ID: PMRREP30339| 189 Pages | 20 Aug 2025 | Format: PDF, Excel, PPT* | Industrial Automation

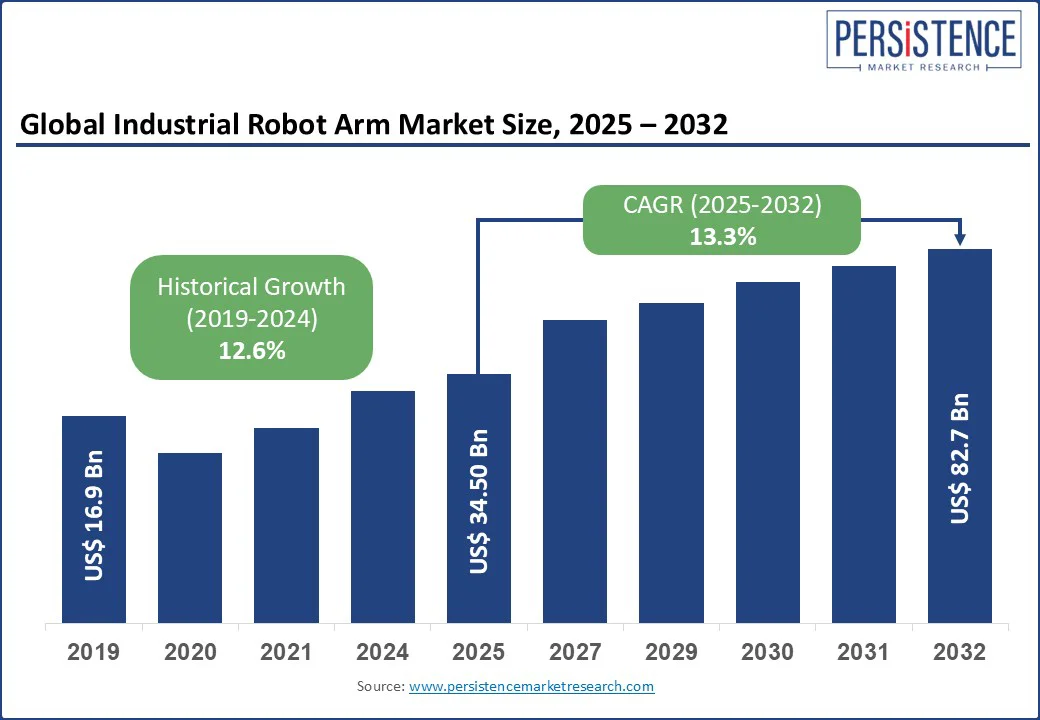

The global Industrial Robot Arm Market size is likely to value at US$ 34.50 Bn in 2025 and reach US$ 82.7 Bn by 2032, registering a CAGR of 13.3% during the forecast period 2025 - 2032.

The Industrial Robot Arm market has experienced robust growth, driven by the increasing adoption of automation in manufacturing, advancements in robotics technology, and the rising demand for precision and efficiency in industrial processes.

Key Industry Highlights:

|

Key Insights |

Details |

|

Industrial Robot Arm Market Size (2025E) |

US$ 34.50 Bn |

|

Market Value Forecast (2032F) |

US$ 82.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

13.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

12.6% |

The global surge in industrial automation, driven by labor shortages and the need for enhanced productivity, is a primary driver. According to the International Federation of Robotics (IFR), over 3.5 million industrial robots were installed globally by 2024, with the automotive and electronics sectors leading adoption due to their precision requirements.

The rising demand for high-throughput production, particularly in industries such as automotive, where vehicles are assembled annually using robotic arms, necessitates advanced systems for tasks such as welding, assembly, and material handling. In the U.S., the automotive industry alone accounts for a significant share of robot arm installations, highlighting their critical role in streamlining operations.

Technological advancements in robotics, particularly in artificial intelligence (AI), machine vision, and sensor integration, are significantly propelling market growth. Modern robotic arms, such as FANUC’s CRX series collaborative robots, offer enhanced safety features, improved adaptability, and reduced downtime, boosting operational efficiency.

An industry study found that AI-enabled robot arms reduced production errors compared to traditional models, making them indispensable in smart factories. Additionally, advancements in lightweight materials and compact designs have made robot arms more versatile, enabling their use in diverse applications, from precision electronics assembly to heavy-duty metal fabrication.

Government initiatives promoting Industry 4.0 and smart manufacturing are further driving market expansion. In China, policies such as “Made in China 2025” have accelerated investments in automation, with the country accounting for a substantial share of global industrial robot installations. In North America, tax incentives and grants for reshoring manufacturing have encouraged companies to invest in advanced robotic systems, further fueling demand for industrial robot arms.

The high initial and operational costs of industrial robot arms remain a significant barrier to widespread adoption, particularly in emerging markets. Advanced robotic systems, equipped with features such as AI-driven controls, high-precision sensors, and IoT connectivity, require substantial upfront investment.

For instance, a single articulated robot arm with AI capabilities can cost upwards of US$ 100,000, excluding additional expenses for integration, software updates, and maintenance. In regions such as Latin America and parts of South Asia, where manufacturing budgets are constrained, these costs limit adoption, even as demand for automation grows. Small and medium-sized enterprises (SMEs) in these regions often struggle to justify the total cost of ownership, highlighting the need for cost-effective, scalable robotic solutions.

The requirement for skilled personnel to program, operate, and maintain industrial robot arms also poses a challenge. Operating advanced systems demands specialized training for engineers and technicians, and a survey by the Robotics Industries Association reported a shortage of certified robotics professionals in Asia Pacific manufacturing hubs.

High training costs and the time required to upskill workers further restrict adoption in developing regions, where access to technical education is limited. This skills gap slows the deployment of advanced robotic systems, particularly in industries that require complex programming for customized applications.

The development of collaborative robot arms (cobots) presents significant growth opportunities by enabling deployment in smaller factories, flexible production lines, and human-robot collaborative environments. Unlike traditional industrial robots, cobots are designed for safety and ease of use, making them suitable for SMEs and dynamic manufacturing settings.

For example, Universal Robots’ UR series cobots, which are lightweight and programmable by non-experts, have seen rapid adoption in electronics and food processing industries. As manufacturing systems prioritize flexibility and responsiveness, demand for cobots is rising, particularly in regions with labor shortages or high labor costs.

The rise of smart manufacturing, driven by Industry 4.0 technologies, offers another growth avenue. Robot arms equipped with IoT connectivity and real-time data analytics enable predictive maintenance and seamless integration into smart factory ecosystems. Companies such as ABB and Mitsubishi Electric are developing cloud-connected robot arms that allow remote monitoring and optimization, further enhancing their appeal in high-tech manufacturing environments.

The growing adoption of digital platforms for remote programming and maintenance also enhances market potential. For instance, Rockwell Automation’s FactoryTalk software enables real-time diagnostics and predictive maintenance, reducing downtime significantly. This trend supports market expansion by addressing integration challenges and improving accessibility for manufacturers in both developed and emerging markets.

The global Industrial Robot Arm market is segmented into less than 500KG, 500-3000kg, and 3001KG and above. The 500-3000kg segment dominates, holding approximately 41.7% share in 2025, due to its critical role in heavy-duty applications such as automotive assembly, material handling, and metal fabrication. High-capacity robot arms, such as Kawasaki’s BX series, are widely adopted for their durability and precision in large-scale manufacturing.

The Less than 500KG segment is the fastest-growing, driven by increasing demand for precision tasks in industries such as electronics and food processing. Innovations in lightweight designs and AI-integrated controls, such as Yaskawa’s GP series, enhance adaptability and efficiency, boosting adoption in flexible production environments.

The Industrial Robot Arm market is divided into Articulated, Cartesian, SCARA, Spherical or Polar, Cylindrical, and Others. Articulated robots lead with a 39.5% share in 2025, driven by their high flexibility and widespread use in complex tasks such as welding and material handling. Over 1.2 million articulated robots are deployed globally, primarily in the automotive and metals industries, due to their multi-axis capabilities.

SCARA robots are the fastest-growing segment, fueled by rising demand in electronics assembly and high-speed picking applications. Their precision and speed make them ideal for industries requiring miniaturized components, with companies such as Epson Robotics leading advancements in SCARA technology.

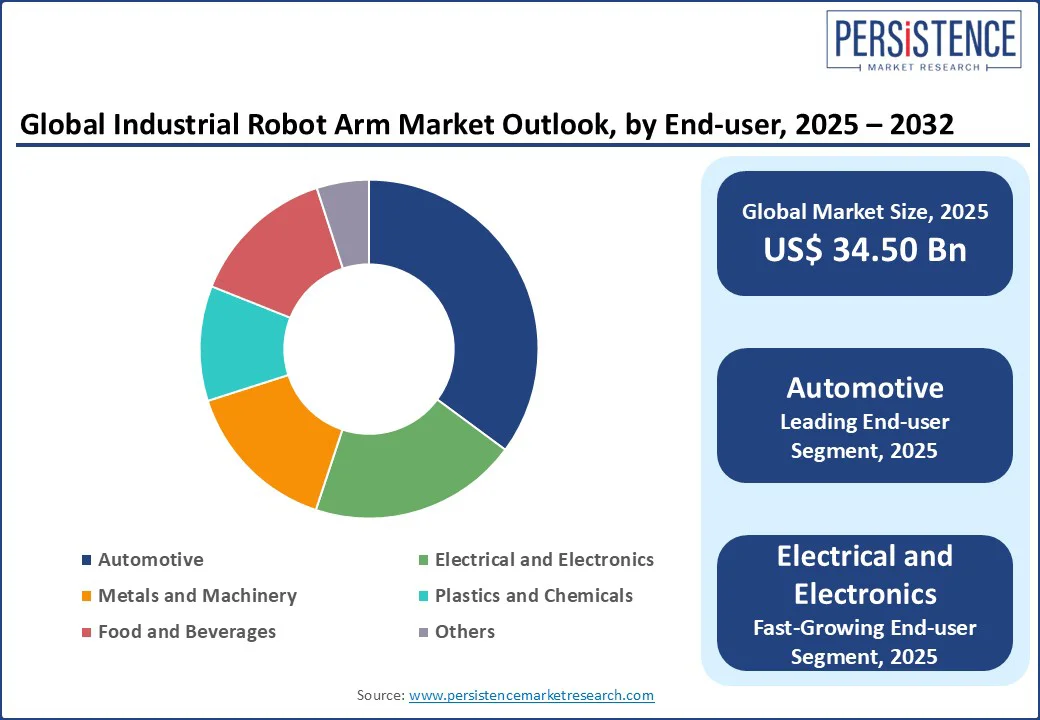

The Industrial Robot Arm market is segmented into Automotive, Electrical and Electronics, Metals and Machinery, Plastics and Chemicals, Food and Beverages, and Others. The Automotive industry dominates with a 35.2% share in 2025, driven by high production volumes and advanced manufacturing infrastructure. Large automotive plants in North America and Europe rely on articulated robots for welding, assembly, and painting tasks.

The Electrical and Electronics industry is the fastest-growing segment, fueled by the increasing demand for precision assembly in consumer electronics and semiconductor manufacturing. The rise of miniaturized devices and high-speed production lines drives the adoption of SCARA and collaborative robots in this sector.

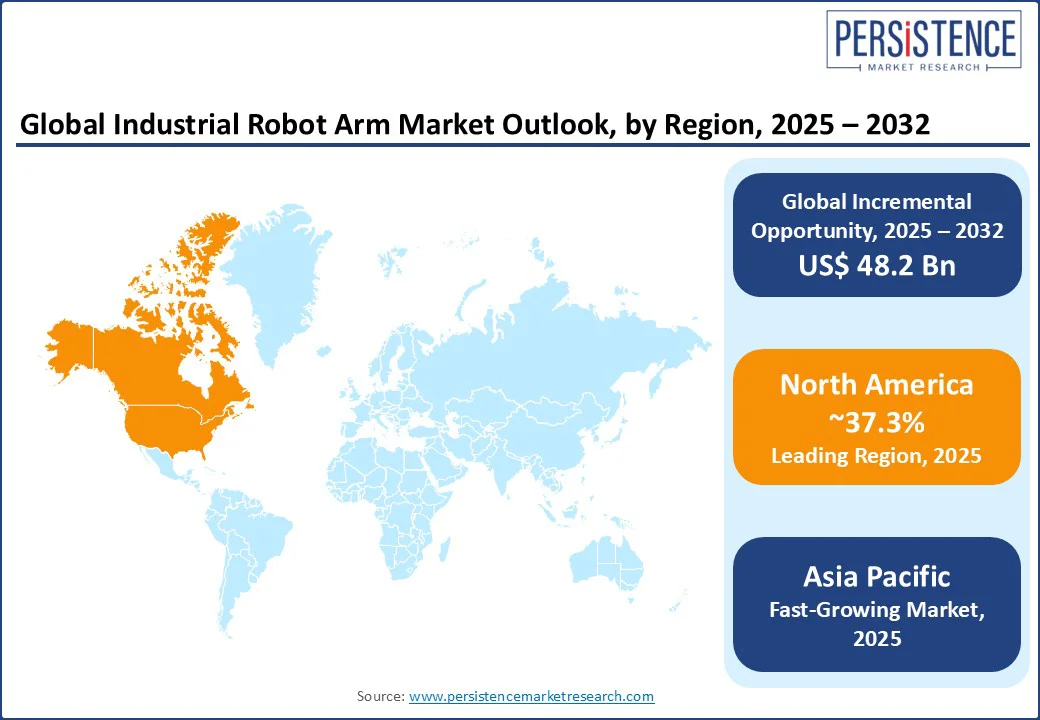

In North America, the U.S. dominates the global Industrial Robot Arm market, expected to account for 37.3% market share in 2025, driven by high automation prevalence and advanced manufacturing infrastructure. The U.S. automotive industry leads demand for articulated and SCARA robots for welding and assembly tasks. Leading brands such as FANUC and Rockwell Automation offer innovative solutions tailored to high-volume production needs.

Consumer preferences are shifting toward collaborative and AI-integrated robot arms, with companies such as ABB incorporating machine vision and IoT connectivity to enhance safety and efficiency. Strict OSHA regulations prioritize worker safety, encouraging the adoption of cobots with advanced sensors. Favorable tax incentives for automation and smart manufacturing further drive investment in robotic systems, supporting market growth.

Europe’s market is led by Germany, the U.K., and France, driven by regulatory support and high production volumes. Germany holds the largest share, supported by strong sales from brands such as KUKA (under Midea) and ABB. The EU’s Horizon Europe program fosters innovation, encouraging the adoption of advanced articulated and Cartesian robots in the automotive and machinery sectors.

In the U.K., market growth is driven by the rising preference for flexible automation in SMEs. Products such as Universal Robots’ UR series cobots are gaining traction for their ease of use and compact design. France is witnessing increased demand for electronics assembly robots, with companies such as Omron offering high-precision SCARA solutions. Regulatory support for sustainable manufacturing practices across Europe further enhances market prospects.

Asia Pacific is the fastest-growing region, led by China, India, and Japan. In China, government initiatives such as “Made in China 2025” and large-scale factory expansions drive demand for articulated and SCARA robots, with brands such as Yaskawa and DENSO leading in automated systems.

India’s market is fuelled by rising labour costs and government schemes such as “Make in India,” boosting demand for cost-effective cobots. Japan focuses on high-precision robots for electronics and automotive applications, with Seiko Epson and Mitsubishi Electric gaining traction. The region’s growing industrial investments and digital procurement platforms accelerate market growth.

The Industrial Robot Arm market is highly competitive, with global and regional players competing on innovation, pricing, and reliability. The rise of collaborative and AI-integrated systems intensifies competition, as companies aim to meet stringent safety and performance standards. Strategic partnerships, mergers, and regulatory approvals are key differentiators in this dynamic market.

The Industrial Robot Arm market is projected to reach US$ 34.50 Bn in 2025.

Rising industrial automation, technological advancements in AI and IoT, and government initiatives for smart manufacturing are the key market drivers.

The Industrial Robot Arm market is poised to witness a CAGR of 13.3% from 2025 to 2032.

Innovation in collaborative robot arms and smart manufacturing practices is the key market opportunity.

FANUC CORPORATION, YASKAWA ELECTRIC CORPORATION, and ABB are among the key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

|

By Payload Capacity Type

By Machine Type

By End-user Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author