ID: PMRREP35686| 175 Pages | 7 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

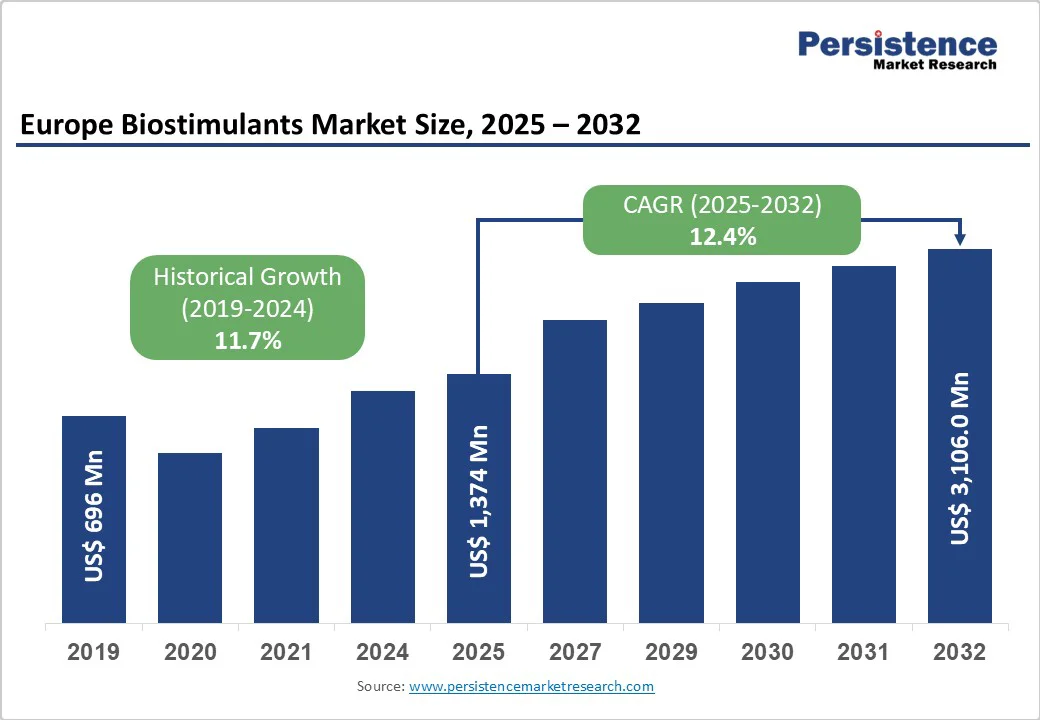

The Europe Biostimulants Market size is likely to reach US$1.4 billion by 2025 and is projected to reach US$3.1 billion by 2032, at a CAGR of 12.4% between 2025 and 2032. The growth is primarily driven by the increasing adoption of sustainable farming practices, the growing emphasis on restoring soil health, and the rising demand for organic and residue-free agricultural produce.

| Key Insights | Details |

|---|---|

|

Europe Biostimulants Market Size (2025E) |

US$1.4 Billion |

|

Projected Market Value (2032F) |

US$3.1 Billion |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

12.4% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

11.7% |

The implementation of the EU Fertilising Products Regulation (FPR) 2019/1009 has created a harmonised regulatory environment that officially recognizes biostimulants as a distinct product category. This regulation, effective since July 2022, establishes clear standards for biostimulant approval and commercialization across all EU member states, providing manufacturers with streamlined market access while ensuring product efficacy through mandatory field trials.

The regulatory framework has eliminated previous uncertainties that hindered market development, with the European Commission allocating €1 billion through the Horizon Europe program for sustainable agriculture projects, including biostimulants research.

The Nitrates Directive, which mandates that member states reduce nitrate pollution by 30% by 2025, is driving farmers toward biostimulant alternatives. Countries like Denmark have imposed strict limits on synthetic nitrogen use, leading to a 30% surge in biostimulant sales in 2022, according to environmental research institutes.

The European biostimulants sector demonstrates exceptional commitment to research and development, with companies allocating 3%- 10% of their revenue to innovation.

The region hosts over 300 collaborations between private companies and universities, fostering breakthrough developments in microbial and nature-based formulations.

Biotechnology advancements have enabled more effective targeted solutions, with precision application systems achieving a 40% reduction in biostimulant use while maintaining crop quality.

German agricultural biotechnology capabilities have contributed to 15% reductions in production costs, making these products more accessible to farmers. Recent developments include the emergence of AI-powered platforms for assessing biostimulant efficacy and the integration of precision agriculture technologies to optimize nutrient delivery systems.

Rising fertilizer costs have motivated farmers to enhance resource efficiency, with fertilizer and soil improver prices increasing by 5.6% in the second quarter of 2025, according to Eurostat data. This economic pressure has made biostimulants an attractive investment for improving returns on agricultural inputs.

Agricultural output prices across the EU increased by 5.6% compared to 2024, with key products like eggs rising 27.8%, fruits 21.1%, and milk 13.3%, creating favorable economic conditions for farmers to invest in yield-enhancing technologies.

The enhanced crop productivity delivered by biostimulants helps farmers capitalize on these favorable price trends while reducing dependency on costly synthetic inputs. Partnerships between farmers and biotech companies have achieved 20% reductions in production costs, further accelerating adoption across diverse agricultural operations.

Despite growing market momentum, biostimulant penetration remains constrained by knowledge gaps, with studies indicating that only 1 in 10 agricultural professionals is currently aware of biostimulant benefits. This awareness deficit is particularly pronounced among small-scale farmers who may lack access to technical advisory services and demonstration programs.

The complexity of biostimulant mechanisms and application protocols requires specialised knowledge that traditional agricultural education systems have not yet fully integrated. Additionally, generational preferences for conventional farming methods create resistance to adopting new biological technologies, especially in regions with established agricultural traditions.

Premium pricing of advanced biostimulant formulations poses significant barriers for smaller agricultural operations, particularly in cost-sensitive market segments. The sophisticated research and development requirements, coupled with complex manufacturing processes, result in higher unit costs than those of traditional fertilizers.

Regulatory compliance costs, including mandatory efficacy trials and documentation requirements under the FPR, contribute to elevated product prices. Small-scale farmers often face budget constraints that limit their ability to invest in these innovative solutions, despite their long-term benefits for soil health and crop productivity.

The convergence of biostimulants with precision agriculture technologies represents a transformative opportunity for European agriculture. Precision farming technologies accounted for 30% of new agricultural investments in 2022, with countries such as Germany and the Netherlands achieving 25% increases in biostimulant adoption through smart farming practices. Advanced application systems enable targeted delivery based on real-time soil and plant condition monitoring, maximising efficacy while minimising waste.

The integration of satellite imagery, drone technology, and AI algorithms provides farmers with unprecedented insights for optimised biostimulant deployment. This technological convergence is particularly promising for large-scale operations seeking to balance productivity gains with environmental stewardship objectives.

European agricultural technology companies are developing sophisticated platforms that combine biostimulant applications with comprehensive crop management systems. These integrated solutions offer farmers data-driven decision support, enabling precise timing and dosage optimisation based on weather patterns, growth stages, and stress indicators. The scalability potential of these technologies positions Europe to lead global innovation in sustainable agriculture, creating export opportunities for both technology and products across international markets.

The rapid growth of urban agriculture presents significant opportunities for specialized biostimulant applications. Urban farming projects grew by 20% in 2022, with biostimulants playing vital roles in nutrient management for indoor crops.

Countries like Spain and Italy, where urban agriculture accounts for over 15% of local food production, demonstrate the commercial viability of this sector. The controlled environment conditions in vertical farming systems enable precise biostimulant applications that maximize plant growth efficiency while minimizing resource consumption.

Consumer preferences for locally sourced, sustainably grown produce are driving investments in urban agriculture infrastructure across major European cities. These facilities require specialized biostimulant formulations optimized for hydroponic and aeroponic systems, creating niche market opportunities for innovative manufacturers.

The premium pricing of urban-grown produce justifies higher input costs, making advanced biostimulant technologies economically viable for these applications. Partnerships between biostimulant manufacturers and urban farming operators are establishing new commercial models that support rapid sector expansion.

Non-microbial biostimulants dominate the European market with a commanding over 70% market share in 2025, reflecting the established commercial success of amino acids, seaweed extracts, and humic substances. These products benefit from well-understood application protocols and proven efficacy across diverse crop systems. The mature technology platform and established supply chains contribute to their market leadership position.

Microbial biostimulants represent the fastest-growing segment, driven by advancing biotechnology capabilities and increasing farmer recognition of the benefits of the soil microbiome.

Recent regulatory clarity under the FPR has accelerated microbial product development, with companies investing heavily in beneficial bacteria and fungi formulations that enhance nutrient uptake and stress tolerance.

Liquid biostimulants hold the leading market position with approximately 68.3% market share, driven by ease of application, rapid plant uptake, and compatibility with fertigation systems.

Liquid formulations offer superior handling characteristics, uniform distribution, and integration with precision application equipment, making them preferred for commercial agricultural operations. The segment benefits from continuous innovation in formulation technologies, including concentrated solutions and enhanced stability formulations that reduce transportation costs and improve shelf life.

Solid biostimulants represent the fastest-growing segment and serve specific application needs, including seed treatment and soil incorporation. This segment includes powder, granular, and coated formulations that provide controlled release characteristics and extended soil activity. Solid formulations are particularly valuable for seed treatment applications, providing season-long protection and growth enhancement.

Seaweed extracts command over 35% market share in 2025, establishing themselves as the dominant active ingredient category. The segment's leadership is attributed to its rich bioactive compound content, proven stress-tolerance benefits, and broad crop applicability.

The brown algae segment dominates seaweed extracts, owing to their high concentrations of polysaccharides, auxins, and cytokinins, which enhance plant growth and stress tolerance.

Humic and fulvic acids are the fastest-growing segment, holding a significant share in 2025. Humic and fulvic acids maintain strong market positions through their soil health benefits, nutrient chelation properties, and compatibility with organic farming systems. These products enhance plant metabolism, stress protein production, and nutrient uptake efficiency.

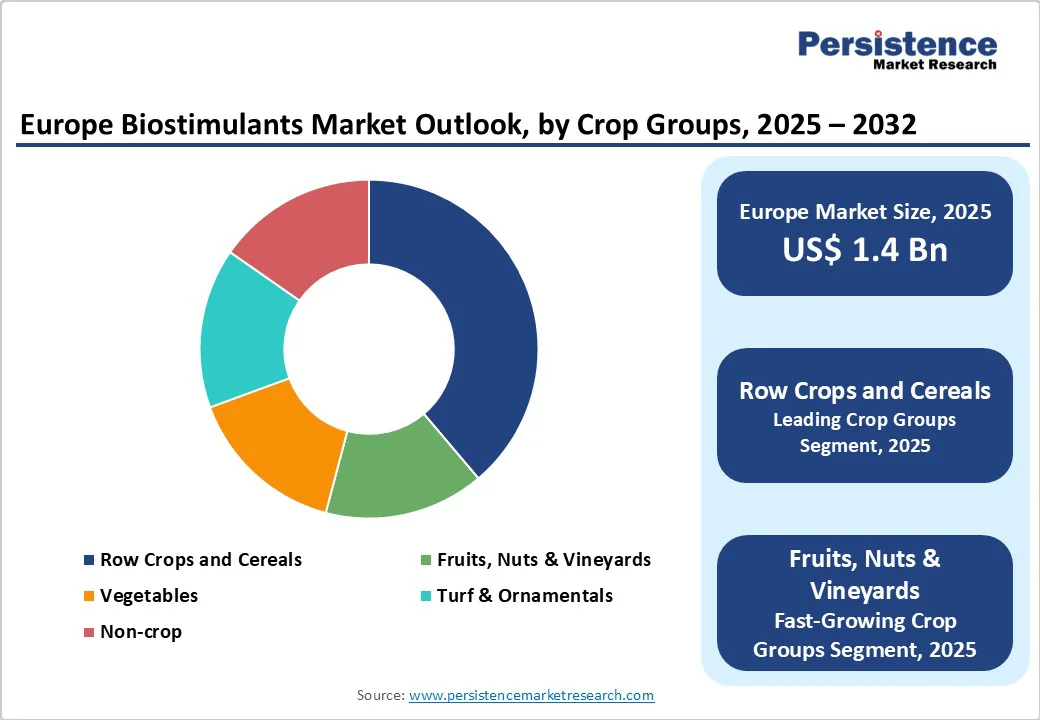

Row Crops and Cereals Market Leadership

Row crops and cereals accounted for more than 50% of the market share in 2025, representing the largest application segment for biostimulants. This category includes major staple crops such as corn, wheat, soybeans, and rice that benefit from improved nutrient efficiency and stress tolerance. The segment's dominance reflects large cultivation areas, increased adoption of sustainable practices, and demonstrated returns on investment for commodity crops.

High-Value Crops Driving Premium Applications

Fruits, nuts, and vineyards represent high-value crop segments with premium biostimulant adoption, driven by quality requirements and export market demands. These crops benefit from specialized formulations that enhance fruit set, improve sugar content, and extend shelf life. Vegetable production shows strong adoption rates, particularly in greenhouse and controlled-environment systems, where precise nutrient management is critical. Turf and ornamental applications continue to grow, supported by biostimulant benefits in stress tolerance, color retention, and aesthetic quality.

Foliar application holds over 75% market share in 2025, driven by rapid nutrient uptake, efficient delivery of active ingredients, and immediate plant response. Research consistently demonstrates that foliar biostimulant applications yield increases of 18.3% on average compared to untreated controls. The method's popularity stems from quick response times, uniform distribution capabilities, and compatibility with existing spray equipment. Foliar applications are particularly effective for stress mitigation, with studies showing improved photosynthetic efficiency and antioxidant activity under drought conditions.

Soil treatment applications focus on long-term improvements in soil health and root-zone enhancement, supporting season-long crop benefits. This segment emphasizes stimulating microbial activity, improving nutrient availability, and enhancing soil structure. Seed treatment is the fastest-growing segment, with an approximate 11% CAGR, driven by convenience, cost-effectiveness, and season-long crop protection. Biological seed treatments enhance root development, improve nutrient uptake, and confer stress tolerance benefits from germination through harvest.

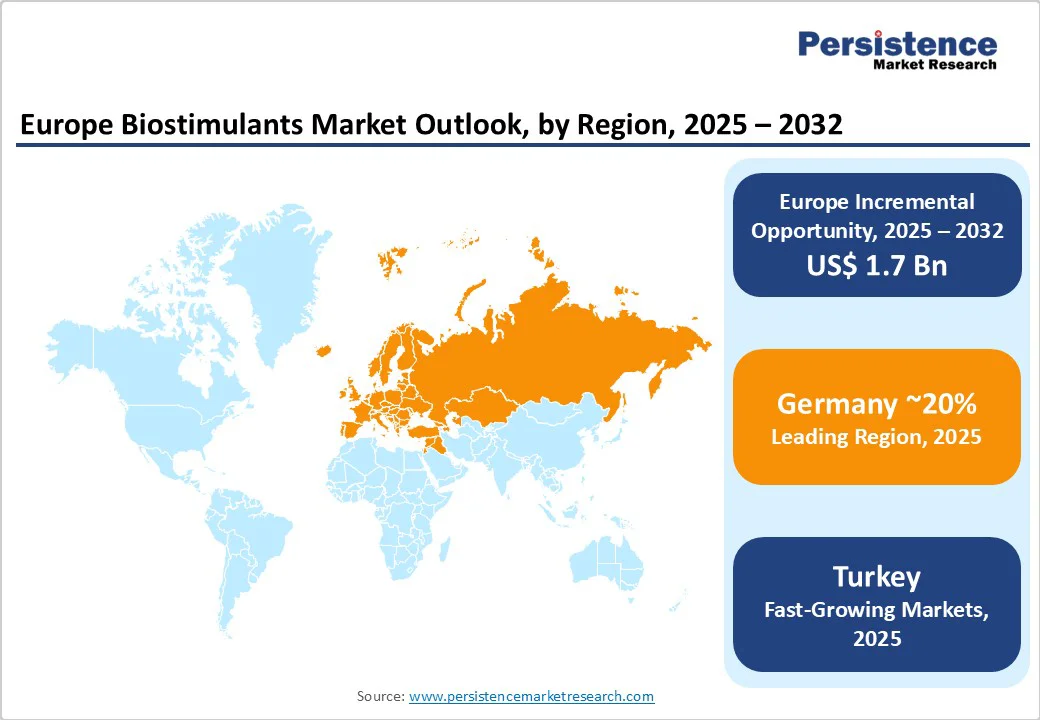

Germany leads the European biostimulants market with over 20% market share, establishing itself as the region's innovation and commercial hub. The country's agricultural sector contributes approximately €50 billion annually to the national economy, with 270,000 agricultural enterprises employing around one million people.

Germany's position as the second-largest importer of consumer-oriented agricultural products worldwide creates substantial market opportunities for biostimulant applications across diverse crop systems. The Federal Ministry of Agriculture, Food and Regional Identity emphasises sustainable growth in response to resource constraints and environmental stewardship requirements, creating favourable policy conditions for biostimulant adoption.

German farmers increasingly balance productivity demands with environmental responsibilities, animal welfare considerations, and consumer preferences for sustainable production. This integrated approach aligns with biostimulant benefits for biodiversity maintenance, landscape preservation, and sustainable resource management. The country's leadership in precision agriculture and agricultural biotechnology provides a competitive advantage in developing and implementing advanced biostimulant technologies across 50% of the farmland devoted to grassland and arable crop production.

Spain holds 15% of the European biostimulants market, driven by its position as the fourth largest agri-food power in Europe, with industry revenue exceeding €168.2 billion and employing 559,700 people.

The country's diverse agricultural production, including leadership in organic farming, olive oil, citrus fruits, and fresh vegetables, creates extensive opportunities for biostimulant applications. Spanish biostimulant companies, represented by approximately 58 specialised companies under the AEFA association, achieved a turnover exceeding €755 million in 2023, with 40% of production exported to over 100 countries.

Spain's technological leadership in developing new ingredients, high-quality protein sources, and precision agriculture positions the country for continued market expansion.

France represents 12.5% of the European biostimulants market, supported by its status as Europe's agricultural powerhouse, with the agri-food industry generating US$207.97 billion in annual sales and employing 459,803 people.

The sector comprises approximately 17,372 companies, with small and medium enterprises accounting for 98% of the industry. Agricultural and agri-food exports contribute significantly to economic growth, with a surplus of US$12.18 billion, driven by cereals and raw product exports.

French adoption of biostimulants increased from 4.8% of cultivated area in 2019 to 9.3% in 2023, demonstrating accelerating market penetration. The government prioritises digitalisation, robotics, and genetics, creating opportunities in precision agriculture, biopesticides, and climate-resilient crops.

Leading agricultural sub-sectors include wine and viticulture (18.1%), livestock and poultry (10.7%), dairy farming (8.1%), and cereals (6.9%). France's commitment to ecologically sustainable practices, including reduced pesticide use and water conservation, positions biostimulants as essential components of agricultural transformation.

Greece, Russia, and the Nordic countries represent emerging opportunities. Greece benefits from Mediterranean agricultural conditions that favour biostimulant applications in fruit and vegetable production. Russia shows potential for market expansion, driven by large agricultural areas and increasing awareness of sustainable farming practices. The Benelux region demonstrates high adoption rates, supported by intensive agriculture and strong environmental regulations. Nordic countries are experiencing growth in biostimulant applications for stress tolerance, particularly in addressing challenging climatic conditions.

The European biostimulants market is highly consolidated, dominated by a few global and regional players with strong R&D capabilities and extensive distribution networks. Key companies such as Bayer, Syngenta, BASF, Corteva, and Valagro lead the market, leveraging technological innovation, acquisitions, and strategic partnerships to expand their product portfolios and market reach. While several smaller niche players contribute to the diversity of offerings, the market remains highly competitive, with emphasis on product differentiation, sustainability, and crop-specific solutions.

Innovation in seaweed-based, microbial, and AI-driven biostimulants is a key differentiator, enabling leading players to maintain a strong foothold. The market’s growth is supported by increasing demand for sustainable agriculture and regenerative farming practices across Europe, encouraging both incumbents and new entrants to enhance their product pipelines continuously. Market dynamics are shaped by technological expertise, strategic collaborations, and the ability to meet evolving regulatory and environmental standards.

The Europe Biostimulants market is projected to be valued at US$1.4 Bn in 2025.

The non-microbial segment is expected to hold a 70% market share by product type in 2025 due to its established commercial success and broad application across crops.

The market is poised to witness a CAGR of 12.4% from 2025 to 2032.

The biostimulants market growth is driven by harmonized EU regulations, technological advancements in precision agriculture, and rising economic pressures to improve resource efficiency.

Key market opportunities include integration with digital farming technologies, expansion in urban and vertical farming sectors, and development of specialized formulations for controlled environment agriculture.

The top key market players in the European biostimulants market include BASF SE, Syngenta AG, Bayer AG, UPL Limited, Valagro (Syngenta Biologicals), and Koppert Biological Systems.

| Report Attribute | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value |

|

Countries Covered |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

By Source

By Form

By Active Ingredients

By Crop Groups

By Application

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author