ID: PMRREP35468| 190 Pages | 7 Jul 2025 | Format: PDF, Excel, PPT* | Industrial Automation

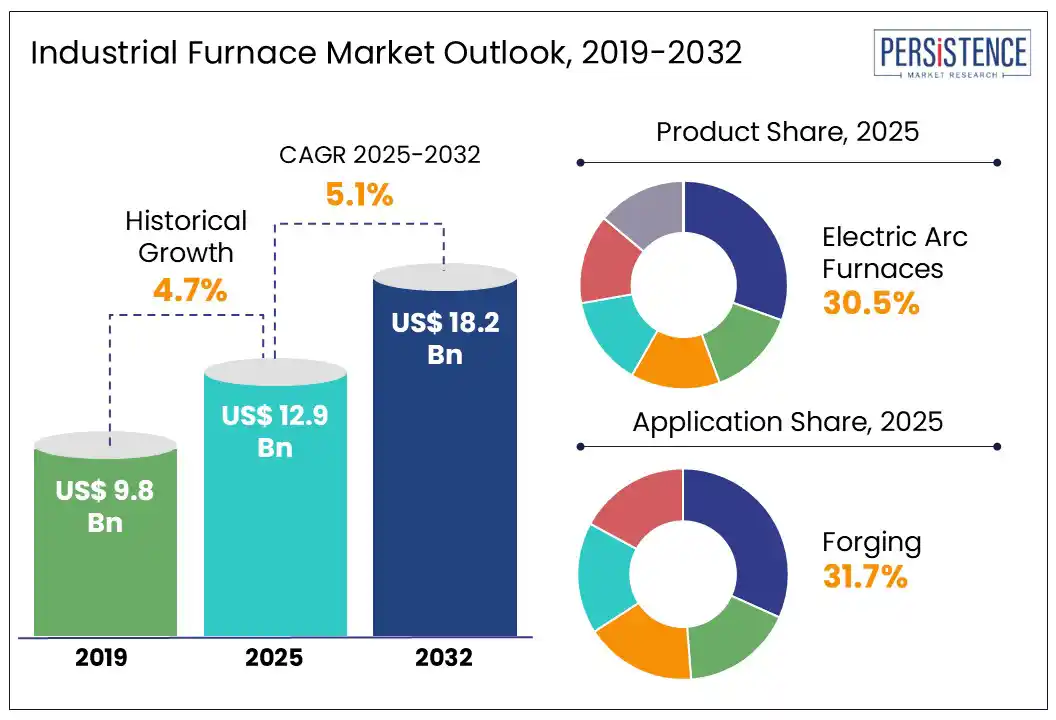

The industrial furnace market size is likely to be valued at US$ 12.9 Bn in 2025 and is estimated to reach US$ 18.2 Bn in 2032, growing at a CAGR of 5.1% during the forecast period 2025-2032.

Industrial furnaces are at the core of modern manufacturing, playing an important role in processes ranging from forging and heat treatment to material synthesis in high-tech sectors. As global industries shift toward energy efficiency, these systems are undergoing a transformation far beyond their traditional applications. The market is predicted to be propelled by the resurgence of heavy industries and high demand for precision thermal processing in EVs as well as battery materials.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Industrial Furnace Market Size (2025E) |

US$ 12.9 Bn |

|

Market Value Forecast (2032F) |

US$ 18.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.7% |

Expansion of the renewable energy sector is predicted to bolster the industrial furnace market growth in the foreseeable future, finds Persistence Market Research. This is due to the surging production of specialized components that require precise thermal processing, particularly in solar, wind, and battery storage technologies. In solar manufacturing, furnaces are essential for the annealing, doping, and sintering processes used in photovoltaic cell production. In wind energy, industrial furnaces are important for producing and heat-treating large-scale forged components, including bearing rings, gear blanks, and turbine shafts.

The shift toward offshore wind, which demands durable components, has boosted the use of forging furnaces and controlled-atmosphere heat-treatment systems. Siemens Gamesa, for instance, reported increased use of gas-fired rotary hearth furnaces for hardening yaw and pitch bearings in its 14 MW offshore wind turbines in 2023. These components must withstand extreme stress and corrosion, necessitating tight metallurgical tolerances only achievable through novel thermal processes.

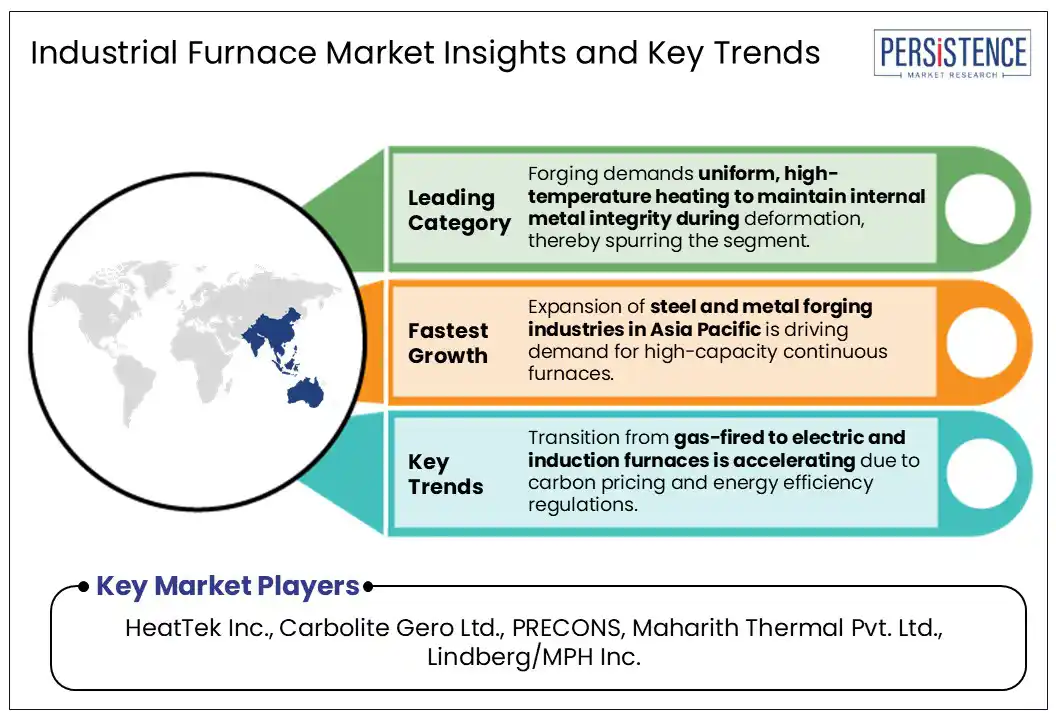

The potential for air pollution from emissions and fuel combustion is acting as a barrier to the broad adoption of industrial furnaces. It is evident in regions with tight environmental regulations and carbon pricing mechanisms. Conventional gas-fired and oil-fired furnaces emit high levels of carbon dioxide, sulfur dioxide, nitrogen oxide, and particulate matter. These often contribute to air quality degradation and climate change. The U.S. Environmental Protection Agency (EPA) recently reported that industrial combustion processes were responsible for around 14% of national stationary-source greenhouse gas emissions.

In Europe, the enforcement of the Industrial Emissions Directive (IED) is placing financial pressure on companies operating traditional industrial furnaces. Operators of reheating furnaces in steel mills now face rising carbon costs, compelling many to delay or reconsider furnace capacity expansions until low-emission alternatives are viable. This regulatory environment has pushed SMEs in Spain and Italy to scale back on new installations or seek subsidies to switch to electric models.

Integration of automation in industrial processes is creating lucrative opportunities for industrial furnaces by enabling real-time control and precision heating. With the rise of smart manufacturing, furnaces are no longer standalone units. They are becoming embedded components in automated workflows that require synchronization with robotics, material handling systems, and quality inspection tools. In the recent past, Bosch implemented an automated heat-treatment line for EV motor shafts in its Stuttgart plant. It helped the company enhance throughput by 30% and reduce energy use by 22%.

A significant shift is the deployment of industrial furnaces in closed-loop manufacturing cells. Here, thermal treatment is automatically adjusted based on input data from upstream processes such as machining or forging. Automation is also enabling 24/7 operation of furnaces with minimal human intervention, which is particularly beneficial in high-labor-cost regions. Companies are integrating predictive maintenance algorithms that analyze vibration, temperature uniformity, and gas flow in real time to forecast potential failures.

Based on product, the market is divided into blast furnace, induction furnace, electric arc furnace, vacuum furnace, and walking beam furnace. Among these, Electric Arc Furnaces (EAFs) are anticipated to account for nearly 30.5% of the industrial furnace market share in 2025 owing to their energy efficiency, precise temperature control, and adaptability in processing scrap metal. EAFs operate by generating heat through high-voltage electric arcs between graphite electrodes and the metal charge, enabling them to use 100% recycled steel scrap. This makes the process environmentally sustainable and helps in reducing raw material costs.

Blast furnaces, on the other hand, are predicted to witness a significant CAGR from 2025 to 2032 due to their unmatched capacity for large-scale, continuous production of high-quality iron and hot metal. These furnaces remain indispensable in regions with abundant iron ore reserves and less accessible steel scrap. Recent developments in low-emission blast furnace technologies are also contributing to their surging relevance. The use of hydrogen injection and Top Gas Recycling Blast Furnace (TGR-BF) systems is allowing steelmakers to reduce carbon emissions without completely overhauling existing infrastructure.

By application, the market is segregated into forging, heat treatment, melting, and sintering. Out of these, the forging segment will likely hold approximately 31.7% of share in 2025 as it requires controlled heat treatment to deform metal billets and ingots into desired shapes without compromising their internal structure. Industrial furnaces enable precise temperature uniformity and consistency. These are significant in achieving the metallurgical properties required in aerospace, automotive, defense, and heavy machinery components. Increasing demand for precision-forged components across high-performance sectors is predicted to spur the use of industrial furnaces for forging.

Heat treatment is predicted to exhibit considerable growth through 2032 as industrial furnaces offer the controlled atmosphere and precise thermal cycles required for processes such as carburizing, annealing, tempering, and quenching. These treatments directly impact hardness, ductility, wear resistance, and fatigue strength. These qualities cannot be achieved through mechanical processing alone. Aerospace-grade turbine blades made from nickel-based superalloys, for instance, undergo multiple heat treatment stages in vacuum furnaces to ensure creep resistance at temperatures above 1000°C.

North America is currently witnessing steady growth due to modernization across metalworking sectors and a shift toward sustainable thermal processing. The region is poised to be dominated by the U.S. industrial furnace market backed by increasing investments in hybrid and hydrogen-ready steelmaking facilities. A significant trend shaping the market is the integration of Industry 4.0 technologies.

More than 40% of newly installed industrial furnaces in the U.S. now incorporate IoT sensors, AI-based control systems, and predictive maintenance capabilities. This digital shift allows for real-time temperature control, energy optimization, and reduced unplanned downtime. Decarbonization initiatives are further accelerating furnace upgrades across the country. Several companies are phasing out aging gas-fired models in favor of electric and hybrid solutions.

Europe is undergoing a transformation backed by decarbonization mandates, reshoring of manufacturing, and rising investments in green steel and electric mobility infrastructure. The U.K. and Germany are considered the technological hubs, with a robust demand for vacuum, induction, and hydrogen-compatible furnaces used in aerospace and automotive sectors. A notable shift in Europe is the accelerated adoption of electric and hybrid furnaces, pushed by energy transition policies and the EU Green Deal.

The European Commission’s Carbon Border Adjustment Mechanism (CBAM) is pushing local industries to upgrade thermal processing equipment to avoid carbon penalties. Hence, leading OEMs and Tier 1 suppliers across the region are replacing old gas-fired systems with electrically heated and vacuum furnaces. The surging demand for localized production of semiconductors, EV powertrains, and innovative materials has further increased demand for precision heat-treatment furnaces across Europe.

In 2025, Asia Pacific is expected to account for around 44.2% of the share due to capacity expansions, technological localization, and government-backed manufacturing incentives. China continues to dominate the region owing to its expansive steel and automotive manufacturing base. As of 2023, more than 85% of the country's crude steel was produced using blast furnace-basic oxygen furnace routes, requiring continuous investments in large-scale industrial furnace systems.

Another significant driver in Asia Pacific is the strategic push toward energy efficiency and emissions reduction without compromising production volume. In 2023, India’s Ministry of Steel implemented pilot projects promoting hydrogen-based furnace operations in select integrated steel plants. It targeted a 20% reduction in carbon dioxide emissions per ton of steel by 2030. Similarly, Japan-based manufacturers are pioneering vacuum and induction furnaces for high-precision applications such as semiconductor substrates and aerospace components.

The industrial furnace market is highly competitive with the presence of global players focusing on specialized technologies, energy efficiency, and Industry 4.0 integration. Leading companies are competing on innovation, particularly in offering vacuum, induction, and hybrid heating solutions for high-value applications. Asia Pacific has become an important hub owing to rapid industrialization and demand for localized manufacturing. China-based firms are scaling up by providing customizable, mid-range furnaces with short lead times for industries.

The market is projected to reach US$ 12.9 Bn in 2025.

The rise of automation in forging lines and high demand for 3D metal printing are the key market drivers.

The market is poised to witness a CAGR of 5.1% from 2025 to 2032.

Emergence of mid-cost systems and government support for industrial equipment upgrades are the key market opportunities.

HeatTek Inc., Carbolite Gero Ltd., and PRECONS are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Fuel Type

By Throughput Rate

By Operation Rate

By Application

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author