ID: PMRREP10876| 185 Pages | 19 Sep 2025 | Format: PDF, Excel, PPT* | Industrial Automation

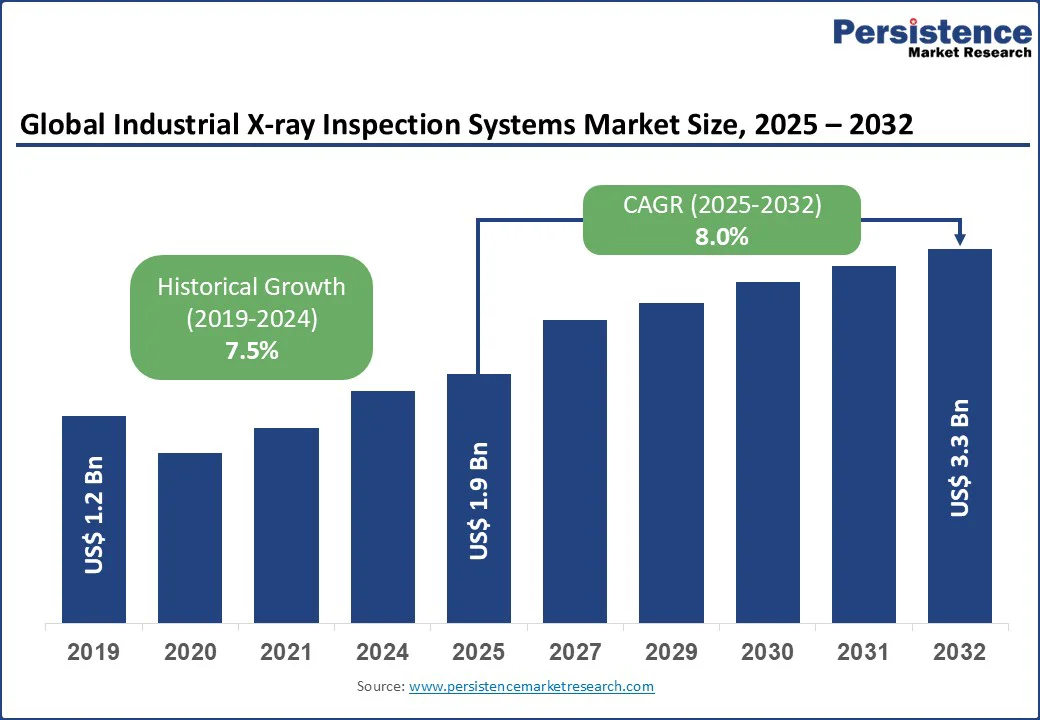

The global Industrial X-ray Inspection Systems Market size is likely to be valued at US$ 1.9 Bn by 2025, and estimated to reach at US$ 3.3 Bn by 2032, with growing at CAGR of 8.0% during the forecast period from 2025 to 2032 driven by the increasing demand for non-destructive testing (NDT) solutions, advancements in digital imaging technologies, and the growing adoption of automation in manufacturing.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

|

Industrial X-ray Inspection Systems Market Size (2025E) |

US$1.9 Bn |

|

Market Value Forecast (2032F) |

US$3.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

8.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.5% |

The global push for stringent quality and safety regulations across industries such as aerospace, automotive, and food & beverage is a primary driver for the industrial x-ray inspection systems market. Regulatory bodies such as the Federal Aviation Administration (FAA) in the U.S. and the European Union Aviation Safety Agency (EASA) enforce rigorous standards to ensure the reliability of critical components, such as turbine blades and composite materials in aerospace.

Similarly, the U.S. Food and Drug Administration (FDA) mandates strict contaminant detection protocols in the food & beverage industry, boosting the adoption of X-ray systems to identify foreign objects such as metal or glass. These regulations compel industries to invest in high-precision X-ray systems, ensuring compliance and minimizing risks of product recalls or safety violations.

The significant capital investment required for advanced X-ray inspection systems, particularly computed tomography (CT) systems, poses a major restraint. These systems, which offer high-resolution 3D imaging, are costly, making them unaffordable for small and medium-sized enterprises (SMEs). Additionally, maintenance costs, including calibration and software upgrades, further deter adoption among smaller players, particularly in cost-sensitive regions, slowing market growth in developing economies.

Regular maintenance, calibration, and periodic software upgrades are essential to ensure optimal performance and compliance with evolving industry standards. These recurring expenses significantly add to the total cost of ownership, straining the resources of smaller companies. As a result, SMEs often resort to less advanced or conventional inspection methods, which, while more affordable, compromise on inspection accuracy and efficiency.

Rapid industrialization in emerging economies such as India, China, and Brazil presents a significant growth opportunity for the Industrial X-ray Inspection Systems Market. Government initiatives promoting domestic production and quality control, coupled with increasing foreign direct investments, drive demand for X-ray systems.

The expanding electronics market, particularly for semiconductors and printed circuit boards (PCBs), and the growing aerospace sector in these regions offer untapped investment potential. Rising awareness among manufacturers about the long-term benefits of quality assurance, coupled with the growing need to comply with international safety certifications, is accelerating the adoption of advanced inspection technologies. This creates a lucrative landscape for global and regional X-ray system manufacturers to expand their presence through partnerships, localized production, and cost-effective solutions tailored to the needs of emerging markets.

Hardware dominates, holds a 55% market share in 2025, due to the critical role of X-ray tubes, detectors, and imaging systems in delivering high-precision inspections. The aerospace and automotive sectors rely heavily on robust hardware to detect micro-defects in complex components such as turbine blades and engine parts, ensuring reliability and safety. Hardware’s compatibility with automated production lines further strengthens its position as the leading segment.

Software is the fastest-growing component segment, driven by the rise of AI-driven image analysis and defect recognition tools. These software solutions enhance inspection accuracy, reduce human error, and enable real-time data processing, making them highly valuable in electronics and manufacturing. The shift toward cloud-based software platforms supports scalability, further fueling growth in this segment.

Aerospace leads the application segment, holding a 25% market share in 2025, driven by the critical need for non-destructive testing of complex components such as turbine blades, composite materials, and landing gear. Stringent regulations mandate rigorous inspections to prevent failures, with major aerospace manufacturers investing heavily in X-ray systems to ensure quality and compliance.

Electronics is the fastest-growing application segment, fueled by the rising production of semiconductors, printed circuit boards (PCBs), and consumer devices. The need for precise inspection of densely packed circuits drives demand for X-ray systems, particularly in regions with robust electronics manufacturing ecosystems.

Digital radiology dominates the imaging technique segment, accounting for 50% share in 2025, due to its real-time imaging capabilities, cost-effectiveness, and reduced processing times compared to film-based systems. Its compatibility with automated workflows and ability to deliver high accuracy make it the preferred choice for industries such as manufacturing and aerospace.

Computed tomography (CT) is the fastest-growing imaging technique, driven by its ability to provide detailed 3D imaging for complex components. Its high precision makes it ideal for aerospace and automotive applications, where intricate inspections are required to ensure the integrity of lightweight materials and advanced structures.

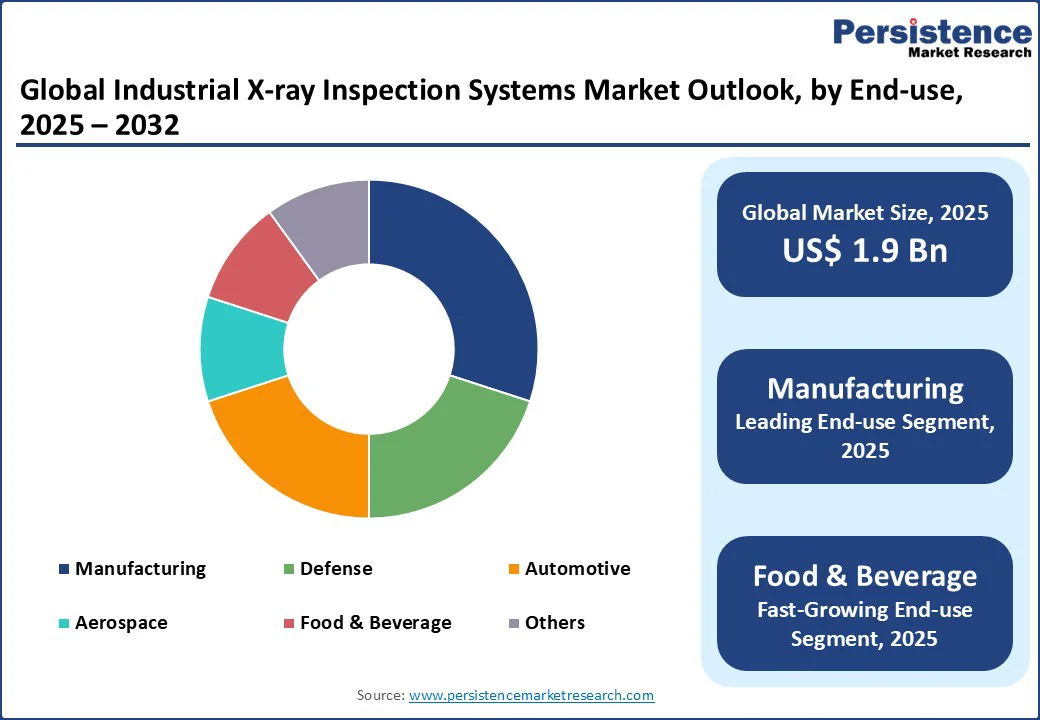

Manufacturing leads the end-use segment, which is expected to account for a 30% share in 2025, driven by the widespread adoption of X-ray systems for quality control and defect detection across industries such as automotive, electronics, and heavy machinery. The need for consistent quality assurance and compliance with international standards fuels this segment’s dominance. The segment’s growth is supported by the increasing automation of production lines and the need for consistent quality assurance.

Food & Beverage is the fastest-growing end-use segment, driven by stringent food safety regulations requiring contaminant detection. The segment is driven by stringent food safety regulations, such as those enforced by the FDA and European Food Safety Authority (EFSA), which require contaminant detection in food products. X-ray systems ensure consumer safety by identifying foreign objects in food products, supporting the growing demand for packaged and processed foods.

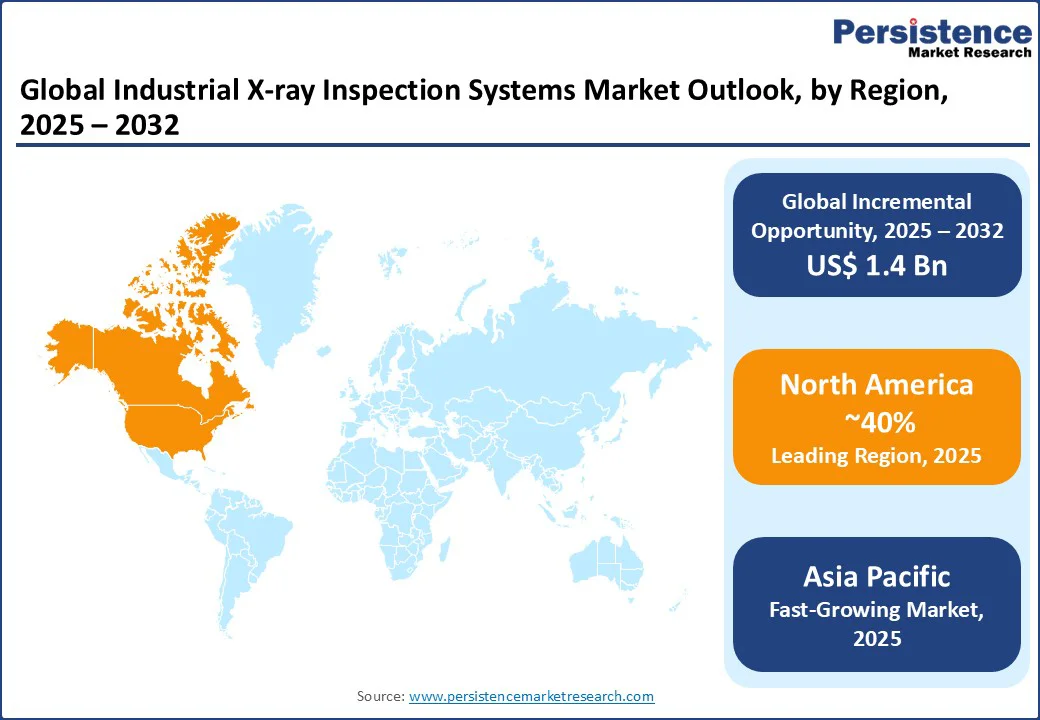

North America is projected to have a 35% share in 2025, driven by its advanced manufacturing infrastructure and stringent regulatory standards. The region’s leadership is supported by significant investments in aerospace, defense, and food & beverage industries, which prioritize quality assurance and compliance. The U.S. leads due to its robust aerospace and defense sectors, with companies such as Boeing and Lockheed Martin relying on X-ray systems for component inspection. The food & beverage industry’s focus on safety compliance, driven by FDA regulations, further boosts demand. The U.S.’s adoption of automation and Industry 4.0 technologies strengthens its position as a market leader.

In the U.K, the demand for X-ray systems to inspect engine components and composite materials. The country’s emphasis on sustainable manufacturing and compliance with EASA regulations supports market growth. The food & beverage sector’s focus on safety standards also contributes to the adoption of X-ray systems.

Europe holds the 30% market share, with leading countries including Germany, France, and the U.K. The region’s growth is driven by its strong aerospace and automotive industries, which prioritize precision engineering and regulatory compliance. Germany’s automotive and aerospace sectors, led by Airbus and BMW, fuel demand for X-ray systems. The country’s focus on Industry 4.0 and precision engineering drives the adoption of advanced inspection technologies, particularly for lightweight materials such as carbon composites. France’s aerospace industry, with companies such as Safran and Airbus, supports market growth. Investments in sustainable technologies, such as eco-friendly X-ray systems, align with the region’s environmental goals, while the automotive sector’s focus on quality assurance further drives demand. Stringent EASA regulations, increasing demand for lightweight materials, and advancements in digital imaging technologies are key growth drivers in Europe.

Asia Pacific is the fastest-growing region, driven by rapid industrialization and expanding electronics manufacturing. The region’s growth is supported by government initiatives and increasing investments in manufacturing and aerospace sectors. China’s electronics and automotive industries, led by BYD and Huawei, drive demand for X-ray systems. The country’s focus on expanding its electronics market and improving manufacturing quality fuels the adoption of advanced inspection technologies. India’s manufacturing and aerospace sectors, supported by initiatives such as Make in India and companies such as Hindustan Aeronautics Limited (HAL), drive market growth. The increasing focus on quality control and infrastructure development further supports demand for X-ray systems. Rapid urbanization, government support for manufacturing, and the growing electronics market are key growth factors in Asia Pacific.

The global industrial X-ray inspection systems market is moderately consolidated, with global leaders and niche specialists competing across high-value sectors such as aerospace, automotive, and electronics. Key players such as Nikon Metrology, Comet Yxlon, and Nordson DAGE dominate with advanced CT and inline inspection solutions, while regional firms such as North Star Imaging, VJ Group, and Visiconsult address localized or cost-sensitive needs. Competition is increasingly shifting from hardware differentiation to software and analytics, with AI-driven defect recognition, automation, and process integration emerging as core value propositions.

Service offerings, including calibration, training, and inspection-as-a-service, have become critical revenue streams, especially as high upfront investment and total cost of ownership remain adoption barriers for SMEs. Strategic mergers and acquisitions are reshaping the landscape, enabling companies to expand their technological capabilities and strengthen aftermarket services. Overall, competitive dynamics are defined by innovation in CT technology, integration of digital inspection software, and tailored solutions for diverse end-user industries.

The global industrial X-ray inspection systems market is projected to reach US$1.9 Bn in 2025.

Stringent regulatory standards in aerospace, automotive, and food & beverage industries drive the market.

The industrial X-ray inspection systems market is expected to grow at a CAGR of 8.0% from 2025 to 2032.

Expansion in emerging markets such as India and China offers significant growth potential.

Nikon Metrology NV, YXLON International GmbH, Nordson DAGE, Thermo Fisher Scientific Inc., and Shimadzu Corporation are key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Component

By Application

By Imaging Technique

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author