ID: PMRREP3683| 198 Pages | 14 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

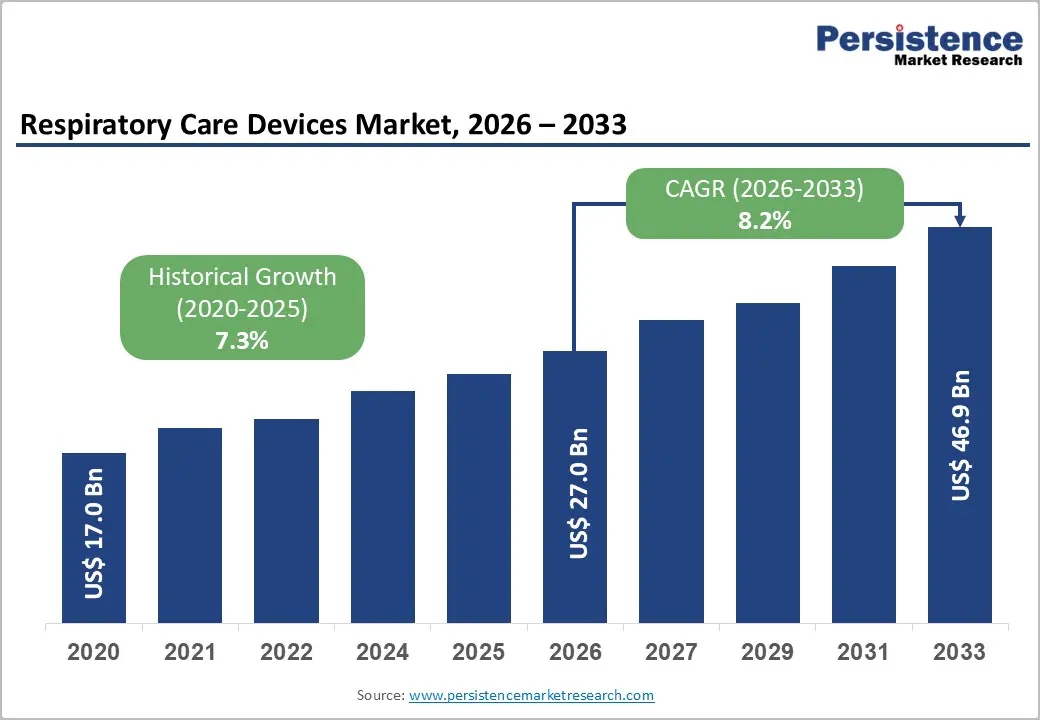

The global respiratory care devices market is estimated to grow from US$ 27.0 Bn in 2026 to US$ 46.9 Bn by 2033. The market is projected to record a CAGR of 8.2% during the forecast period from 2026 to 2033.

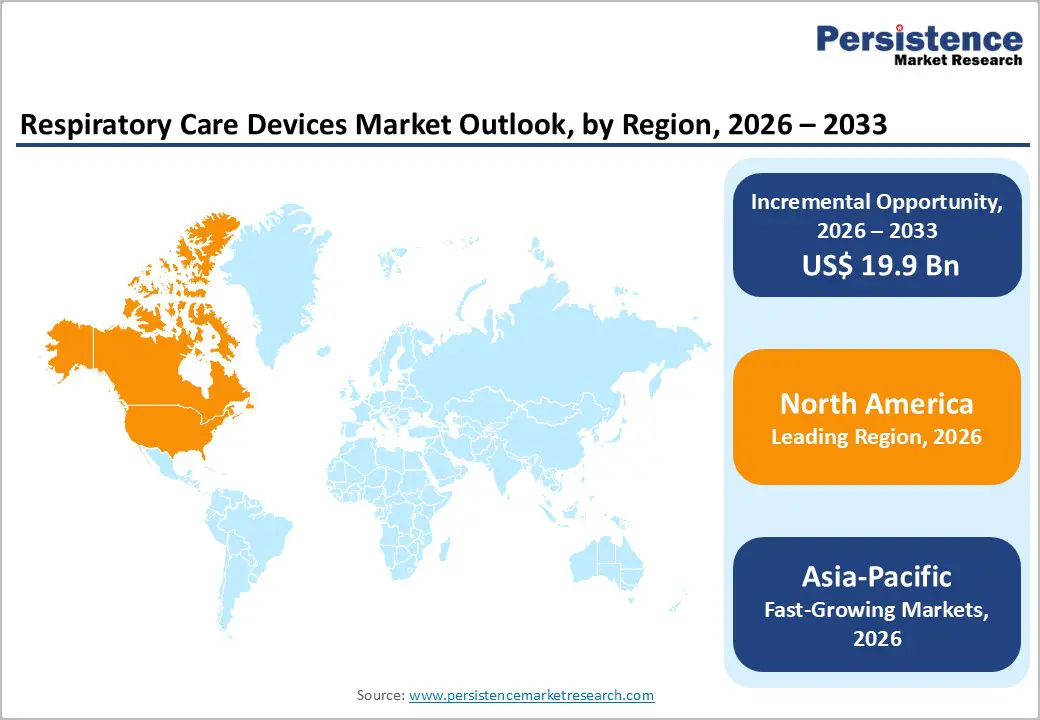

The global respiratory care devices market is growing steadily, fueled by rising cardiovascular disease prevalence, emergency admissions, and demand for precise respiratory interventions. North America leads due to advanced healthcare infrastructure and early technology adoption. Asia-Pacific is the fastest-growing region, supported by expanding facilities, higher patient volumes, better access, and increasing awareness of early diagnosis and treatment.

| Global Market Attributes | Key Insights |

|---|---|

| Global Respiratory Care Devices Market Size (2026E) | US$ 27.0 Bn |

| Market Value Forecast (2033F) | US$ 46.9 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8.2% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.3% |

Emergency hospital admissions for respiratory diseases have risen substantially in recent years, reflecting greater acute care demand that bolsters the need for advanced respiratory care devices. In England, emergency admissions for respiratory conditions increased by 7% from 2023 to 2024, with COPD admissions up 9%, asthma in adults up 17%, and pneumonia up 16%, underscoring intensified pressure on acute care services. Data from NHS England shows that between October 2024 and March 2025, there were approximately 1.19 million emergency respiratory admissions, peaking at 221,325 in December alone, highlighting sharp seasonal demand spikes.

Critical care utilization further illustrates severity and support needs: in the United States, more than 5 million patients are admitted annually to intensive care units (ICUs) for conditions requiring advanced monitoring and respiratory support, with 20–40% of ICU admissions needing mechanical ventilation. Acute respiratory distress syndrome (ARDS), a major cause of respiratory failure, accounts for over 10% of ICU admissions in multicountry studies and nearly a quarter of patients requiring mechanical ventilation. Together, these government and public health data points demonstrate a clear upward trend in emergency and critical respiratory care needs, driving demand for respiratory care devices globally.

The high cost of advanced respiratory care devices can limit patient access and market growth. For example, Medicare Part B in the United States covers rental of oxygen equipment but patients still pay 20 percent of the Medicare?approved amount after meeting the deductible, which can represent meaningful out?of?pocket expenses for long?term oxygen therapy. Medicare’s capped rental structure for oxygen equipment also reflects ongoing expenses over months of use rather than a one?time purchase, increasing financial burden for patients needing continuous support.

Beyond direct rental charges, ongoing operational costs contribute to affordability challenges. A study analyzing household usage of durable medical equipment, including oxygen concentrators, CPAP machines, and ventilators found that annual electricity costs for running such devices can range from about USD 120 to over USD 700 depending on device and usage frequency, and these costs are not covered by Medicare or Medicaid. These hidden operational costs can further discourage use among low?income patients reliant on respiratory therapy at home.

Portable and smart ventilators and oxygen delivery systems present a significant opportunity in the Respiratory Care Devices Market by improving access to respiratory support beyond traditional hospital settings. In the United States alone, more than 300,000 patients receive mechanical ventilation annually, demonstrating the extensive need for respiratory support; portable devices can extend care into home and transport environments, alleviating pressure on critical care units.? Government home health care data also show that 3.0 million people received home health care services in the U.S. in 2020, indicating a substantial population that could benefit from mobile respiratory devices integrated into home care plans.?

Empirical evidence supports increased mobility and usage of portable oxygen systems. Studies reveal that many patients using portable oxygen concentrators are mobile for significant portions of daily use, with mean usage around 4.3 hours per day and mobility observed during nearly 42 percent of that time, highlighting the value of lightweight, battery?powered systems that support daily activity.? Furthermore, global shipments of portable oxygen concentrators have exceeded 4 million units, reflecting widespread adoption and patient preference for devices that enable independence and continuous oxygen support outside of hospitals.? These trends indicate that innovation in portable and connected respiratory devices can drive better outpatient care, reduce hospital readmissions, and expand market reach.

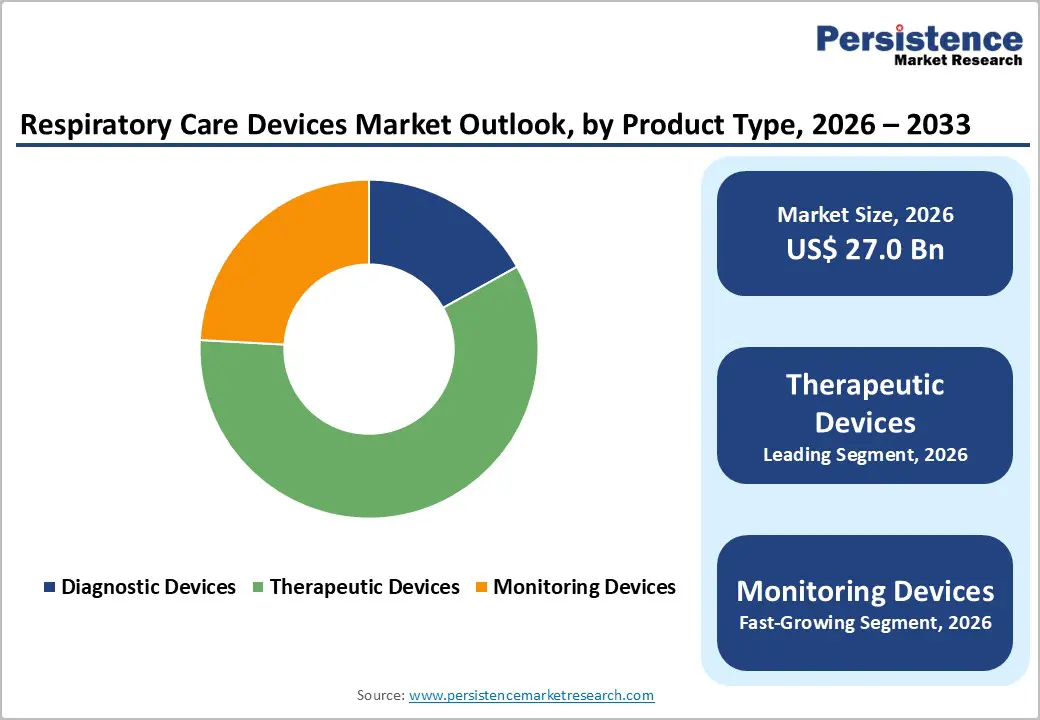

Therapeutic Devices occupies 58.9% share of the global market in 2025, because they directly address the high and growing burden of chronic and acute respiratory diseases that require ongoing treatment and support rather than just diagnosis or monitoring. Chronic obstructive pulmonary disease (COPD) affects millions, with about 3.8 % of U.S. adults diagnosed and more than 854,000 related emergency department visits annually, indicating substantial sustained clinical demand for ventilators, oxygen therapy, and PAP devices rather than episodic use. This persistent disease burden drives continuous use of therapeutic equipment in both hospitals and home settings, supporting superior adoption rates.

Hospitals and clinics dominate the global respiratory care devices market because they manage most severe and acute respiratory cases requiring advanced support and continuous monitoring. Chronic respiratory diseases affected nearly 570 million people worldwide in 2023, while acute lower respiratory infections alone account for an estimated 5.5 million hospital admissions annually among children and adolescents. Hospitals are equipped with ventilators, oxygen delivery systems, and therapeutic devices essential for COPD exacerbations, asthma attacks, pneumonia, and post-surgical care. This high patient volume, combined with the need for trained personnel and intensive care facilities, makes hospitals and clinics the largest end-users of respiratory care devices globally, driving substantial market demand.

North America dominates the respiratory care devices market with 44.1% share in 2025, due to a combination of high respiratory disease prevalence and advanced healthcare infrastructure supporting widespread device adoption. In the United States, approximately 16 million adults live with COPD and 8.6 percent of adults have asthma, generating sustained demand for ventilators, oxygen therapy, and other respiratory support devices. Canada similarly faces a high burden, with over 3.8 million people affected by asthma, reinforcing the need for advanced respiratory care. Strong diagnostic capabilities, well-established reimbursement frameworks, and widespread healthcare coverage allow hospitals and clinics to access and deploy advanced respiratory technologies, while ongoing public health initiatives and R&D investment further strengthen adoption, making North America the leading regional market globally.

Europe is an important region in the respiratory care devices market due to its substantial burden of chronic respiratory diseases and supportive healthcare infrastructure. In the WHO European Region, over 81.7?million people live with chronic respiratory diseases such as COPD and asthma, making these conditions a leading health challenge and a major cause of disability and death.?The region also experiences significant morbidity and mortality due to air pollution and smoking, which exacerbate respiratory conditions and drive demand for ventilators, oxygen delivery systems, and other therapeutic devices. Additionally, Europe’s ageing population, with nearly one?fifth of EU residents aged 65 or older raises the prevalence of chronic respiratory ailments, further reinforcing the need for advanced respiratory care solutions across hospitals and home care settings.

Asia Pacific is the fastest?growing region in the respiratory care devices market due to a rising prevalence of chronic respiratory conditions and expanding healthcare access. COPD prevalence ranges widely up to 16.7 percent in China and 14.5 percent in Australia, indicating substantial disease burden across the region.?Additionally, respiratory diseases in South?East Asia caused about 1.56?million deaths in 2021, highlighting urgent care needs.Rapid urbanization, rising pollution exposure, and an ageing population increase healthcare demand, while improving infrastructure and government initiatives expand diagnostic and treatment capacity, accelerating adoption of advanced respiratory care devices across hospitals and home settings.

The respiratory care devices market is competitive, led by global and regional players providing ventilators, oxygen therapy, and PAP devices. Companies prioritize device reliability, safety, efficiency, and regulatory compliance. Innovations in portable, smart, and connected respiratory devices, combined with strategic partnerships and regional expansion, enhance market differentiation and drive adoption across hospitals, clinics, and homecare settings globally.

The global respiratory care devices market is projected to be valued at US$ 27.0 Bn in 2026.

Rising respiratory disease prevalence, aging population, homecare demand, technological innovations, and increasing hospital admissions drive growth.

The global respiratory care devices market is poised to witness a CAGR of 8.2% between 2026 and 2033.

Opportunities include portable devices, smart oxygen systems, telehealth integration, homecare expansion, emerging markets, and preventive solutions.

Medtronic, Masimo, Drägerwerk AG & Co. KGaA, Becton, Dickinson and Company, Hamilton Medical, Invacare Corporation.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author