ID: PMRREP16969| 210 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

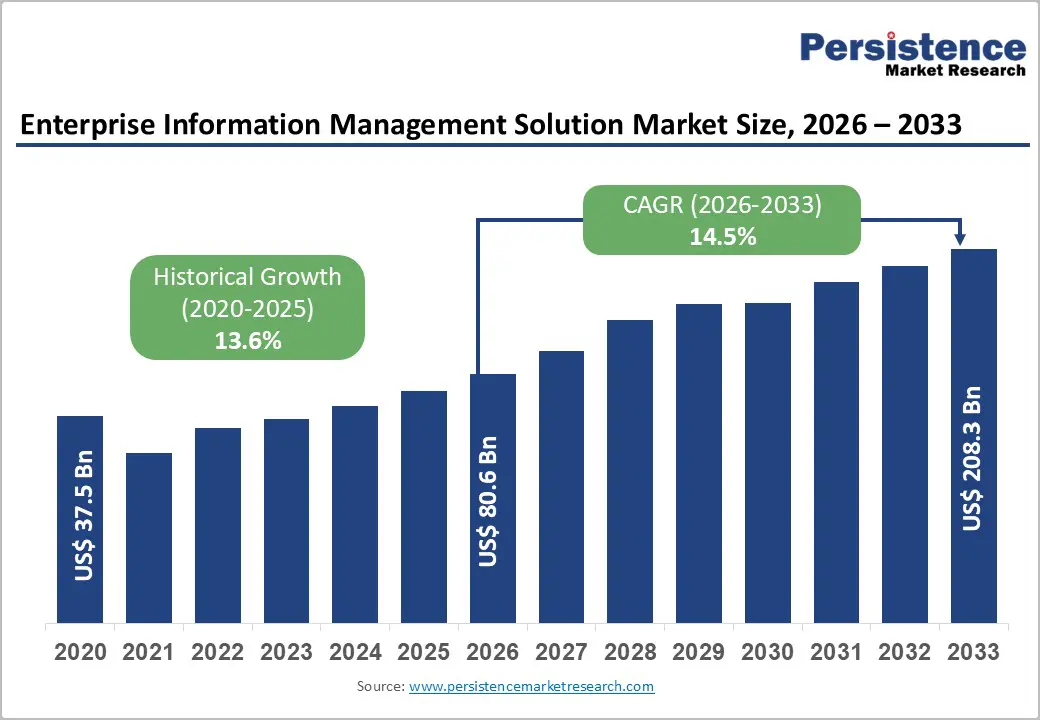

The global enterprise information management solution market size is likely to be valued at US$ 80.6 billion in 2026 and is projected to reach US$ 208.3 billion by 2033, growing at a CAGR of 14.5% between 2026 and 2033.

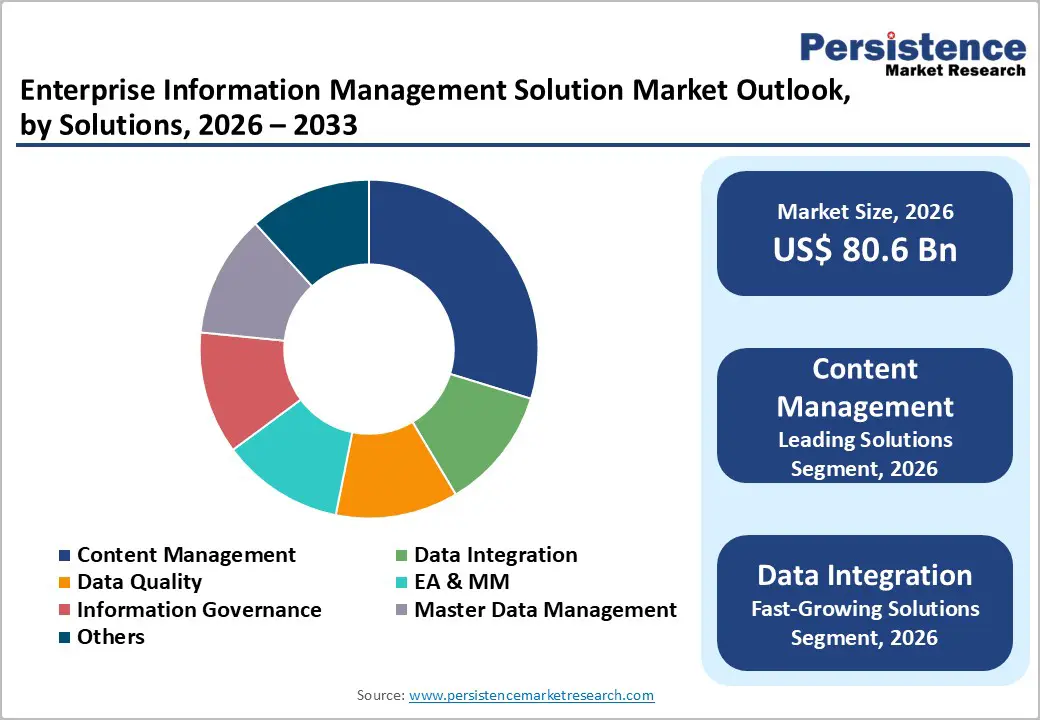

Business organizations are prioritizing integrated information management to unify fragmented data ecosystems, enhance real-time decision-making, and meet evolving data governance mandates such as GDPR, CCPA/CPRA, and sector-specific regulations. Content management leads with over 25% revenue share, while cloud deployment is the fastest-growing channel, underpinned by improved total cost of ownership, operational agility, and seamless integration with enterprise analytics platforms.

| Key Insights | Details |

|---|---|

| Enterprise Information Management Solution Market Size (2026E) | US$ 80.6 Bn |

| Market Value Forecast (2033F) | US$ 208.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 14.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 13.6% |

Regulatory pressure is reshaping EIM adoption patterns globally. The GDPR, CCPA (and the newly enforceable CPRA in California), HIPAA, and sector-specific mandates such as Basel III and Dodd-Frank are mandating comprehensive data retention, protection, and auditability frameworks. The California Privacy Protection Agency (CPPA) issued enforcement advisories in 2024 emphasizing data minimization as a foundational compliance principle, with mandatory risk assessments and annual cybersecurity audits for high-risk processors. In Europe, the Data Governance Solutions market is growing at a 21.8% CAGR, significantly outpacing growth in broader technology spending. Financial institutions and healthcare providers face particular urgency, as BFSI organizations account for over 35% of EIM revenue share and rely on archiving and governance solutions to satisfy regulatory audit requirements and demonstrate data lineage in response to enforcement actions.

Enterprise data volumes are expanding at unprecedented rates, driven by IoT sensors, digital engagement channels, transactional systems, and unstructured content. Organizations recognize that leveraging this data through advanced analytics and machine learning requires robust foundational data management. Enterprises with strong integration practices report 3.7x ROI from AI initiatives, with top AI leaders achieving 10.3x ROI. EIM solutions that embed AI and machine learning for data quality detection, automated governance, metadata classification, and anomaly identification are becoming table stakes. Cloud-native data integration platforms now offer AI-driven data matching, cleansing, and governance automation that reduce manual effort and improve decision velocity, compelling further investment across all enterprise sizes.

As data sensitivity increases and regulatory oversight tightens, organizations remain cautious about cloud adoption and data transfer across systems. Misconfigurations can cause 70% of data breaches, a concern that motivates continued on-premises adoption among regulated industries. Interoperability challenges persist; integrating EIM tools with heterogeneous enterprise application landscapes (ERP, CRM, specialized industry platforms) requires custom connectors, API management, and data transformation logic that add cost and complexity. Additionally, 81% of CIOs believe digital transformation succeeds only when integrated with cloud strategies. Yet, many organizations struggle with multi-cloud governance, data residency requirements, and compliance with regional data sovereignty laws, slowing adoption momentum.

The Enterprise Information Management (EIM) market is entering a high-growth phase driven by two structurally important opportunity areas: cloud-native adoption among small and medium enterprises (SMEs) and accelerating demand for vertical-specific data governance solutions, particularly in healthcare. SMEs represent a historically underserved but rapidly expanding customer base for EIM vendors. Traditionally, master data management (MDM) and advanced data quality platforms were accessible mainly to large enterprises due to high implementation costs and complexity. However, cloud-native architectures, pre-configured templates, and guided workflows are now enabling SMEs to adopt these solutions with minimal upfront investment. As a result, SMEs are realizing measurable business benefits, including up to 15% revenue uplift and nearly 20% reduction in operational and compliance risks through improved analytics and data accuracy. Cloud-based content and data management adoption among SMEs is expanding at a robust 15-20% CAGR, supported by subscription and consumption-based pricing models. By 2033, SME-focused EIM offerings could unlock incremental revenue opportunities exceeding US$ 20-30 billion.

Simultaneously, healthcare is emerging as the fastest-growing vertical within the EIM landscape. Driven by patient data unification needs, interoperability mandates such as the U.S. 21st Century Cures Act, and stringent quality-reporting requirements, healthcare data governance solutions are growing at a 19.05% CAGR-outpacing traditionally dominant sectors such as BFSI. Cloud-based master patient data and identity resolution platforms are enabling accurate cross-institution record matching, reducing duplication and improving clinical decision-making. With durable regulatory tailwinds, healthcare-focused EIM solutions alone could represent a US$ 15-20 billion market opportunity by 2033.

Content management remains the leading solution area, contributing over 25% of total revenue as enterprises depend on advanced content services platforms for document lifecycle management, compliance, collaboration, and audit readiness. Adoption is highest in BFSI, government, and healthcare, where secure, document-heavy workflows demand mature ECM capabilities from providers such as OpenText, IBM, Microsoft, and Hyland. These platforms are rapidly shifting toward cloud-native and API-driven architectures to support modern EIM needs.

Data Integration is the fastest-growing segment, driven by enterprise migration to data lakes, modern warehouses, and real-time analytics. As ETL/ELT, API integration, streaming ingestion, and event-driven frameworks become essential, vendors including Informatica, SAP, Oracle, IBM, Talend, and major cloud platforms are expanding unified integration suites. With rising digital transformation, M&A system consolidation, and AI data-quality demands, this segment is projected to grow above the 14.5% market CAGR.

On-premise deployments currently dominate the market with over 65% revenue share, largely driven by enterprises in highly regulated sectors that require strict control over sensitive data, adherence to data-residency rules, and optimal use of existing IT infrastructure. Government agencies, defense organizations, and tightly regulated BFSI institutions in Europe and parts of Asia continue to prefer on-premise EIM systems, particularly for master data management and information governance functions.

Cloud deployment, in contrast, is expanding at the fastest rate and is gradually reshaping the market landscape. Faster implementation, lower upfront CapEx, and elastic scalability make public and private cloud models attractive for both large enterprises adopting hybrid architectures and SMEs implementing EIM for the first time. Cloud-native content services, iPaaS platforms, and SaaS-based governance tools are increasingly selected for new projects, supported by clearer compliance guidelines and rapid growth in hyperscaler data centers.

Large enterprises hold over 65% of market revenue, supported by complex multi-country operations, diverse regulatory obligations, and expansive data ecosystems that require unified EIM platforms. Global manufacturers, banks, telecom players, and public agencies invest in enterprise-wide content management, data quality systems, master data management, and governance frameworks to strengthen compliance, risk control, and advanced analytics.

The SME segment is the fastest-expanding category, driven by rapid digital adoption, cloud-based workflows, and cross-border online commerce. Limited in-house IT resources push SMEs toward modular, cloud-delivered EIM tools that offer content management, integration, and governance at subscription-based pricing. Government digitalization programs in regions such as the EU and Asia Pacific further accelerate uptake. SME penetration in EIM is set to rise sharply through 2033, with growth rates surpassing those of large enterprises as affordability improves and deployment complexity declines.

The BFSI sector holds the largest share of the EIM Solutions market, contributing over 35% of total revenue. Banks, insurers, and financial service providers manage vast volumes of transactional, customer, compliance, and risk data under strict oversight from central banks and global regulatory bodies such as the Basel Committee and IASB. EIM platforms strengthen data quality, lineage, governance, and transparency across risk management, AML operations, regulatory reporting, and customer initiatives, making them essential to digital banking modernization.

The IT & ITES industry represents the fastest-expanding segment. IT service companies, BPOs, and technology consultancies operate multi-client data ecosystems with demanding SLAs, creating a strong need for unified content and data management frameworks. As global enterprises increasingly outsource business processes and application management, IT & ITES firms continue to invest in scalable, multi-tenant EIM architectures that ensure secure, compliant, and efficient data handling. Their position as major implementation partners and managed service providers accelerates adoption and drives growth that significantly outpaces the market average.

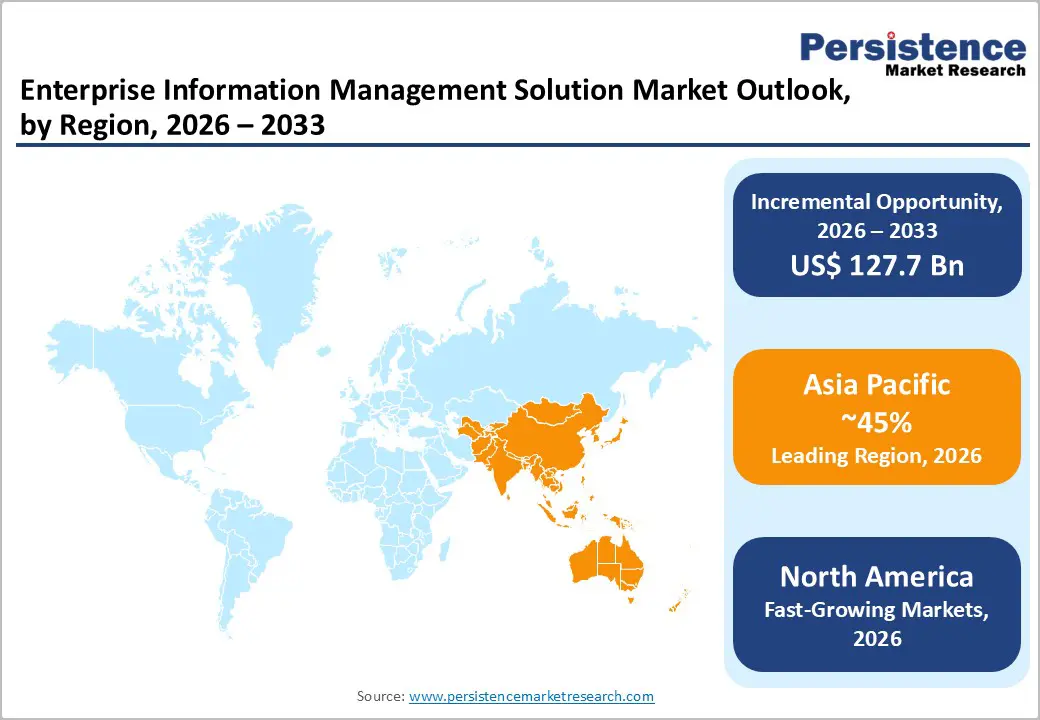

Asia Pacific is the dominating regional market, accounting for above 40% of global revenue share, and is expected to remain the primary growth engine over the forecast period. Rapid economic expansion, large-scale digitalization initiatives, and a broad manufacturing and services base underpin strong demand. China is a major market, where financial institutions, state-owned enterprises, telecom operators, and internet companies deploy EIM to manage exploding data volumes and comply with data security and personal information protection laws. Government-led digital governance and smart city programs further fuel EIM investment.

Japan demonstrates strong adoption in manufacturing, automotive, electronics, and financial services, leveraging EIM to support quality management, product lifecycle documentation, and advanced analytics within long-standing Kaizen and Industry 4.0 practices. India is experiencing rapid growth driven by Digital India initiatives, fintech expansion, IT & ITES strength, and public sector digitization, all of which increase demand for content management, data integration, and governance. ASEAN countries (such as Singapore, Malaysia, Indonesia, and Thailand) are investing in digital financial inclusion, e-government, and smart manufacturing, creating fertile ground for EIM deployments. The region’s combination of large enterprise demand and fast-growing SME digitalization, reinforced by national digital economy strategies, positions Asia Pacific as both the largest and fastest-growing regional market for EIM Solutions.

North America, led by the United States, represents one of the largest and most mature markets for EIM Solutions. The region benefits from advanced digital infrastructure, high IT spending, and strong adoption of cloud and analytics technologies. U.S. financial institutions, technology companies, healthcare providers, and federal/state agencies are among the earliest adopters of enterprise content management, data integration, and governance platforms. Regulatory frameworks such as sectoral privacy laws, Sarbanes-Oxley (SOX) for financial reporting, and industry-specific rules in healthcare and utilities drive substantial compliance-oriented EIM investments.

The U.S. innovation ecosystem, anchored by large vendors such as Microsoft, IBM, Oracle, OpenText, Salesforce, and numerous SaaS providers, supports continuous product innovation and integration of AI into EIM capabilities. Canada also contributes meaningfully through public-sector digital government programs and financial-sector modernization. Competitive intensity is high, with global software vendors, cloud hyperscalers, and specialized EIM providers all vying for share. Investment trends include migration from legacy ECM to cloud content services, expansion of data governance programs, and integration of EIM with analytics and AI platforms, ensuring steady, though more moderate, growth compared to faster-growing Asia Pacific and Europe.

The EIM Solutions market is moderately consolidated at the high end, with a set of global leaders holding substantial combined share, while a long tail of regional and specialist vendors supports niche requirements. Major vendors such as OpenText, IBM, SAP, Oracle, Microsoft, and Micro Focus offer broad EIM suites, including content services, integration, master data management, and governance, and collectively account for a significant portion of enterprise-class deployments. At the same time, integration specialists, cloud-native content platforms, and data quality providers intensify competition in specific segments, resulting in a structure that combines platform-centric consolidation with solution-level fragmentation.

The Enterprise Information Management Solution market is estimated to be valued at US$ 80.6 Bn in 2026.

The key demand driver for the Enterprise Information Management (EIM) Solution market is the increasing need for accurate, secure, and well-governed data to support digital transformation across industries.

In 2026, the Asia Pacific region will dominate the market with an exceeding 40% revenue share in the global Enterprise Information Management Solution market.

Among enterprise types, Large Enterprise has the highest preference, capturing beyond 65% of the market revenue share in 2026, surpassing other enterprise types.

Microsoft Corporation, Oracle Corporation, SAP SE, Hewlett Packard Enterprises, IBM Corporation, Adobe Systems, Inc. are a few leading players in the Enterprise Information Management Solution market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Solution

By Deployment

By Enterprise Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author