ID: PMRREP14524| 199 Pages | 27 Oct 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

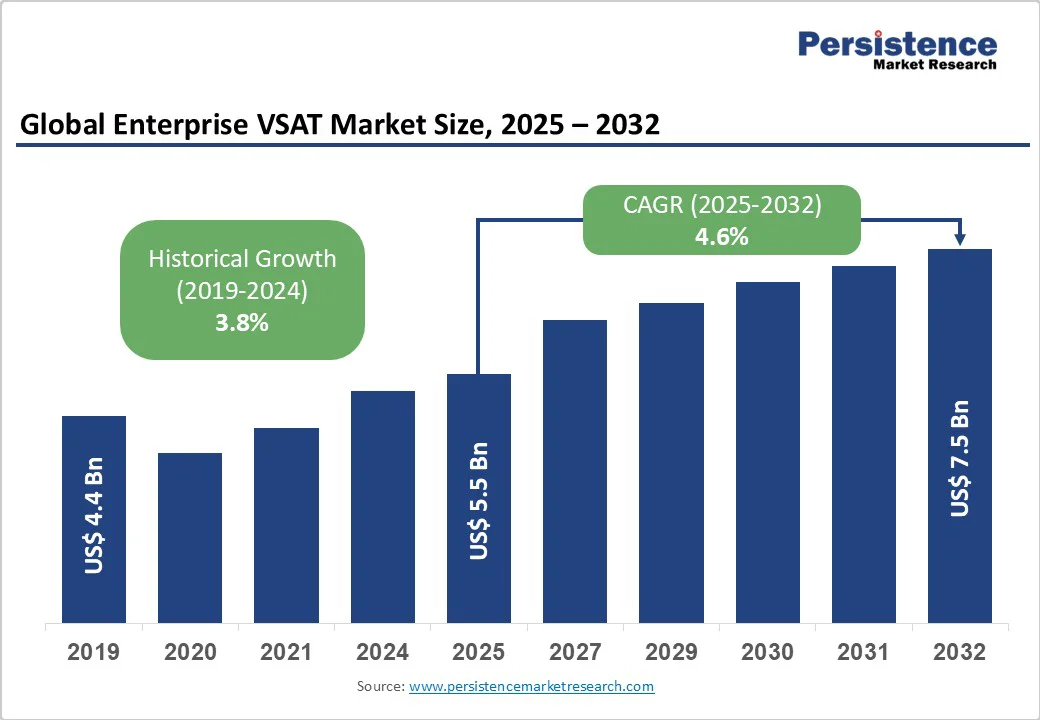

The global enterprise VSAT market size is likely to be valued at US$5.5 Billion in 2025 and is estimated to reach US$7.5 Billion in 2032, growing at a CAGR of 4.6% during the forecast period 2025-2032, driven by the increasing demand for reliable and high-speed communication networks across remote and underserved areas. The expansion of energy and mining industries has further accelerated adoption.

| Key Insights | Details |

|---|---|

|

Enterprise VSAT Market Size (2025E) |

US$5.5 Bn |

|

Market Value Forecast (2032F) |

US$7.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.8% |

Enterprise VSAT technology is essential in providing reliable satellite communication to remote and underserved areas, where traditional terrestrial networks are often unavailable or unreliable. This capability is important for sectors, such as defense, maritime, energy, and aviation, which require consistent connectivity for operations in isolated locations.

For example, Satmed utilizes satellite broadband to deliver eHealth services to remote regions in developing countries, addressing the lack of infrastructure and trained professionals. Also, developments in satellite technology, including Low Earth Orbit (LEO) systems, have improved the reliability and speed of VSAT services in these areas.

VSAT systems provide a key backup communication channel for enterprises, ensuring operational continuity during terrestrial network failures. This redundancy is important for maintaining business operations in the sectors, such as retail, banking, and logistics, where uninterrupted communication is essential.

For instance, Cisco's IP VSAT module provides two-way satellite connectivity for WAN backup, improving network reliability and enabling mobile communication in disaster scenarios. In addition, companies such as ConnectaSat deliver comprehensive satellite communication solutions that provide continuous and redundant connectivity, strengthening business continuity plans.

Enterprise VSAT systems often face delays because signals must travel long distances to geostationary satellites, sometimes up to 36,000 km, creating noticeable latency of 500 to 800 milliseconds. This delay can affect real-time applications such as video conferencing, VoIP, and high-frequency trading, limiting the adoption of VSAT for latency-sensitive operations.

For example, financial firms relying on instantaneous trading data tend to avoid geostationary VSAT due to these delays. On the other hand, maritime operators increasingly explore Low Earth Orbit (LEO) alternatives, including Starlink, to reduce latency and improve responsiveness.

VSAT networks generally provide lower bandwidth and slower data speeds than fiber optic or 5G networks, which can result in network congestion during high-demand periods. This limitation restricts performance for bandwidth-heavy applications such as cloud computing, large-scale data transfer, and video streaming. Enterprises relying solely on VSAT may experience delays in critical operations, affecting productivity and decision-making.

For instance, remote oil and gas sites or offshore platforms often face bottlenecks when transmitting large volumes of sensor or operational data in real time. To address this, several organizations implement hybrid solutions that combine VSAT coverage with terrestrial networks or satellite constellations such as LEO systems, improving network efficiency and ensuring smooth handling of high-volume data traffic.

Enterprise VSAT systems are now being integrated with terrestrial and 5G networks to form hybrid communication solutions, combining satellite coverage with high-speed ground-based connectivity. This approach improves network reliability, reduces latency, and ensures continuous operations even in areas with intermittent terrestrial infrastructure.

For example, Hughes Network Systems has partnered with regional telecom providers to provide hybrid VSAT-5G solutions for enterprise clients in remote oilfields and maritime operations, enabling smooth real-time monitoring and data transfer. Such hybrid networks also support bandwidth-intensive applications such as cloud services and video conferencing, making VSAT adoption attractive for enterprises that require resilient and extensible connectivity.

Government initiatives aimed at promoting digital services and e-governance present key opportunities for VSAT adoption. Programs focused on connecting rural schools, healthcare centers, and administrative offices rely on satellite connectivity where fiber or 5G networks are unavailable.

For instance, India’s CSC SPV project uses VSAT networks to provide digital services to remote villages, supporting education, telemedicine, and local administration. Also, VSAT enables quick deployment for disaster recovery and emergency response, allowing authorities to maintain communication during natural disasters, which is essential for timely coordination and service delivery.

Enterprise VSAT hardware systems are predicted to lead with about 60.2% of the share in 2025, as physical terminals, including antennas, modems, and outdoor units, are essential. They provide control over performance, durability, and customization for harsh environments. Enterprises working offshore, in oil rigs or remote mining, choose rugged VSAT hardware to meet compliance, environmental, and reliability standards rather than relying on third-party gear. Also, upgrades to flat-panel electronically steerable antennas and more powerful modems give firms longevity and the ability to handle multi-orbit or HTS links.

Enterprise VSAT services fill gaps where terrestrial networks are weak or unavailable, especially for remote or mobile operations. Rising demand for managed connectivity means multiple enterprises prefer subscription-style services. For instance, industries such as defense, maritime, and energy increasingly outsource the management of VSAT links rather than build full in-house setups. Services also bundle cybersecurity, uptime guarantees, and remote diagnostics, thereby making the offering highly attractive.

Shared bandwidth VSAT systems are likely to capture nearly 61.7% of the share in 2025, as these help spread satellite capacity over multiple users or sites, reducing the cost per user. That makes them easier to expand. They are ideal when peak traffic is intermittent or variable. Various enterprises prefer flexibility and cost efficiency over fixed high throughput. Also, developments in dynamic bandwidth allocation via HTS allow shared-VSAT links to adjust capacity dynamically across users.

Dedicated VSAT gives guaranteed bandwidth/SLA as well as better quality for real-time applications such as video-feed, trading, and live telemetry. Industries with mission-critical data, including defense, oil & gas control rooms, and banking back-office transfers, prefer it because congestion is not acceptable. As high-capacity satellite beams and High-Throughput Satellite (HTS) technology mature, cost-performance for dedicated links becomes ideal even in remote areas.

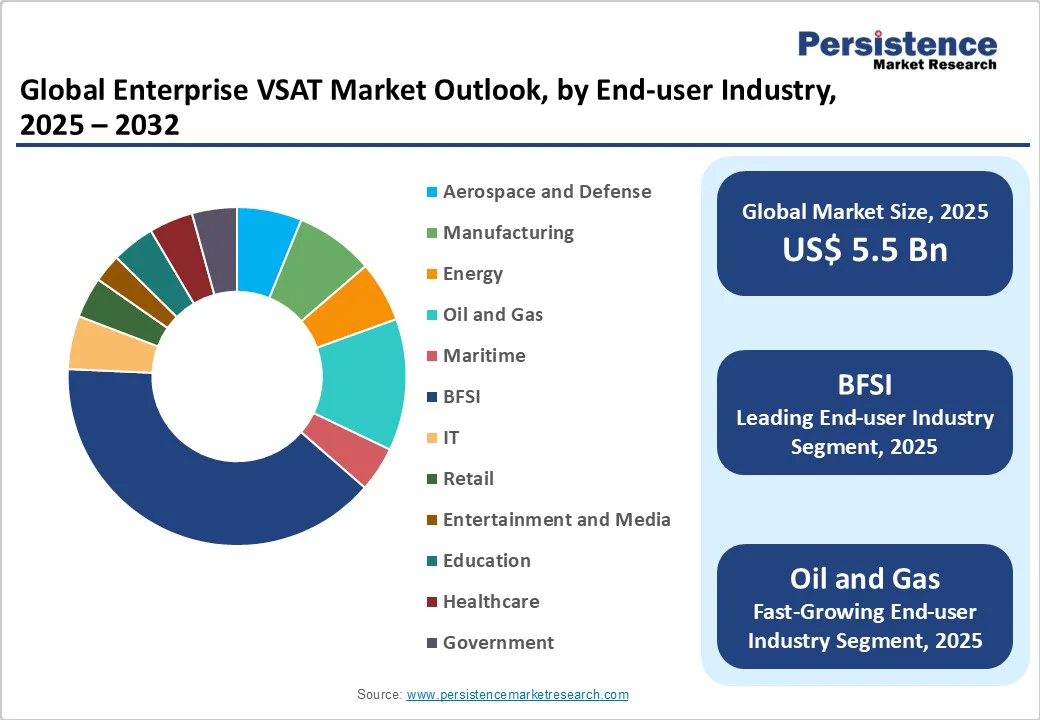

BFSI is poised to dominate with approximately 39.3% of the share in 2025, as it heavily relies on remote ATMs, branch offices, and real-time settlement systems. In various regions, especially rural or semi-remote zones, terrestrial backup is weak or vulnerable. Hence, VSAT is used for redundancy and secure links. Regulatory and audit requirements also favor encrypted and resilient connectivity. Firms often prefer VSAT to ensure uptime even when terrestrial links fail.

Oil and gas operations often operate far offshore, in deserts, and in remote fields or pipelines. They require reliable monitoring and control (SCADA), safety alerts, remote diagnostics, and telemetry where fiber or 5G is impractical. VSAT provides near-real-time data links for drilling operations, emergency alerts, video feeds from the site, and connects remote workers. As downtime or failures in such environments can be extremely costly, VSAT becomes almost indispensable.

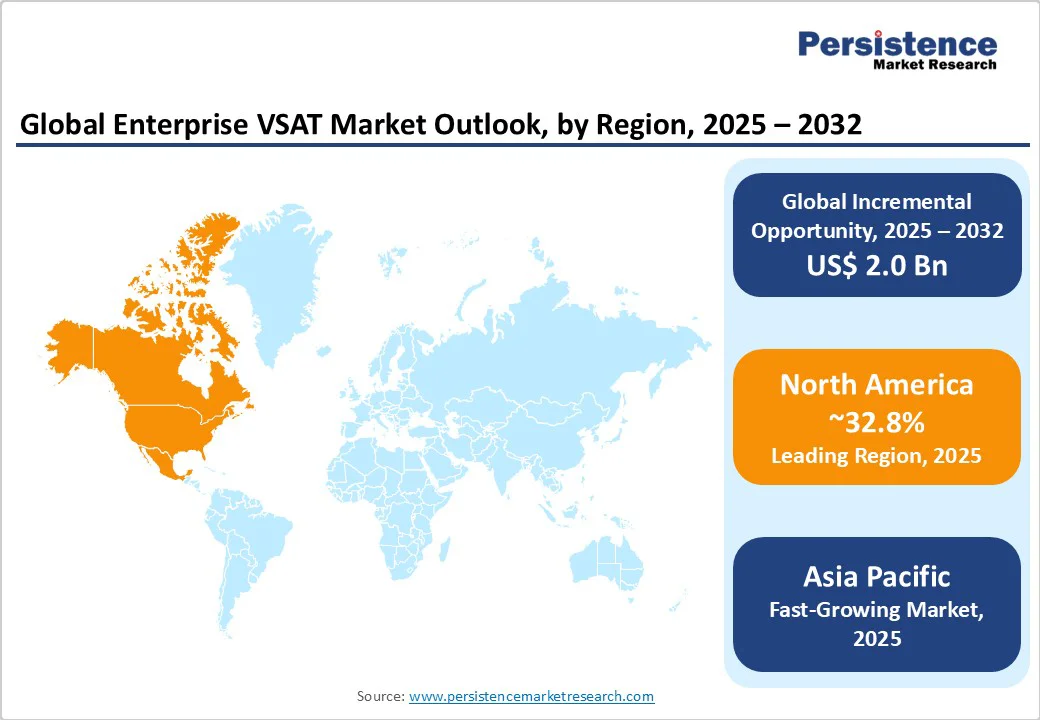

In 2025, North America is expected to account for approximately 32.8% of the share, boosted by unique satellite infrastructure and high demand from sectors such as defense, energy, and maritime. The U.S. leads adoption, with enterprises relying on VSAT to maintain connectivity in offshore oil rigs, mining sites, and remote research stations where terrestrial networks or 5G coverage are unavailable.

Companies such as Hughes Network Systems and Viasat dominate the regional market. They are focusing on hybrid network solutions that combine satellite and fiber connectivity to improve reliability and reduce downtime. The rise of LEO constellations, including SpaceX’s Starlink and Amazon’s Kuiper, is changing North America’s VSAT landscape by reducing latency and enabling real-time applications for enterprise users.

Asia Pacific’s market is expanding considerably, supported by rising demand for reliable connectivity in remote and underserved areas. India, Indonesia, and the Philippines rely heavily on VSAT systems to connect rural schools, healthcare centers, and administrative offices where terrestrial infrastructure is limited. For instance, India’s BharatNet and CSC programs use satellite links to deliver broadband and digital services to more than 250,000 villages.

The technology is also gaining traction in industries such as maritime, mining, and oil and gas, where VSAT enables real-time communication and monitoring in offshore or isolated operations. In Australia, VSAT systems are being deployed across mining belts in Western Australia to support automation and safety systems. Meanwhile, the adoption of LEO constellations by players, including Starlink and OneWeb, is further improving connectivity speeds and latency across Asia Pacific, making VSAT an ideal option for enterprise and government users.

The market in Europe is undergoing a major transformation, bolstered by the region’s focus on secure and sovereign satellite communication systems. Governments and enterprises increasingly depend on VSAT for critical communication, disaster management, and operations in remote or maritime areas. The European Union’s GOVSATCOM program is a key initiative in this regard, aimed at ensuring secure and reliable satellite communication for government agencies, defense operations, and emergency responders across member states.

Europe is further making strategic moves toward autonomy in satellite connectivity through the development of its own constellation, IRIS² (Infrastructure for Resilience, Interconnectivity and Security by Satellite). Expected to be operational by 2030, IRIS² will deliver multi-orbit connectivity to support both public and commercial users, reducing dependence on U.S. or Asia Pacific-based providers. Strict norms on data security and spectrum use under the upcoming EU Space Act are further influencing the competitive landscape.

The global enterprise VSAT market consists of key players such as Hughes Network Systems, Viasat, SES Networks, and Intelsat. The competitive landscape is evolving with the rise of low Earth orbit (LEO) satellite constellations and increased consolidation among vendors. For instance, SES Networks operates a fleet of over 50 geostationary satellites, providing extensive global coverage. Countries are pursuing satellite autonomy to counter the dominance of U.S.-based providers. China's integration of LEO networks with its Belt and Road Initiative adds a strategic layer to this new space race.

The enterprise VSAT market is projected to reach US$5.5 Billion in 2025.

Rising demand for reliable remote connectivity and increasing adoption of cloud-based enterprise solutions are the key market drivers.

The enterprise VSAT market is poised to witness a CAGR of 4.6% from 2025 to 2032.

Expanding digital transformation initiatives in the BFSI sector and a shift toward software-defined VSAT systems are the key market opportunities.

Gilat Satellite Networks, OMRON Corporation, and Viasat, Inc. are a few key market players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Component

By Product Type

By End-user Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author