ID: PMRREP18478| 198 Pages | 10 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

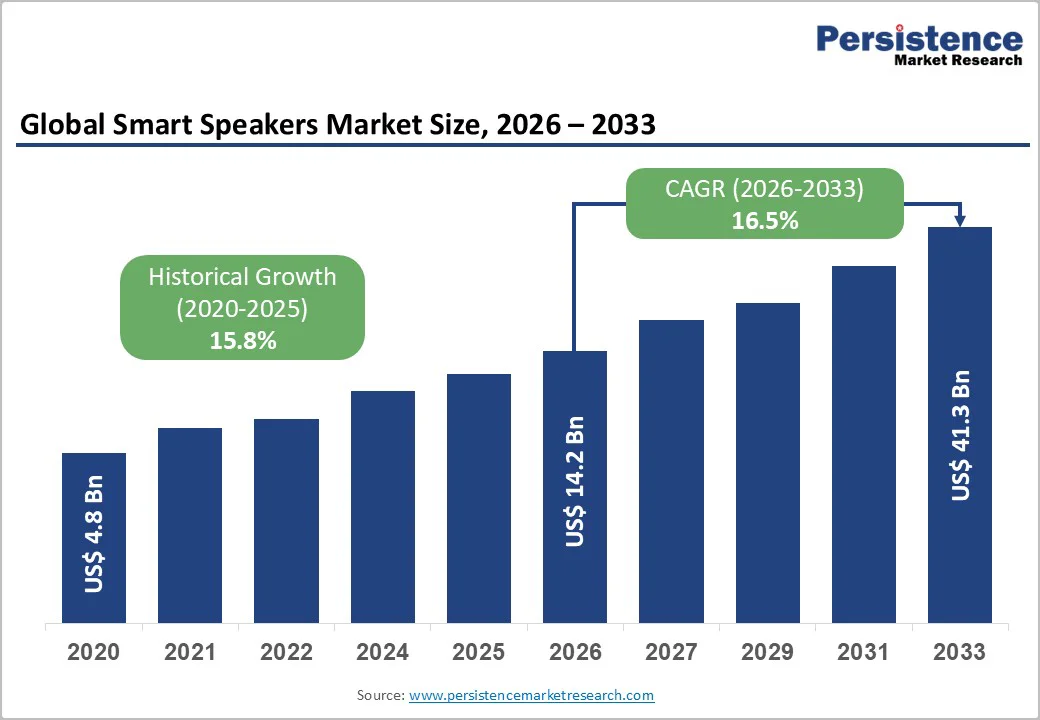

The global Smart Speakers market size is projected to value at US$ 14.2 billion in 2026 and is projected to reach US$ 41.3 billion by 2033, growing at a CAGR of 16.5% between 2026 and 2033. The market's acceleration is driven by three primary catalysts: rapid adoption of smart home ecosystems across residential and commercial segments, substantial advancements in artificial intelligence and natural language processing capabilities, and declining device costs coupled with expanding digital infrastructure globally.

| Key Insights | Details |

|---|---|

|

Smart Speakers Market Size (2026E) |

US$ 14.2 Bn |

|

Market Value Forecast (2033F) |

US$ 41.3 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

16.5% |

|

Historical Market Growth (CAGR 2020 to 2024) |

15.8% |

The acceleration of smart home adoption represents the single most significant demand driver for smart speakers. Globally, smart speakers function as central hubs orchestrating interconnected ecosystems encompassing lighting systems, thermostats, security cameras, and connected appliances. As of 2024, approximately 95% of U.S. households have broadband internet access, creating essential infrastructure for device deployment. The wireless connectivity revolution, particularly Wi-Fi 6 and emerging 5G standards, enables seamless multi-device integration, with Wi-Fi connectivity commanding 55.3% of market revenue in 2026.

Consumer preference for centralized voice control has catalyzed ecosystem adoption, with major players integrating compatibility across Zigbee, Z-Wave, and proprietary protocols. This standardization reduces fragmentation barriers and accelerates residential penetration. The commercial sector demonstrates parallel momentum, with hospitality, healthcare, and enterprise applications expanding beyond early-stage deployments. Market research indicates that smart home system sales increase by over 30% annually, with smart speakers serving as primary control interfaces, driving downstream hardware sales across related categories.

Emerging market expansion, particularly Asia Pacific, Latin America, and select African regions provides enormous addressable market growth independent of developed-market saturation dynamics. India's smart speakers market exemplifies this trend, with the segment valued at USD 87.3 million in 2024. Amazon's targeted expansion demonstrates clear-eyed market strategy: Alexa-enabled devices reached 99% of India's postal codes by 2024, spanning metros to rural villages.

Regional manufacturers including Baidu DuerOS, Alibaba Tmall Genie, and Xiaomi XiaoAI speakers capture over 80% of Asia Pacific markets through localization strategies prioritizing regional language support and culturally relevant content libraries. Rising smartphone penetration (72% of global households now have both fixed and mobile internet access) creates propitious conditions for complementary device adoption. Declining smart speaker pricing average device costs reduced 25% over three years—democratizes access across lower-income consumer segments.

Consumer privacy apprehension and fragmented regulatory environments create structural headwinds limiting market expansion velocity. Recurring high-profile data breaches affecting voice assistant platforms have generated sustained consumer skepticism regarding personal data collection, storage, and third-party sharing practices. Recent surveys indicate that 22-30% of potential adopters explicitly cite privacy concerns as primary purchase barriers, representing substantial addressable market loss. Regulatory divergence amplifies compliance complexity: GDPR requirements in Europe mandate granular consent protocols and data minimization standards fundamentally different from emerging frameworks in India, Brazil, and Southeast Asian jurisdictions.

Some regional governments restrict cloud-based voice processing or mandate on-device processing capabilities, forcing manufacturers to bifurcate product architectures and support structures. Companies failing to implement credible privacy playbooks face substantial scaling constraints in 2026 forward, with market penetration potentially capped at 60-65% in highly regulated geographies.

Inconsistent broadband infrastructure in developing regions and persistent audio quality concerns constrain addressable market expansion. While developed markets approach universal broadband saturation, approximately 3.2 billion individuals globally lack stable high-speed internet access, eliminating market viability in substantial geographic regions. Smart speaker deployment requires consistent connectivity; intermittent or low-bandwidth scenarios degrade user experience to unacceptable levels, creating negative perception spirals. In rural and semi-urban emerging markets, infrastructure inadequacy represents hard constraint on near-term penetration velocity.

Additionally, consumer audio quality expectations shaped by premium audio market standards remain unsatisfied by many mid-range speaker implementations. Significant consumer segment prioritizes audio fidelity alongside smart functionality; failure to deliver premium audio quality (dynamic range, frequency response, directional sensitivity) limits adoption among affluent early-adopter segments.

Voice shopping represents nascent but high-growth opportunity segment, with voice commerce market estimated at USD 43.7 billion in 2024 and projected to reach USD 49.2 billion by 2026. Amazon pioneered Alexa voice shopping functionality, enabling one-click reordering and voice-driven product discovery integration with Prime ecosystem. This direct-to-commerce pathway reduces friction in consumer purchasing while capturing valuable zero-party preference data enabling sophisticated personalization algorithms.

Market research indicates that voice commerce adoption accelerates at 28-% annually, reflecting growing comfort with voice-mediated transactions. However, penetration remains concentrated among Amazon ecosystem users (36% market usage share). Significant opportunity exists for Google Assistant, Siri, and regional assistants to capture voice commerce share through strategic partnership development with major e-commerce platforms, payment processors, and retail networks.

Commercial application segments hospitality, healthcare, enterprise facilities represent fastest-growing deployment category with commercial market share expanding from current 45.7% baseline to projected 65% penetration by 2033. Hotel chains implement smart speakers for guest room voice control (HVAC, entertainment, service requests), reducing operational costs while enhancing guest satisfaction metrics. Healthcare applications patient room environmental control, medication reminders, telehealth integration—address workforce efficiency constraints and patient experience improvement simultaneously.

The commercial segment growth rate estimated at 18% annual expansion substantially exceeds residential growth (14%), reflecting different adoption curves and decision frameworks. Initial deployment concentrations in luxury hospitality and large enterprise environments demonstrate successful scaling models, with mid-market and SMB segments representing immediate expansion opportunity.

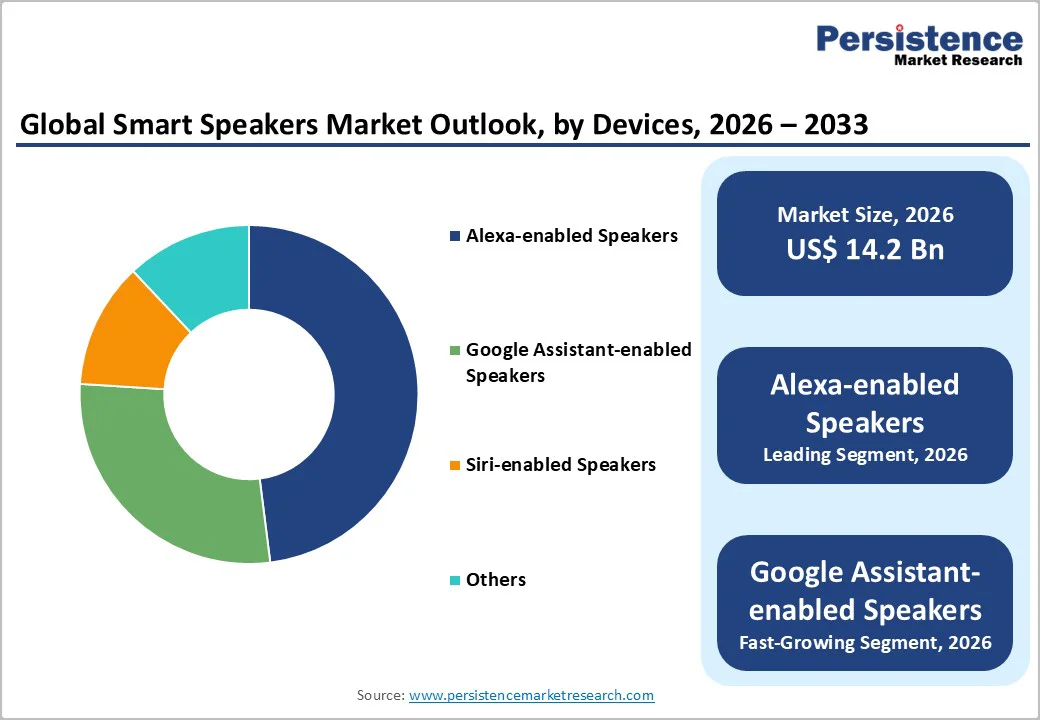

Alexa speakers can be controlled using voice commands, which makes it convenient for users to play music, set reminders, control smart home devices, and perform other hands-free tasks. Alexa speakers are integrated with many other devices and services, making it easy for users to control multiple devices with voice commands.

Alexa speakers are relatively affordable, which has made them accessible to a large number of people. Alexa speakers have a simple and user-friendly interface, making it easy for people to use the device even if they are not tech-savvy.

These are some of the reasons why Alexa Intelligent Speakers have become so popular in the market. In 2026, the Alexa intelligent speakers share was estimated to dominate the global market and account for 46.4% of the total market value share.

E-commerce channels account for 38.6% of global smart speaker sales, driven by digital-native buying behavior, Amazon’s D2C model, and cost-efficient distribution. Benefits include lower channel markups, personal recommendations, rapid product launch cycles, and real-time inventory optimization. In 2024, online sales reached 42% in developed markets, led by North America and Europe, while emerging markets remain lower at 25% due to infrastructure and in-store evaluation preferences.

Organized retail is the fastest-growing channel (18% annually), supported by product demonstrations, sales guidance, bundled offerings, and rising electronics retail expansion in India, Indonesia, and Brazil. As markets mature, physical retail accelerates mainstream adoption, while unorganized retail holds a modest but slower-growing presence.

In 2026, it was estimated that the residential intelligent speaker’s application market share was 54.3%.

Intelligent speakers are mostly used in residential settings because they offer a convenient and easy way to control smart devices and access various entertainment options such as music and podcasts, hands-free. Intelligent speakers allow users to control their smart devices, access entertainment options, and perform tasks hands-free, making them a convenient and efficient solution for everyday tasks.

The integration of intelligent speakers with smart home devices like lights, thermostats, and security systems allows users to control their home environment with voice commands. Virtual assistants like Amazon Alexa and Google Assistant provide users with a quick and easy way to perform various tasks, such as setting reminders, answering questions, and making purchases.

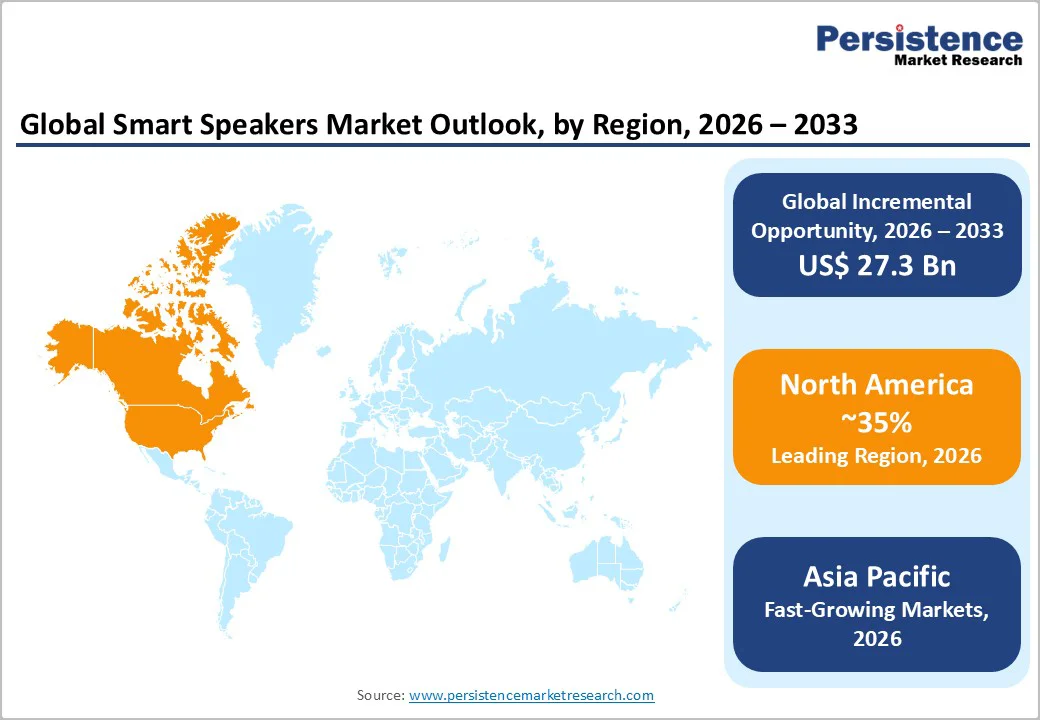

North America commanded approximately 35% of global smart speaker market value in 2024, with estimated market size of USD 5.4 billion and projected expansion to USD 9.2 billion by 2033 at approximately 15.5% CAGR. The United States represents dominant regional driver, with market size reaching USD 3.0 billion in 2024 and projected expansion to USD 17.6 billion by 2033 at 19.7% CAGR, indicating accelerating adoption velocity through forecast period.

Federal Trade Commission (FTC) oversight of privacy and consumer protection practices, combined with state-level privacy regulations (California Consumer Privacy Act, complementary state legislation) creating increasingly stringent data protection requirements. European-comparable privacy regulation absents, creating North American manufacturers with substantial competitive advantage in product iteration velocity relative to European counterparts navigating GDPR complexity.

Europe represented approximately 22% of global smart speaker market in 2024, with estimated market value of USD 3.2 billion. The region demonstrates comparatively slower adoption velocity relative to North America (12% CAGR) reflecting regulatory complexity and consumer privacy consciousness. Germany, United Kingdom, France, and Spain collectively represent 65% of European market value, with Germany maintaining largest market share (approximately USD 1.0 billion) driven by strong manufacturing expertise and premium consumer positioning.

On-device processing capabilities, local data storage, and transparent data governance resonate strongly with European consumer preferences. Estimated market growth opportunity: USD 1.4 billion incremental annual revenue through 2033, with concentration in commercial applications and privacy-enhanced consumer segments.

Asia Pacific region commands approximately 25% of global smart speaker market with estimated 2025 market value of USD 3.8 billion and projected expansion to USD 14 billion by 2033, reflecting 22% CAGR substantially exceeding global average. The region demonstrates highest absolute growth velocity reflecting convergence of rapid smartphone penetration, expanding digital infrastructure, rising disposable incomes, and aggressive vendor investment prioritizing emerging market positioning.

China represents dominant Asia Pacific market with estimated 40% of regional market value, characterized by distinct ecosystem built around local champions Baidu DuerOS, Alibaba Tmall Genie, and Xiaomi XiaoAI controlling 80%+ of Chinese market share. Chinese market dynamics diverge substantially from Western markets: government-influenced content curation, mandated data localization, and limited Western vendor accessibility create parallel ecosystem dynamics.

India represents fastest-growing Asia Pacific market with 29.8% CAGR driven by mass-market affordability dynamics and aggressive Amazon/Google regional investment: Amazon achieved 99% postal code penetration by 2024, establishing dominant position in Indian market. Japan maintains mature market dynamics comparable to developed Western markets with strong premium audio preferences and high penetration among affluent demographics.

Market concentration demonstrates oligopolistic characteristics with four vendors (Amazon, Google, Apple, and regional champions in specific geographies) controlling 60% of global market value. Amazon maintains leadership position with 30.4% market share through comprehensive ecosystem integration and aggressive pricing strategies. Google follows with estimated 20% market share gaining momentum through superior NLP capabilities and emerging market expansion.

Apple captures approximately 10% market share concentrated among premium consumer segment and iOS ecosystem users. Remaining market share disperses across regional champions (Alibaba, Baidu, Xiaomi in Asia Pacific) and audio specialists (Sonos, Bose, Harman Kardon) pursuing premium audio differentiation or niche market positioning.

The Smart Speakers market is estimated to be valued at US$ 14.2 Bn in 2026.

The primary demand driver for the smart speaker’s market is the rapid expansion of AI-driven smart-home ecosystems, particularly powered by advancements in Generative AI, voice-assistant intelligence, and multimodal user interaction.

In 2026, the North America region will dominate the market with an exceeding 35% revenue share in the global Smart Speakers market.

Among the Device Types, Alexa-enabled Speakers hold the highest preference, capturing beyond 46.4% of the market revenue share in 2026, surpassing other Devices type.

The key players in Smart Speakers are Amazon.com, Apple, Sonos, Riva Concert and JBL

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Devices

By Distribution Channel

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author