ID: PMRREP35251| 150 Pages | 28 Apr 2025 | Format: PDF, Excel, PPT* | Consumer Goods

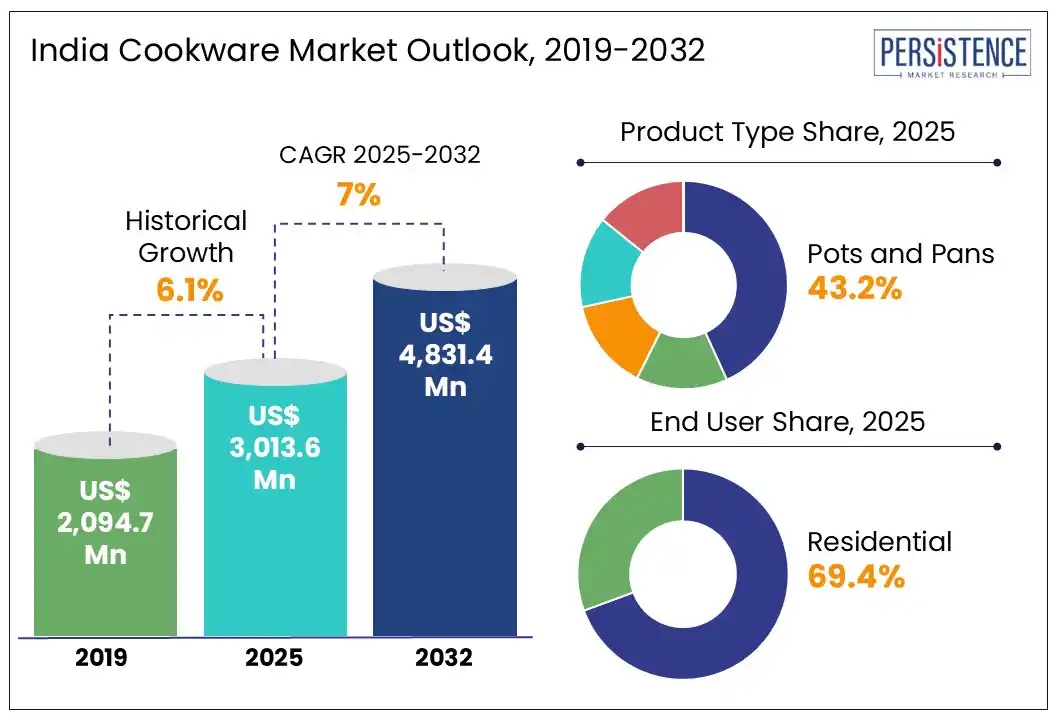

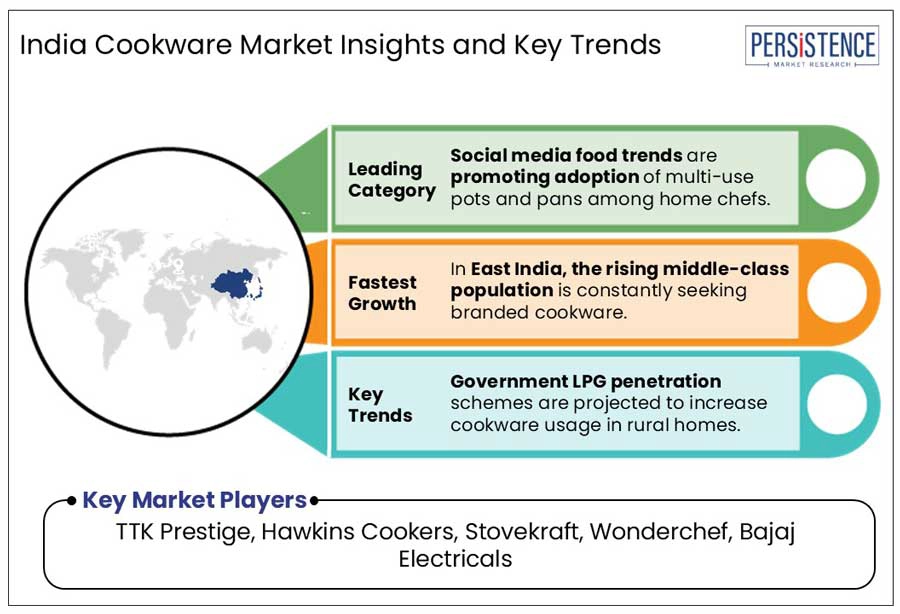

The India cookware market size is projected to rise from US$ 3,013.6 Mn in 2025 to US$ 4,831.4 Mn to witness a CAGR of 7.0% by 2032. India has been witnessing considerable growth in the field of cookware in recent years due to a rising shift of modern consumers toward branded products. Social media platforms such as Instagram are also playing a key role in raising the interest of millennials and Gen Zs in cooking activities. These platforms serve as a medium to showcase their cooking skills with various reels and images featuring new recipes and aesthetically appealing cookware to attract viewers.

Key Industry Highlights

|

Global Market Attribute |

Key Insight |

|

India Cookware Market Size (2025E) |

US$ 3,013.6 Mn |

|

Market Value Forecast (2032F) |

US$ 4,831.4 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

7.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.1% |

The increasing shift of individuals toward health-conscious cooking is a key factor pushing the market. Rising awareness of various chronic diseases such as heart diseases, diabetes, and obesity in the country has made modern consumers more selective about what and how they cook. The Indian Council of Medical Research (ICMR) revealed that at present, about 136 Mn people in India are in the pre-diabetic stage, while more than 101 Mn people are suffering from diabetes. This rising prevalence is compelling consumers to opt for healthy cooking practices, which is constantly influencing their choice of cookware.

Preference for cookware that can support nutrient-preserving and low-oil cooking is increasing steadily. Non-stick kitchenware, for example, has gained immense popularity as it enables cooking with minimal oil. Cast iron cookware is also experiencing a robust comeback, backed by superior iron-enriching and non-stick properties. Brands such as Rock Tawa and The Indus Valley are focusing on extending their cast iron pan manufacturing capacities, specifically for health-conscious urban consumers.

Inconsistent GST classifications and import restrictions are envisioned to create hindrances in the field of cookware across India. Imports of renowned global brands such as Staub and Le Creuset are currently taxed at 28% under the sky-high GST slab. However, local companies are facing confusion over differentiations between kitchen appliances (18 to 28%) and utensils (12%).It is further predicted to harm competitiveness and pricing strategies. Such tax anomalies often discourage local manufacturing companies from extending their inventories or providing competitive pricing on sophisticated products. It will likely result in declining demand for significant cookware.

The emergence of connected and smart kitchen products is poised to create new opportunities for key players in India. As of 2024, the country has more than 800 Mn internet users, with over 450 Mn individuals owning smartphones, reveals the Internet and Mobile Association of India. This rising penetration of technology has led to the development of IoT-enabled cookware such as app-connected pressure cookers, induction-compatible smart pots, and temperature-controlled pans.

Companies, including Nutricook, Typhur, and TTK Prestige are focusing on experimenting with smart technologies, mainly targeting millennial and Gen Z consumers looking for precision cooking. A few other companies are also aiming to develop eco-conscious cookware to meet the high demand for sustainable products. Brands such as Meyer India have already started offering zero-waste production models and plastic-free packaging to attract consumers.

The revival of traditional and regional cookware due to increasing interest in indigenous cooking practices is speculated to be a leading trend in India. Conventional cookware made of soapstone, bronze, brass, and clay has gained momentum in the recent years as consumers are trying to avoid mass-produced kitchen utensils with chemical coatings. A recent survey found that around 65% of respondents in metro cities across India reported that they plan to either purchase or have already switched to conventional cookware for regular use.

MittiCool, Gujarat-based, witnessed a significant surge in clay cookware demand in the last few years. Between FY2021 and FY2023, it recorded a 40% increase in sales, specifically for earthen water bottles, tawas, and pots. Tamil Nadu-based The Village Fair also exhibited a 3x rise in online orders for bronze and brass utensils in 2023. These rising numbers highlight the growing shift of consumers toward traditional cookware.

Based on product, the market is segregated into pots and pans, cooking racks, cooking tools, bakeware, and pressure cookers. Among these, pots and pans are estimated to generate a share of around 43.2% in 2025, finds Persistence Market Research. Increasing popularity of home cooking as a wellness choice is anticipated to spur demand for pots and pans. Multi-purpose pots as well as non-stick kadais and pans are highly demanded across urban kitchens due to their convenience and compatibility with induction cooktops and innovative stoves.

Pressure cookers, on the other hand, exhibit steady growth through 2032. These are considered a kitchen staple in India’s households as the local cuisine involves the preparation of meats, rice, and lentils that require prolonged cooking. These also help lower the total cooking time by 50 to 70%, states a recent study. Hence, pressure cookers are gaining high popularity among dual-income households and working professionals who have less time for elaborate cooking.

By end-user, the market is bifurcated into commercial and residential. The residential segment will likely lead by accounting for 69.4% of the Indian cookware market share in 2025. The surge of single-person households and nuclear families in the country has led to an increasing demand for cookware. The National Family Health Survey (NFHS-5) revealed that around 27% of urban households in India are now nuclear. These households require multi-purpose yet compact products to support diverse cooking options and save space. It has resulted in high sales of non-stick pans, stackable pots, and modular cookware sets.

Commercial end-users are predicted to show decent growth in the foreseeable future due to the booming food service and hospitality sectors. This boom will likely propel demand for commercial-grade cookware, mainly in prominent segments such as premium dining establishments, Quick-Service Restaurants (QSRs), and cloud kitchens. In addition, the growth of cloud kitchens in India is expected to augment demand for high-efficiency cookware capable of withstanding repeated usage.

In West India, Maharashtra and Gujarat are likely to become the most significant hubs for both commercial and residential cookware manufacturers. The adoption of induction-friendly utensils, multi-layer stainless steel pans, and non-stick cookware is seeing an uptick in urban Maharashtra due to changing lifestyles. Mumbai and Pune have recently experienced a surge in rented accommodations and dual-income households, further pushing demand for stackable modular kitchen tools and compact cookware sets.

Gujarat is witnessing a high demand for hard-anodized tawas, pressure cookers, and aluminum kadais, especially from cities such as Rajkot, Vadodara, and Ahmedabad. Local exhibitions and fairs, including those organized at the Gujarat Trade Fair, have become prominent platforms for companies such as Nirlon and Sumeet to promote mid-range products catering to domestic usage patterns.

East India is predicted to account for a share of about 28.5% in 2025. West Bengal will likely remain at the forefront of growth in this region through 2032. This is attributed to a strong cooking culture in the state that values both modern and conventional cooking. Demand for combination cookware sets featuring saucepans, frying pans, and tawas often remains high during wedding seasons or festivals such as Durga Puja. In a recent report, e-commerce platforms, including Meesho and Flipkart, mentioned that they witnessed a 20 to 25% annual surge in cookware orders from Howrah and Kolkata in 2024 alone.

In Bihar and Odisha, on the other hand, cookware demand is primarily pushed by rural and semi-urban households, where durability and affordability are considered more important than aesthetics. Hard-anodized and aluminum utensils are currently leading in terms of sales, specifically deep kadais and pressure cookers.

South India is projected to be considered a lucrative market for cookware in the forthcoming years. This is due to a rising preference for functional and branded products in the region. The Indian Kitchenware Market Observatory, for example, stated that Telangana, Tamil Nadu, Andhra Pradesh, Kerala, and Karnataka together accounted for around 35% of the total cookware sales in India in 2023. It is attributed to robust retail infrastructure and increasing interest among consumers in preparing multi-course meals.

In cities such as Coimbatore and Chennai, demand for hard-anodized and stainless-steel cookware remains high. Increasing popularity of traditional recipes, including chettinad gravies, rasam, and sambar that require kadais, multiple-tier steamers, and deep-bottomed pans will likely transform the market. Local brands such as Premier and Butterfly Gandhimathi Appliances lead in terms of shelf space in both offline and online channels.

India cookware market is currently facing intense competition from several renowned and emerging companies. Various international companies are also focusing on collaborating with domestic firms to co-develop new product lines to cater to changing customer demands. Domestic companies, on the other hand, are constantly aiming to extend their presence in India with innovative products suitable for both professional and home cooks.

The market is projected to be valued at US$ 3,013.6 Mn in 2025.

Increasing demand for traditional cookware and rising influence of social media platforms are the key market drivers.

The market is poised to witness a CAGR of 7.0% from 2025 to 2032.

Launch of smart cookware sets and surging inclination of consumers toward low-oil cooking are the key market opportunities.

TTK Prestige, Hawkins Cookers, and Stovekraft are a few leading market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Material

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author