ID: PMRREP13141| 199 Pages | 13 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

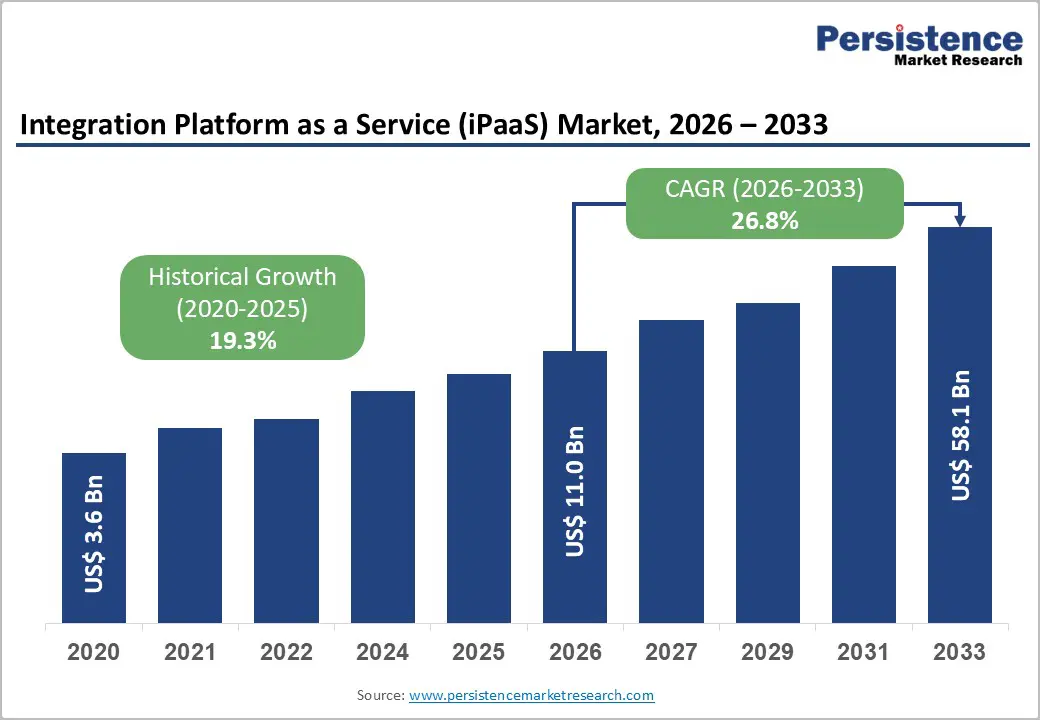

The global integration platform as a service (iPaaS) market size was valued at US$ 11.0 billion in 2026 and is projected to reach US$ 58.1 billion by 2033, growing at a CAGR of 26.8% between 2026 and 2033. This substantial growth trajectory reflects the accelerating digital transformation across enterprises worldwide, driven by the critical imperative to modernise legacy IT infrastructure, embrace cloud-native architectures, and enable real-time data integration across increasingly complex application ecosystems.

Organizations are prioritizing iPaaS solutions to reduce the burden of maintaining outdated systems, with nearly two-thirds of businesses allocating over US$ 2 million annually to legacy system maintenance and to support hybrid and multi-cloud environments, where 85% of financial institutions are already operating. The market's expansion is underpinned by the widespread adoption of microservices architectures, API-driven enterprise strategies, and the necessity for seamless integration between on-premises and cloud-based applications to maintain competitive advantage in rapidly digitizing industries.

| Global Market Attributes | Key Insights |

|---|---|

| Integration Platform as a Service (iPaaS) Market Size (2026E) | US$ 11.0 Bn |

| Market Value Forecast (2033F) | US$ 58.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 26.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 19.3% |

Accelerated Digital Transformation and Legacy System Modernisation

Organisations worldwide are confronting the substantial costs and operational inefficiencies associated with ageing legacy systems. Nearly two-thirds of enterprises spend more than US$2 million annually on maintaining outdated infrastructure, creating a compelling business case for adopting Integration Platform as a Service (iPaaS). Legacy systems typically lack modern integration capabilities, creating isolated data silos that impede real-time insights and business agility. The Integration Platform as a Service (iPaaS) Market has emerged as the enabling technology for enterprises transitioning from monolithic architectures to distributed, cloud-native systems.

Financial institutions in India, for example, have witnessed their BFSI sector expand fifty-fold in market capitalisation to reach US$ 1 trillion in 2025 from US$ 20.28 billion in 2005, with gross non-performing assets declining from 5.8% to 2.2% between fiscal 2022 and 2025, metrics demonstrating how integration solutions support institutional modernisation and risk management. iPaaS platforms provide the critical connectivity layer enabling enterprises to extract maximum value from legacy investments while progressively adopting next-generation technologies, thereby reducing project timelines from months to weeks and minimising disruption to production environments.

Proliferation of Hybrid and Multi-Cloud Enterprise Architectures

The contemporary enterprise technology landscape is fundamentally multi-cloud and hybrid by necessity. Eighty-five percent of financial institutions are actively adopting multi-cloud and hybrid models to optimise performance, reduce vendor lock-in, and enhance resilience across their infrastructure. This architectural complexity creates unprecedented demand for sophisticated integration orchestration capabilities.

The Integration Platform as a Service (iPaaS) Market directly addresses this challenge by providing centralised platforms that seamlessly connect applications and data sources distributed across AWS, Azure, Google Cloud, private cloud environments, and on-premises infrastructure.

European enterprises have demonstrated particular sophistication in leveraging iPaaS for compliance and data sovereignty. The European Union's financial and insurance sector generated €0.9 trillion in value added with 236.1% wage-adjusted labour productivity in 2022, representing an economically significant segment requiring robust hybrid integration capabilities. iPaaS solutions enable this complexity through unified governance, security enforcement, and real-time monitoring across disparate cloud ecosystems, allowing organisations to achieve operational consistency while maintaining the flexibility to select best-of-breed services from multiple providers.

Explosion of Real-Time Data Integration and Event-Driven Architectures

Modern business operations increasingly depend on instantaneous access to synchronised data across the entire enterprise ecosystem. Organisations leveraging event-driven architectures report 56% application integration usage, 48% data sharing across applications, and 45% IoT device connectivity, all requiring real-time, event-triggered data flows.

The Integration Platform as a Service (iPaaS) Market has evolved to incorporate sophisticated event streaming, real-time monitoring, and orchestration capabilities that enable businesses to respond to operational anomalies, customer interactions, and market conditions within milliseconds.

Healthcare organisations represent a compelling use case: the U.S. healthcare system loses approximately US$300 billion annually due to integration-related inefficiencies, and 84% of healthcare organisations continue relying on manual workarounds to maintain data flows. Advanced iPaaS platforms now deliver compliance-first design patterns, audit-ready logging, AI-powered data normalisation supporting FHIR, HL7, and CCD standards, and predictive observability that forecasts integration failures before they occur. Event-driven architecture platforms experienced around ~15% CAGR growth, with real-time analytics representing over 30% of market revenue in 2024, underscoring the critical importance of this segment within the broader Integration Platform as a Service (iPaaS) Market.

Substantial Implementation Complexity and Project Risk

Despite compelling value propositions, Integration Platform as a Service (iPaaS) implementations encounter significant structural barriers. Legacy system integration represents a particularly acute challenge: many organisations operate hybrid environments where aging applications lack standardised APIs, necessitating expensive middleware solutions and requiring specialised IT expertise increasingly difficult to source.

Integration projects often take 6-12 months in complex supply chain environments due to data format compatibility issues, regulatory compliance requirements, and the need to support multiple EDI standards simultaneously. Project cost overruns, scope creep, and delayed deployments frequently undermine anticipated ROI, particularly for mid-market enterprises lacking dedicated integration expertise.

Organisations must carefully evaluate implementation methodologies, build appropriate internal capabilities, and manage stakeholder expectations regarding timeline constraints that hinder rapid market adoption despite favourable economic fundamentals that underpin iPaaS value creation.

Healthcare and Life Sciences Digital Transformation

Healthcare organizations face unprecedented pressures to modernise disparate clinical, administrative, and financial systems while managing exploding data volumes from electronic health records, genomic research, precision medicine initiatives, and population health analytics.

The Integration Platform as a Service (iPaaS) Market represents a strategic imperative for healthcare providers, particularly as regulatory requirements for interoperability intensify. Integration-related inefficiencies that consume US$300 billion annually present a significant opportunity to reduce costs and improve care quality. Forward-thinking health systems are implementing iPaaS platforms to automate 340B compliance workflows, enable real-time interoperability between electronic medical records and payer systems, and normalise diverse clinical data formats to support AI-driven diagnostic and predictive analytics.

Leading healthcare organisations are leveraging AI-powered iPaaS capabilities to build "AI-ready" data lakes that normalise formats including FHIR, HL7, and CCD, and cleanse datasets to standards like LOINC and SNOMED, enabling real-time predictive modelling for patient outcomes and resource optimisation. As healthcare evolves toward value-based care models and regulatory mandates increasingly emphasise patient data exchange, the Healthcare and Life Sciences segment represent the fastest-growing industry vertical within the Integration Platform as a Service (iPaaS) Market, with organisations prioritising platforms delivering compliance-first design patterns, audit-ready infrastructure, and scalability to support thousands of endpoints.

Financial Services Digital Banking and Real-Time Payments Infrastructure

The global banking and insurance sector continues to undergo a profound transformation driven by emerging real-time payment systems, open banking mandates, and the rise of fintech and neobank competition. Latin America presents a particularly compelling case study: over 50% of adults remain unbanked, yet innovation in real-time payment networks like Brazil's PIX demonstrates rapid adoption of modern payment infrastructure. Banks face mounting pressure to modernise legacy core banking systems, many built decades ago on monolithic architectures that cannot support instantaneous payment settlement, sophisticated fraud detection, or personalised customer experiences. The Integration Platform as a Service (iPaaS) Market enables this modernisation through hybrid integration platforms supporting incremental, API-first transformation approaches.

Organisations implementing iPaaS solutions achieve faster time-to-market for new financial products, enhanced customer personalisation through real-time data access, and significant cost reduction by reducing development overhead for custom integrations. As emerging markets expand digital financial inclusion and developed markets compete intensely on customer experience and product innovation, the Integration Platform as a Service (iPaaS) Market represents essential infrastructure for competitive differentiation within financial services globally.

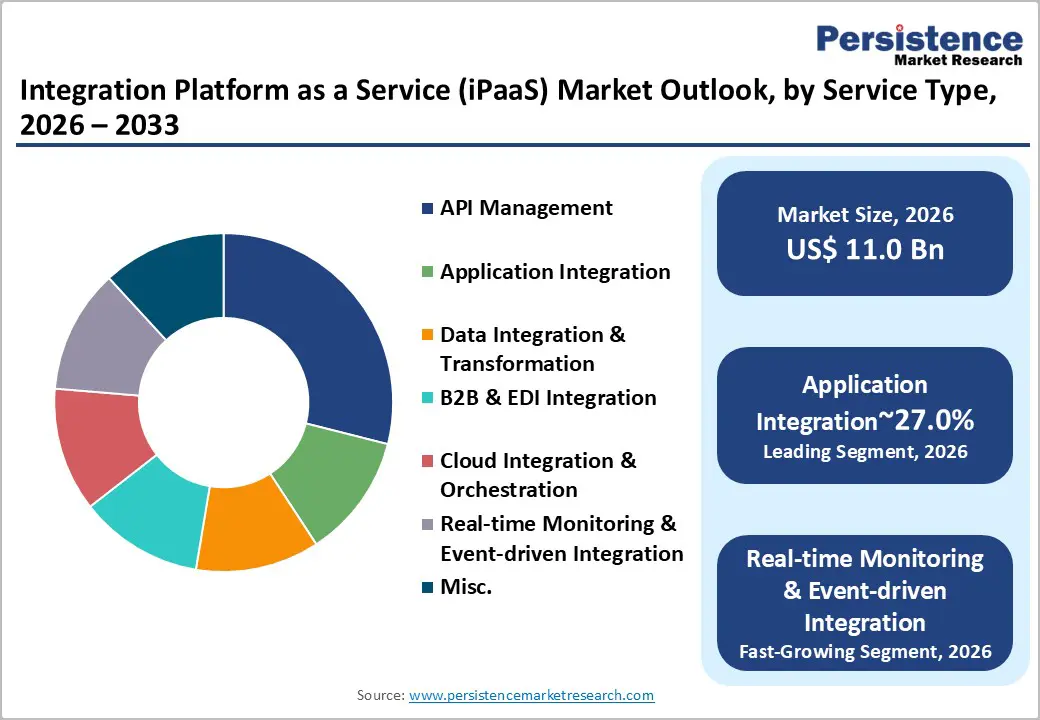

Application Integration represents the dominant Integration Platform as a Service (iPaaS) Market segment, commanding 27% market share in 2026 and encompassing enterprise initiatives to synchronise data, workflows, and processes across heterogeneous application portfolios. Organizations require comprehensive Application Integration capabilities to connect CRM systems (Salesforce), ERP platforms (SAP, Oracle), HCM solutions, supply chain applications, and industry-specific software without developing custom middleware or point-to-point integrations.

The established position of Application Integration reflects decades of enterprise software fragmentation and organisations' fundamental dependency on reliable integration mechanisms to execute business processes spanning multiple applications. Leading enterprises report 30% cost reductions following Application Integration platform deployment, alongside streamlined business process automation that reduces manual data entry and associated operational errors. The maturity of Application Integration service offerings, combined with extensive vendor connector ecosystems and proven deployment methodologies, establishes this segment as the foundational component of enterprise integration strategies and the primary revenue contributor within the overall market.

Real-time Monitoring and Event-driven Integration represents the most rapidly expanding Integration Platform as a Service (iPaaS) Market segment, driven by escalating organisational dependence on instantaneous data visibility and event-responsive architecture capabilities. Modern enterprises cannot rely on batch integration cycles or delayed data synchronisation when competitive imperatives demand immediate response to business events, payment processing exceptions, customer behaviour anomalies, supply chain disruptions, or operational equipment failures.

Banking, Financial Services and Insurance (BFSI) organizations maintain the largest Integration Platform as a Service (iPaaS) Market share at 24% in 2026, reflecting the sector's mission-critical dependence on integration infrastructure to execute complex financial workflows, transaction processing, and multi-party information exchange. BFSI enterprises operate among the most sophisticated and interconnected IT environments across all industries, requiring integration platforms capable of reliably orchestrating payments, settlements, regulatory reporting, customer data synchronisation, and third-party financial service integration

India's BFSI sector exemplifies the scale and growth trajectory of financial services integration demand, expanding to US$1 trillion market capitalization in 2025 while contributing 27% to the national GDP. The sector's robust fundamentals, including declining gross NPAs from 5.8% in FY22 to 2.2% in FY25 and reduced credit costs, establish financial institutions as sophisticated, well-capitalised adopters of enterprise integration platforms.

Chinese banking assets reached RMB 467.3 trillion (US$55 billion equivalent) in Q2 2025, demonstrating the substantial scale of financial services infrastructure requiring coordinated integration across lending, deposit management, capital markets, and insurance operations. European banking assets totalled €43.6 trillion in 2023, with €26.8 trillion in outstanding loans and €17.3 trillion in deposits, establishing the BFSI sector as the dominant integration platform consumer globally.

Healthcare and Life Sciences represent the fastest-expanding Integration Platform as a Service (iPaaS) Market segment, driven by interoperability mandates, precision medicine initiatives, clinical research acceleration, and patient-centric digital health expansion.

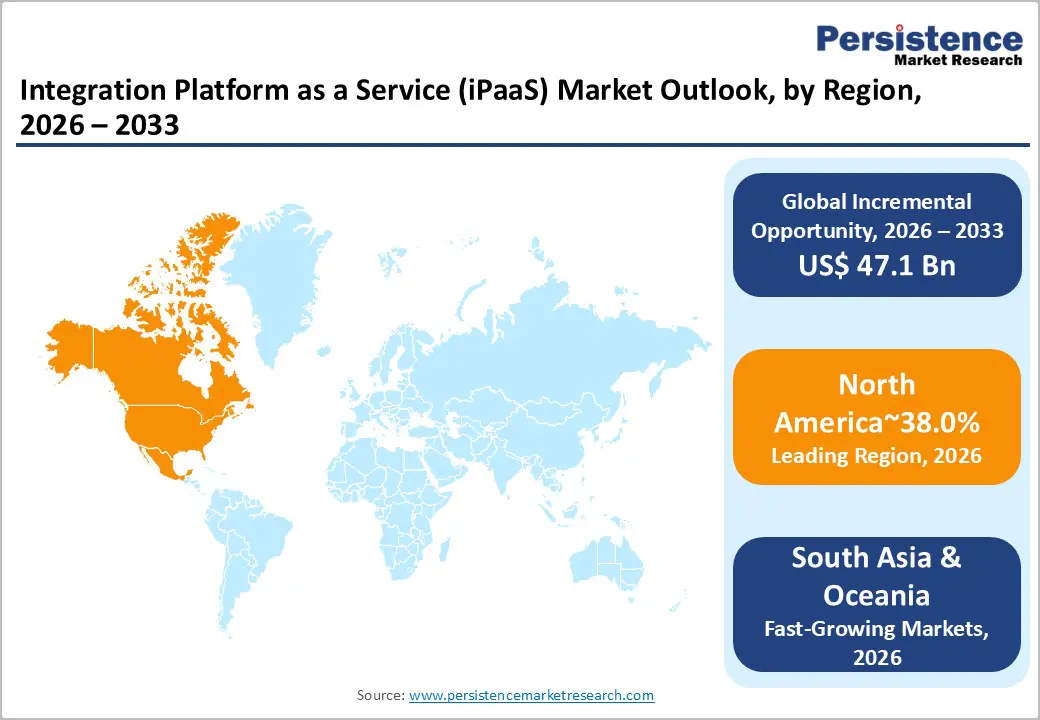

North America represents the largest Integration Platform as a Service (iPaaS) Market region, commanding 38% of global market share and establishing the region as the epicentre of iPaaS innovation, vendor competition, and enterprise adoption. The United States, Canada, and supporting infrastructure vendors have created mature ecosystems encompassing comprehensive iPaaS offerings, extensive consulting and implementation services, and established best practice methodologies

The region's dominance reflects multiple structural factors: robust IT infrastructure and mature cloud computing environments; high concentration of global technology vendors and integration platform providers headquartered within the region; substantial enterprise investments in digital transformation initiatives; and regulatory environments (GDPR, HIPAA, SOX compliance) establishing integration platforms as mission-critical infrastructure

Large North American enterprises spanning Fortune 500 and mid-market organisations have transitioned to cloud-centric infrastructure, creating urgent requirements for integration platforms capable of orchestrating applications, data, and workflows across diverse cloud providers and on-premises systems. Organisations prioritise iPaaS solutions offering comprehensive API management, advanced data transformation, and hybrid deployment flexibility to support legacy modernisation initiatives while protecting existing IT investments.

East Asia represents a rapidly expanding Integration Platform as a Service (iPaaS) Market region, commanding 16% of global market share and demonstrating the strongest structural growth dynamics driven by accelerating cloud adoption, digital-first enterprise transformation, and emerging manufacturing competitiveness. China, India, and Southeast Asian markets are experiencing cloud adoption rates exceeding North American and European precedents, establishing integration platform requirements at accelerated timescales.

China's banking and insurance sectors demonstrated robust expansion, with total banking assets reaching RMB 467.3 trillion in Q2 2025 (up 7.9% year-on-year), while insurance assets expanded 9.2% to RMB 39.2 trillion. Chinese financial institutions are modernising legacy integration architectures to support mobile payment ecosystems, cross-border financial flows, and inclusive financial services expansion to underserved populations.

Manufacturing sectors across East Asia, particularly in automotive, electronics, and industrial equipment, are prioritising cloud-based integration platforms to support Industry 4.0 initiatives, global supply chain coordination, and rapid digital transformation. The region records integration platform adoption rates exceeding 20% annually, positioning East Asia as the fastest growing iPaaS market globally.

Europe commands 26% of the global Integration Platform as a Service (iPaaS) Market share, establishing the region as the second-largest market following North America, while demonstrating distinct regulatory dynamics and vertical industry characteristics. European enterprises operate within stringent GDPR data protection frameworks and emerging regulations, including DORA (Digital Operational Resilience Act), establishing integration platforms as essential infrastructure for compliance management and cross-border data governance.

The European financial services sector represents substantial iPaaS demand, with total banking assets of €43.6 trillion in 2023, €26.8 trillion in outstanding loans, and €17.3 trillion in customer deposits, establishing Europe as a major global financial centre requiring sophisticated integration infrastructure. The sector's complexity, including €1.2 trillion in insurance and pension funding, operations across 26 plus regulatory jurisdictions, and coordination with legacy banking infrastructure predating modern cloud computing, creates persistent integration platform requirements.

The global Integration Platform as a Service (iPaaS) market is largely consolidated, with a few key players capturing significant market share while smaller vendors compete in niche segments. Leading companies such as Informatica Inc., Boomi, Inc. (Dell Boomi), SAP SE, Oracle Corporation, Salesforce’s MuleSoft, and IBM Corporation dominate the market with enterprise-grade integration solutions that offer hybrid and multi-cloud support, AI-driven automation, and low-code/no-code capabilities. These top players invest heavily in platform enhancements, API management, and real-time, event-driven workflows to maintain leadership and address complex IT integration needs.

The market shows fragmented characteristics in mid-market and specialised sectors, where agile vendors like Workato, SnapLogic, TIBCO Software, Jitterbit, and Zapier compete on usability, flexible pricing, and niche-focused connectors. This dual dynamic of consolidation at the top and fragmentation in niche areas ensures continuous innovation and competitive pressure. Overall, the iPaaS market balances strong dominance by major global leaders with opportunities for smaller, specialised providers to thrive, driving ongoing advancements in integration technology.

The global Integration Platform as a Service (iPaaS) market is projected to be valued at US$ 11.0 Bn in 2026.

The Application Integration segment is expected to account for approximately 27.0% of the global Integration Platform as a Service (iPaaS) market by Solution Type in 2026.

The market is expected to witness a CAGR of 26.8% from 2026 to 2033.

The growth of the global Integration Platform as a Service (iPaaS) market is driven by the need for accelerated digital transformation, legacy system modernization, the proliferation of hybrid and multi-cloud architecture, and the demand for real-time data integration and event-driven architectures.

Key market opportunities in the global Integration Platform as a Service (iPaaS) market include driving digital transformation in healthcare and life sciences and enabling financial services' digital banking and real-time payments infrastructure modernisation.

The key players in the Integration Platform as a Service (iPaaS) market include Informatica Inc., Boomi, Inc. (Dell Boomi), SAP SE, Oracle Corporation, Salesforce’s MuleSoft, and International Business Machines Corporation (IBM).

| Report Attribute | Details |

|---|---|

| Forecast Period | 2026 to 2033 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Solution Type

By Organisation Size

By Deployment Mode

By End Use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author