- Executive Summary

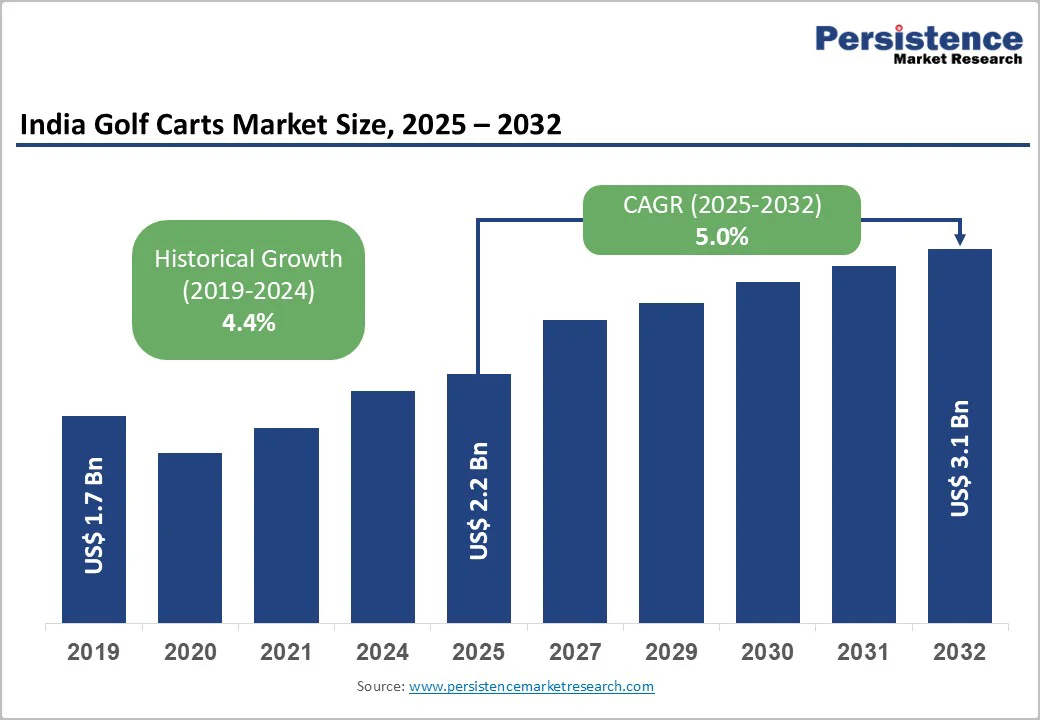

- India Golf Carts Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- Macro-economic Factors

- Urbanization and Infrastructure Development

- Tourism and Hospitality Sector Expansion

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Regulatory Landscape

- Value Chain Analysis

- PESTLE Analysis

- Porter’s Five Force Analysis

- Price Trend Analysis 2019 - 2032

- Key Highlights

- Key Factors Impacting Product Prices

- Pricing Analysis by Seating Capacity

- India Golf Carts Market Outlook

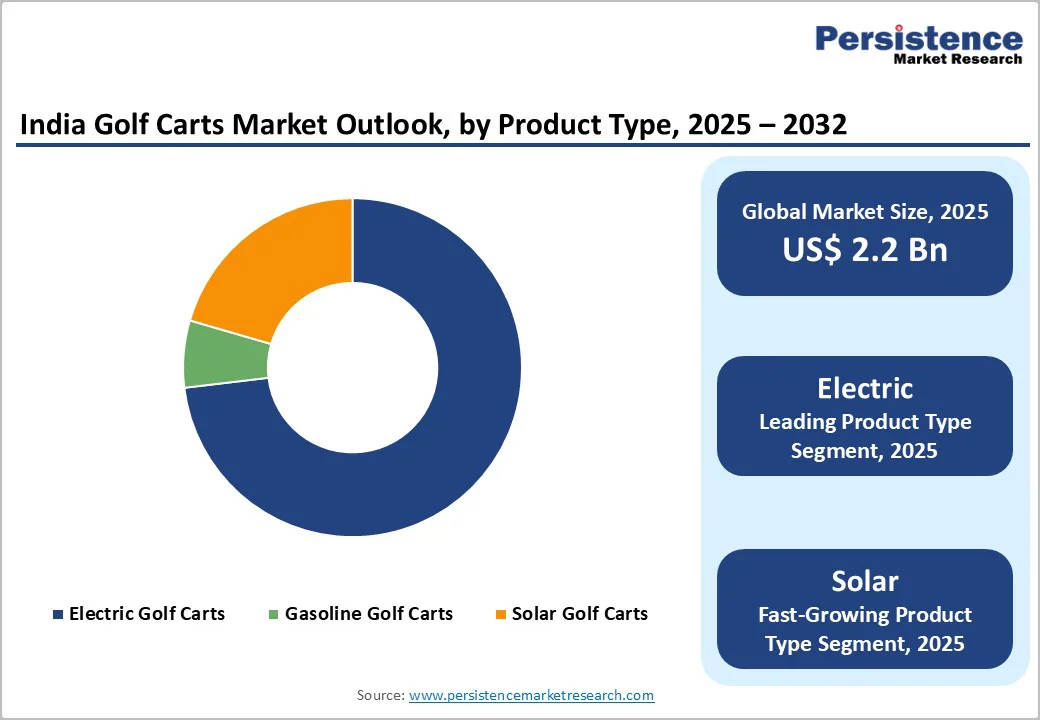

- India Golf Carts Market Outlook: Product Type

- Introduction / Key Findings

- Historical Market Sales Area (US$ Bn) and Analysis, By Product Type, 2019 - 2024

- Current Market Sales Area (US$ Bn) and Analysis and Forecast, By Product Type, 2025 - 2032

- Electric Golf Cart

- Gasoline Golf Cart

- Solar Golf Cart

- Market Attractiveness Analysis: Product Type

- India Golf Carts Market Outlook: Seating Capacity

- Introduction / Key Findings

- Historical Market Sales Area (US$ Bn) Analysis, By Seating Capacity, 2019 - 2024

- Current Market Sales Area (US$ Bn) Analysis and Forecast, By Seating Capacity, 2025 - 2032

- Small (2 to 4 Seater)

- Medium (6 to 8 Seater)

- Large (Above 8 Seats)

- Market Attractiveness Analysis: Seating Capacity

- India Golf Carts Market Outlook: Application

- Introduction / Key Findings

- Historical Market Sales Area (US$ Bn) Analysis, By Sales Area, 2019 - 2024

- Current Market Sales Area (US$ Bn) Analysis and Forecast, By Sales Area, 2025 - 2032

- Golf Course

- Personal Services

- Commercial Services

- Market Attractiveness Analysis: Application

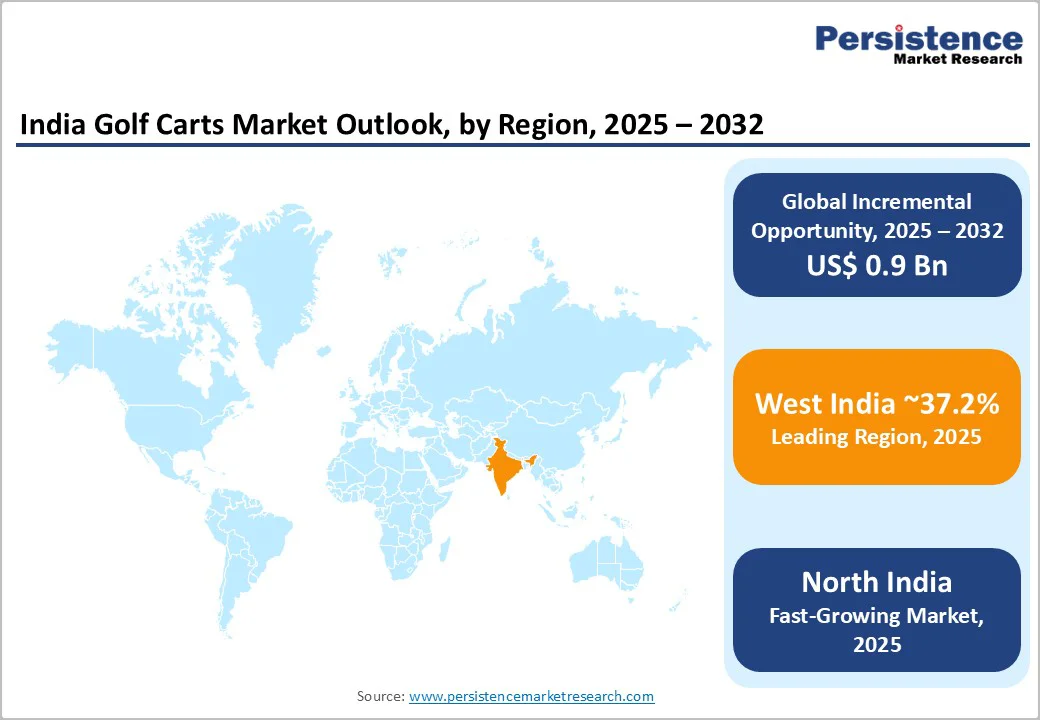

- Market Attractiveness Analysis: Region

- India Golf Carts Market Outlook: Product Type

- India Golf Carts Market Outlook: Region

- Key Highlights

- Historical Market Sales Area (US$ Bn) Analysis, By Region, 2019 - 2024

- Current Market Sales Area (US$ Bn) Analysis and Forecast, By Region, 2025 - 2032

- North India

- West India

- South India

- East India

- Market Attractiveness Analysis: By Region

- Competition Landscape

- Market Share Analysis, 2023

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Club Car, LLC

- Overview

- Solution Portfolio

- Key Financials

- Market Developments

- Market Strategy

- Yamaha Golf-Car Company

- Speedways Electric

- Maini Material Movement Pvt. Ltd.

- Prevalence Ltd.

- Auto Power

- Nebula Automotive Pvt. Ltd.

- GDrive Golf Carts

- Carrieall Car Private Limited

- Volmac Engg. (P) Limited

- Others

- Club Car, LLC

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment