ID: PMRREP18469| 221 Pages | 20 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

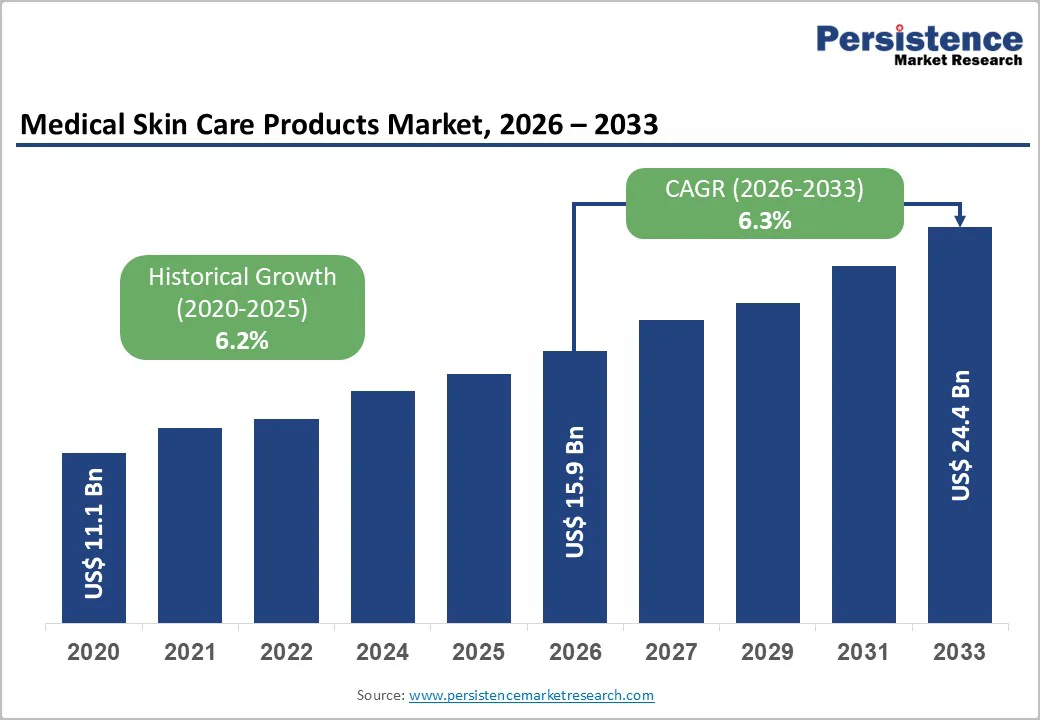

The global medical skin care products market size is likely to be valued at US$ 15.9 billion in 2026 and is estimated to reach US$ 24.4 billion by 2033, growing at a CAGR of 6.3% during the forecast period 2026−2033. This growth is driven by rising prevalence of dermatological conditions such as acne, eczema, and hyperpigmentation, alongside an expanding aging population that increasingly seeks clinically proven solutions for skin health and appearance. Growing consumer preference for evidence-based dermatology, supported by regulatory emphasis on safe and well-tested formulations, is reinforcing trust in medical-grade products and accelerating their adoption across both developed and emerging markets. Market momentum is further amplified by the increasing integration of clinical-grade formulations into mainstream skincare routines and the rising availability of personalized skincare therapies. Advancements in dermatology, such as targeted actives and prescription-strength ingredients, are enabling more effective and tailored treatment regimens. Improved access to dermatology services and digital consultation platforms is further broadening the user base and shaping the competitive landscape.

| Key Insights | Details |

|---|---|

| Medical Skin Care Products Market Size (2026E) | US$ 15.9 Bn |

| Market Value Forecast (2033F) | US$ 24.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.2% |

The rising prevalence of dermatological conditions is a key driver as consumers experiencing acne, pigmentation disorders, eczema, or chronic sensitivity increasingly seek clinically validated solutions that deliver measurable outcomes. A growing portion of the population is dealing with skin issues linked to urban pollution, lifestyle stress, and hormonal imbalances, prompting a shift from cosmetic-grade formulations to high-performance clinical products. This shift elevates demand for targeted treatments such as barrier-repair creams, pigmentation correctors, acne therapies, and sensitivity-focused formulations grounded in dermatological science.

A population-based survey across 27 European countries reported that 43% of adults experienced at least one dermatological condition within a 12-month period, demonstrating a substantial and recurring need for therapeutic skincare support. This significant affected base drives consistent preference for products with active ingredients, clinical validation, and outcome-centric performance. Brands offering medical efficacy and dermatologist-endorsed formulations achieve stronger market positioning as consumers allocate higher spending toward solutions addressing long-term skin health challenges.

Elevated product costs represent a significant market restraint that directly impacts growth potential. Medical-grade formulations demand substantial investment in advanced research, clinically validated active ingredients, and stringent quality control protocols. Premium compounds such as peptides, retinoids, and ceramides carry high sourcing expenses, and stabilizing these ingredients in effective concentrations requires sophisticated formulation expertise. Manufacturing processes depend on specialized equipment and must comply with rigorous dermatological standards, which drives production overheads upward. These accumulated costs transfer to end-users, positioning premium products beyond the reach of a broader demographic and limiting market expansion. ?

Accessibility barriers create additional constraints that restrict market penetration, particularly in regions with underdeveloped distribution infrastructure. These specialized products are predominantly available through dermatology clinics, specialty retailers, or regulated pharmacies, which confines reach to urban centers and high-income areas. Limited e-commerce penetration in certain markets further compounds this challenge, reducing the potential user base. The combination of premium pricing and restricted access concentrates demand among affluent, awareness-driven consumers. This market concentration slows adoption rates and impedes growth in emerging economies, creating a cycle that reinforces exclusivity rather than broad-based market development.

The expansion of personalized and prescription-based skincare represents a significant opportunity due to the rising consumer demand for targeted solutions that address specific skin concerns. Consumers increasingly seek products tailored to their unique skin type, condition, and lifestyle, driving a shift from generic offerings to customized formulations. Prescription-based solutions enhance consumer trust by delivering clinically verified results under professional guidance. This approach allows brands to differentiate themselves, create stronger customer loyalty, and justify premium pricing while delivering measurable outcomes. Personalized regimens also facilitate a higher engagement rate, as consumers are more likely to adhere to a program designed specifically for their skin needs.

Advancements in technology and data analytics have enabled brands to offer precision skincare at scale. Tools such as AI-driven skin assessments, genetic profiling, and dermatology-backed diagnostics allow for accurate formulation matching and treatment plans. Prescription-based offerings provide an added layer of credibility and effectiveness, appealing to consumers who prioritize scientifically validated solutions. This convergence of personalization, technology, and clinical oversight positions companies to capture new consumer segments and strengthen their competitive advantage. The ability to deliver individualized care while demonstrating tangible results creates long-term growth potential and fosters trust-driven brand equity.

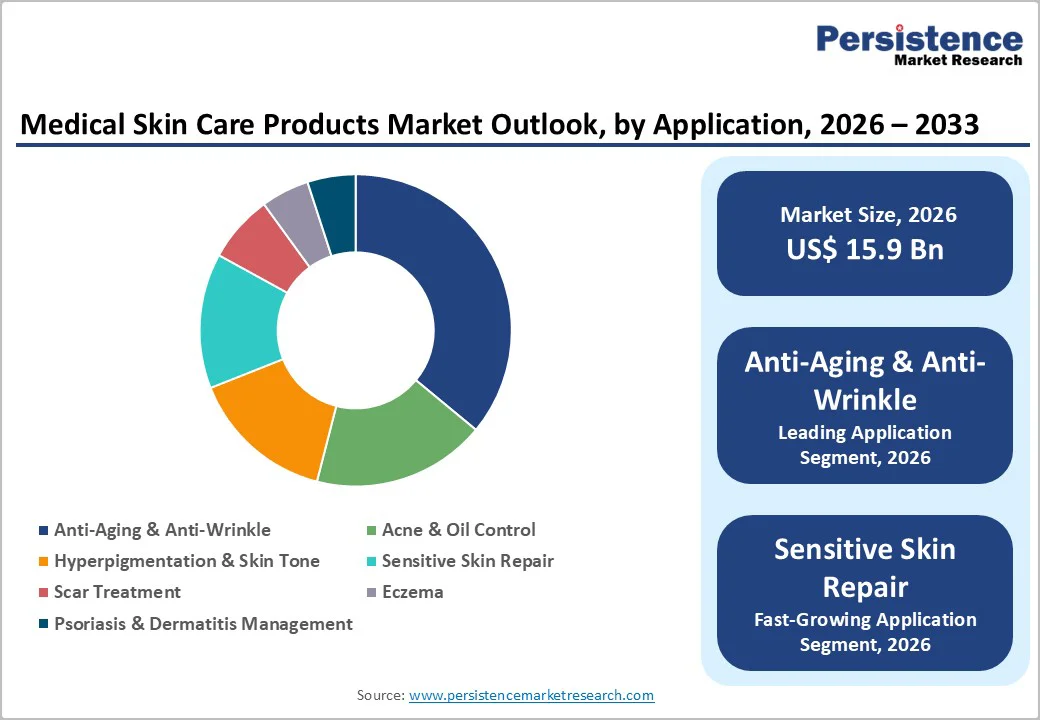

Anti-aging products are expected to maintain the largest market share, forecasted at approximately 38% in 2026, driven by the rising global elderly population and increasing consumer focus on maintaining youthful appearance. Demand is fueled by preference for clinically validated formulations containing retinoids, peptides, and antioxidants that target fine lines, wrinkles, and skin elasticity. Consumers show high trust in products endorsed by dermatologists, with professional guidance reinforcing perceived efficacy. Brands offering scientifically backed solutions, such as peptide-enriched serums with clinical proof of skin tightening, continue to dominate revenue contributions and brand loyalty.

Sensitive skin products are predicted to experience the fastest growth from 2026 to 2033, propelled by the increasing prevalence of skin irritation, environmental stressors, and dermatitis cases. The market expansion is driven by consumer preference for hypoallergenic, fragrance-free, and microbiome-friendly formulations that prevent inflammation and strengthen the skin barrier. Early adoption by younger consumers seeking preventive solutions accelerates growth, while availability across retail pharmacies, online platforms, and dermatology clinics enhances accessibility. For instance, barrier-repair creams with ceramides and prebiotics illustrate the segment’s appeal and rapid adoption among health-conscious demographics.

The anti-aging & anti-wrinkle segment is projected to hold around 36% of the medical skin care products market revenue share in 2026, driven by an expanding aging population and increased consumer focus on maintaining youthful skin. Adoption of retinol-based, collagen-stimulating, and peptide-infused medical products has been consistently high, reflecting trust in clinically backed formulations. Strong demand from mature markets, including North America, Europe, and Japan, supports sustained expenditure in premium skincare. Products such as peptide-enriched serums with clinically demonstrated wrinkle reduction exemplify the segment’s dominance and long-term revenue leadership.

Sensitive skin repair applications are forecast to witness the fastest growth through 2033 due to rising environmental stressors, pollution, and lifestyle-induced skin sensitivities. Consumers increasingly prefer dermatologist-recommended products that restore barrier function and alleviate irritation. The availability of over-the-counter (OTC) medical formulations and clinically guided regimens enhances adoption across retail and clinical channels. Innovative products, including ceramide-based moisturizers and prebiotic-infused barrier creams, cater to preventive and therapeutic needs, driving rapid expansion. Growing awareness among younger and health-conscious consumers accelerates the segment’s market penetration and positions it for sustained growth.

The women segment is anticipated to capture approximately 52% of the market revenues in 2026, propelled by widening adoption of medical skincare products across anti-aging, pigmentation correction, and sensitive-skin treatments. Female consumers demonstrate frequent dermatology visits, increasing exposure to clinically validated formulations and professional recommendations. Their preference for products with proven efficacy, such as peptide-infused anti-aging serums or brightening creams with vitamin C, ensures sustained leadership. Brand loyalty among women, coupled with awareness of skin health and preventive care, reinforces the segment’s dominance in both clinical and retail channels.

The unisex segment is poised to experience the fastest growth during the 2026-2033 forecast period on account of a growing focus on gender-neutral skincare solutions that address universal concerns such as acne, sun damage, and barrier repair. Increased awareness among men regarding preventive and therapeutic skin solutions supports broader adoption. Brands offering formulations suitable for all genders, such as multifunctional moisturizers and antioxidant serums, capture expanding consumer segments. This trend aligns with evolving global preferences for inclusive, professional-grade skincare, accelerating market penetration and positioning the Unisex category for sustained expansion across clinical and retail channels.

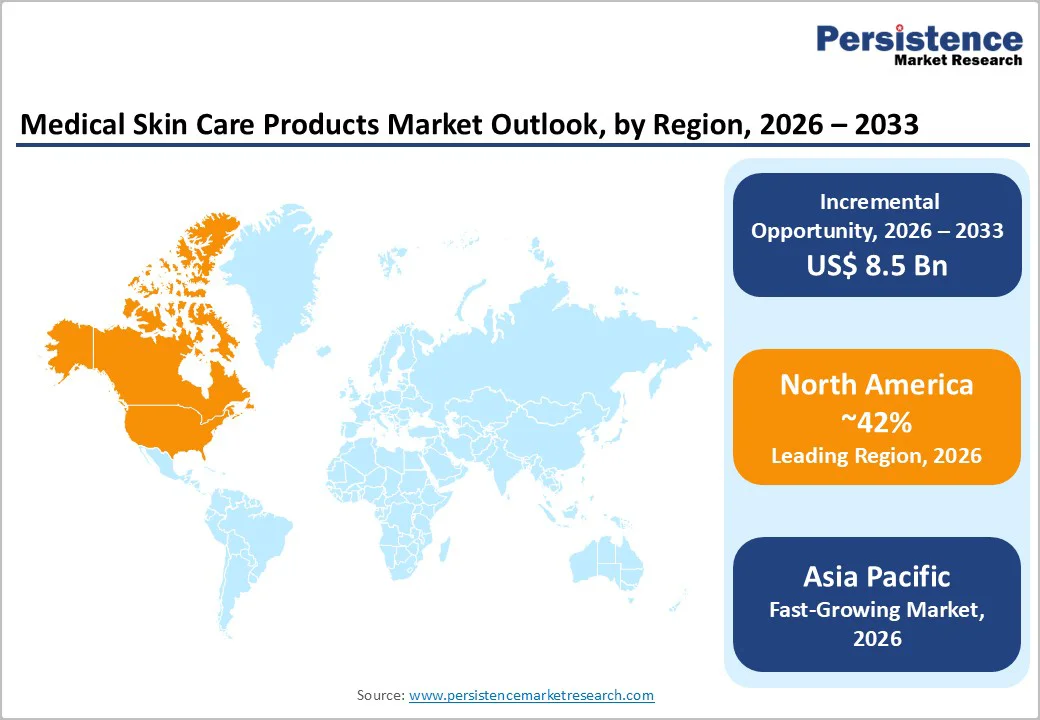

North America is expected to hold an estimated 42% of the medical skin care products market share in 2026, fueled by a mature ecosystem for clinical and preventive skincare. A primary factor behind this dominance is the high penetration of dermatology services coupled with strong consumer preference for scientifically validated formulations. Demand is particularly robust for anti-aging, pigmentation correction, and barrier-repair products. Advanced research and development infrastructure supports the rapid commercialization of innovative solutions, such as peptide-infused serums, retinol-based creams, and microbiome-friendly barrier-repair formulations. Professional endorsements and evidence-backed marketing reinforce consumer trust, sustaining premium product adoption across both over-the-counter and prescription channels.

The regional market benefits from a regulatory framework that facilitates the introduction of clinically tested medical-grade skincare products while ensuring safety standards, enhancing consumer confidence. Extensive multi-channel distribution, including dermatology clinics, retail pharmacies, and e-commerce platforms, accelerates product accessibility and adoption. The increasing focus on personalization and precision skincare, supported by AI-driven diagnostics and data analytics, strengthens competitive positioning. Rising demand among health-conscious and aging populations further consolidates the region’s leading position, making it the most influential market globally for medical-grade skincare products.

Europe holds a strong position in the medical skincare landscape, powered by advanced dermatology networks, stringent regulatory oversight, and a consumer base that values scientifically validated formulations. Adoption of medical-grade products is reinforced by high trust in evidence-based treatments and widespread access to dermatologists and aesthetic clinics across Germany, France, Italy, Spain, and the United Kingdom. Demand remains resilient for anti-ageing, pigmentation correction, and barrier-repair solutions, supported by strict European Union (EU) safety requirements that prioritize ingredient transparency, product efficacy, and clinical substantiation. These elements strengthen confidence in high-performance formulations and sustain consistent product uptake.

Long-term market expansion through 2033 is supported by rising sensitivity-related skin concerns, pollution-driven dermal stress, and increasing acceptance of prescription-guided skincare routines. Growth is further enhanced by innovation in biomimetic peptides, ceramide complexes, and dermatologist-formulated antioxidant blends tailored to evolving consumer needs. The expansion of medical-spa networks, derma-cosmetic pharmacies, and aesthetic tourism contributes to broader exposure and accessibility for premium medical skincare offerings. These structural factors position Europe as an influential and methodically expanding market with strong alignment to clinical standards and growing adoption of targeted, results-focused skincare solutions.

The Asia Pacific market is forecasted to expand at the fastest pace through 2033, supported by an accelerating demand for dermatology-guided skincare and rising awareness of medical-grade formulations across urban and semi-urban populations. Growth momentum is reinforced by broader access to clinical treatments, increasing disposable incomes, and a shift toward targeted solutions for sensitivity, pigmentation, and early-ageing concerns. Markets such as China, South Korea, and India reflect strong adoption of cosmeceutical-grade actives, propelled by a young demographic seeking preventive and corrective skincare aligned with dermatologist-endorsed routines.

Innovation capability across the area further strengthens expansion, as manufacturers incorporate advanced ingredients such as niacinamide (nicotinamide), ceramides, and azelaic-acid blends into competitively positioned medical skincare portfolios. Rapid growth in e-pharmacy platforms and medical-beauty clinics boosts visibility for premium formulations and enables broader penetration across diverse consumer segments. Rising preference for personalized and results-centric regimens continues to elevate spending on clinically validated solutions. These factors position Asia Pacific as the most dynamic and fast-advancing growth hub through 2033, outperforming other regional markets in product diversification and adoption of patient-driven skincare solutions.

The global medical skin care products market reflects a moderately fragmented structure with participation from global dermatology leaders, pharmaceutical companies, and specialized medical skincare brands. Established players such as La Roche-Posay, CeraVe, SkinCeuticals, Galderma, AbbVie (Allergan Aesthetics), and Johnson & Johnson maintain strong industry influence through clinically validated formulations and continuous investment in dermatology-focused innovation. Their portfolios emphasize solutions for anti-aging, pigmentation correction, acne management, and barrier repair, supported by strong clinical endorsement.

Emerging brands strengthen competitive intensity by advancing targeted solutions for sensitive skin and early-ageing concerns. Companies such as The Ordinary (DECIEM), PAULA’S CHOICE, ISDIN, and Obagi differentiate through transparent ingredient strategies, advanced actives, and strong digital engagement. Competitive positioning is shaped by research and development capability, regulatory compliance strength, and dermatologist-driven validation, factors that collectively reinforce long-term brand trust and sustained global expansion.

Key Industry Developments

The global medical skin care products market is projected to reach US$ 15.9 billion in 2026.

Rising demand for clinically validated, targeted skincare solutions for anti-aging, pigmentation, sensitive skin, and preventive care is driving the market.

The market is poised to witness a CAGR of 6.3% from 2026 to 2033.

Expansion of personalized, prescription-based, and sustainable medical-grade skincare products presents key growth opportunities in the market.

Some of the key market players include La Roche-Posay, CeraVe, SkinCeuticals, Galderma, AbbVie, Johnson & Johnson, L’Oréal, and Beiersdorf AG.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author