ID: PMRREP35621| 199 Pages | 17 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

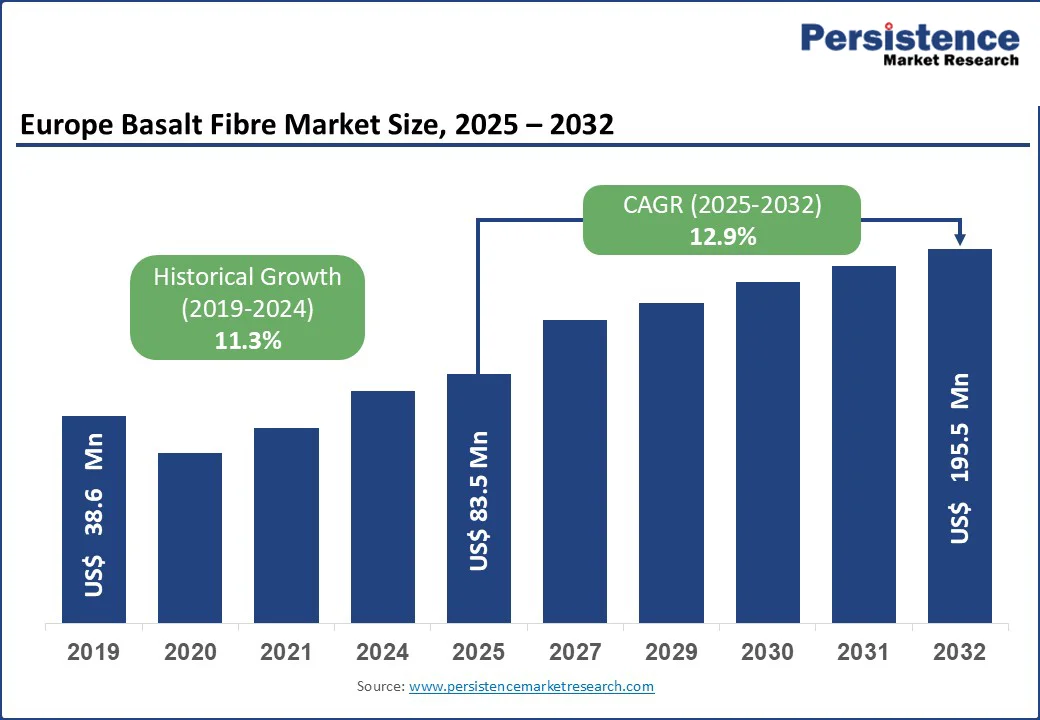

Europe basalt fibre market size is likely to value at US$ 83.5 Mn in 2025 and is expected to reach US$ 195.5 Mn by 2032 growing at a CAGR of 12.9% during the forecast period from 2025 to 2032 driven by EU Net-Zero 2050 targets, 60% composite dominance, 40% construction share, non-corrosive BFRP rebars cutting CO2 by 50%, and rising aerospace, wind energy, and automotive adoption.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

|---|---|

| Europe Basalt Fibre Market Size (2025E) | US$ 83.5 Mn |

| Market Value Forecast (2032F) | US$ 195.5 Mn |

| Projected Growth (CAGR 2025 to 2032) | 12.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 11.3% |

A key driver of Europe basalt fibre market is the growing demand for high-performance, fire-resistant, and thermally stable materials across construction, transportation, and energy sectors. Unlike traditional synthetic and glass fibres, basalt fibres maintain structural integrity under extreme heat, withstanding continuous exposure in the 300°C-560°C range and short-term peaks of 700-800°C, while acting as a sacrificial fire-barrier textile.

This superior thermal shock resistance, non-combustibility, and dimensional stability make basalt fibre indispensable in fire-protection applications, including barrier cloths, tunnel linings, and safety textiles in European infrastructure projects.

As the European Union enforces stricter fire-safety codes, nuclear safety protocols, and high-performance material standards, basalt fibre emerges as a preferred eco-friendly and high-strength alternative to E-glass fibres, driving adoption in critical infrastructure, automotive safety, renewable energy systems, and industrial composites.

This regulatory push, combined with the material’s unmatched thermal and mechanical profile, makes fire- and temperature-resilience a primary growth driver for basalt fibre adoption in Europe.

A primary driver of the Europe basalt fibre market is the region’s stringent climate and infrastructure policies, which increasingly favor low-carbon and durable construction materials. The construction industry’s growing demand for non-corrosive reinforcement solutions aligns perfectly with basalt fibre-reinforced polymer (BFRP) rebars.

Unlike traditional steel, which corrodes over time, basalt composites offer tensile strength nearly three times greater than steel, high resistance to alkalis and de-icing salts, and the ability to extend the lifespan of bridges, tunnels, and coastal structures.

EU-funded pilot projects across Germany, the Netherlands, and Sweden have demonstrated that substituting steel reinforcement with BFRP rebars can cut embodied carbon emissions by up to 50% while maintaining equivalent load-bearing capacity.

These results directly support the EU’s Energy Performance of Buildings Directive (2024 revision) and its Net-Zero by 2050 roadmap, both of which prioritize sustainable material substitution in civil infrastructure. Moreover, the upcoming Carbon Border Adjustment Mechanism (2025) will penalize carbon-intensive construction inputs, further boosting basalt’s competitiveness against steel.

With procurement agencies increasingly including basalt benchmarks in infrastructure tenders and European standards (such as EAD 260023-00-0301) now covering FRP rebars, basalt fibre is rapidly gaining acceptance as a cost-efficient, non-corrosive, and regulation-compliant reinforcement material across Europe.

Europe basalt fiber market faces significant restraints due to the lack of standardization in manufacturing technologies and the complex regulatory environment imposed by both EU-wide and national authorities. Despite basalt fiber’s superior tensile strength, corrosion resistance, and eco-friendly profile, its large-scale adoption is slowed by design non-uniformity, process variability, and non-recurring development costs.

The absence of harmonized standards for material grades, testing methodologies, and production processes obliges manufacturers to adopt conservative, risk-averse designs and favors traditional materials such as steel and glass fiber over basalt composites for critical applications.

Adding to this challenge, basalt fiber producers must comply with stringent regulations such as CE Marking, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), RoHS (Restriction of Hazardous Substances), and increasingly strict digital traceability frameworks under GDPR.

Countries such as Germany and France enforce additional national standards beyond EU directives, further complicating certification and elevating compliance costs. For startups and SMEs, these legal and technical hurdles increase barriers to entry, strain R&D resources, and extend commercialization timelines even as EU incentives like R&D tax credits exist to mitigate costs.

Collectively, the dual challenge of technological non-standardization and regulatory rigidity slows the scaling of basalt fiber manufacturing in Europe, obstructs mass production, and tempers the material’s penetration in high-growth applications such as construction, automotive, and consumer goods.

A key opportunity emerges in sustainable construction and renewable energy initiatives. There is a marked shift in Europe’s construction sector toward environmentally responsible, high-performance building solutions.

Basalt fibre’s unique properties, including high tensile strength, excellent thermal resistance, and superior durability, make it an attractive material for both builders and environmental agencies. EU investment in large-scale infrastructure projects, such as bridges with basalt FRP and wind energy facilities utilising basalt composites, reinforces the growth prospects.

Governmental support for renewable energy, as well as incentives for the adoption of green materials, drive both research and commercial applications.

This creates a particularly strong opportunity for market leaders such as Kamenny Vek, Technobasalt-Invest, and Sudaglass, who are expanding production across Europe, investing in quality improvements, and collaborating with local governments for pilot projects that demonstrate the environmental and economic benefits of basalt fibre technologies.

Europe basalt fibre market is segmented by product type into composites and non-composites. Among these, the composites dominate, capturing over 60% revenue share in 2025 due to strong regulatory backing, technical validation, and superior performance advantages.

The European Organisation for Technical Assessment (EOTA) issued EAD 260067-00-0301, certifying basalt-reinforced concrete applications with a 50-year working life, while CEN/TS 19101:2022 provides Eurocode-aligned design standards, ensuring safety and harmonization across the EU.

ASTM test data confirms basalt composites deliver tensile strength of 2900-3200 MPa, nearly three times stronger than steel yet 67% lighter, making them vital in aerospace, automotive, and structural applications.

Non-composites represent the fastest-growing segment, propelled by EU sustainability mandates and construction investment. France’s Circular Economy Law accelerates basalt’s replacement of plastics, while Italy’s €34 billion infrastructure modernization fund expands demand in telecom and energy grids.

Germany’s Industry 4.0 subsidies support basalt in industrial applications, from textiles to insulation. Together, composites provide the institutionally certified, performance-driven backbone of the market, while non-composites rapidly expand adoption in traditional construction and sustainable industrial uses, making Product Type segmentation a dual-growth engine.

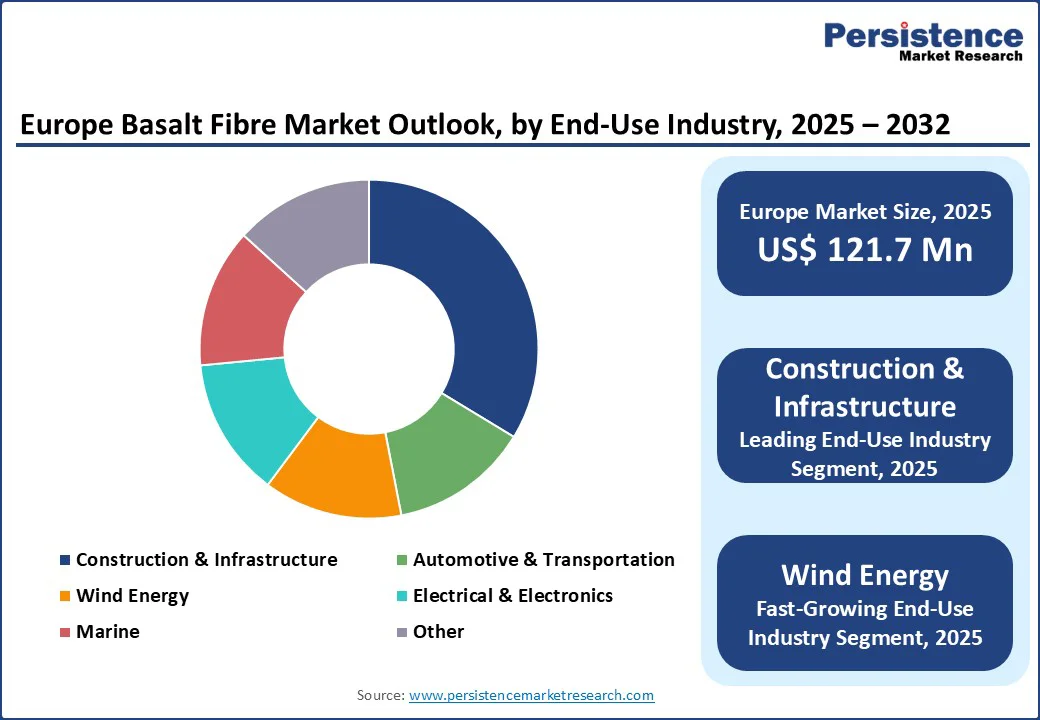

In 2025, construction & infrastructure dominates the Europe basalt fiber market exceeding 40% revenue share, supported by government megaprojects, EU funding, and sustainability standards. The European Investment Bank’s €120 million grid modernization financing demonstrates institutional demand for basalt reinforcement in civil engineering.

ISO 10406-1:2015 testing confirms basalt rebar maintains 97% tensile strength after seawater exposure, proving resilience for bridges, tunnels, and marine projects. With the European Green Deal targeting carbon neutrality by 2050, basalt’s 70% lower CO2 footprint vs. steel positions it as a sustainable construction material.

At the same time, wind energy emerges as the fastest-growing Industry, fueled by renewable mandates and technical superiority. WindEurope reports 153.7 GW installed wind capacity, consuming 150,000-186,000 tonnes of composites annually, with basalt offering 15% higher modulus and 25% greater tensile strength than E-glass.

EU-backed funds, including the €3.6 billion Innovation Fund and EIT Raw Materials investment, further accelerate basalt’s integration into recyclable wind blades. Thus, construction secures dominance, while wind energy sets the pace for future growth in basalt applications.

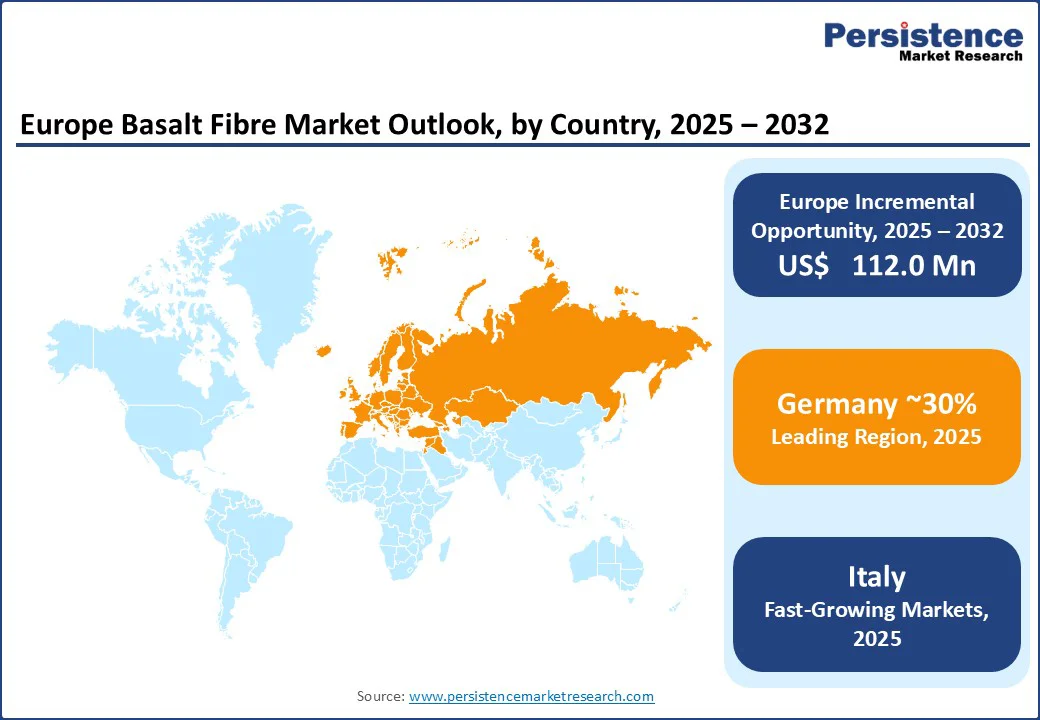

Germany dominates Europe basalt fiber market, leveraging its industrial leadership, regulatory frameworks, and automotive demand. The German Federal Environment Ministry’s Industry 4.0 initiatives provide subsidies and tax relief for sustainable materials, directly supporting basalt fiber adoption in manufacturing, aerospace, and construction.

The German Institute for Construction Technology (DIBt) issued ETA-20/0599, approving basalt reinforcement in concrete with a 50-year lifespan, setting a gold standard for European certification.

According to ACEA, Germany anchors EU automotive output, producing 2.8 million commercial vehicles in 2018, requiring lightweight composites for fuel efficiency and emissions compliance. Compliance with the EU Construction Products Regulation ensures German basalt products bearing CE marking gain full EU-wide market access, expanding Germany’s export capacity.

The country’s advanced ecosystem, with leading OEMs such as Volkswagen, BMW, and Mercedes-Benz, fosters basalt adoption in EV battery casings, lightweight panels, and fire-resistant interiors. Combined with strong infrastructure investment, Germany remains the dominant force in setting technical, regulatory, and industrial benchmarks for basalt fiber market in Europe.

Italy is the fastest-growing market for basalt fiber in Europe, fueled by EU recovery funding, infrastructure modernization, and industrial diversification. The Italian government allocated €34 billion from the EU Recovery and Resilience Facility to upgrade fiber networks, power infrastructure, and transportation grids, creating massive basalt demand for telecom cables, bridges, and smart energy systems.

The European Investment Bank’s €120 million financing with AGSM AIM for Italian power grid reinforcement further illustrates institutional reliance on advanced reinforcement materials.

Italy’s strategic focus on decarbonization and sustainable construction aligns with basalt’s 70% lower CO2 footprint vs. steel, directly supporting the European Green Deal objectives. Beyond infrastructure, Italy’s strong automotive, textiles, and fashion industries are experimenting with basalt in lightweight vehicle parts, heat-resistant fabrics, and sustainable apparel.

National initiatives promoting digitization for SMEs are expanding basalt applications across industrial and consumer goods. With diversified demand and EU-backed funding, Italy is set to become the fastest expanding basalt fiber hub in Europe.

Europe basalt fibre market is marked by intense competition, where manufacturers differentiate through certifications, performance metrics, and sustainability credentials. Leading players emphasize EOTA approvals, ISO standards, and DIBt pilot projects, ensuring compliance with stringent EU construction and infrastructure regulations.

Companies are strategically targeting automotive, wind energy, and construction sectors by offering lightweight, high-strength basalt composites with tensile strengths exceeding 2,900 MPa, aligning with OEM and renewable energy requirements.

Innovation remains central, with pioneers advancing automated 3D basalt fibre production, finite element analysis integration, and steel-replacement mineral composites that reduce CO2 emissions by up to 70%. Facility expansions across Northern and Central Europe cater to offshore wind projects, where basalt-epoxy fabrics provide superior UV, lightning, and marine durability.

Vertically integrated operations highlight zero gas dispersion melting, 100% recyclability, and Green Deal-aligned processes, positioning firms strongly in sustainable manufacturing. Overall, market competitiveness is shaped by regulatory compliance, advanced R&D, scalable production, and sustainability leadership, making Europe a hub for next-generation eco-friendly, high-performance basalt fibre solutions.

Europe Basalt Fibre market is estimated to be valued at US$ 83.5 Mn in 2025.

Rising demand for high-temperature and fire-resistant materials in critical european industries is the key demand driver for the Basalt Fibre market.

In 2025, Germany will dominate the market with an exceeding 30% revenue share.

Among Industry, Construction & Infrastructure holds the highest preference, capturing beyond 40% of the market revenue share in 2025, surpassing other end-use industries.

The key players in the Basalt Fibre market are Deutsche Basalt Faser Gmbh, Bastech Trade Ltd, Fiberbas Construction and Building Technologies, Hg Gbf Basalt Fiber Co., Ltd, Kamenny Vek Company, Mafic SA and Technobasalt-Invest LLC.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author