ID: PMRREP33697| 188 Pages | 24 Nov 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

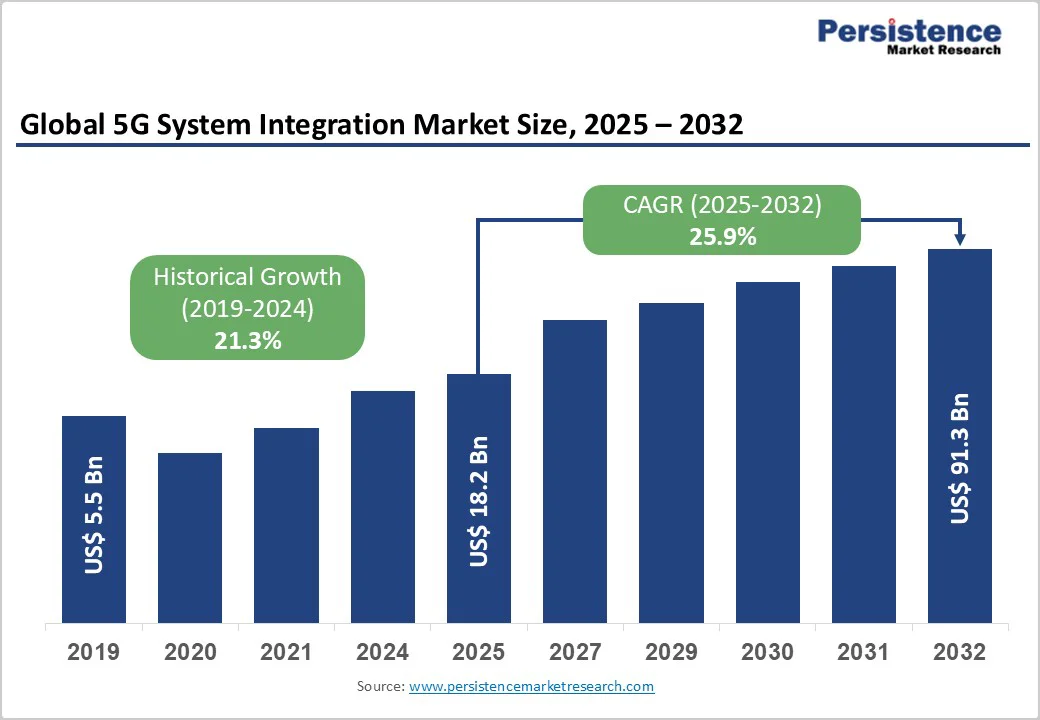

The global 5G system integration market size is value at US$18.2 billion in 2025 and projected to reach US$91.3 billion at a CAGR of 25.9% during the forecast period from 2025 to 2032.

The growth is driven by the rising demand for ultra-high-speed, low-latency connectivity to support Industry 4.0, autonomous vehicles, smart healthcare, and IoT-enabled smart cities. Telecom operators and system integrators are collaborating to provide customized 5G solutions for efficient network deployment and enhanced reliability. The increasing focus on managed services and network optimization is creating significant opportunities for value-added 5G integration services.

| Key Insights | Details |

|---|---|

| 5G System Integration Market Size (2025E) | US$18.2 Bn |

| Market Value Forecast (2032F) | US$91.3 Bn |

| Projected Growth (CAGR 2025 to 2032) | 25.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 21.3% |

The surge in data-intensive and real-time enterprise applications has elevated connectivity to a strategic imperative, with organizations demanding sub-millisecond latency, ultra-reliable links, and bandwidth beyond 4G. Industry 4.0 adoption in manufacturing, remote surgery, and patient monitoring in healthcare, and autonomous vehicle operations rely on 5G’s deterministic, mission-critical performance.

Companies report 30-40% efficiency gains and up to 40% cost reduction through 5G integration. According to the Nokia 5G report, energy and manufacturing sectors show the highest 5G awareness, with 83% of businesses valuing video monitoring and 48% identifying 5G-enabled video as an immediate opportunity. These benefits are driving significant investments in 5G system integration services, expanding IT spending by billions annually.

The global IoT market is rapidly expanding, with GSMA Intelligence forecasting over 38.7 billion IoT connections by 2030, with enterprises accounting for more than 63% of these connections, and Ericsson reporting ~3.9 billion cellular IoT connections and ~18.8 billion total IoT connections in 2024, projected to reach ~43 billion by 2030.

Traditional centralized data processing struggles to meet the low-latency, real-time requirements of sensor-heavy manufacturing plants, smart cities, and supply chain operations. 5G-enabled edge computing brings processing closer to IoT devices, eliminating bandwidth bottlenecks.

Enterprises are leveraging these solutions for real-time asset tracking, autonomous warehouses, traffic optimization, energy management, and public safety automation, creating strong growth opportunities for 5G system integrators.

Government-backed initiatives and regulatory mandates are accelerating 5G system integration globally. The U.S. Federal Communications Commission allocated US$9 billion via the 5G Fund for Rural America, while the EU’s CEPT is harmonizing spectrum allocation in the 694-790 MHz band to enable standardized cross-border deployment.

Asian countries such as China, Japan, and South Korea have rolled out comprehensive 5G policies with substantial capital commitments for infrastructure modernization. These efforts reduce integration complexity, lower deployment costs, and establish compliance frameworks, enabling enterprises and smaller operators to adopt faster 5G services economically.

5G system integration involves high technical complexity, requiring seamless coordination of multi-vendor network components, cloud-native applications, and legacy systems. Enterprises face interoperability challenges, network slicing automation issues, and cybersecurity risks due to expanded attack surfaces from virtualization, edge computing, and massive device connectivity.

Skilled professionals are in short supply, increasing labor costs and slowing deployment. Integration failures or security breaches cause substantial financial losses and reputational damage, making organizations cautious about aggressive 5G adoption. For example, European operators reported increased costs and delays when integrating standalone 5G cores across heterogeneous networks in 2024.

Private 5G networks are emerging as a high-growth segment, allowing enterprises to deploy secure, controllable connectivity independent of public carriers. Multinational corporations leverage private 5G across facilities for mission-critical operations with deterministic performance, while public sector institutions adopt it for defense, government, and critical infrastructure protection.

Campus networks, industrial parks, and geographic corridors further expand deployment opportunities, complementing public 5G services. As of March 2025, GSA reports 1,714 private LTE/5G networks globally, with 626 operators in 187 countries testing or deploying 5G, and 349 operators in 131 countries offering commercial 5G.

Healthcare is the fastest-growing vertical in the 5G system integration market, with projected CAGR exceeding 30.1% through 2032, driven by remote surgery, telemonitoring, real-time imaging, and autonomous diagnostics requiring low-latency, high-reliability connectivity. European clinical trials validate 5G-enabled remote surgical procedures, showing improved diagnostic accuracy, faster treatment response, and enhanced patient outcomes.

Regulatory support for telemedicine market and healthcare modernization initiatives across developed and developing economies creates a market opportunity of US$12-15 billion through 2032. Projects like 5G Mobile Healthcare Innovative solutions 5GMHI, 2024-2026, €8.5 million budget exemplify EU investment in 5G-enabled healthcare use cases.

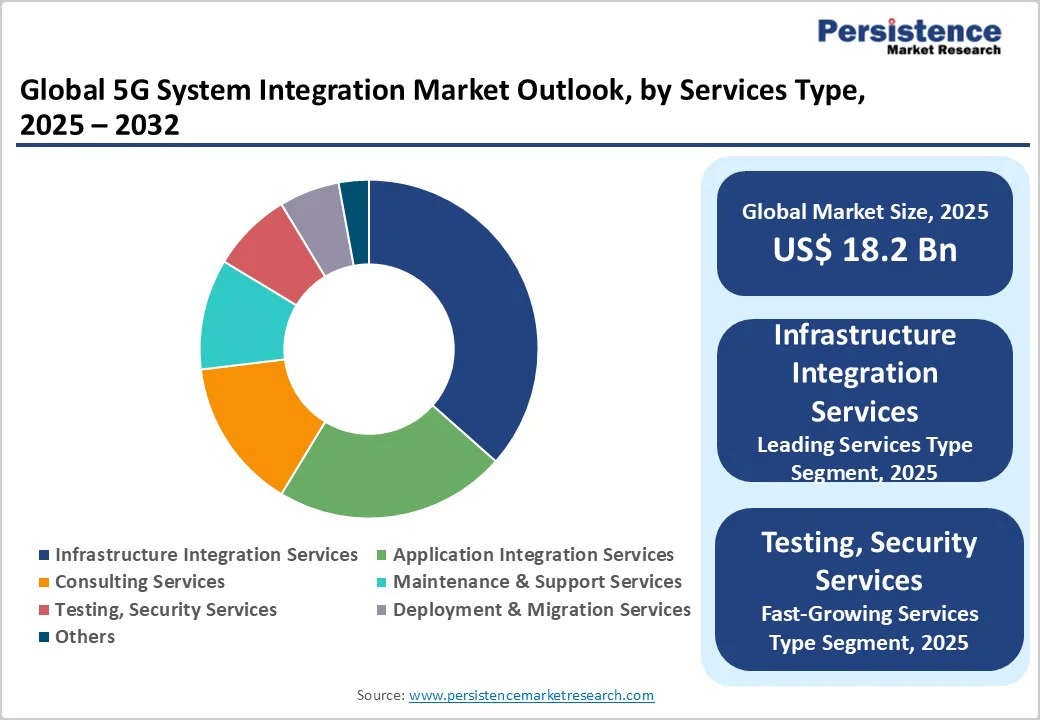

Infrastructure integration services are expected to account for more than a 38% share in 2025, with a value exceeding US$ 6.9 billion, reflecting enterprises’ prioritization of foundational connectivity infrastructure modernization.

These services address critical needs such as network densification, spectrum management, backhaul optimization, and multi-vendor equipment integration. With rising demand for low-latency, high-bandwidth applications like IoT, AI, and cloud services, infrastructure integration ensures reliable, end-to-end connectivity while reducing deployment complexity and operational risks.

Testing, security services are projected to grow rapidly with a CAGR of 23.9%, due to the critical need for network reliability and protection against sophisticated cyber threats. As 5G supports mission-critical applications like autonomous vehicles, remote surgery, and industrial automation, comprehensive testing ensures seamless performance, while robust security services safeguard sensitive data and prevent network breaches.

The increasing complexity of 5G networks drives demand for specialized solutions that validate network integrity and maintain trust across verticals.

Large enterprises are expected to account for over 60% of the market share in 2025 due to their critical need for high-speed and reliable connectivity to support complex operations. They require seamless integration of 5G for real-time data analytics, automation, and enhanced operational efficiency. Security, scalability, and customized solutions are essential for their mission-critical applications.

Large enterprises also have the financial capacity to invest in end-to-end 5G solutions, ensuring faster deployment and higher ROI compared to smaller organizations. Their focus on digital transformation and maintaining a competitive advantage further drives adoption.

Small and medium enterprises will grow at the highest rate, driven by declining integration solution costs, consumption-based pricing models, and vendor financing options, reducing capital barriers.

Cloud-based integration platforms, managed services delivery models, and shared infrastructure approaches enable SMEs to access 5G capabilities previously requiring prohibitive capital investments. Shared spectrum models and neutral-host infrastructure approaches reduce entry barriers substantially, expanding the addressable market.

IT & Telecom is expected to account for more than 32% share in 2025, with a value exceeding US$ 5.8 billion due to its critical need for ultra-reliable, high-speed connectivity to support massive data traffic and complex network infrastructures. Telecom operators require seamless integration of 5G core, edge computing, and network slicing to enable new services such as enhanced mobile broadband, IoT, and private networks.

IT service providers need advanced 5G solutions to manage cloud migration and real-time enterprise applications. The sector’s constant demand for network modernization, low-latency performance, and scalable infrastructure drives its dominant market share.

Manufacturing will grow at a CAGR of 27.6%, due to its need for ultra-reliable, low-latency connectivity to enable smart factories, real-time automation, and predictive maintenance. 5G supports massive IoT deployments, allowing seamless communication between machines, robots, and sensors. It also facilitates AR/VR-based training, remote monitoring, and digital twins, driving efficiency and reducing downtime.

Rising demand for Industry 4.0 adoption further accelerates 5G integration in manufacturing.

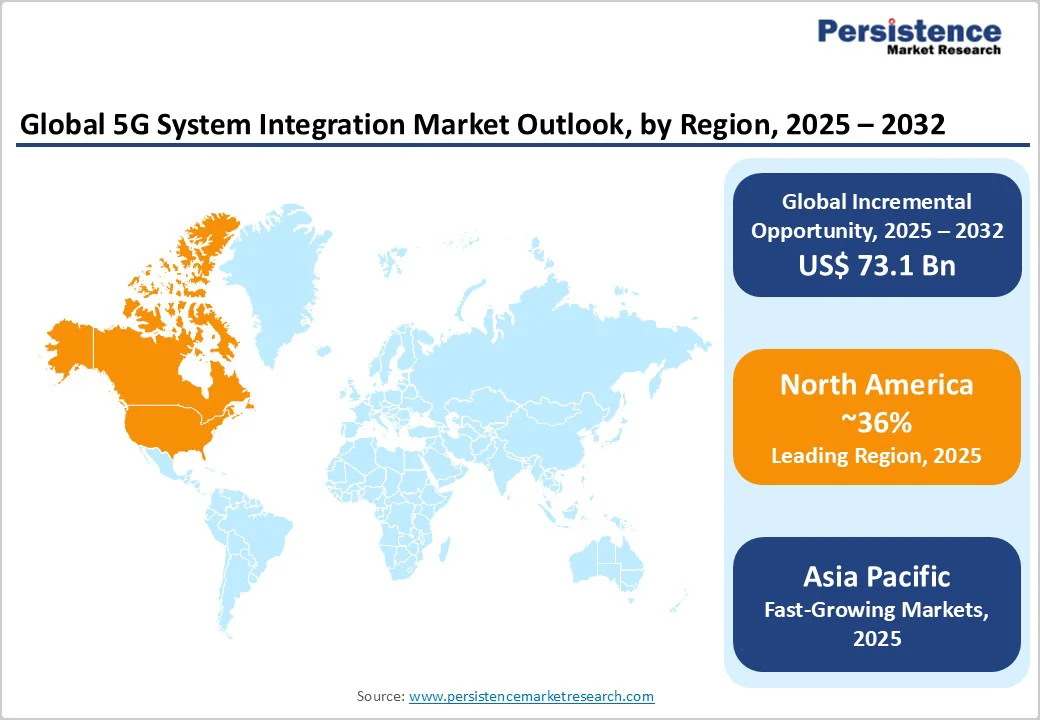

North America is expected to hold over 36% market share by 2025 & is projected to exceed the value US$23 billion by 2032. The U.S. leads due to a strong technology ecosystem, high enterprise IT spending, and government support, including the FCC’s US$9 billion rural 5G fund, while Canada’s ICT sector generated US$298 billion in 2024, accounting for about 5.8% of GDP.

Regulatory focus on spectrum efficiency and security, alongside nationwide 5G roll-outs, drives integration of legacy and next-gen systems. Strategic investments by Accenture, Cisco, and regional carriers in 5G integration capability establishment underpin North American market leadership. By end 2024, North America had over 182 million 5G connections, with the U.S. median SA download speed reaching 388.44 Mbps, highlighting growing demand for system integration.

Asia Pacific is the fastest-growing 5G system integration market, with a CAGR of 31.5%, expected to exceed US$28 Bn by 2032. China leads with 4.39 million 5G base stations by March 2025 and 75.9% 5G user penetration, driven by government deployment initiatives, Industry 4.0 adoption, and telecom scale.

Japan focuses on private 5G networks for advanced manufacturing and healthcare innovation, while South Korea leverages telecom leadership and manufacturing excellence. India’s 5G data traffic tripled in 2024 to ~7.6 exabytes/month, supported by IT services growth and digital infrastructure investments noted by the Nokia MBIT report.

ASEAN nations offer emerging opportunities through rapid industrialization, cost-efficient manufacturing, talent availability, and supportive government policies, with regional and global providers competing to deliver integrated 5G solutions.

The European market is rapidly expanding with a CAGR of 24.8%, driven by regulatory harmonization, GDPR compliance, and Industry 4.0 adoption in manufacturing. Germany leads with advanced automotive integration, and Telekom Deutschland achieved ~99 % population 5G coverage by October 2025, while the UK leverages healthcare digitalization, financial modernization, and smart city projects.

France focuses on digital sovereignty with ~94.3% coverage in 2024, including ~77.9% in rural households, supported by strategic investments in European technology providers. Spain combines growing manufacturing integration demand with telecom modernization.

Rising demand for higher data volumes, ultra?low latency, and massive IoT is accelerating the shift from 4G/4.5G to standalone 5G, with Europe’s mobile 5G usage rising from 32.8% in Q2 2024 to 44.5% in Q2 2025.

The 5G system integration market is highly fragmented, with numerous service providers competing to deliver end-to-end 5G integration solutions. They are forming strategic partnerships with telecom operators, IT service providers, and enterprise clients to expand their service offerings.

Companies are focusing on customized 5G solutions and managed services for verticals such as healthcare, manufacturing, and transportation. Competitive pricing, rapid deployment, and strong after-sales support are leveraged to attract and retain clients.

The global 5G system integration market is projected to be valued at US$18.2 Bn in 2025.

The need for ultra-reliable, high-speed connectivity to support complex network infrastructures, massive data traffic is a key driver of the market.

The market is poised to witness a CAGR of 25.9% from 2025 to 2032.

Rising deployment of edge computing and network slicing, which require specialized 5G integration services to optimize performance, is creating strong growth opportunities.

Cisco Systems, Inc., Huawei Technologies Co., Ltd., Ericsson AB, Nokia Corporation, Infosys Limited are among the leading key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Services Type

By Enterprise Size

By Vertical

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author