ID: PMRREP35151| 199 Pages | 9 Jul 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

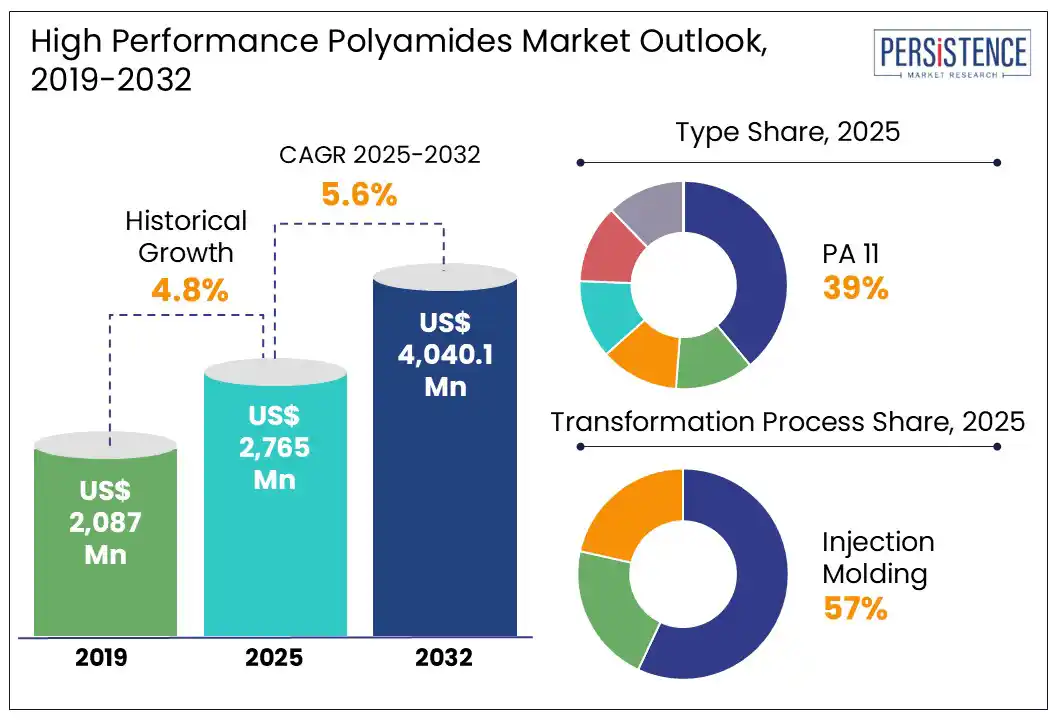

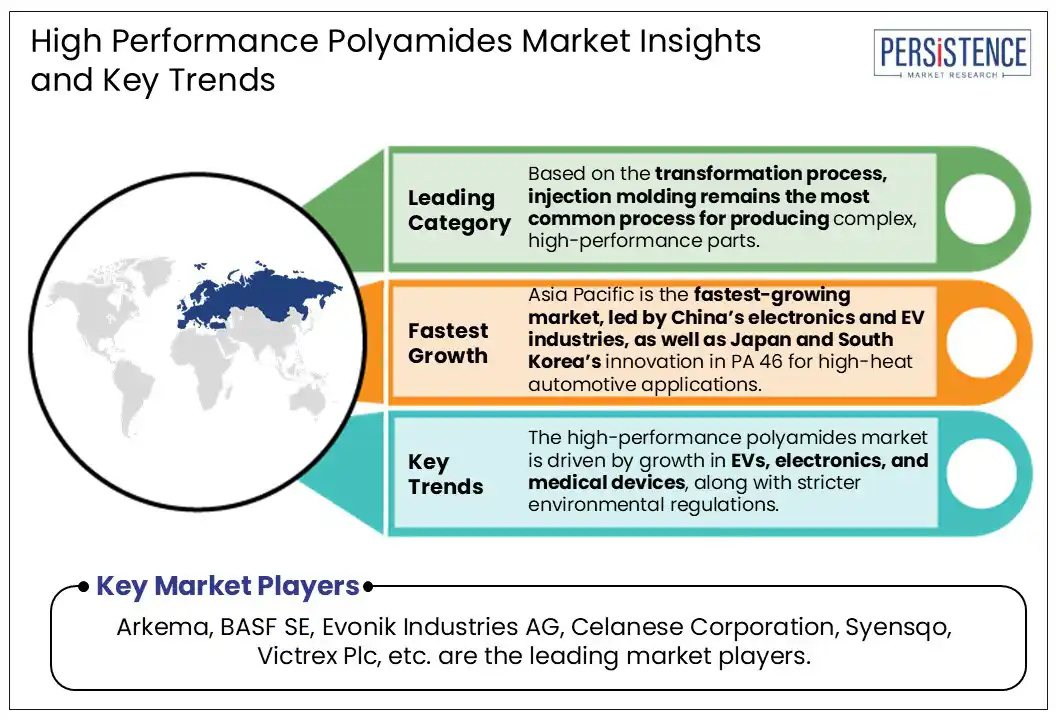

The global high performance polyamides market size is likely to be valued at US$ 2,765.0 Mn in 2025 and is expected to reach US$ 4,040.1 Mn by 2032, growing at a CAGR of 5.6% during the forecast period 2025 to 2032. The high performance polyamides market is expected to grow through 2032, driven by growth in EVs, electronics, and medical devices, along with stricter environmental regulations.

Key Industry Highlights:

|

Market Attribute |

Key Insights |

|

High Performance Polyamides Market Size (2025E) |

US$ 2,765.0 Mn |

|

Projected Market Value (2032F) |

US$ 4,040.1 Mn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

5.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

4.8% |

The global shift towards EVs, renewable energy, and smart electronics is rapidly driving demand for high performance polyamides. Materials such as polyamide 12 and 9T offer superior thermal stability, flame resistance, and complex formation, which can be used for connectors, housings, and high-voltage insulation. The growth in automotive and electronics industry drives the demand for such polyamides.

Government initiatives, such as the U.S. Bipartisan Infrastructure Law and India’s PLI Scheme for Electronics, are accelerating investment in semiconductor manufacturing and EV ecosystems. These programs are increasingly demanding for high performance polymer solutions.

The manufacturers are also following the trend by investing in polyamide products. For instance, in October 2024, BASF developed a new polyphthalamide, Ultramid® Advanced N3U41 G6, tailored for IGBT housings in EVs and renewable energy systems. This high performance PPA supports high-voltage insulation and miniaturization while ensuring thermal stability.

The complex processing requirements of high performance polyamides hinders the market growth. Advanced polyamides such as PA 9T, PA 46, and polyphthalamide show high melting points, limited processing methods, and moisture sensitivity, which leads to the use of specialized equipment and precise temperature control. These factors significantly increase production costs and limit the process adoption, especially by small regional manufacturers.

Furthermore, integrating such materials into complex electronics products adds design and technical challenges. Such challenges lead the Tier II manufacturers to avoid producing the high performance polyamides. To address such needs, leading market players are investing in the market. For instance,

The medical industry presents a growing opportunity for the market, due to rising demand for lightweight, biodegradable, and materials unaffected by sterilization. Such materials are highly needed in surgical tools, catheters, and diagnostic equipment due to their complex applications.

Polyamides such as PA 9T and medical-grade PA 11 and 12 offer excellent chemical resistance, mechanical strength, and compatibility with gamma and steam sterilization. It makes them ideal for minimally invasive and single-use devices.

Government initiatives such as U.S. FDA’s Digital Health Innovation Action Plan, India’s National Medical Devices Policy, and China’s “Made in China 2025” healthcare plans are driving the market players for local manufacturing.

The manufacturers are also supporting the government’s resolution by investing in the innovations of the high performance polyamides. For instance, Arkema partnered with ALBIS in January 2025 to distribute its medical-grade PA 11 and PA 12 polymers under the Pebax® MED and Rilsamid® MED brands. These innovations cater to stringent global healthcare standards and position high performance polyamides as critical enablers of next-generation medical solutions.

Polyamide 11 is leading the high performance polyamide market, owing to its bio-based origin, enhanced mechanical properties, and resistance to harsh environments. Derived from natural sources such as castor oil, polyamide 11 is widely used in automotive fuel lines, flexible tubing, and high-pressure pneumatic systems. PA 11 is mostly favored due to its low moisture absorption, lightweight, sustainability, and chemical resistance.

The government across the globe are focusing on developing regulations and policies favoring the environmental sustainability. For instance, the EU’s Green Deal and India’s Bio-Economy Roadmap 2025 are driving the industries toward bio-based polymers. Such initiatives are driving the manufacturers towards PA 11 due to its bio-based origin.

The manufacturers are also investing in the PA 11 to improve their component’s properties. For instance, in November 2024, Arkema and Authentic Material partner to offer innovative and more sustainable materials for the luxury goods market and beyond. The new compounds based on combinations of recycled leather and Rilsan® polyamide 11 or Pebax® TPE pellets are produced by Authentic Material and sold under their Qilin™ brand.

Injection molding dominates the high performance polyamide market due to its precision, and its suitability for complex production. It makes the manufacturing of complicated components with low tolerances and excellent surface finish easy. Such components are primarily used for applications in automotive, medical, and electronics sectors.

The growth of EV industry and medical technologies boosts the demand for injection molded parts using polyamides like PA 11, PA 12, and PA 6T. Government are also running initiatives such as India’s PLI Scheme for Auto Components, Germany’s “Industrie 4.0”, and China’s Intelligent Manufacturing Plan. Such programs are driving automation and local production of high-precision parts.

The manufacturers are financing to improve the R&D in direction of injection molding. For instance, in January 2024, Evonik launched the impressively sturdy, TROGAMID® eCO Impact 75 polymer for injection molding. Ideal for a wide range of applications, from protective eyewear to electrical or mechanical housings, the new product has a high transparency of 88% and superior chemical, and crack and break resistance.

The automotive industry leads the high performance polyamides market, driven by the shift toward light weighting and electrification of the vehicles. Polyamides such as PA 11, PA 12, and PA 46 have excellent heat resistance, dimensional stability, and chemical durability. These products are widely used in fuel lines, air ducts, battery modules, and e-mobility connectors.

The government across the globe are promoting the EVs due to their benefits in environmental sustainability. Government policies such as the EU’s Fit for 55, U.S. Inflation Reduction Act, and India’s FAME II Scheme are driving the electric and fuel-efficient vehicles. Such policies motivate the manufacturers to promote the vehicles by using bio-based polymers as a material for the vehicles.

For instance, in October 2024, BASF developed a polyphthalamide (PPA) that is especially suited for manufacturing housings of IGBT (insulated-gate bipolar transistor) semiconductors. Ultramid® Advanced N3U41 G6 addresses the growing demand for high performance, reliable electronic components, e.g., electric vehicles, high-speed trains, smart manufacturing, and the generation of renewable energy.

North America plays an important role in the market, driven by rising demand from the automotive industry. The EV industry in the region, especially U.S., is growing with the significant rate, demanding more efficient and innovative functions in the vehicles. Such functions lead the manufacturers to high performance polyamides due to their light weight properties.

Government in the region are promoting the industries to apply bio-based materials to reduce the carbon footprint. Initiatives in the region such as DOE's Bio-products Program are focusing on accelerating the development of renewable materials, including bio-based polymers. Furthermore, initiatives in the region, such as the U.S. CHIPS and Science Act and Advanced Manufacturing Initiative are promoting the domestic production of semiconductors, and EV components.

Such initiatives are encouraging the Automotive manufacturers to apply high performance polymers in vehicles. For instance, in October 2023, Celanese Corporation, a global specialty materials and chemical company, announced the global commercial launch of two new polyamide solutions for manufacturers of EV powertrain components and battery applications. The Frianyl® PA W-Series of flame-retardant polyamide solutions enable the manufacturing of large, thick-walled, flame-retardant components for EV batteries. With the W-Series solutions, manufacturers can improve the safety of the components, introduce novel designs, and enhance manufacturing efficiency.

Europe leads the high performance polyamide market, with the share of 37% of the global market. The regional market is driven by strict environmental regulations, strong automotive and medical industry bases, and growing investment in sustainable materials.

The dominance of the Europe in the global market is primarily due to the region’s environmental regulations. EU policies such as the European Green Deal and REACH Regulation are driving the manufacturers to shift toward lightweight and recyclable materials. The region also leads in the production of bio-based polyamides, supported by established R&D and infrastructure.

The high shift towards eco-friendly materials in the region is driving the manufacturers to expand their reach in the region. For instance,

Asia Pacific is the fastest-growing market, with the CAGR of 6.3% by 2032. The market growth is driven by growing industrialization and expanding automotive production. Countries like China, Japan, South Korea, and India are leading the regional market by investing in several industries such as automotive, healthcare, and electronics.

Asia Pacific high performance polyamides market is well supported by regional government’s initiatives such as China’s “Made in China 2025” and South Korea’s K-Semiconductor Strategy. Such policies are encouraging local production of advanced materials.

Supporting to the growing industrialization in the region, the global players are expanding their market reach in the leading countries. For instance, in May 2024, BASF India Limited increased the production capacity of its Ultramid® polyamide (PA) and Ultradur® polybutylene terephthalate (PBT) compounding plant in Panoli, Gujarat, and Thane, Maharashtra. With the production capacity increase of over 40% in Panoli and Thane, BASF is well-positioned to meet the strong market demand for the high performance material solution in India. The increased capacity will be available in the second half of 2025.

The global high performance polyamide market is moderately consolidated, due to entry barriers such as dependence on natural sources for raw materials like castor oil. Leading players are competing based on their ability to offer the polyamides according to the demands from end-use industries.

The rising focus on sustainability drives the market with increasing importance on bio-based polyamides. The recycling ability of polyamide is also motivating manufacturers to invest and innovate in the market. The leading market players are focusing on the development of bio-based, recyclable, and high-temperature-resistant polyamides to meet the rising demand across the automotive, electronics, and medical sectors.

Yes, the market is set to reach US$ 4,040.1 Mn by 2032.

The high chemical and thermal resistance of polyamides with their application in several industries is propelling the market growth.

India is estimated to witness a CAGR of 6.3% in forecast period.

The increasing applications of polyamides in the medical sector due to their biocompatibility and sterilization resistance is creating the opportunities in the high performance polyamide market.

Arkema is considered the leading player of the High Performance Polyamides market.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Type

By Transformation Process

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author