ID: PMRREP33183| 187 Pages | 12 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

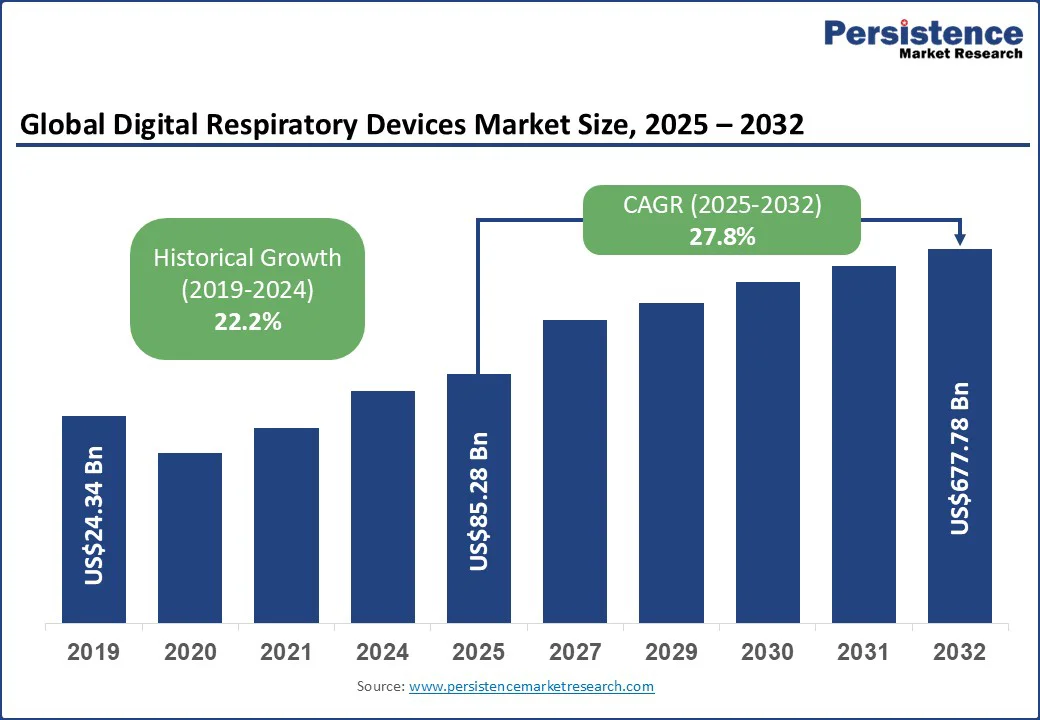

The global digital respiratory devices market size is likely to be valued at US$85.28 Bn in 2025. It is estimated to reach US$677.78 Bn by 2032, growing at a CAGR of 27.8% during the forecast period 2025-2032.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Digital Respiratory Devices Market Size (2025E) |

US$85.28 Bn |

|

Market Value Forecast (2032F) |

US$677.78 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

27.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

22.2% |

The robust growth of the digital respiratory devices industry is primarily attributable to the rising prevalence of chronic respiratory diseases worldwide, which is a result of an aging population across countries and rising levels of urban air pollution.

The global burden of CRDs has steadily risen over the last few decades. According to the Global Burden of Disease Study, the number of individuals afflicted by CRDs stood at 454.56 million in 2019. Moreover, CRDs caused 3.97 million deaths and led to disability-adjusted life years (DALY) for 103.53 million people in 2019. The World Health Organization (WHO) states that tobacco exposure through smoking, occupational inhalation of dust and fumes, and air pollution are the main factors responsible for triggering respiratory disorders.

Moreover, the lasting impacts suffered by those who contracted the severe form of COVID have exacerbated the respiratory health crisis. This rise is expected to augment the demand for digital respiratory devices, including AI-integrated smart inhalers and remote monitoring platforms, that offer precise, real-time disease management. Governments around the world have started perceiving CRDs as a serious concern. For instance, the European Union (EU) spends €38.6 Bn (US$41.3 Bn) annually on COPD-related healthcare costs, highlighting both the economic impact and the urgent need for innovative respiratory care solutions.

The high cost of advanced respiratory care solutions, combined with complex regulatory barriers, is significantly limiting their widespread adoption and accessibility, especially in emerging economies. Digital respiratory devices such as AI-enabled smart inhalers and connected nebulizers often come with price tags ranging from US$100 to US$300 per unit, considerably higher than traditional analog counterparts, making them virtually unaffordable for low-income populations who bear a disproportionate burden of respiratory diseases.

Regulatory approvals from bodies such as the FDA, EMA, and other regional health authorities, which often lead to protracted product launch timelines, also impact the pace of dissemination of technology. Data security and privacy concerns have also created reluctance among users and healthcare providers to embrace these innovations, especially with sensitive health data transmitted and stored digitally under frameworks such as HIPAA and GDPR. As a result, despite technological advancements and growing clinical evidence supporting digital devices, these systemic restraints threaten the market expansion and impede equitable access to modern respiratory care devices.

One of the most lucrative opportunities market players can tap into is merging smart inhalers, AI-enabled remote patient monitoring (RPM), and connected digital therapeutics into integrated healthcare ecosystems. These advanced digital respiratory solutions, such as Aptar Pharma’s HeroTracker Sense, which converts traditional inhalers into smart, connected devices, are revolutionizing adherence management and real-time clinical data collection, ensuring precision in asthma and COPD treatment. For example, a pilot program in Louisville equipped asthma and COPD patients with smartphone-connected smart inhalers linked to real-time air quality data, resulting in significantly fewer symptoms and hospital visits while helping users better manage environmental triggers.

The infusion of AI algorithms within these devices enables proactive intervention by healthcare providers, reducing hospital admissions and improving patient outcomes. Furthermore, government reimbursement policies and telemedicine adoption will also help in accelerating the uptake of digital respiratory technologies, especially in developed regions. At the same time, markets such as India, which have a large patient pool suffering from CRDs, offer vast, untapped potential.

In the product category, the dominant segment is expected to be smart inhalers, projected to hold approximately 52.0% of the revenue share in 2025. This segment is also predicted to showcase the highest CAGR from 2025 to 2032. Smart inhalers mainly owe their prominence to the rising prevalence of COPD and asthma around the world. The alarming increase in the incidence of these debilitating diseases has necessitated the development of smart inhalers that can be seamlessly embedded with real-time medication tracking, dosage reminders, and connectivity with mobile health platforms. These features significantly enhance medication adherence and empower clinicians with actionable patient data, reducing acute flare-ups of chronic diseases such as asthma and COPD.

Leading companies such as Aptar Pharma have been innovating in this space to enable precise real-time monitoring and personalized care for patients suffering from CRDs. Furthermore, the convergence of IoMT (Internet of Medical Things) with AI-driven analytics has elevated the potential of the smart inhalers market by facilitating remote patient monitoring and predictive healthcare management, making it a lucrative growth avenue.

The hospital pharmacies segment is anticipated to lead, securing a considerable revenue share of around 58.0% in 2025, attributable to the direct integration of these pharmacies with healthcare providers and hospitals, facilitating bulk procurement and ensuring the timely availability of smart respiratory devices to critical care and inpatient settings. The rising prevalence of chronic respiratory diseases and a general global rise in geriatric population requiring inpatient care are driving the demand for advanced respiratory care devices through hospital pharmacy channels. For instance, in the U.S., which is home to more than 14 million COPD patients and also exhibits a rising elderly demographic, patients rely heavily on hospital pharmacies for access to critical medical devices.

Online pharmacies represent the fastest-growing distribution channel. The growing dominance of online pharmacies is fueled by an increasing consumer preference for convenience, home delivery, and discreet access to chronic disease management devices. The COVID-19 pandemic accelerated telehealth and e-commerce adoption, creating lasting shifts in purchasing behaviors. Convenience-driven purchases, combined with improving digital health literacy and expanding smartphone ownership globally, are likely to propel the growth of online pharmacies in the near future. Market players are also utilizing advanced analytics and personalized marketing strategies on these platforms to enhance customer engagement and upsell connected respiratory devices bundled with digital therapeutics and adherence apps.

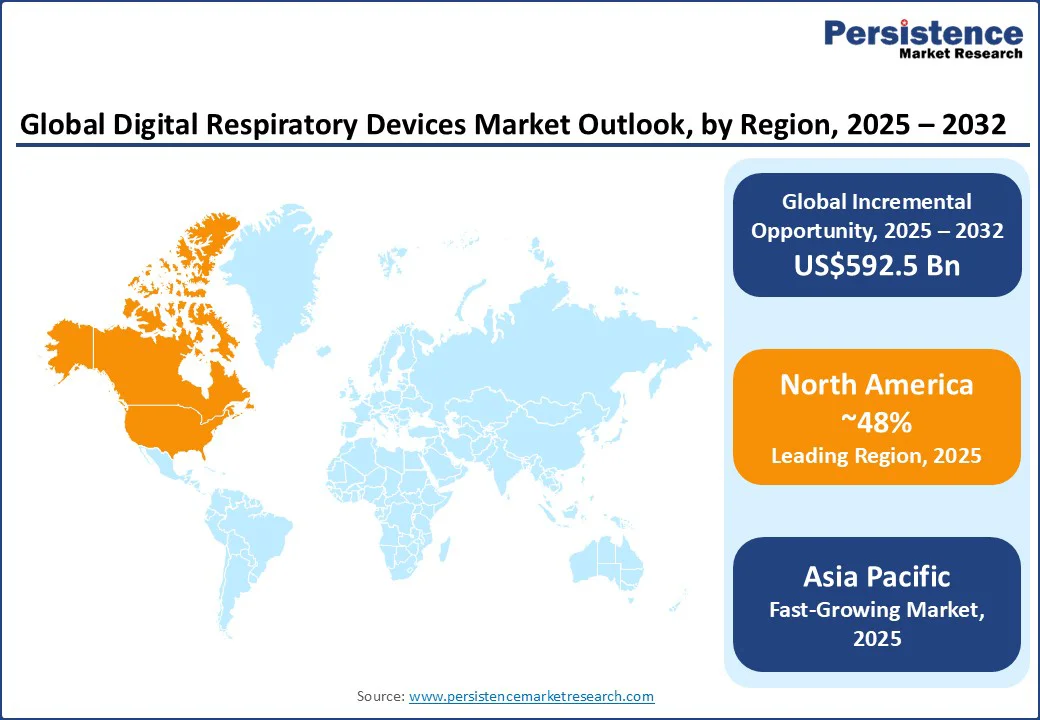

Capturing approximately 48.0% of the digital respiratory devices market share, North America is set to dominate in 2025. The regional market here is driven primarily by the U.S., where the adoption of digital medical devices is high on account of an advanced healthcare infrastructure, favorable reimbursement policies, and robust regulatory support. The increasing prevalence of CRDs such as asthma and COPD, which together affect over 25 million Americans, has created a sustained demand for advanced digital healthcare solutions.

Moreover, Medicare’s expanded reimbursement codes for remote physiologic monitoring and remote therapeutic monitoring will encourage the integration of digital respiratory devices into routine care. With 82 million Americans estimated to be aged 65 and above by 2050, according to the Population Reference Bureau (PRB), the reliance on remote and connected care is likely to intensify, heightening the demand for digital respiratory technologies.

Asia Pacific is poised to be the fastest-growing market through 2032, fueled by an escalating incidence of CRDs, rapid healthcare infrastructure digitization, and expanding access to modern medical care devices and technologies. In China and India, severe air pollution has led to millions of respiratory-related fatalities yearly, with the WHO estimates indicating over 2 million air pollution-related deaths in China alone annually. India’s more than 35 million asthma patients are expected to fuel the demand for digital respiratory devices to improve disease management and adherence.

Governmental and private sector initiatives to boost respiratory awareness, such as ALKEM’s 2023 #RelieverFreeIndia campaign on World Asthma Day in India, featuring diagnostic camps and public outreach, are also set to foster robust market growth in the forthcoming years. Technological advancements, such as BioIntelliSense’s patented pulse oximetry sensor that works effectively across diverse skin tones, address vital accessibility gaps, while smart inhalers equipped with real-time monitoring capabilities, such as Aptar Pharma’s HeroTracker Sense, are transforming treatment adherence and personalized care.

Europe is slated to hold about a quarter of the smart respiratory devices market share in 2025, boosted by widespread awareness of respiratory diseases and a well-established and digitized healthcare ecosystem. Respiratory disorders are the third leading cause of mortality in Europe.

A 2021 study published in the European Respiratory Journal found that in 2020, 36.5 million Europeans were living with COPD, and by 2050, this figure will be close to 50 million. These numbers have prompted the European Union (EU) to implement specific mandates under its Medical Device Regulation (MDR) to facilitate the adoption of respiratory devices such as smart inhalers and connected nebulizers. Notably, the UK became the first European country to launch Teva’s GoResp Digihaler system in 2023, enabling patients to track inhaler usage digitally and share data with healthcare providers, emblematic of the shift toward personalized respiratory care.

The global digital respiratory devices market landscape is primarily shaped by advanced technology integration, strategic collaborations, and patient-centric innovation. Rising prevalence of CRDs worldwide has compelled major industry players to develop cutting-edge respiratory care devices such as AI-powered smart inhalers and wearable sensors that offer remote monitoring and data-driven therapeutic support. For instance, in 2022, Aptar Pharma launched the HeroTracker Sense device, transforming conventional metered-dose inhalers into connected smart devices with real-time adherence tracking.

Market participants are also finding support from regulatory bodies that are encouraging remote patient monitoring and reimbursements, aligning well with strategic product advancements. Innovation ecosystems and M&A activity are also playing a pivotal role in making the market even more dynamic and collaborative in nature. Furthermore, companies are increasingly focused on overcoming data privacy, interoperability, and cost barriers by embedding cybersecurity frameworks and focusing on scalable solutions.

The digital respiratory devices market is projected to reach US$85.28 Bn in 2025.

The rising prevalence of chronic respiratory diseases (CRDs) worldwide and increasing aging populations across countries are driving the market.

The digital respiratory devices market is poised to witness a CAGR of 27.8% from 2025 to 2032.

Merging smart inhalers, AI-enabled remote patient monitoring (RPM), and connected digital therapeutics into integrated healthcare ecosystems and the convergence of IoMT (Internet of Medical Things) with AI-driven analytics are key market opportunities.

3M Company, Adherium Limited, and AireHealth, LLC are some of the key players in the digital respiratory devices market.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Disease Indication

By Distribution Channel

By End-Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author