addressing regional water stress affecting over 400 million people, with per capita water availability declining to critically low levels. The country’s water challenges compel aggressive smart water infrastructure development, with utilities deploying IoT-enabled monitoring systems across vast distribution networks spanning thousands of kilometers.

India’s smart water meter market is expanding strongly at 13.7% CAGR through 2033, driven by AMRUT 2.0 program and Jal Shakti Abhiyan water conservation initiatives addressing non-revenue water losses exceeding 30% across many utilities. India and EU agreed to strengthen collaboration on sustainable water management during the 6th EU-India Water Forum, exploring technology transfer and resilient infrastructure solutions. The region’s combination of rapid urbanization, severe water scarcity, government-backed smart city initiatives, and substantial infrastructure investment creates exceptional growth opportunities for smart water management market participants.

The global smart water management market displays a moderately consolidated structure, characterized by a mix of large infrastructure solution providers and specialized digital water technology companies. Market participants focus on integrated platforms that combine smart metering hardware, communication networks, and cloud-based analytics to support utility modernization and operational optimization. Competitive strategies increasingly emphasize machine-learning-enabled predictive maintenance, real-time leak detection, and cybersecurity-compliant remote monitoring solutions.

Many providers are shifting toward service-based and subscription pricing models to reduce upfront capital barriers for utilities and commercial users, strengthening long-term customer relationships and recurring revenue streams. Partnerships and acquisitions remain central to competitive positioning, particularly to expand IoT connectivity capabilities, enhance interoperability across device ecosystems, and accelerate portfolio expansion in software, device integration, and edge analytics. As digital utility transformation progresses, market competitiveness will depend on bundled solution offerings, technology maturity, and proven scalability across municipal, industrial, and behind-the-meter applications.

The global smart water management market is projected to reach about US$ 22.6 billion in 2026.

Rising water scarcity, high non-revenue water losses, and increasing adoption of IoT- and AI-enabled monitoring systems are the key growth drivers.

North America leads the market in 2025 with the highest regional share.

The major opportunity lies in industrial and commercial behind-the-meter real-time monitoring and optimization applications.

Major participants include Xylem, Siemens, ABB, Schneider Electric, IBM, Itron, Landis+Gyr, Badger Meter, Suez, and emerging digital solution providers.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author