ID: PMRREP31540| 200 Pages | 2 Feb 2026 | Format: PDF, Excel, PPT* | Consumer Goods

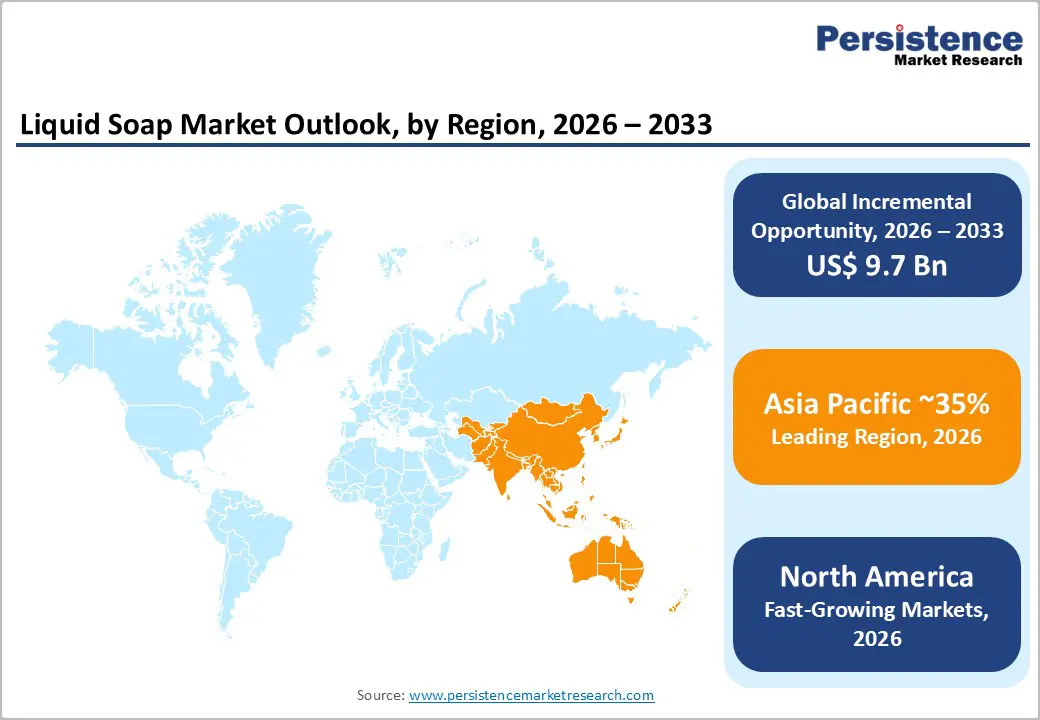

The global liquid soap market size is projected at US$ 25.1 billion in 2026 and is projected to reach US$ 34.9 billion by 2033, growing at a CAGR of 4.8% between 2026 and 2033.

Market growth is primarily driven by heightened global hygiene awareness following pandemic outbreaks and increasing disposable incomes in developing regions. Furthermore, the growing consumer shift toward organic and premium liquid soap variants for skin-care benefits significantly increases demand. Additionally, the rapid expansion of organized retail and e-commerce channels enhances global product accessibility.

| Key Insights | Details |

|---|---|

| Liquid Soap Market Size (2026E) | US$ 25.1 billion |

| Market Value Forecast (2033F) | US$ 34.9 billion |

| Projected Growth CAGR (2026 - 2033) | 4.8% |

| Historical Market Growth (2020 - 2025) | 4.3% |

The surge in global hygiene consciousness, accelerated by recent infectious disease outbreaks, acts as a primary catalyst for the Liquid Soap Market. According to the World Health Organization (WHO), regular handwashing reduces the spread of respiratory illnesses by 20%, driving sustained consumer adoption. Governments and health organizations worldwide are running sanitation campaigns and mandating the use of liquid hand soap in public spaces, schools, and commercial establishments. This cultural shift towards preventative healthcare has transformed liquid soap from a discretionary item to an essential daily commodity. Consequently, manufacturers are capitalizing on this trend by introducing antibacterial formulations, which now account for significant shelf space and directly correlate with heightened demand for infection-control products across both residential and commercial sectors.

There is a profound shift in consumer preference toward organic, herbal, and moisturizing liquid soaps, driven by growing awareness of the harmful effects of synthetic chemicals such as parabens and sulfates. Industry data indicate that the organic personal care segment is growing at over 9% annually, fueling demand for plant-based liquid soaps. Consumers are increasingly willing to pay a premium for products enriched with natural ingredients such as aloe vera, essential oils, and shea butter, which offer dual benefits of hygiene and skin nourishment. This "skinification" of hand hygiene products is prompting major brands to reformulate their portfolios. The rise of "clean beauty" standards is compelling manufacturers to obtain eco-certifications, thereby attracting a health-conscious demographic and driving value-based market expansion.

The liquid soap market is highly fragmented, with numerous global multinationals and low-cost regional players, creating a fiercely competitive landscape. Leading brands face significant pricing pressure from private-label products offered by retailers, which are typically priced 20-30% lower than branded alternatives. This price sensitivity, particularly in developing markets, severely constrains profit margins for established players who invest heavily in R&D and marketing. Furthermore, the low barrier to entry allows small-scale manufacturers to flood the market with inexpensive alternatives, making it challenging for premium brands to maintain market share without succumbing to aggressive price wars that erode overall industry profitability.

Volatility in the prices of key raw materials, including surfactants, essential oils, and packaging plastics, poses a significant challenge to market stability. Recent geopolitical tensions and logistical bottlenecks have caused raw material costs to fluctuate by approximately 15%, directly impacting manufacturing expenses. These supply chain inconsistencies often lead to production delays and increased operational costs, which manufacturers may struggle to pass on to price-sensitive consumers. Additionally, strict environmental regulations regarding plastic packaging require companies to invest in sustainable but more expensive biodegradable alternatives. These structural cost burdens and logistical uncertainties are substantial restraints, limiting the operational flexibility and margin expansion of key market players.

Developing economies in Asia-Pacific and Latin America present massive untapped potential due to rapid urbanization and improving standards of living. With rural penetration of liquid hand wash remaining below 20% in countries like India, there is a significant opportunity for market expansion. As disposable incomes rise, consumers in these regions are shifting from traditional bar soaps to liquid formats, which are perceived as more hygienic and convenient. Companies that strategically introduce affordable, small-sized sachets or refill packs can effectively penetrate these price-sensitive markets. This demographic shift, combined with growing retail infrastructure, creates a lucrative pathway for volume growth in high-population regions.

The escalating global demand for eco-friendly products creates a robust opportunity for brands to differentiate through sustainable packaging innovations. Market research indicates that more than 60% of modern consumers prefer brands committed to reducing plastic waste, creating opportunities for refillable and biodegradable packaging solutions. Manufacturers investing in "zero-waste" concepts, such as glass bottles, aluminum containers, or concentrated refill tablets, can capture the environmentally conscious consumer segment. This trend aligns with global sustainability goals and regulatory pressures, offering a competitive advantage. Transitioning to circular economy models not only enhances brand equity but also opens new revenue streams through subscription-based refill models.

The antibacterial liquid soap segment leads with a dominant 35% share, driven by unwavering consumer focus on germ protection and infection control. This segment's supremacy is underpinned by widespread usage in healthcare facilities, educational institutions, and households where hygiene is paramount. Major players actively promote the "99.9% germ kill" efficacy, thereby solidifying consumer trust and driving repeat purchases. The sheer volume of institutional procurement for antibacterial formulations ensures its continued market leadership, as it remains the standard for public health safety compliance globally.

The Organic Liquid Soap segment is the fastest-growing, registering a robust 7.0% CAGR, driven by the "clean beauty" movement and rising chemical sensitivities. Consumers are rapidly shifting toward plant-based formulations free of synthetic ingredients, driving manufacturers to innovate with natural ingredients such as tea tree oil and chamomile to meet this surging ethical demand.

Supermarkets & Hypermarkets constitute the leading segment, commanding a substantial 36% market share, serving as the primary purchase destination for household personal care products. This dominance is attributed to the convenience of one-stop shopping, extensive shelf space that enables product comparison, and aggressive promotional activities such as bundling. The physical visibility of diverse brands and the ability to verify on-pack product claims significantly influence consumer purchase decisions, thereby ensuring high-volume sales through these large-format retail outlets.

Online Retail / E-commerce is the fastest-growing segment, expanding at an impressive 8% CAGR, driven by the convenience of doorstep delivery and the proliferation of digital payment platforms. The availability of subscription models for refills, exclusive online-only discounts, and the capacity to research product reviews empower consumers, accelerating the shift towards digital purchasing channels.

The Residential segment is the leading end-user category, accounting for 61% of the market, driven by the widespread adoption of liquid soap as a daily household hygiene staple. The transition from bar soaps to liquid forms in bathrooms and kitchens across urban and semi-urban households underpins this dominance. Continuous product innovation in fragrances and moisturizing properties tailored for family use further entrenches liquid soap's status as a non-negotiable item in the monthly consumer basket.

The Residential segment is also the fastest-growing, projected to grow at a 5.1% CAGR, driven by the increasing frequency of handwashing at home and the premiumization of household care. As consumers improve their living standards, there is a sustained demand for higher-quality, aesthetically pleasing, and skin-friendly liquid soap variants for personal use.

North America is growing at a prominent Pace with a CAGR of 4.1%, maintaining its position as a highly mature and innovation-led market. The region's growth is anchored by high consumer awareness regarding health and hygiene, coupled with a strong preference for premium and multifunctional personal care products. The United States dominates the regional landscape, where high disposable incomes drive the demand for specialized organic and medicated liquid soaps. Furthermore, strict FDA regulatory frameworks governing product safety and ingredients ensure high-quality standards, thereby fostering consumer trust. The widespread presence of automated dispensing systems in commercial sectors further bolsters market volume.

The region serves as an innovation hub, with frequent launches of eco-friendly packaging and advanced dermatological formulations. Investment trends are heavily skewed towards sustainable manufacturing practices, with major players acquiring niche organic brands to diversify portfolios. The competitive landscape is consolidated yet dynamic, as established giants continually adapt to the growing influence of direct-to-consumer brands.

Europe is holding a considerable market share of 24% & Growing at a steady CAGR of 3.8%, characterized by a stringent regulatory environment and a sophisticated consumer base. Countries like Germany, France, and the U.K. are at the forefront, driven by a cultural emphasis on sustainability and corporate social responsibility. The European Chemicals Agency (ECHA) enforces rigorous standards for ingredients, thereby pushing the market toward safer, biodegradable formulations. This regulatory harmonization fosters a market environment where transparency and eco-certification are critical success factors. High urbanization rates and a robust healthcare infrastructure also sustain steady demand across both residential and commercial sectors.

The competitive landscape in Europe is marked by a strong presence of private-label brands that offer high-quality, cost-effective alternatives to premium names. Investment opportunities are burgeoning in the circular economy space, particularly in refill station infrastructure and plastic-free packaging solutions. Companies are focusing on "green chemistry" to appeal to environmentally conscious European consumers, thereby ensuring long-term relevance.

Asia Pacific is likely to account for a share of 35% in 2026, emerging as the global volume leader due to its vast population and rapid economic development. China and India are the primary growth engines, fueled by government-led sanitation initiatives such as "Swachh Bharat" and rising middle-class affluence. The region benefits significantly from low-cost manufacturing capabilities and the availability of raw materials, making it a production hub for global exports. The shift from traditional bar soaps to liquid formats is accelerating in urban centers, while rural penetration offers a massive runway for future growth through affordable pricing strategies.

The market is highly dynamic, with intense competition between multinational corporations and agile local players who understand regional fragrance preferences. Investments are pouring into expanding distribution networks, particularly in Tier-2 and Tier-3 cities, and enhancing digital retail presence. The "sachet economy" remains a vital strategy for market penetration, allowing premium brands to reach price-sensitive consumers and drive mass adoption.

Leading market players are adopting a multi-pronged strategy focusing on product premiumization, sustainability, and digital transformation. They differentiate by reformulating with natural ingredients and introducing eco-friendly refills to secure brand loyalty. Simultaneously, companies are leveraging data analytics to optimize supply chains and aggressively expanding e-commerce capabilities to capture direct-to-consumer value.

The market is valued at US$ 25.14 Billion in 2026 and is expected to reach US$ 34.89 Billion by 2033.

Growth is driven by rising global hygiene awareness, increasing disposable incomes, and a shift towards organic and premium personal care products.

The liquid soap market is projected to grow at a CAGR of 4.8% from 2026 to 2033.

Key opportunities include penetrating untapped emerging markets in the Asia Pacific and innovating in sustainable, zero-waste packaging solutions.

Major players include Unilever, Procter & Gamble, Colgate-Palmolive, Reckitt Benckiser, and Henkel, who dominate through global distribution and brand equity.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Distribution Channel

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author