ID: PMRREP35823| 175 Pages | 4 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

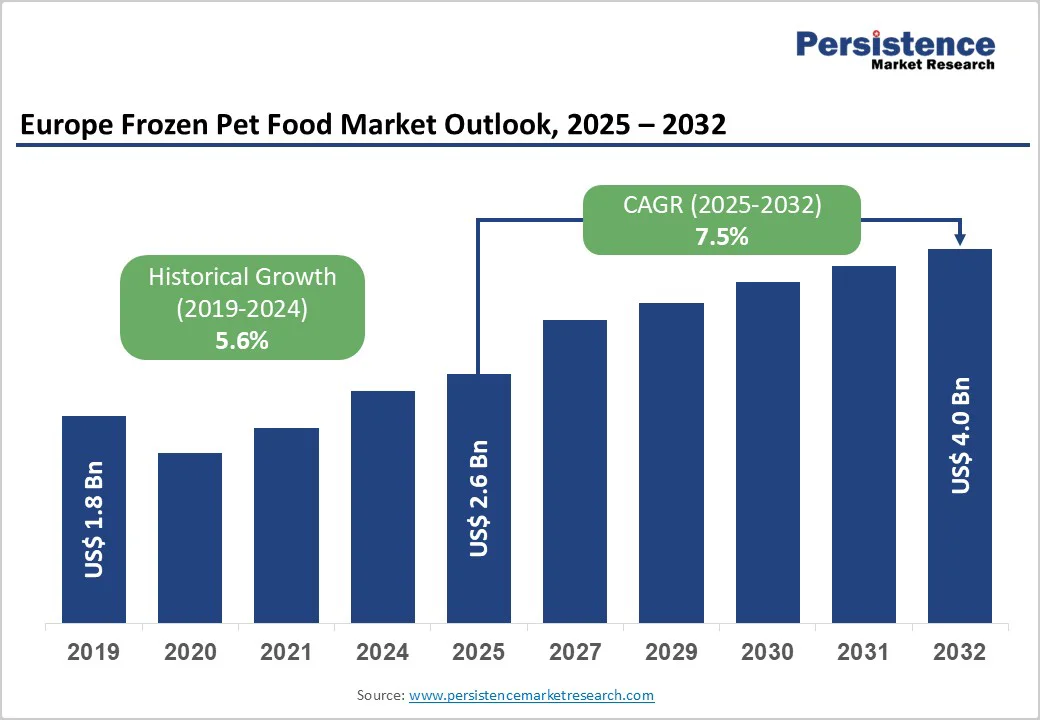

Europe Frozen Pet Food Market size is likely to reach US$2.6 billion in 2025 and projected to reach US$4.0 billion by 2032, growing at a CAGR of 7.5% during the forecast period from 2025 to 2032. The expansion of private labels and acquisitions by established players is significantly driving growth in the European frozen pet food market. Retailers are capitalizing on the rising demand for fresh and chilled meals by launching their own frozen pet food lines, increasing accessibility and affordability.

| Key Insights | Details |

|---|---|

|

Europe Frozen Pet Food Market Size (2025E) |

US$2.6 Bn |

|

Market Value Forecast (2032F) |

US$4.0 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.6% |

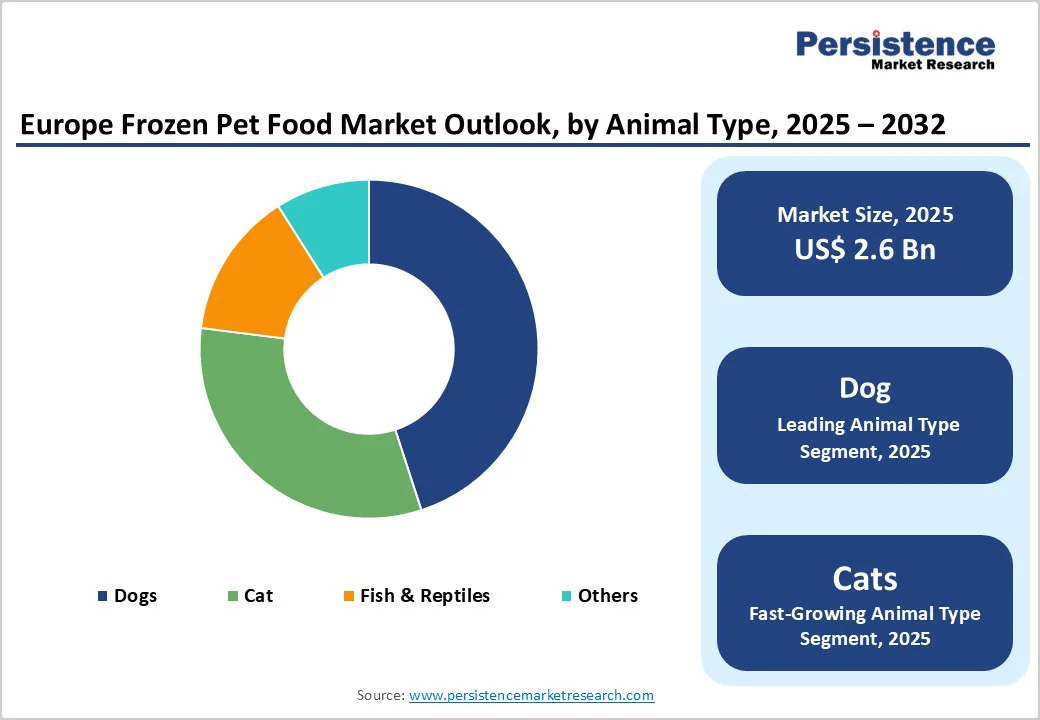

The Europe frozen pet food market is growing steadily as pet humanization continues to influence buying behavior, with owners placing greater emphasis on health and nutrition. This has increased demand for premium, natural, and minimally processed diets, positioning frozen food as a preferred option for many. Dogs currently dominate the share, yet frozen cat food is witnessing rapid growth due to rising adoption in urban households.

According to the European Pet Food Federation (FEDIAF), Europe had more than 340 million pets in 2023, including 104 million cats and 91 million dogs, reflecting a significant consumer base. Sustainability preferences, such as recyclable packaging and ethically sourced protein, are also shaping purchasing patterns. Moreover, strict European Commission guidelines on animal by-products and food safety (EC No 1069/2009) ensure product quality, safety, and traceability. These factors collectively enhance consumer trust, making frozen pet food a dynamic and increasingly important category within the region’s pet nutrition market.

A key challenge for the Europe frozen pet food market is the need for constant refrigeration at every stage of the supply chain. Frozen products must stay cold during production, transport, and storage in shops to remain safe and fresh. This makes logistics more expensive compared to regular dry or canned food and limits distribution in smaller stores that do not have enough freezer space. For pet owners, household freezer capacity is another concern, as it prevents them from buying larger packs or stocking up. These storage issues make it harder for many consumers to shift to frozen diets, even though they are becoming more aware of their health benefits. The problem is greater in parts of Eastern Europe, where cold storage and transportation systems require tedious efforts, slowing down the spread of frozen pet food in the region.

The increasing adoption of cats in urban households across Europe presents a significant growth opportunity for the frozen pet food market. Urban living, smaller household sizes, and changing lifestyles have contributed to a rise in cat ownership, particularly in countries such as Germany, France, and the United Kingdom. According to the European Pet Food Federation (FEDIAF), Europe had over 104 million cats in 2023, representing a substantial portion of the total pet population.

This growing consumer base is increasingly seeking convenient, nutritious, and high-quality feeding options, creating demand for frozen cat food that offers balanced diets and minimally processed ingredients. Urban pet owners often face limited storage space and busy schedules, making pre-portioned frozen meals and subscription-based delivery models highly appealing. Brands can leverage this trend by offering tailored formulations for different cat breeds, age groups, and dietary needs. As a result, rising urban cat adoption is expected to drive market expansion and open new avenues for product innovation and targeted marketing in the European frozen pet food sector.

In Europe, dogs dominate the frozen pet food market in 2024. The rising sales of frozen dog food are largely driven by the growing popularity of dogs as household companions, as pet owners seek high-quality, convenient, and nutritionally balanced meal options. Leading manufacturers are responding by developing frozen pet food products tailored to dogs' specific dietary needs, including breed-, age-, and health-focused formulations.

Consumers are becoming more aware of the health benefits of commercial frozen pet food, such as precise nutrient content, enhanced digestibility, and longer shelf life, which is encouraging adoption. Additionally, trends like pet humanization and the desire to provide pets with fresh, wholesome diets are further boosting demand. Overall, the combination of rising dog ownership, targeted product innovation, and growing nutritional awareness is expected to sustain strong market growth in Europe.

The conventional frozen pet food segment is anticipated to hold a dominant position in the market. These products typically combine various meat sources, helping manufacturers lower production costs and making them a more affordable option for pet owners. The cost-effectiveness of conventional frozen pet food has contributed significantly to its widespread adoption across households.

Additionally, these products benefit from a well-established distribution network, as they are commonly available in supermarkets, hypermarkets, and pet specialty stores. Unlike niche or raw diets, conventional frozen pet foods are easier to locate, increasing accessibility for a broader customer base. The convenience of purchase, combined with affordability and balanced nutrition, continues to drive the popularity of conventional frozen pet food, supporting its leading market share in Europe and other regions.

The Germany frozen pet food market is experiencing consistent growth, driven by increasing pet ownership and the rising demand for convenient, nutritious meal options. Dogs remain the dominant segment, while the cat segment is growing rapidly due to changing lifestyle patterns and increased urban pet adoption. Consumers are showing a preference for frozen meals that maintain freshness and nutritional integrity, encouraging manufacturers to innovate with customized formulations for different life stages and health requirements. Strong distribution networks through supermarkets, hypermarkets, and e-commerce platforms are enhancing product accessibility across the country. Additionally, ongoing investments in advanced freezing technologies ensure better shelf life and taste retention, further boosting market acceptance. Competitive pricing strategies and promotional campaigns by key players are also helping expand the consumer base, making frozen pet food a preferred choice among German pet owners seeking convenience and quality nutrition.

The competitive landscape of Europe frozen pet food market is marked by the presence of established multinational brands alongside regional specialists. Leading players focus on premium raw and minimally processed offerings, while European companies like Kiezebrink and Natures Menu cater to local demand with tailored formulations. Competition is intensifying through product innovation in protein diversity, grain-free options, and sustainable packaging. Online platforms and specialty pet stores are key battlegrounds, with subscription models and portion-controlled packs further differentiating strategies as companies’ target health-conscious and convenience-seeking pet owners.

Europe frozen pet food market is projected to be valued at US$ 2.6 Bn in 2025.

Rising pet humanization, demand for premium, natural diets, and growing cat adoption drive the frozen pet food market in Europe.

Europe pet food market is poised to witness a CAGR of 7.5% between 2025 and 2032.

E-commerce growth, sustainable packaging, and new protein sources offer significant opportunities for Europe’s frozen pet food market.

Major players in the Europe frozen pet food market is Stella & Chewy’s, Natures Menu, Nutriment, Kiezebrink, and Tackenberg, and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Country |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Animal Type

By Ingredients

By Form

By Nature

By Sales Channel

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author