ID: PMRREP32444| 260 Pages | 30 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

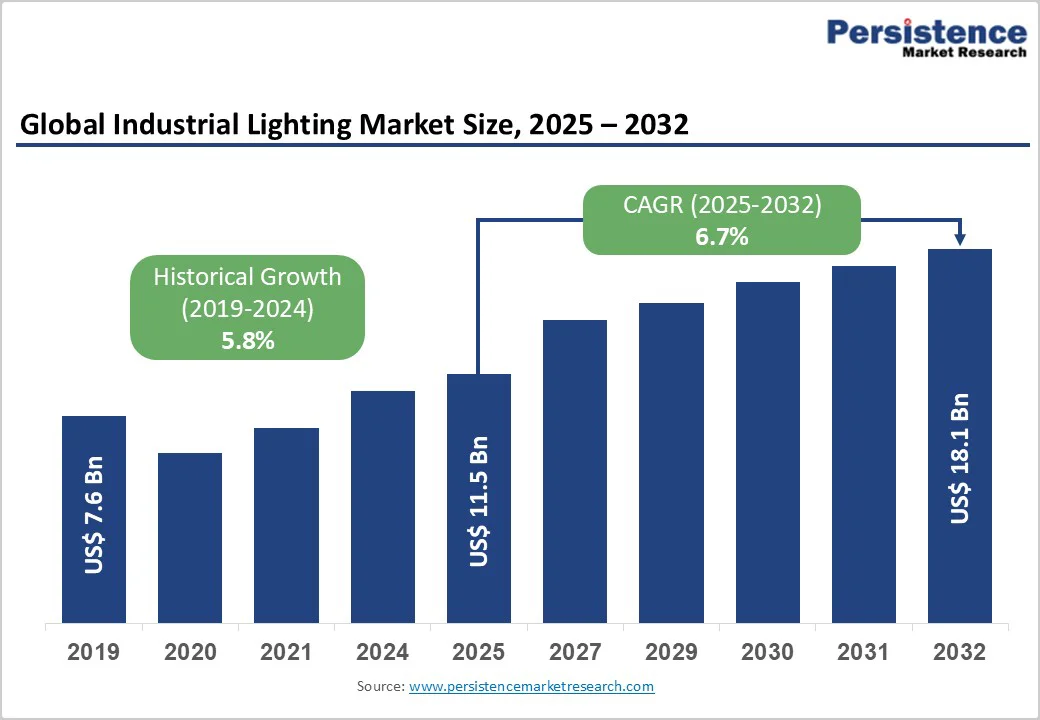

The global industrial lighting market size is likely to be valued at US$11.5 Billion in 2025 and is expected to reach US$18.1 Billion by 2032, growing at a CAGR of 6.7% during the forecast period from 2025 to 2032, driven by energy savings of over 60% compared to traditional HID and fluorescent lighting, regulations phasing out halogen and low-efficiency lamps, and warehouse modernization to support e-commerce operations with improved visibility and efficiency.

| Key Insights | Details |

|---|---|

| Industrial Lighting Market Size (2025E) | US$11.5 Bn |

| Market Value Forecast (2032F) | US$18.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.8% |

Energy Efficiency Regulations and Operational Cost Reduction Imperatives

Global energy efficiency regulations, including EU Ecodesign directives, EPA Energy Conservation Standards, and national government mandates eliminating low-efficiency lighting technologies, create regulatory compliance drivers compelling industrial facilities to transition from fluorescent and HID systems toward LED alternatives, achieving energy consumption reduction of 50-60%.

Industrial facilities consuming substantial electricity for lighting operations recognize LED adoption delivering operational savings of US$1,400-1,800 annually per 10 replaced 60-watt bulbs, with warehouses achieving electricity bill reductions exceeding 60% through LED conversion from 400W metal halide fixtures to 150W LED equivalents.

Traditional high bay lighting operating at 50-100 lumens per watt contrasts with modern LED systems delivering 100-150 lumens per watt, representing efficiency improvements enabling 20-35% fixture count reduction while maintaining illumination standards.

E-Commerce and Logistics Infrastructure Expansion Driving Industrial Facility Growth

Global e-commerce market expansion reaching US$5.8 Trillion annually, with 25-30% annual growth in emerging markets, creates unprecedented warehouse, distribution center, and logistics facility construction requiring comprehensive lighting infrastructure supporting 24/7 operations and high-throughput inventory processing. Warehouse facilities requiring extended operating hours and comprehensive illumination across large floor areas demonstrate the fastest-growing industrial lighting demand segment, with logistics companies prioritizing LED adoption, reducing operational costs, and supporting environmental sustainability objectives.

Warehouse automation, including robotic sorting systems and conveyor networks, requires precise lighting, ensuring 75% accident risk reduction through enhanced visibility, supporting worker safety and operational efficiency. Parking areas and outer premises lighting expansion supporting warehouse facilities drives additional flood lighting and area lighting demand as facility footprints expand to support growing fulfillment operations.

Barrier Analysis - High Initial Capital Investment and Payback Period Considerations

Industrial lighting retrofit projects requiring complete system replacement of existing fluorescent and HID infrastructure demand substantial capital investment ranging from US$100,000 to US$1,000,000+, depending on facility size and complexity, constraining adoption among budget-constrained manufacturers and small-to-medium enterprises lacking capital availability. Small and medium-sized industries preferring lower-cost CFL, fluorescent, and HID alternatives over premium LED systems limit market penetration despite favorable operating cost economics, with payback period calculations often exceeding three to five years, constraining financing availability and management justification.

Installation complexity requiring electrical infrastructure modifications, mounting system updates, and potential facility downtime during retrofit projects extends implementation timelines by four to eight weeks, creating operational disruption concerns, preventing adoption decisions despite long-term cost benefits.

Technical Standardization Gaps and Regulatory Fragmentation across Geographies

Industrial lighting technology standards diverge across regions, including varying safety requirements (OSHA North America, CE marking Europe, ATEX directives), electrical specifications, and hazardous location classifications, creating supply chain complexity requiring market-specific product variants and certification processes, escalating manufacturer costs. Hazardous location classification systems, including the three-class OSHA North American taxonomy versus the IEC six-zone European framework, require distinct product development and certification pathways, limiting economies of scale and supporting standardized manufacturing.

Emerging market regulatory environments lacking mature industrial lighting standards or certification processes create uncertainty, constraining multinational manufacturer investment in region-specific product development and market entry strategies.

Opportunity Analysis - Smart Lighting Systems and IoT-Enabled Facility Management Integration

Emerging intelligent lighting platforms incorporating occupancy sensing, wireless mesh connectivity, and cloud-based control systems enable an additional 10-25% energy savings through demand-responsive illumination, real-time facility utilization analytics, and predictive maintenance capabilities, creating premium opportunities justifying 15-30% price premiums versus conventional LED systems. Smart lighting adoption, enabling facility managers to monitor energy consumption patterns, optimize illumination schedules aligning with occupancy, and coordinate HVAC and lighting systems for holistic efficiency improvements, positions lighting infrastructure as a core building management component rather than a commodity utility.

Occupancy-sensing capabilities automatically adjust illumination levels based on real-time facility utilization, reducing energy waste in partially occupied warehouses and factories where traditional continuous operation wastes resources during low-activity periods.

Emerging Market Industrial Infrastructure Development

Rapidly developing economies across Asia Pacific, Latin America, and Africa, experiencing infrastructure expansion, manufacturing capacity growth, and logistics network development, require comprehensive industrial lighting deployment, creating substantial addressable market opportunities for LED and advanced lighting solutions. China's 450+ smart city projects under construction, combined with existing industrial sector dominance, create an estimated US$800 Million-US$1.2 Billion annual industrial lighting procurement representing 25-30% of the global market opportunity.

India's industrial sector expansion, including manufacturing, food processing, and mining operations, combined with warehouse infrastructure supporting e-commerce growth, creates proportional lighting demand, with emerging market industrial lighting projected to grow at a high CAGR through 2032. Southeast Asian manufacturing expansion, attracting foreign direct investment from automotive, electronics, and component suppliers, generates industrial facility construction requiring modern lighting infrastructure, with regional growth rates exceeding global averages. Market opportunity for emerging market industrial lighting is estimated at US$2.5-4 Billion by 2032 as infrastructure development accelerates.

LED technology holds a dominant 65% market share as industries shift from HID and fluorescent systems to energy-efficient, long-life semiconductor lighting. Falling LED component costs, strong manufacturing capacity, and global efficiency regulations continue to accelerate adoption. Smart LED solutions with occupancy sensing and wireless control represent the fastest-growing segment, driven by their role in intelligent facility management.

Superior color rendering (CRI 80+), instant illumination, mercury-free design, and flexible configurations strengthen LED appeal across diverse industrial applications. HID lighting maintains an 18.2% share, supported by ongoing demand in ultra-high-output environments such as steel mills and shipyards, along with maintenance needs from the large installed base.

Industrial flood and area lighting leads the market with a 35.9% share due to its essential role in warehouses, outdoor premises, parking areas, and large industrial spaces requiring wide, high-brightness illumination. Warehouses rely heavily on flood lighting to support e-commerce operations, benefiting from LED efficiency, reduced heat emissions, and improved uniformity that minimizes dark spots and inventory risks. Outdoor loading zones, storage yards, and perimeter areas also adopt LEDs for better visibility, safety, and lower energy consumption. Parking facilities continue shifting to LED systems for cost savings and enhanced security.

Industrial spot lighting is the fastest-growing segment, driven by precision manufacturing, machine vision, welding, and task-specific applications where focused, flicker-free, tunable lighting improves accuracy, quality control, and worker productivity.

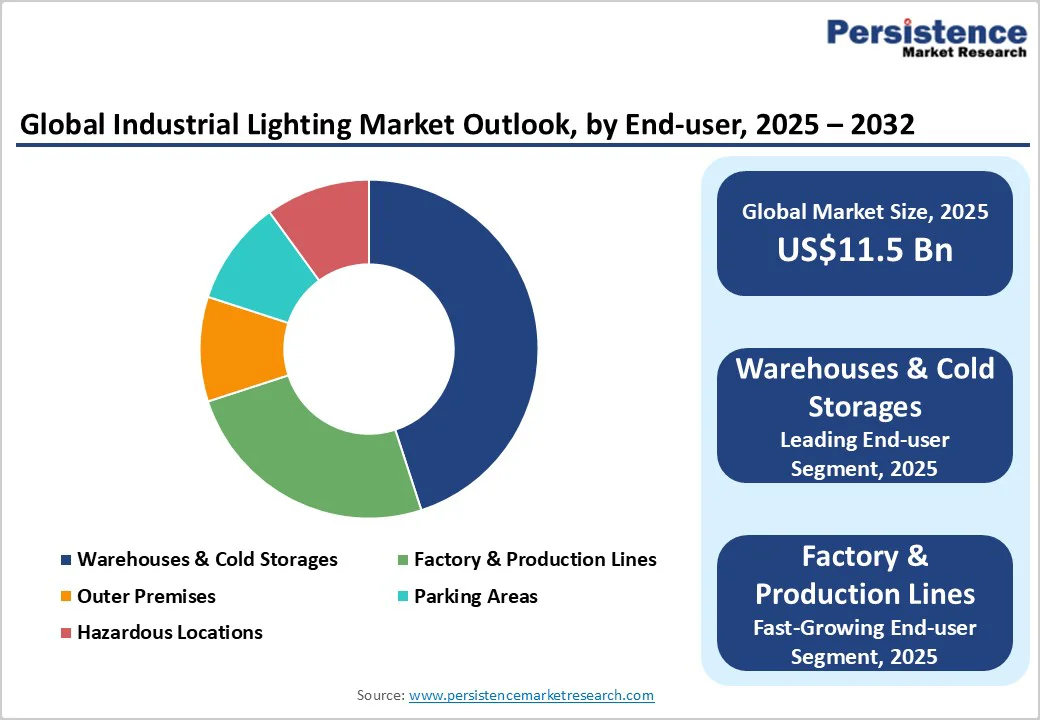

Warehouses and cold storage facilities hold 38.6% of the market share due to their need for reliable lighting that supports 24/7 operations, efficient inventory management, and worker safety across large, expanding spaces driven by e-commerce growth. Cold storage areas benefit from LED fixtures that handle low temperatures, emit less heat, and maintain consistent illumination to protect product quality. Warehouse modernization, including robotics and automation, requires uniform, shadow-free lighting for vision systems and barcode scanning. LED upgrades improve lighting uniformity by 8% compared to fluorescent systems, enhancing accuracy and reducing worker fatigue.

Factory and production lines are the fastest-growing segment, driven by manufacturing modernization and precision needs. Linear LED systems support machine vision, quality control, and safe operations, while hazardous industries require compliant, specialized lighting. Expansion of 24/7 manufacturing further boosts demand.

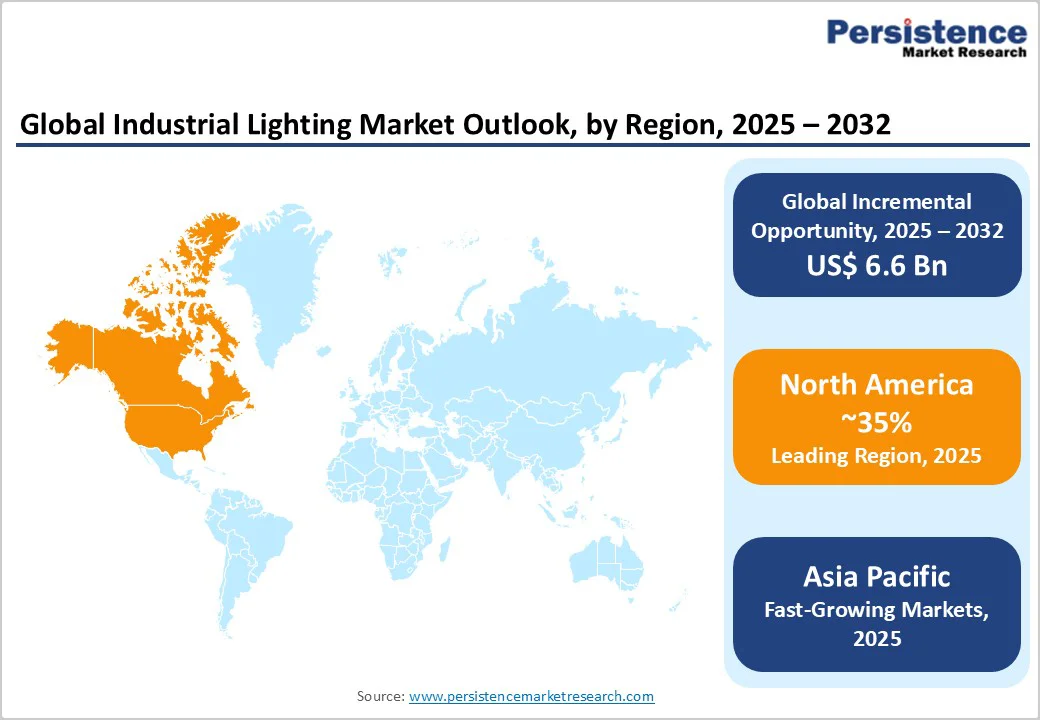

North America generates approximately US$3.4-3.9 Billion market value in 2025, representing 33.9% global market share through 2032, driven by a mature industrial base, strong regulatory framework supporting LED adoption, and advanced manufacturing infrastructure. The U.S. dominates North America market through established manufacturing facilities, extensive warehouse and logistics infrastructure supporting the e-commerce market, and regulatory leadership, including OSHA standards and the EPA energy conservation initiatives promoting LED adoption.

The U.S. warehouse modernization supporting record e-commerce growth and Amazon/similar logistics operator expansion creates substantial market demand for advanced lighting supporting 24/7 operations and rapid fulfillment processing. Regulatory environment through state-level energy efficiency standards, including California building codes and municipal sustainability initiatives, drives accelerated LED penetration. The Canadian industrial sector's contribution of approximately 12-15% regional share supports proportional lighting demand through manufacturing sector presence and warehouse infrastructure supporting the North American e-commerce network.

Europe represents approximately US$2.8-3.3 Billion market in 2025, capturing 24.3-28.7% global market through 2032, characterized by stringent environmental regulations, premium product positioning, and an advanced manufacturing ecosystem. Germany leads the European market with 28-35% regional share through automotive manufacturing complexity requiring precision lighting, chemical industry presence demanding hazardous location expertise, and industrial sector maturity supporting advanced technology adoption.

The U.K., contributing 16-18% European share, benefits from logistics infrastructure supporting EU trade, while France and Spain demonstrate steady growth through manufacturing sector presence and warehouse infrastructure. The EU regulatory harmonization through Ecodesign directives and energy efficiency standards creates consistent market conditions supporting harmonized product development and supply chain optimization across member states.

Asia Pacific represents a dominant region at approximately 48% of the global growth with an estimated market value of US$5.8-6.8 Billion by 2025 through 2032, driven by manufacturing dominance, smart city development, and warehouse infrastructure expansion supporting emerging e-commerce markets.

China dominates Asia Pacific with a 40-45% regional share through LED manufacturing capacity, government subsidies supporting smart city projects with 450+ initiatives under construction, and industrial sector expansion, including warehouse and logistics infrastructure. China's government support for MOCVD technology development, enabling domestic LED chip manufacturing, establishes cost leadership supporting price-competitive positioning in global markets.

The global industrial lighting market participants are strategically focused on the development of new, cutting-edge, and highly effective goods, along with tailored solutions to expand their client bases and increase their market shares. In order to supplement their revenue growth and increase their market shares, industry participants are strategically focused on the launch of new, innovative, and high-efficiency goods, together with tailored solutions.

The market is moderately fragmented, with prominent players such as Signify, Holdings, Panasonic Corporation, Osram GmbH, Hubbell, Incorporated, and Emerson Electric Company holding a significant market share in the industrial lighting market. Prominent companies are concentrating on significant investment in research and development activities to provide cost-effective solutions.

The industrial lighting market is estimated to be valued at US$11.5 Billion in 2025.

Industrial facilities, including manufacturing plants, warehouses, logistics hubs, cold storage units, chemical plants, and processing facilities, are rapidly shifting toward LED and smart lighting systems to reduce operational costs, improve worker safety, and comply with tightening energy-efficiency regulations.

In 2025, the North America region will dominate the market with an exceeding 35% revenue share in the global industrial lighting market.

LED holds the highest preference, capturing beyond 65% of the market revenue share in 2025, surpassing other lighting technologies.

The key players in the industrial lighting market include Emerson Electric Co.Signify Holding, OSRAM Opto Semiconductors GmbH, GE Current, and Panasonic Corporation.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Lighting Type

By Installation

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author