ID: PMRREP5201| 199 Pages | 25 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

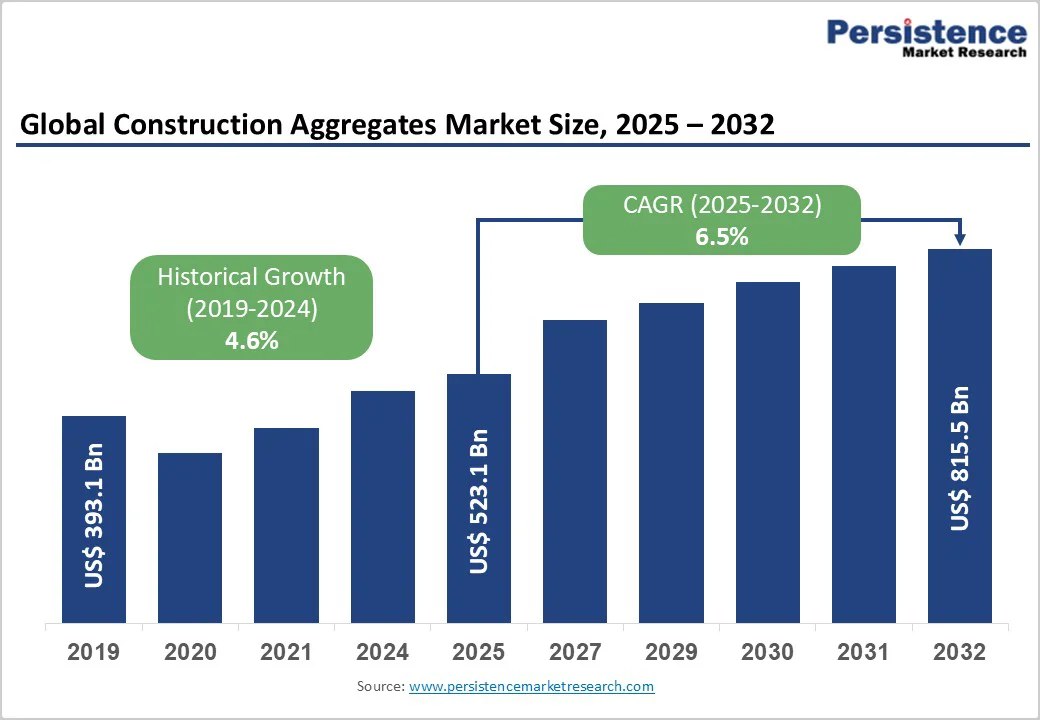

The global construction aggregates market size is likely to be valued at US$523.1 billion in 2025, and is projected to reach US$815.5 billion by 2032, growing at a CAGR of 6.5% during the forecast period 2025-2032.

Robust global infrastructure development, rising urbanization, and consistent demand for construction materials supporting residential, commercial, and industrial projects are among the prominent factors bolstering the sales of construction aggregates worldwide. Rising government investments in transportation networks, renewable energy infrastructure, and sustainable construction practices further stimulate demand for recycled aggregates and construction chemicals.

| Key Insights | Details |

|---|---|

|

Construction Aggregates Market Size (2025E) |

US$523.1 Bn |

|

Projected Market Value (2032F) |

US$815.5 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

6.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

4.6% |

With the global urban population projected to reach 68% by 2050, according to the United Nations, governments worldwide have significantly increased infrastructure spending over the past decade to support road network expansion, bridge construction, railway development, and port modernization projects. The consumption of construction aggregates in India and China has risen exponentially, reflecting the rapid pace of urbanization driving new housing, commercial facilities, and infrastructure development in these regions. Advanced economies such as the U.S., Germany, and the U.K. continue to sustain demand through infrastructure rehabilitation and renewal projects aimed at extending asset lifespans. The combination of consistent material replacement cycles and ongoing project development creates predictable, multi-year aggregate demand, positioning the market for sustained expansion through 2033.

The global shift toward renewable energy is also driving substantial demand for construction aggregates, as solar farms, wind turbine installations, hydroelectric facilities, and energy storage infrastructure require extensive concrete and foundation work. Renewable energy capacity additions exceeded 300 GW annually during 2023 and 2024, with cumulative global investment approaching US$1.8 trillion, according to the International Renewable Energy Agency (IRENA). Hydroelectric projects, in particular, require significant concrete works for dam construction and spillway development, consuming millions of tons of crushed stone and sand. Similarly, solar installation sites demand large concrete foundations and access roads that incorporate considerable aggregate volumes.

Stringent environmental regulations constrain natural aggregate extraction through protected area designations, riverbed mining prohibitions, and sustainability mandates that significantly impact quarry operations. Sand mining depletion rates in certain regions exceed sustainable replenishment levels, and environmental organizations estimate that global annual sand consumption ranges from 40 to 50 billion tons, surpassing natural replenishment capacity.

Additionally, transportation bottlenecks, volatile fuel prices, and limited logistics infrastructure create supply disruptions that extend project timelines and increase operational costs for producers. Fuel costs typically represent 15% to 20% of aggregate production expenses, directly affecting profitability during periods of energy price inflation and limiting margin expansion for regional producers.

Recycled aggregate quality inconsistency, stemming from variable feedstock composition, contamination risks, and processing methodology variation, currently limits mainstream adoption for high-strength structural applications. Quality control challenges require sophisticated washing and separation equipment, significantly increasing capital investment requirements for producers. Certification gaps and performance uncertainty further limit acceptance among specification-driven contractors and engineers who prioritize proven materials. Established market participants remain hesitant to adopt recycled aggregate technologies despite evident environmental benefits, citing concerns about perceived performance risks and potential liability issues associated with newer materials.

Emerging smart city initiatives across Asia Pacific, Europe, and North America are creating substantial demand for construction aggregates through digitalized infrastructure projects featuring embedded sensors, autonomous drainage systems, and climate-resilient construction that supports environmental adaptation. These smart infrastructure projects require advanced concrete specifications that incorporate performance-enhancing aggregates and construction chemicals designed for embedded systems compatibility. The deployment of 5G networks is generating multi-year aggregate demand across urban centers through extensive conduit and foundation work, while electric vehicle (EV) charging infrastructure development is driving incremental demand for specialized aggregate formulations capable of supporting substantial concrete and foundation systems. Digitalization technologies are enabling real-time supply chain visibility, demand forecasting, and logistics optimization, which attract new market entrants and technology-driven service providers.

Marine dredged aggregates offer a significant market opportunity to address supply constraints in coastal regions while supporting critical port infrastructure development. Major ports globally require approximately 3 billion cubic meters of dredged material over the next 10 years, generating substantial aggregate demand. Marine dredged sand and gravel support coastal defense and beach replenishment projects, directly addressing climate change impacts and rising sea levels. Advanced dredging technologies incorporating sediment processing and quality screening enable consistent material specifications that meet construction standards. Environmental regulatory frameworks ensure sustainable practices and create transparent market conditions. At the same time, integration with recycled materials positions marine aggregates as an environmentally responsible alternative that reduces pressure on natural quarries and addresses geographic supply constraints in island nations and coastal development zones worldwide.

Crushed stone commands approximately 42% of the construction aggregates market revenue share, driven by its exceptional versatility across infrastructure, road construction, and concrete production applications. Crushed stone applications including highway base layers, airport runways, and railway ballast leverage superior load-bearing capacity and weathering resistance justifying market leadership.

Huge volumes of crushed stone is being produced across the globe to support infrastructure networks across developed and emerging markets. Concrete production, consuming approximately 75% of total aggregates, relies heavily on crushed stone for structural performance and durability optimization. Technology improvements in quarrying efficiency and processing automation enhance supply reliability while reducing environmental impact, sustaining competitive positioning through 2033.

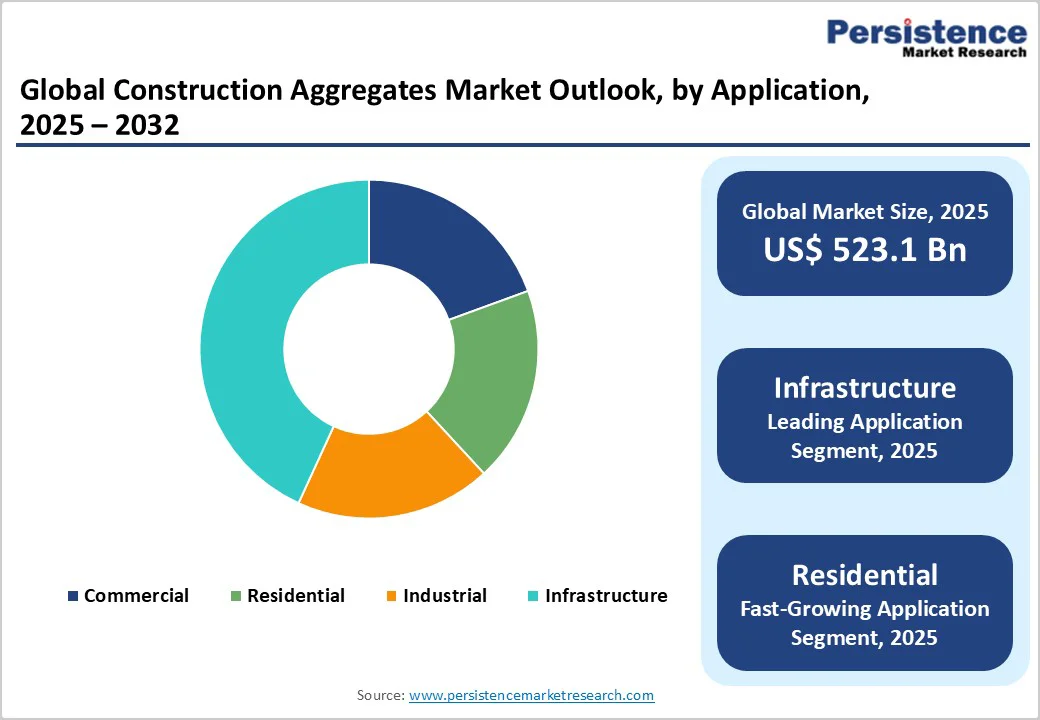

Infrastructure applications capture approximately 32% of the construction aggregates market demand through transportation networks, bridges, railways, airports, and utility infrastructure requiring massive material volumes. Government infrastructure investment initiatives totaling trillions of dollars globally support multi-year procurement contracts, ensuring consistent demand. Road construction and maintenance, consuming approximately 18% of total aggregates, create recurring replacement demand as infrastructure ages, requiring rehabilitation and upgrade.

Bridge and dam construction demanding specialized high-performance aggregates creates premium pricing opportunities, enabling profitability optimization. Renewable energy infrastructure, including wind farms and solar installations requiring concrete foundations, expands application diversity beyond traditional construction markets, supporting sustained demand growth.

North America maintains significant market position through established infrastructure networks requiring modernization, sustained construction activity, and mature recycled aggregate market development. U.S. construction spending exceeded US$2.1 trillion in 2024, with infrastructure modernization targeting aging transportation networks and utility systems. The Infrastructure Investment and Jobs Act (IIJA), channeling multi-year funds into roads, bridges, and ports, creates substantial aggregate procurement demand supporting regional producer profitability.

The region is seeing accelerated adoption of recycled aggregate through state-level procurement mandates and sustainability certifications, driving specification integration across commercial and residential projects. Advanced logistics capabilities and digital supply chain integration enable cost-effective material sourcing and project-specific delivery optimization. Regional consolidation among leading suppliers including Vulcan Materials and Martin Marietta Materials strengthens competitive positioning and operational efficiency across the North America market.

China dominates the Asia-Pacific construction aggregates market, accounting for approximately 40% of regional consumption, driven by unprecedented urbanization and infrastructure expansion across the country. Government urbanization policies targeting a 70% urban population by 2030 are creating sustained demand for infrastructure and residential construction, while investments under the Belt and Road Initiative span multiple countries and require massive aggregate procurement for transportation networks and development projects. Major infrastructure programs, such as Shanghai urban expansion, Beijing-Tianjin-Hebei metropolitan integration, and southern regional development initiatives, are driving consistent multi-year aggregate demand throughout the region.

India is emerging as the world's second-largest consumer of construction aggregates, demonstrating exceptional market growth potential. Government initiatives are fueling this demand, including the Pradhan Mantri Awas Yojana, which targets 30 million affordable housing units, the Bharatmala Pariyojana highway development program, and the Smart Cities Mission. These multi-year projects have generated an enormous demand for aggregates across residential, commercial, and infrastructure sectors. Infrastructure investment programs, such as metro rail expansion across major cities and railway network modernization, are generating sustained demand for crushed stone and sand. Concurrently, government regulations increasingly emphasizing environmental compliance and sustainable materials are accelerating recycled aggregate market adoption, supporting long-term sustainability objectives throughout the region.

Gulf Cooperation Council (GCC) countries, including Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain, demonstrate strong demand for construction aggregates driven by economic diversification initiatives and mega-project development. Saudi Arabia dominates the GCC construction aggregates market share with 37.8% market share through the Vision 2030 economic transformation program. The Neom megacity development project represents one of the world's largest construction initiatives requiring extraordinary aggregate volumes for infrastructure, residential, and commercial development.

The United Arab Emirates (UAE) contributes substantially through infrastructure modernization, real estate development, and renewable energy projects, including massive solar installations. Regional emphasis on sustainability and green construction practices aligned with environmental commitments drives recycled aggregate adoption. Government procurement programs and private sector development initiatives ensure predictable multi-year infrastructure and construction spending supporting sustained aggregate demand through infrastructure maturation.

The global construction aggregates market structure exhibits moderate consolidation. Holcim Ltd., CRH plc, Heidelberg Materials AG, and Vulcan Materials Company collectively controlling approximately 8-10% market share through extensive quarrying operations, established distribution networks, and regional market dominance.

Tier-two participants including CEMEX, Martin Marietta Materials, and regional specialists capture significant market segments through cost competitiveness and localized service excellence. Substantial capital requirements for quarry development and processing facility establishment create high market entry barriers supporting established player advantages. Strategic acquisition activity consolidates regional market positions as leading companies expand geographic footprint and product portfolio capabilities.

The global construction aggregates market is projected to reach US$ 523.1 billion in 2025.

Primary market drivers include accelerating global infrastructure investment, rapid urbanization, government mandates for sustainable construction, and recycled aggregate adoption supporting circular economy objectives globally.

The market is poised to witness a CAGR of 6.5% from 2025 to 2032.

Renewable energy infrastructure expansion including solar farms, wind turbines, and hydroelectric facilities requiring millions of tons of aggregates presents the most lucrative market opportunity.

CRH plc, Vulcan Materials Company, Holcim Ltd., and Heidelberg Materials AG are some of the key players in the market.

| Report Attribute | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author