ID: PMRREP29152| 165 Pages | 21 Aug 2025 | Format: PDF, Excel, PPT* | Industrial Automation

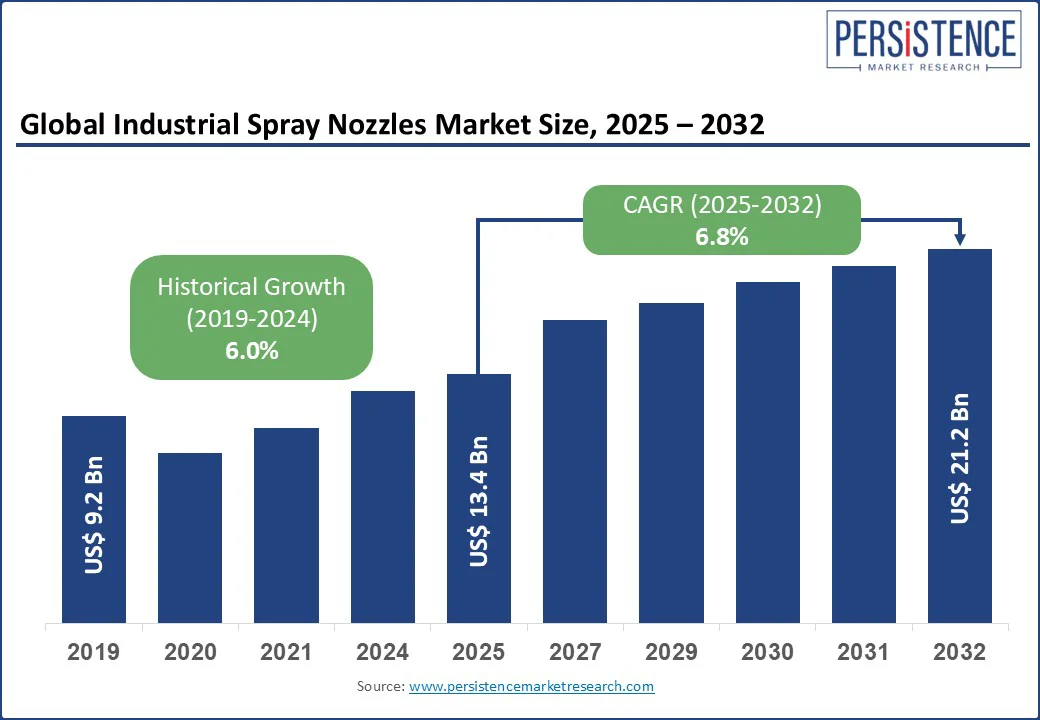

The global industrial spray nozzles market size is likely to be valued at US$13.4 Bn in 2025 and is expected to reach US$21.2 Bn by 2032, achieving a robust CAGR of 6.8% during the forecast period 2025 - 2032.

The industrial spray nozzle industry is expanding rapidly, driven by demand across manufacturing, agriculture, and chemical processing. Hydraulic nozzles are widely used due to their versatility in industrial cleaning, coating, and irrigation, while metal and ceramic nozzles are preferred for their durability and precision in demanding applications. Pneumatic nozzles are growing in popularity for spray cooling and gas scrubbing

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Industrial Spray Nozzles Market Size (2025E) |

US$13.4 Bn |

|

Market Value Forecast (2032F) |

US$21.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.0% |

The industrial spray nozzles market is propelled by several key factors, with a significant focus on increasing industrial automation and stringent environmental regulations, driving demand for water spray nozzles, flat spray nozzles, and full cone nozzles. The global industrial automation market grew by 10% in 2025, increasing demand for automated spraying solutions and precision spray nozzles for cleaning applications to enhance efficiency in industrial cleaning and washing.

A survey indicates that 65% of manufacturers prioritize energy-efficient spray systems, reducing water and energy consumption by 20%. Environmental regulations, such as the EU’s Water Framework Directive and EPA’s Clean Air Act, boosted the adoption of dust suppression systems and gas scrubbing nozzles by 18%, with 80% of oil and gas facilities complying in 2025.

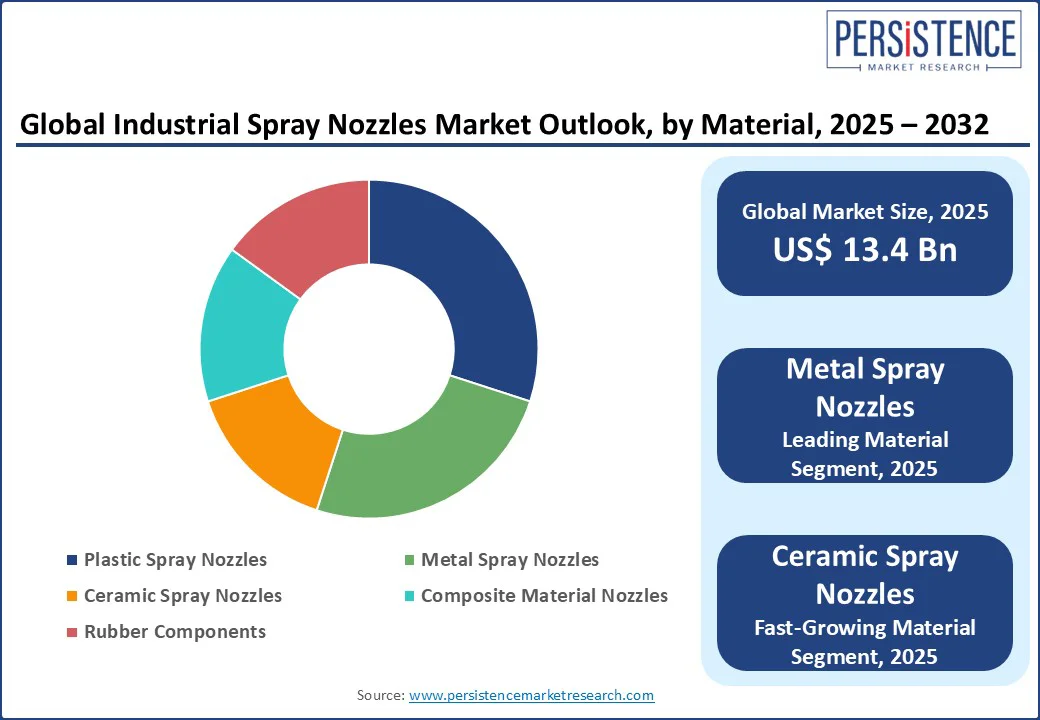

The global manufacturing sector, valued at US$15 Tn in 2025, supports coating and painting systems and spray cooling solutions, with 60% of production lines using spray heads and spraying tips. Industrial spray nozzle material selection and performance, particularly for ceramic spray nozzles, grew by 15%, driven by durability and corrosion resistance needs in industrial applications and the pharmaceutical sector, aligning with the market forecast for industrial spray nozzles 2025-2030.

High initial costs and maintenance requirements pose significant restraints to the industrial spray nozzles market, impacting liquid spraying devices and industrial cleaning systems. The cost of pneumatic spray nozzles and electric spray nozzles, ranging from US$500-5,000 per unit, deters small-scale industries, with 40% of SMEs opting for manual systems, per a 2025 survey.

Maintenance of industrial spray nozzles, particularly for ceramic spray nozzles and composite material nozzles, increases operational costs by 12% annually, due to wear and clogging issues. Regulatory complexities, such as compliance with oil and gas industry safety standards, raise costs for gas scrubbing nozzles by 10%.

Supply chain disruptions, with 15% cost increases in raw materials such as stainless steel and ceramics in 2025, further challenge industrial spray nozzle material selection and performance in price-sensitive markets such as Africa and parts of Latin America, constraining the scalability of automated spraying solutions.

The rise of precision agriculture and sustainable solutions presents significant opportunities for the industrial spray nozzles market. The global precision agriculture market is projected to grow at a CAGR of 12% through 2032, increasing demand for precision spray nozzles for cleaning applications and water spray nozzles in agricultural applications.

A 2025 study denotes that 25% of new agricultural equipment incorporates spray heads, boosting dust suppression systems by 18%. Energy-efficient spray systems, with 15% growth in food and beverages processing applications, align with sustainability goals.

Companies such as Spraying Systems Co. are investing US$200 million in R&D for automated spraying solutions and spray cooling solutions, targeting the agricultural and pharmaceutical sectors. Emerging markets, with 1 Bn new industrial consumers by 2030, offer opportunities for coating and painting systems and gas scrubbing nozzles, positioning industrial cleaning and washing as a key growth driver.

Hydraulic Spray Nozzles hold approximately 40% of the industry share in 2025 due to their versatility in industrial and agricultural applications, with 55% adoption in industrial cleaning systems. These nozzles operate under high-pressure liquid flow, making them ideal for industrial cleaning systems, surface coating, dust suppression, and irrigation. Their ability to deliver a precise, high-impact spray ensures effective cleaning and coating, which is critical in manufacturing plants, food processing facilities, and chemical industries.

Pneumatic Spray Nozzles are driven by spray cooling solutions and gas scrubbing nozzles, with 18% growth in 2025. These nozzles utilize compressed air to atomize liquids, allowing for fine, controlled sprays that are ideal for temperature control, dust suppression, and pollutant removal. Their precision reduces water and chemical consumption while maintaining high operational efficiency.

Industrial Applications hold a 35% market share in 2025, driven by industrial cleaning and washing and dust suppression systems, with 50% adoption in 2025. These applications are critical for maintaining operational efficiency, ensuring workplace safety, and complying with stringent environmental regulations. Spraying systems in industrial settings are employed for tasks such as removing debris, controlling airborne dust, and cleaning equipment surfaces, thereby reducing downtime and improving productivity.

Agricultural Applications are fueled by precision spray nozzles for cleaning applications, with 15% growth in 2025. These nozzles enable accurate delivery of water, fertilizers, and agrochemicals, which helps improve crop yields, reduce resource wastage, and minimize environmental impact. Precision spraying systems are particularly important for enhancing productivity, protecting crops, and supporting sustainable farming practices, as they allow farmers to target specific areas with minimal overspray.

Metal Spray Nozzles command a 45% market share in 2025, driven by industrial spray nozzle material selection and performance in the oil and gas industry, with 60% adoption in 2025. These nozzles are widely utilized in sectors such as oil and gas, chemical processing, and heavy manufacturing, where they must withstand high pressure, temperature extremes, and corrosive environments.

Ceramic Spray Nozzles are fueled by coating and painting systems, with 15% growth in 2025. These nozzles are highly valued for their exceptional wear resistance, chemical inertness, and ability to maintain performance under abrasive conditions, making them a preferred choice in industries where precision coating is essential, such as automotive, aerospace, and electronics.

End-use Insights

The manufacturing Industry holds a 30% market share in 2025, driven by industrial cleaning systems and gas scrubbing nozzles, with 50% adoption in 2025. With stringent environmental regulations and a rising focus on workplace safety, manufacturers are investing heavily in systems that reduce pollutants and enhance operational efficiency.

The agricultural Sector was fueled by precision spray nozzles for cleaning applications, with 12% growth in 2025. Precision spraying allows farmers to apply fertilizers, pesticides, and herbicides efficiently, reducing operational costs and improving yield quality. The shift toward mechanized farming and the increasing adoption of smart agriculture solutions further enhance the demand for advanced nozzles.

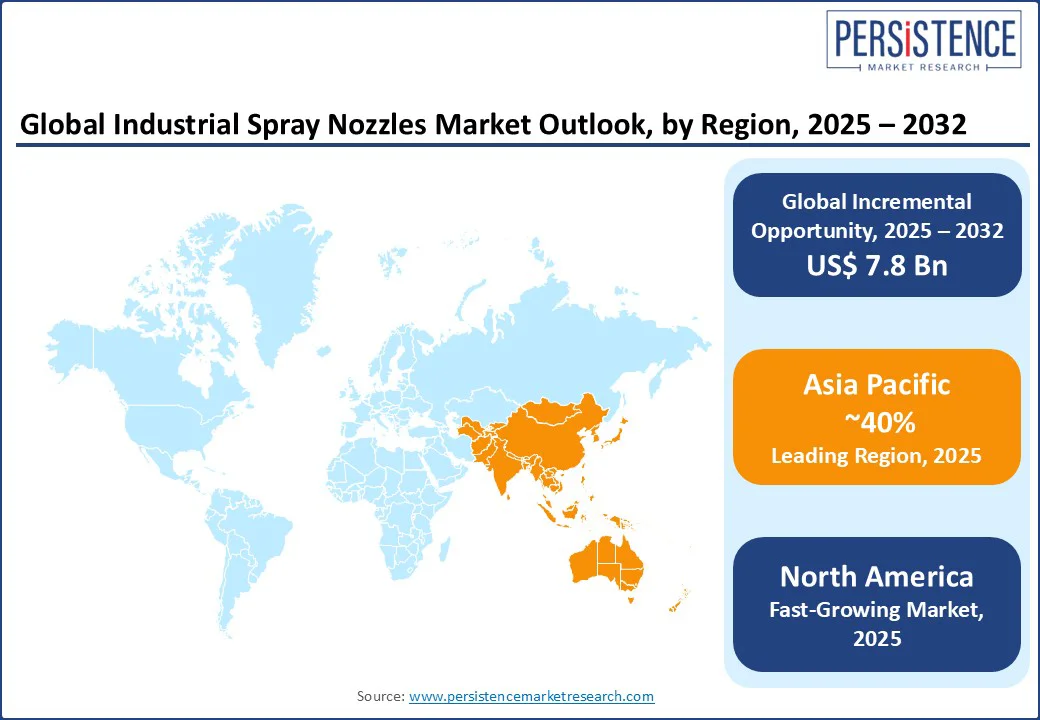

In North America, the industrial spray nozzles market holds a prominent position, commanding a 30% market share in 2025. The U.S. dominates due to its advanced manufacturing and agricultural sectors, with US$ 500 Bn in industrial output in 2025. The U.S. market is driven by industrial cleaning and washing, and coating and painting systems, with 70% of manufacturing facilities using flat spray nozzle in 2025.

Spray cooling solutions grew by 12%, supported by Spraying Systems Co. and Hunter Industries. Energy-efficient spray systems witness a 15% growth, aligning with sustainability goals. TeeJet and Lechler Inc. drive 25% of regional revenue, leveraging industrial spray nozzle material selection and performance.

In Europe, the industrial spray nozzles market accounts for a 30% market share, led by Germany, the UK, and France. Germany’s market is driven by industrial applications and gas scrubbing nozzles, with 60% of manufacturing plants using full cone nozzle in 2025.

The UK’s food and beverage processing applications support with spray heads adopted by Nestlé. France’s pharmaceutical sector drives 12% growth in precision spray nozzles for cleaning applications. EU environmental regulations boost 15% growth in dust suppression systems, with €120 Mn in funding for sustainable manufacturing in 2025 enhancing automated spraying solutions. Lechler leads with 10% market share.

Asia Pacific is the most prominently growing region, with a CAGR of 7.5%, led by China, India, and Japan. China holds a 45% regional market share, driven by a 25% increase in manufacturing output in 2025 boosting industrial cleaning systems and coating and painting systems. The push toward smart factories and automation is further enhancing the need for advanced spraying technologies to ensure precision and efficiency.

India’s market is fueled by agricultural applications and water spray nozzles, with 85% of new farming equipment using spraying tips in 2025. Japan’s pharmaceutical sector drives 15% growth in liquid spraying devices. Spraying Systems Co. and IKEUCHI lead, supported by US$ 20 Bn in industrial automation investments by 2030.

The global industrial spray nozzles market is highly competitive, with equipment manufacturers competing on innovation, durability, and sustainability. Spraying Systems Co. and Hunter Industries dominate in industrial cleaning systems, while TeeJet leads in agricultural applications. Gas scrubbing nozzles, spray cooling solutions, and energy-efficient spray systems add a competitive layer. Strategic partnerships and R&D investments in automated spraying solutions are key differentiators.

The industrial spray nozzles market is projected to reach US$ 13.4 Bn in 2025, driven by water spray nozzles and industrial cleaning systems.

Industrial automation, dust suppression systems, and energy-efficient spray systems are key drivers.

The industrial spray nozzles market grows at a CAGR of 6.8% from 2025 to 2032, reaching US$ 21.2 Bn by 2032.

Opportunities include precision spray nozzles for cleaning applications, spray cooling solutions, and gas scrubbing nozzles.

Key players include Spraying Systems Co., Hunter Industries, TeeJet, Lechler Inc., and John Deere.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Material

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author