ID: PMRREP26587| 188 Pages | 26 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

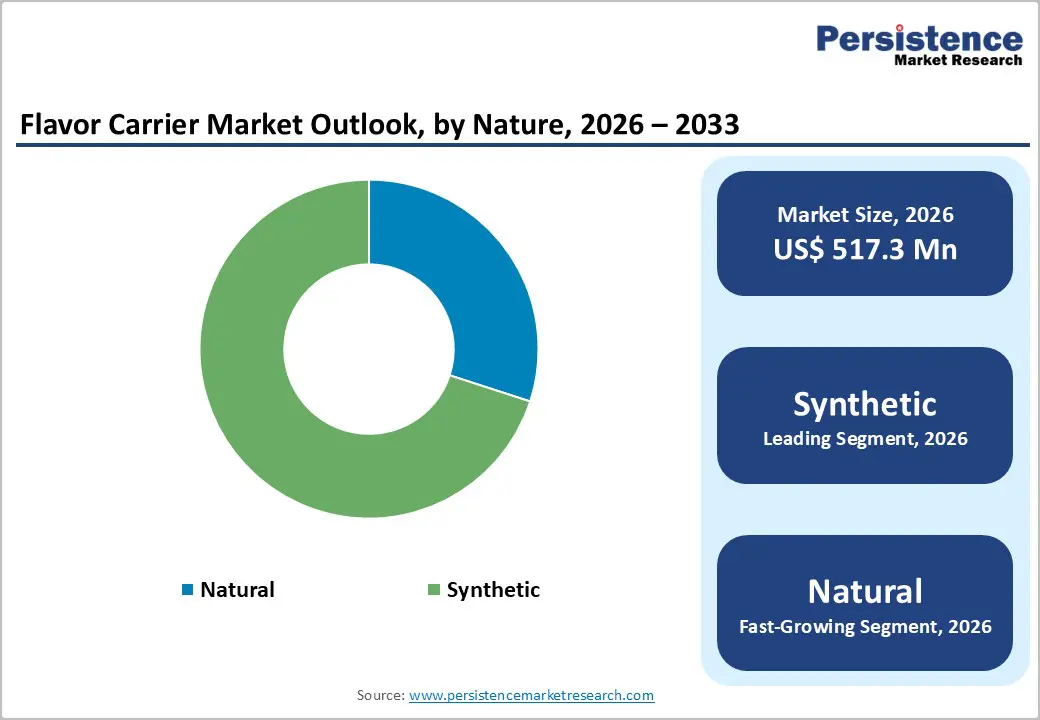

The global flavor carrier market size is estimated to grow from US$ 517.3 million in 2026 to US$ 772.7 million by 2033, growing at a CAGR of 5.9% during the forecast period from 2026 to 2033.

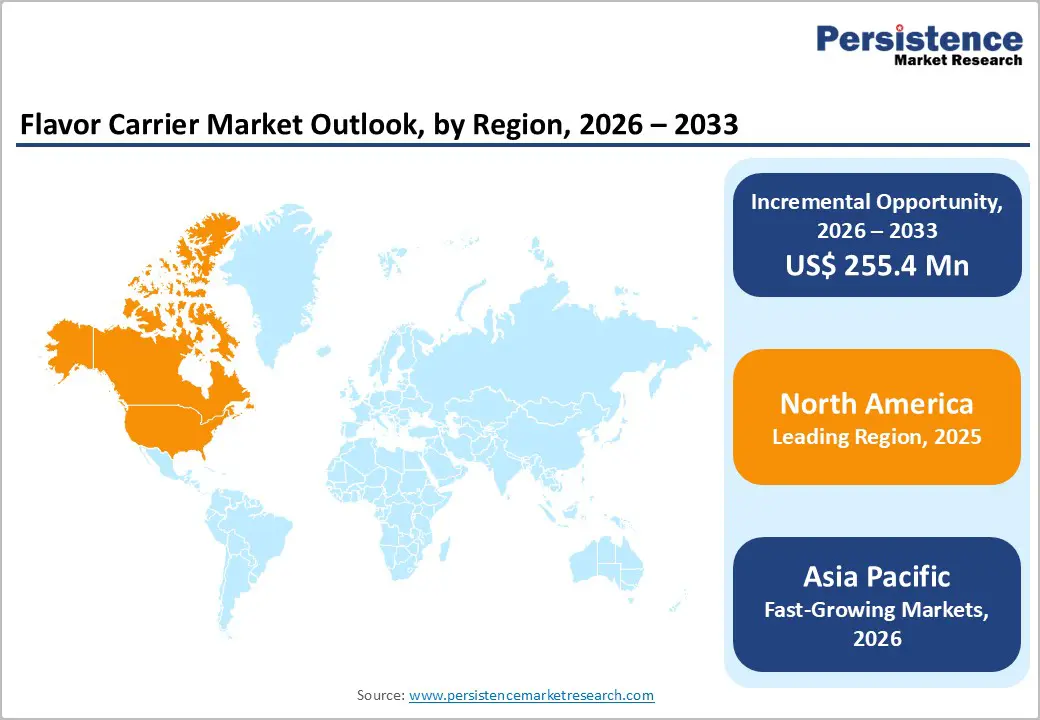

The global market is entering a transformative phase shaped by clean-label reformulation, advanced encapsulation technologies, and rapid shifts in consumer preferences across major food systems. With innovation accelerating across North America, Europe, and Asia, the market is growing for next-gen delivery systems that guarantee stronger flavor retention and better processing stability.

| Key Insights | Details |

|---|---|

| Global Flavor Carrier Market Size (2026E) | US$ 517.3 Mn |

| Market Value Forecast (2033F) | US$ 772.7 Mn |

| Projected Growth (CAGR 2026 to 2033) | 5.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.8% |

A global shift toward faster eating habits is reshaping demand for flavor carriers as processed and convenience foods gain prominence across major consumer markets. Urban lifestyles, rising workforce participation, and shrinking cooking time are accelerating reliance on ready-to-eat meals, instant snacks, and packaged beverages that require stable, high-impact flavor delivery. Manufacturers are pushing for carriers that maintain aroma intensity through high-heat processing, long storage cycles, and complex distribution networks. This surge is prompting reformulation of emulsions, spray-dried systems, and encapsulated carriers suited for high-throughput industrial lines. As brands compete for sensory differentiation, flavor carriers are becoming essential tools for building signature taste profiles that survive processing stress while meeting clean-label and cost-efficiency expectations.

Regulatory variations across regions continue to complicate progress in the global flavor carrier market, especially as companies scale across multiple continents. Divergent rules on permitted solvents, carrier thresholds, labeling language, and natural-versus-synthetic definitions push manufacturers to redesign formulations for each regulatory environment. This slows commercialization cycles and increases compliance costs, particularly for producers serving North America, Europe, and rapidly evolving Asian markets. Frequent updates to food-safety frameworks, coupled with stricter scrutiny of emulsifiers and extraction aids, create uncertainty in long-term product planning. Import-export documentation for carrier ingredients further tightens operational flexibility, making global harmonization difficult. These fragmented standards ultimately constrain innovation speed and limit the ability of companies to maintain unified product portfolios worldwide.

Leveraging innovative encapsulation to improve flavor stability and shelf life is emerging as a high-value opportunity for companies shaping the global flavor carrier market. As brands push for clean-label, heat-stable, and oxidation-resistant formulations, microencapsulation and advanced delivery technologies give producers a chance to differentiate. These systems protect volatile aromatics during processing, enhance controlled release in baked, fried, or high-acid applications, and extend storage performance for global shipments. Startups experimenting with biopolymer matrices, lipid-based capsules, and spray-drying enhancements are gaining traction among beverage, bakery, and savory manufacturers seeking precision flavor retention. Encapsulation also supports reduced-dosage formulations, helping customers manage cost inflation. With rising demand for longer-lasting, authentic taste profiles, companies investing early in encapsulation platforms secure a durable competitive edge.

Food & beverage nearly accounts for. 68% share as of 2025, reflecting the sector’s heavy reliance on flavor carriers to achieve consistent taste, aroma, and stability across high-volume processed products. Rapid growth in ready-to-eat meals, functional drinks, and low-sugar reformulations strengthens the dominance of this segment, as manufacturers depend on carriers to maintain flavor integrity under heat, shear, and extended storage. Pharmaceutical applications are expanding steadily, driven by the need to mask bitterness in syrups, chewables, and nutraceutical blends, yet remain smaller in scale due to strict formulation constraints. Animal nutrition uses flavor carriers for palatability enhancement and uniform nutrient delivery, contributing niche but growing demand as feed producers improve product consistency and acceptance across livestock categories.

Flavor carrier is projected to grow at a CAGR of 7.9% during the forecast period, and the natural segment is emerging as the strongest catalyst behind this momentum. Rising consumer scrutiny of ingredient lists is pushing brands toward carriers sourced from botanical, fermentation-based, and clean-processing methods. Natural carriers help formulators meet tightening retailer standards and evolving regulatory expectations around permissible additives. Manufacturers are scaling investments in enzymatic extraction, bio-based solvents, and low-residue processing to enhance purity while preserving functional performance. Growth is further supported by the surge in natural flavors across beverages, confectionery, and wellness-oriented foods, where synthetic components face declining acceptance. As global brands expand clean-label portfolios, demand for natural carriers is gaining sustained traction across both established and emerging markets.

North America holds approximately 38% share in the global flavor carrier market, and the region is entering a phase defined by cleaner formulations and next-generation delivery technologies. In the US, brands are accelerating the shift toward natural, bio-derived carriers as food and beverage companies intensify reformulation programs to align with retailer-driven clean-label requirements. The push for enhanced flavor impact in low-sugar beverages and protein-enriched products is steering R&D toward microencapsulation systems and controlled-release matrices. Canada is seeing rising adoption of plant-based and allergen-conscious carriers, particularly in functional foods and nutraceutical blends. Across both markets, partnerships between flavor houses, contract manufacturers, and CPG innovators are driving rapid scale-up of high-efficiency carriers that deliver improved stability and streamlined processing performance.

Europe’s flavor carrier market is undergoing a rapid transition as manufacturers re-engineer formulations to meet stricter purity standards and evolving sensory expectations. Germany is driving momentum with advanced carrier systems designed for sugar-reduced beverages and plant-based dairy alternatives, supported by strong food-tech investments. France is prioritizing premium, culinary-inspired flavor delivery, prompting suppliers to develop carriers that preserve delicate aroma notes in gourmet applications. Italy is leaning into natural botanical sources to support its booming functional confectionery and beverage sectors. The U.K. is accelerating demand for clean-solvent carriers as brands align with retailer audits and sustainability mandates. Across Europe, innovation is shifting toward solvent-free, enzymatically processed, and bio-based carriers that deliver stronger flavor retention and cleaner ingredient declarations.

The global flavor carrier market reflects a moderately consolidated structure where influential players shape innovation intensity and sourcing standards. Leading companies are sharpening their portfolios through advanced encapsulation technologies, solvent-free carriers, and tailored solutions for clean-label reformulation. Product development cycles are accelerating as B2B customers demand rapid customization.

Strategic collaborations with food, beverage, and nutraceutical manufacturers are expanding commercial reach, while acquisitions and mergers strengthen technology capabilities and global distribution. Trade alliances support smoother ingredient flow amid tightening regional rules. R&D investments are rising in bio-based carriers and controlled-release systems, and several producers are boosting domestic manufacturing to improve regulatory compliance. Government regulations around solvents and ingredient transparency continue to guide formulation priorities.

The global flavor carrier market is projected to be valued at US$ 517.3 Mn in 2026.

Global surge in processed and convenience foods is driving the global flavor carrier market.

The global flavor carrier market is poised to witness a CAGR of 5.9% between 2026 and 2033.

Leveraging advanced encapsulation technologies to enhance flavor stability and extend shelf life is unlocking compelling growth avenues for leading industry players.

Major players in the global Flavor Carrier market include Givaudan, IFF, Symrise, Kerry Group, DSM-Firmenich, Sensient Technologies, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Form

By Nature

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author