ID: PMRREP12970| 174 Pages | 12 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

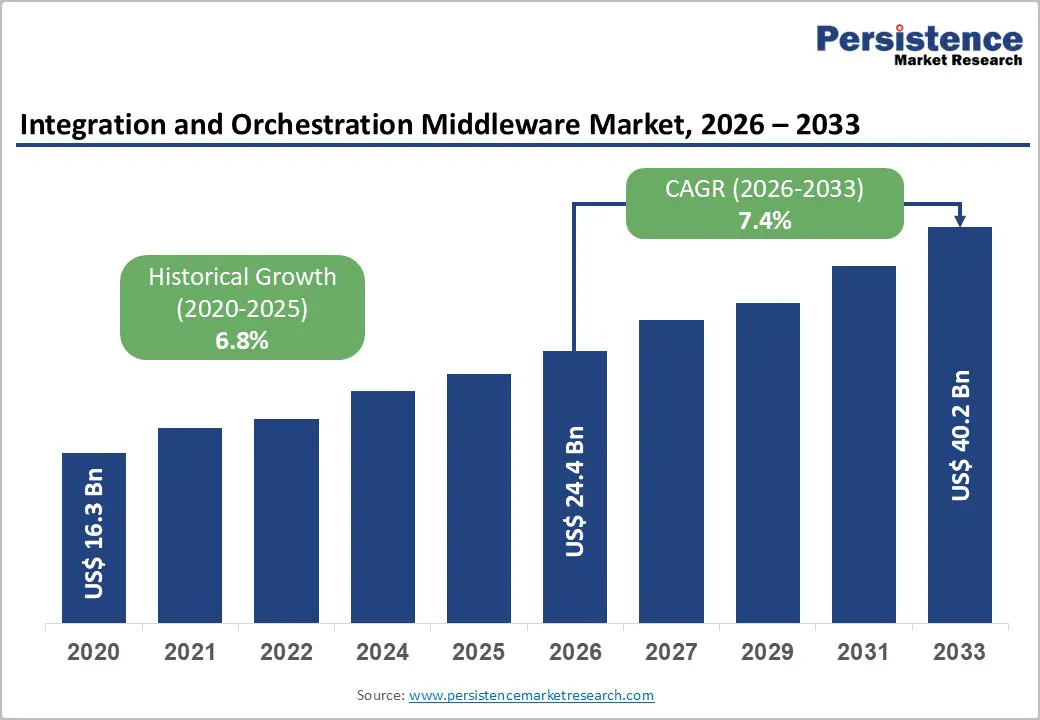

The Global Integration and Orchestration Middleware Market was valued at US$24.4 billion in 2026 and is projected to reach US$40.2 billion by 2033, growing at a CAGR of 7.4% during this forecast period, 2026 to 2033.

The market expansion is primarily driven by accelerating digital transformation across enterprises, widespread adoption of microservices architectures, and the proliferation of cloud-based business applications requiring seamless system connectivity. As enterprises increasingly deploy hybrid and multi-cloud environments, the demand for robust integration solutions continues to grow. The transition from monolithic systems to distributed cloud-native architectures has created a structural shift in how organisations manage application connectivity and data orchestration across their technology landscapes.

| Key Insights | Details |

|---|---|

| Integration and Orchestration Middleware Market Size (2026E) | US$ 24.4 Bn |

| Market Value Forecast (2033F) | US$ 40.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.8% |

Digital transformation has become a critical strategic imperative for organisations globally, fundamentally reshaping how businesses operate and deliver customer value. This transformation encompasses modernising legacy infrastructure, adopting cloud platforms, and enabling real-time data exchange across disparate systems.

The Market has emerged as a cornerstone technology for enterprises executing these transformation strategies, facilitating seamless communication between cloud-based applications, on-premises systems, and emerging digital channels. Digital transformation in the Banking, Financial Services & Insurance sector is expanding. This explosive growth reflects enterprises' urgent need for middleware solutions that can bridge legacy infrastructure with modern cloud architectures.

The integration of the middleware sector directly benefits from this transformation momentum as organisations require sophisticated tools to connect ERP systems, CRM platforms, cloud services, and third-party applications in real-time. Manufacturing organizations, particularly those pursuing Industry 4.0 initiatives, are deploying middleware to connect shop-floor operational technology with enterprise IT systems, enabling predictive maintenance and optimised production workflows. Government agencies are similarly investing in middleware to consolidate fragmented systems and deliver citizen-centric digital services with improved transparency and operational efficiency.

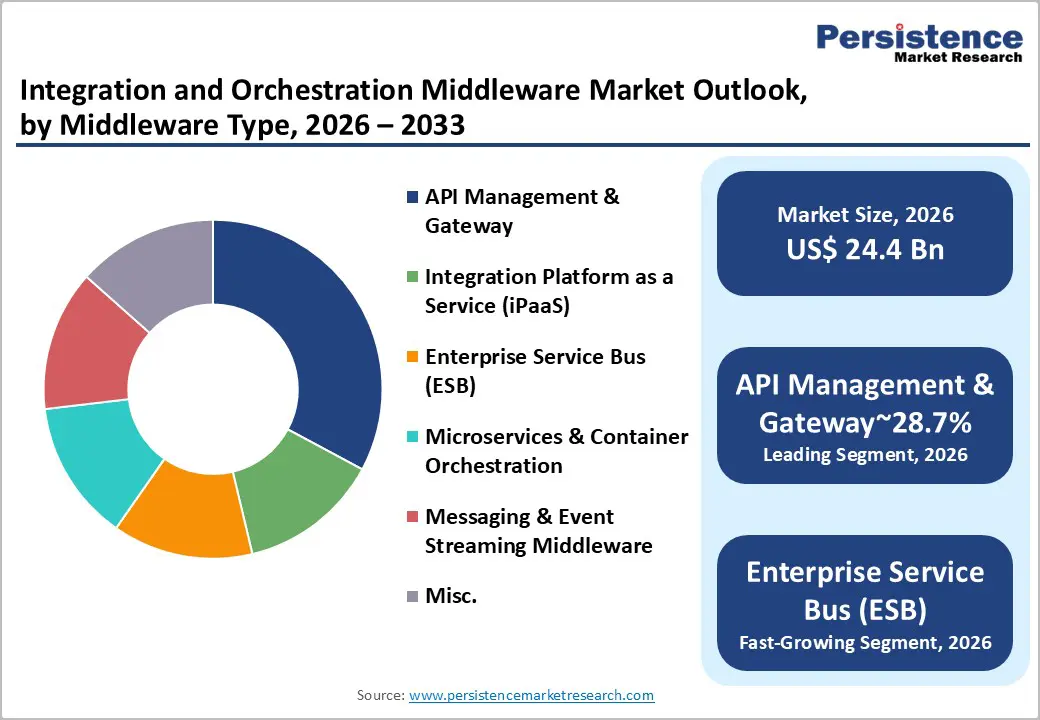

The shift toward microservices architecture represents a fundamental change in how enterprises design and deploy applications, with profound implications for the Integration and Orchestration Middleware Market. Unlike monolithic applications, where components are tightly coupled, microservices decompose applications into independently deployable services that communicate through well-defined APIs. This architectural pattern necessitates sophisticated middleware capabilities to manage service discovery, traffic routing, fault tolerance, and data consistency across distributed services. According to O'Reilly's microservices adoption research, 92 percent of enterprises have successfully deployed microservices in production environments, underscoring the widespread market penetration of this architectural paradigm. The API management component of the integration of the middleware market is particularly benefiting from this trend, with API gateways accounting for 28.7 percent of the global API management market share in 2025. These gateways serve as centralised hubs for controlling API traffic, enforcing security policies, monitoring performance metrics, and enabling real-time observability across distributed service meshes.

The Integration and Orchestration Middleware Market is experiencing accelerated demand as enterprises require middleware platforms that support containerised deployments, Kubernetes orchestration, serverless computing, and dynamic service scaling. In the Asia-Pacific, API management is driven by rapid digitalisation, the expansion of emerging market, and the widespread adoption of microservices by technology-forward enterprises seeking competitive differentiation through faster innovation cycles and improved operational agility.

Enterprise cloud strategies have evolved significantly from single-cloud commitments to sophisticated multi-cloud and hybrid cloud architectures, creating substantial demand for the Integration and Orchestration Middleware Market. Flexera's 2024 State of the Cloud Report indicates that 89 percent of enterprises employ multi-cloud strategies with an average of multiple public cloud providers, while 79 percent report already using multiple cloud providers, a figure increasing to 90 percent for cloud-mature organisations. This multi-cloud reality creates complex integration challenges as organisations must seamlessly connect applications, data, and services across different cloud platforms, on-premises infrastructure, and edge computing environments.

Middleware solutions are essential for achieving this level of integration complexity, enabling organisations to abstract underlying cloud-specific APIs and create unified governance frameworks for security, compliance, and data management. The hybrid cloud segment of the Integration and Orchestration Middleware Market is advancing, reflecting enterprises' preference for maintaining sensitive workloads on-premises while leveraging elastic public cloud capacity for scalability.

Privacy regulations such as GDPR require certain data to remain within specific geographic regions or data centres, making hybrid and sovereign cloud deployments necessary from a compliance perspective. Companies in financial services and healthcare are particularly reliant on middleware solutions that support hybrid architectures, enabling them to process sensitive data securely on-premises while leveraging cloud analytics for advanced insights and cost optimization.

The Integration and Orchestration Middleware Market faces significant headwinds due to the substantial complexity of deploying, configuring, and managing middleware platforms across heterogeneous enterprise environments. Organisations must integrate middleware with existing IT infrastructure, legacy systems with undocumented integrations, and custom-built applications with proprietary communication protocols. This complexity requires specialised expertise in middleware platforms, cloud architectures, security frameworks, and integration design patterns, which are in acute shortage across the global enterprise IT market. The implementation timelines for enterprise-grade middleware solutions often extend from several months to years, requiring substantial capital investment and diverting internal IT resources from other strategic initiatives.

Organizations report challenges in managing middleware throughout its lifecycle, including capacity planning, performance optimisation, security patching, and updates across distributed environments.

Artificial intelligence is fundamentally transforming the Integration and Orchestration Middleware Market by enabling intelligent data mapping, automated workflow optimisation, and predictive integration management. AI-powered middleware platforms can automatically discover data schemas, recommend optimal integration patterns, and detect integration failures before they impact business operations, significantly reducing manual configuration work and accelerating time-to-value. According to industry research, 83 percent of enterprises are leveraging APIs to increase ROI on their digital assets, with AI-enhanced API lifecycle management becoming an increasingly critical capability for maximising this value creation.

The emergence of AI-driven orchestration creates compelling opportunities for middleware vendors to differentiate themselves through intelligent automation capabilities. In March 2025, WSO2 introduced AI-enhanced API Management tools designed to automate API lifecycle management and optimise gateway operations, streamlining developer workflows and accelerating deployment velocity. These intelligent systems can analyse historical integration patterns, identify optimisation opportunities, and recommend architectural changes that improve performance and reduce operational overhead.

For the Integration and Orchestration Middleware Market, AI integration represents a pivotal opportunity to reduce implementation barriers, expand addressable markets by enabling SMEs to deploy sophisticated integration without extensive specialised expertise, and create new revenue streams through intelligent services and managed integration offerings. Organisations pursuing digital transformation are increasingly prioritising middleware solutions that incorporate AI capabilities, recognising that intelligent automation is essential for scaling integration efforts across thousands of applications and data sources.

The proliferation of Internet of Things devices and edge computing infrastructure is creating substantial new demand for the Integration and Orchestration Middleware Market, as enterprises must connect millions of distributed sensors, devices, and edge computing nodes to centralised business systems and cloud analytics platforms. Industrial IoT applications require middleware solutions that support event-driven architectures, real-time data streaming, low-latency processing, and bidirectional communication between operational technology layers and business-oriented IT systems. Manufacturing organisations pursuing Industry 4.0 initiatives are deploying middleware to integrate production equipment, robotics, quality control sensors, and supply chain systems, enabling predictive maintenance, optimised production scheduling, and real-time decision-making based on operational data.

Energy and utilities companies are leveraging middleware to manage data from smart grids, renewable energy sources, and distributed energy resources, requiring sophisticated orchestration of millions of data points and real-time control signals across complex operational networks. The OT/IT bridge concept, integrating operational technology with information technology, requires middleware platforms that can handle real-time data synchronisation, ensure data consistency, support multiple communication protocols, and bridge the architectural divide between industrial control systems and enterprise applications.

Healthcare organisations deploy IoT middleware to connect medical devices, patient monitoring equipment, and healthcare IT systems, enabling real-time patient monitoring, predictive diagnostics, and efficient management of medical equipment across hospital networks. For the Integration and Orchestration Middleware Market, the IoT and edge computing opportunity represents a significant expansion vector, as enterprises require middleware that can operate at the edge with minimal latency, support distributed deployment models, and intelligently aggregate data from millions of devices for transmission to cloud-based analytics platforms.

The API Management & Gateway segment commands the largest share of the Integration and Orchestration Middleware Market with 28.7% of market revenues in 2026, reflecting the centrality of APIs to modern enterprise architecture and digital business models. API gateways function as intelligent traffic directors, managing API requests, enforcing security policies, rate-limiting connections, and providing real-time performance monitoring and analytics. The dominance of this segment reflects enterprise recognition that APIs are essential infrastructure for digital transformation, partner ecosystem expansion, and monetisation of digital assets. API gateways now include advanced capabilities such as API versioning management, OAuth 2.0 and OpenID Connect authentication, request/response transformation, and sophisticated observability features enabling operators to detect anomalies and optimise performance.

The maturation of the API economy has accelerated adoption across industries, with enterprises recognising that API-first strategies enable faster innovation cycles, improved customer experiences, and operational efficiency gains. Cloud hyperscalers, including Microsoft, Amazon, and Google, have incorporated API management capabilities into their cloud platforms as core services, driving standardisation and widespread adoption.

Leading enterprises, including Coca-Cola, Barclays, and Unilever, have deployed MuleSoft's Anypoint Platform to connect applications and data across legacy systems, cloud environments, and devices, enabling rapid innovation and improved customer experience delivery. In February 2025, Boomi unveiled its enhanced API Management platform specifically designed to address "API sprawl", the challenge of managing growing numbers of APIs across complex enterprise environments. These enhancements included integration of APIIDA capabilities for federated API management and Mashery components for comprehensive API lifecycle management, positioning Boomi to compete aggressively in the API management segment.

The Banking, Financial Services & Insurance sector commands 24.5% of the Integration and Orchestration Middleware Market in 2026, reflecting the sector's critical dependence on seamless integration between legacy banking systems, modern cloud platforms, and emerging fintech applications. Financial institutions operate complex IT ecosystems spanning decades of accumulated systems, including mainframe-based core banking platforms, real-time payment systems, regulatory compliance infrastructure, and customer-facing digital channels. Middleware platforms are essential for BFSI organisations to integrate these disparate systems, enable real-time data synchronisation, and comply with stringent regulatory requirements around data governance, transaction logging, and cybersecurity.

India's BFSI sector exemplifies the integration infrastructure imperative within this industry, having grown 50-fold in market capitalization to reach Rs. 91,00,000 crore (US$1 trillion) in 2025 from Rs. 1,80,000 crore (US$20.28 billion) in 2005. This extraordinary growth has been accompanied by substantial modernisation of banking infrastructure, with organisations deploying middleware to connect legacy systems with fintech platforms, digital banking channels, and emerging technologies such as blockchain-based payment systems.

India's banking sector's gross non-performing assets declined from 5.8 percent in FY22 to 2.2 percent in FY25, reflecting improved asset quality management enabled partially by middleware-powered real-time risk monitoring and portfolio analytics. The financial sector's digital transformation is accelerating globally. BFSI organisations are deploying middleware to enable open banking initiatives, real-time payment systems such as Brazil's PIX system, API-first connectivity with fintech partners, and intelligent automation of back-office processes, including loan origination, claims processing, and customer onboarding.

The Retail & E-commerce sector represents the fastest-growing segment within the Integration and Orchestration Middleware Market, driven by explosive growth in online commerce, complex omnichannel retail operations, and the proliferation of direct-to-consumer brands requiring sophisticated integration capabilities.

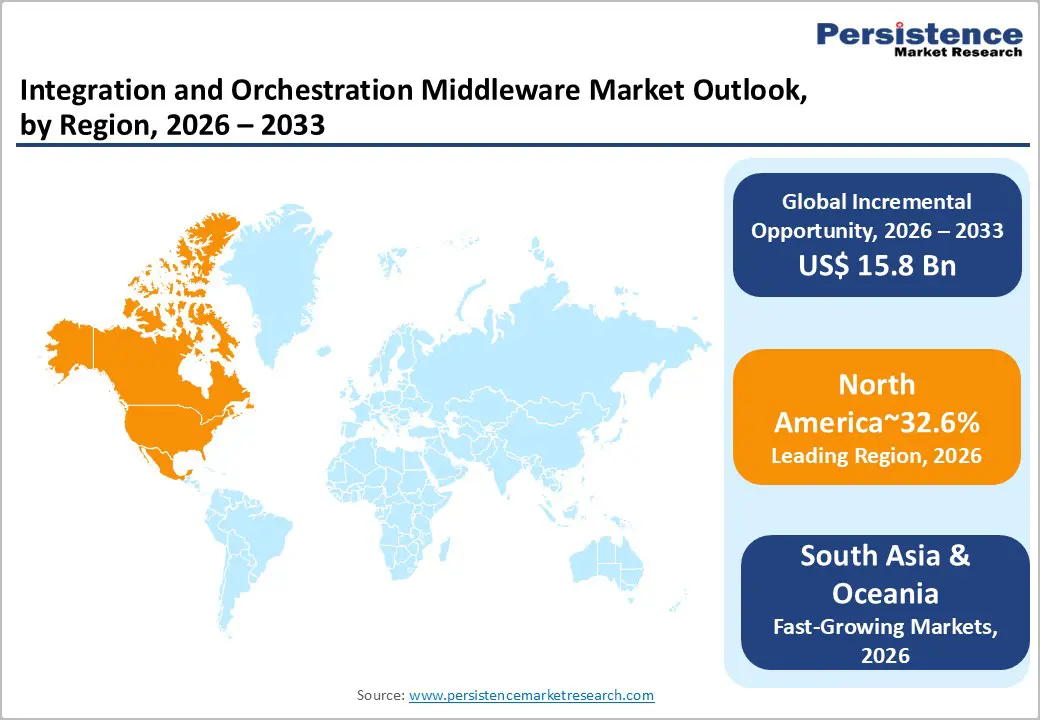

North America commands 32.6% of the global Integration and Orchestration Middleware Market, reflecting the region's mature digital infrastructure, advanced enterprise IT investments, and concentration of technology-forward organizations. The United States maintains a particularly dominant position, driven by aggressive digital transformation initiatives across industries, widespread cloud adoption by enterprises, and substantial capital allocation toward integration infrastructure modernization. According to market research, the U.S. middleware market is characterised as mature and innovation-led, with significant adoption across finance, healthcare, retail, and government sectors where large legacy estates must interoperate with cloud-native services.

North America's dominance reflects the region's early adoption of cloud technologies, with major enterprises achieving high penetration of platform-as-a-service, infrastructure-as-a-service, and software-as-a-service offerings. The API management market is particularly robust in North America, with 80.10 percent of the market deployment occurring in cloud environments, reflecting enterprises' confidence in managed cloud services and vendor-provided integration infrastructure. Integration platform-as-a-service adoption is accelerating, driven by SME growth and the proliferation of SaaS applications requiring sophisticated cloud-based integration orchestration.

The market in North America is propelled by aggressive cloud migration initiatives, as enterprises systematically modernise legacy ERP monoliths into microservices-based architectures deployed across multiple cloud providers. Regulatory-driven data integration requirements, particularly around financial data privacy (GLBA), healthcare data protection (HIPAA), and emerging privacy regulations, have created mandated demand for middleware solutions ensuring data governance, audit trails, and compliance across distributed environments. Large enterprises are investing heavily in API platforms and service meshes, recognising these as essential infrastructure for supporting modern application delivery models, including microservices, serverless computing, and containerised workloads. The region's dominant technology companies, including Microsoft, Amazon, and Google, are embedding API management and integration capabilities into their cloud platforms as core services, driving standardisation and expanding addressable markets.

East Asia represents 20% of the global Integration and Orchestration Middleware Market and is experiencing accelerated growth driven by rapid digital economy development, substantial government investments in cloud infrastructure, and aggressive Industry 4.0 initiatives. China's technology sector demonstrates particular dynamism, with extensive state-sponsored cloud infrastructure investments, government mandates for digital transformation across government agencies, and enterprise adoption of integration technologies supporting export-oriented manufacturing and emerging digital service sectors.

China's financial sector exemplifies the integration infrastructure imperative, with total banking assets reaching RMB 467.3 trillion, up 7.9 percent year-on-year as of Q2 2025, while insurance assets expanded 9.2 percent to RMB 39.2 trillion. These sectors are deploying sophisticated middleware to integrate banking systems serving 1.4 billion plus customers, process real-time payment volumes exceeding global averages, and manage complex regulatory requirements around capital adequacy and loan classification. Inclusive lending initiatives extending financial services to micro and small enterprises drive middleware adoption for connecting traditional banking infrastructure with digital lending platforms and fintech partners.

Europe represents 22% of the global Integration and Orchestration Middleware Market and is characterised by an emphasis on data sovereignty, compliance, and interoperability across cross-border enterprise networks. The European Union's stringent regulatory requirements around data protection (GDPR), privacy, and data localisation have profoundly shaped middleware technology selection and deployment architectures. Organisations operating across multiple European countries must ensure that integration middleware enforces data residency requirements, enables data transfers compliant with Standard Contractual Clauses, and provides audit capabilities satisfying regulatory authorities' oversight requirements.

Europe's information and communication services sector demonstrates substantial economic significance, with approximately 1.4 million enterprises employing 7.2 million people and generating €667 billion in value added as of 2022. This sector's high productivity levels, that is, €92,800 apparent labour productivity per person, reflect the region's advanced digital infrastructure and sophisticated software services ecosystem. The European banking sector, holding €43.6 trillion in total assets with €26.8 trillion in outstanding loans, requires sophisticated middleware to integrate cross-border payment systems, regulatory reporting requirements, and customer-facing digital channels across multiple legal entities.

The Integration and Orchestration Middleware Market exhibits consolidated market characteristics, with competitive dynamics concentrated among a small number of major vendors controlling substantial market share through established technology platforms, extensive partner ecosystems, and deep enterprise customer relationships. The market structure is dominated by IBM, Oracle, Microsoft, TIBCO Software, MuleSoft (Salesforce), SAP, and innovative private companies, including Dell Boomi, Informatica, and WSO2. These leading players maintain comprehensive platform offerings spanning API management, iPaaS, event streaming, microservices orchestration, and data integration capabilities, enabling them to serve diverse customer requirements across industries and use cases.

Competitive positioning reflects significant barriers to entry, including technological complexity, customer lock-in effects, substantial capital requirements for R&D and go-to-market activities, and the importance of pre-built connectors and industry-specific integration templates.

The global Integration and Orchestration Middleware Market is projected to be valued at US$ 24.4 Bn in 2026.

The API Management & Gateway segment is expected to account for approximately 24.8% of the Global Integration and Orchestration Middleware Market by Middleware Type in 2026.

The market is expected to witness a CAGR of 7.4% from 2026 to 2033.

The Integration and Orchestration Middleware Market is driven by large-scale digital transformation initiatives across industries, fueled by cloud adoption, API-led microservices architectures, and the accelerating shift toward multi-cloud and hybrid environments.

Key opportunities in the Integration and Orchestration Middleware Market include AI-driven orchestration and intelligent automation, plus expanding demand for IoT and edge computing integration to support real-time, distributed, and large-scale connected ecosystems.

Key players in the Integration and Orchestration Middleware Market include OpenText Corporation, IBM Corporation, Oracle Corporation, Microsoft Corporation, TIBCO Software Inc., Infor, Covisint, SWIFT, SPS Commerce, Inc., and Axway, with the leading competitive presence typically held by OpenText, IBM, Oracle, Microsoft, TIBCO, and Axway.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Middleware Type

By Deployment Mode

By Enterprise Size

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author