ID: PMRREP32069| 245 Pages | 13 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

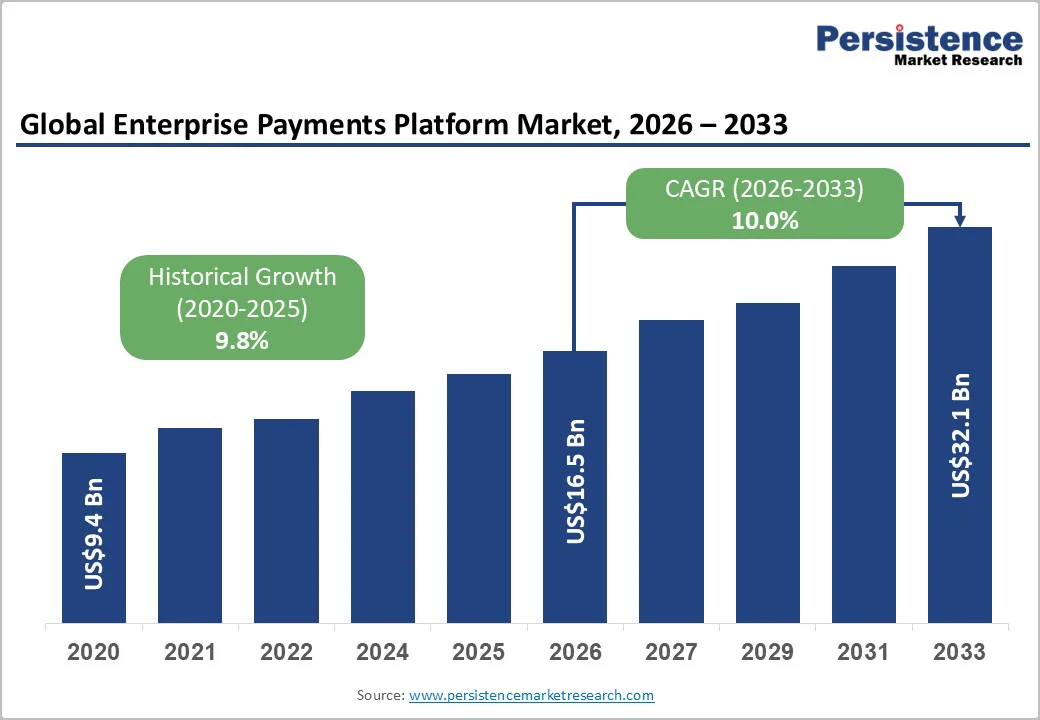

The global enterprise payments platform market size is likely to be valued at US$16.5 billion in 2026. It is expected to reach US$32.1 billion by 2033, growing at a CAGR of 10.0% during the forecast period from 2026 to 2033, driven by enterprises modernizing legacy payment systems to support real-time, API-driven, multi-rail capabilities across cards, ACH, instant, and alternative payment methods.

Increasing cloud adoption, open banking mandates, and embedded finance models further accelerate demand for platforms across banks, fintechs, retailers, and large corporates. Regulatory initiatives supporting instant payments and open banking, combined with rising enterprise focus on real-time, omni-channel, and cross-border payments, reinforce demand across BFSI, retail, and other verticals.

| Key Insights | Details |

|---|---|

| Enterprise payments platform Market Size (2026E) | US$16.5 Bn |

| Market Value Forecast (2033F) | US$32.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 10.0% |

| Historical Market Growth (CAGR 2020 to 2025) | 9.8% |

Digital transformation is a primary driver of the market, reshaping how organizations handle transactions, optimize financial workflows, and enhance customer experiences. As enterprises shift from legacy systems to real-time, API-driven architectures, payment operations are becoming more automated, integrated, and data-rich.

Businesses across BFSI, retail, IT & telecom, and manufacturing are adopting modern platforms to support multi-rail capabilities, including cards, ACH, instant payments, and alternative payment methods.

Digital transformation also aligns with broader modernization agendas such as open banking, embedded finance, and cross-border digitization. As enterprises implement digital channels and omni-experience strategies, demand increases for payment platforms capable of seamless integration with ERPs, CRMs, and e-commerce systems.

AI-enabled analytics, automated reconciliation, and real-time fraud detection strengthen financial decision-making and operational efficiency. With 70-80% of global enterprises prioritizing digital-first models, payment platforms have become foundational infrastructure supporting growth, security, and global interoperability.

Payment systems are frequent targets for cyberattacks, fraud, and ransomware. Enterprises handling large transaction volumes across multiple rails, cards, ACH, instant payments, and cross-border transfers face increased exposure due to expanding digital ecosystems.

Legacy infrastructure, weak API security, and fragmented third-party integrations further amplify risks, making platforms vulnerable to phishing, malware infiltration, and man-in-the-middle attacks. With regulatory environments becoming stricter, including mandates such as GDPR, PCI DSS, and open-banking compliance, even minor breaches can lead to substantial penalties, operational downtime, and reputational damage.

Data breaches also undermine customer trust and slow the adoption of advanced payment technologies, particularly in highly regulated sectors such as BFSI, healthcare, and oil & gas. Enterprises may delay modernization decisions or opt for limited deployments due to fear of compromising sensitive financial data.

The high costs associated with implementing advanced cybersecurity tools, continuous monitoring, and encryption technologies challenge SMEs with limited budgets. These risks create friction in the shift toward fully digitized payment ecosystems, thereby restraining overall market growth despite the increasing demand for seamless, real-time financial operations.

AI-enabled fraud prevention and personalization present a transformative opportunity for the market, enabling businesses to enhance both security and customer experience simultaneously. As digital payments expand across industries, enterprises face rising incidents of identity theft, synthetic fraud, and sophisticated cyberattacks.

Advanced AI and machine learning models can analyze vast amounts of transactional data in real time, detect anomalies, and block fraudulent activities before they occur. This reduces financial losses and builds stronger trust between enterprises and their customers.

Alongside security, AI-driven personalization is emerging as a strategic value differentiator. Enterprise payment platforms can use AI to study customer spending behavior, preferences, and transaction history to deliver customized payment experiences. This includes tailored payment options, dynamic loyalty rewards, personalized product recommendations, and predictive insights for businesses.

Such personalization increases customer satisfaction, enhances conversion rates, and strengthens customer retention. As enterprises across North America, Europe, and Asia Pacific accelerate their digital transformation journeys, AI-enabled payment intelligence is becoming a key competitive advantage.

Solutions are expected to lead, accounting for approximately 65% of total revenue in 2026, driven by their central role in enabling real-time payment processing, orchestration, authentication, and compliance automation.

Enterprises depend heavily on these solution components to manage high payment volumes, integrate multiple payment rails, and ensure regulatory alignment across diverse markets. The sophistication of modern payment ecosystems requires advanced routing engines, API layers, and monitoring dashboards capabilities embedded primarily within solution frameworks.

For instance, Fiserv’s Enterprise Payments Platform which supports unified transaction management across different rails. Its ability to consolidate processing, enable fraud detection, and deliver real-time insights illustrates why solution components hold the dominant share, providing enterprises with the robust digital infrastructure necessary for next-generation payment modernization.

The services enterprise payments platform is likely to represent the fastest-growing component types in 2026, driven by enterprises increasingly requiring expert consulting, system integration, and continuous support to manage evolving payment technologies. Organizations undergoing digital transformation seek specialized service providers to guide modernization, migrate legacy cores, and maintain hybrid environments.

The rising complexity of payment compliance, fraud detection, and cross-border settlement fuels demand for services that provide ongoing optimization and strategic oversight. For example, Accenture’s payment modernization services support enterprises in redesigning their payment flows, integrating real-time rails, and improving end-to-end process efficiency.

Cloud-based deployments are projected to lead the market, capturing around 55% of the total revenue share in 2026, driven by the growing preference for scalable, flexible, and cost-efficient payment infrastructures. Enterprises increasingly adopt cloud-native payment platforms to accelerate innovation cycles, integrate new payment methods, and support dynamic transaction surges.

Cloud-based models facilitate quicker onboarding, enhanced agility, and seamless API-driven integration with fintechs, payment gateways, and other third-party partners. For example, Stripe’s cloud-first architecture allows global merchants to instantly integrate payments and scale transaction processing efficiently as demand grows.

On-premises deployment is likely to be the fastest-growing deployment mode in 2026, due to maximum control, strong security governance, and strict data residency adherence. Enterprises in highly regulated sectors, such as banking, defense, oil & gas, and public institutions, prefer on-premises systems to maintain full visibility over infrastructure and restrict external access. On-premise architectures enable organizations to tailor encryption, network isolation, and hardware-level security based on unique compliance requirements.

An example is Oracle’s on-premises payment infrastructure, used by institutions with stringent data governance mandates. Its integration with internal cores and secure local hosting exemplifies why on-premises deployments continue to grow in specific high-security environments.

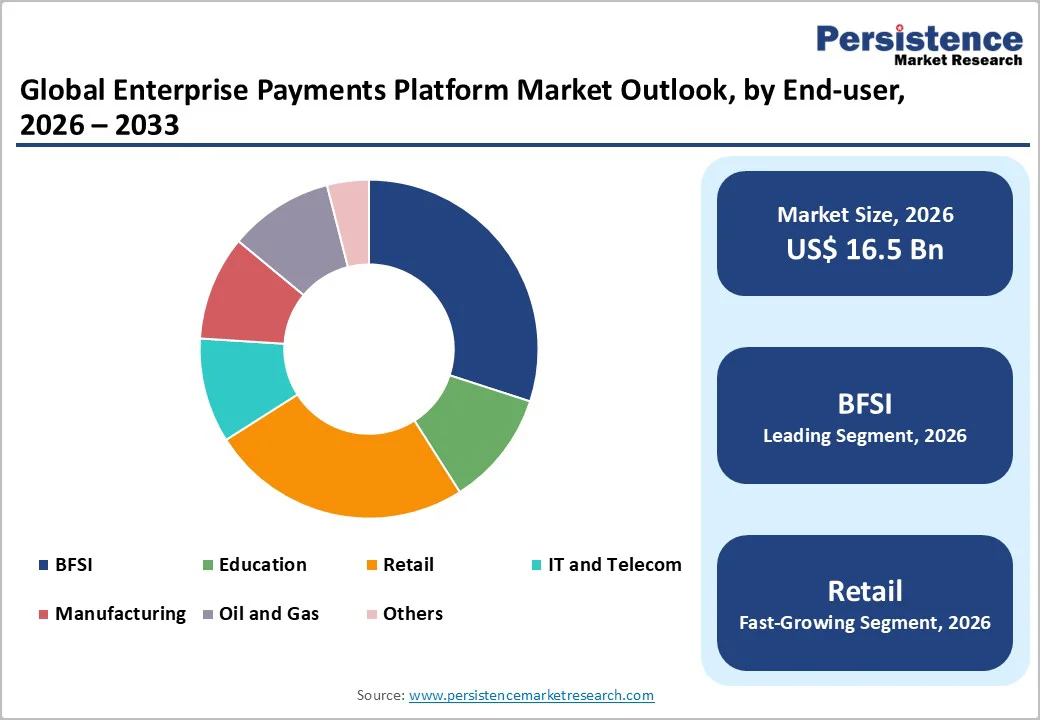

The BFSI segment is projected to lead the market, capturing around 40% of the total revenue share in 2026, driven by its need for high-volume, high-security, and highly regulated payment operations. Financial institutions rely on advanced enterprise platforms to support numerous payment rails, reduce operational risk, and maintain compliance across global jurisdictions.

The sector handles continuous flows of digital payments, fund transfers, settlements, and cross-border transactions, requiring robust orchestration engines and fraud prevention systems. For example, Adyen’s unified financial technology platform is used by financial institutions to manage issuing, acquiring, and risk operations within a centralized ecosystem.

Retail is likely to be the fastest-growing end-user in 2026, driven by businesses accelerating digital commerce adoption and prioritizing seamless customer payment journeys. The rise of omnichannel commerce, mobile shopping, QR payments, and subscription-based retail services drives the need for unified payment platforms that synchronize online and offline transactions.

Retailers seek enterprise payment systems that enhance checkout speed, reduce payment failures, and offer frictionless experiences across stores, websites, and apps. For example, Shopify Payments empowers merchants to accept multiple payment methods while synchronizing online and in-store transactions. This exemplifies why retail is scaling rapidly. Modern consumer expectations require flexible, fast, and intelligent payment ecosystems.

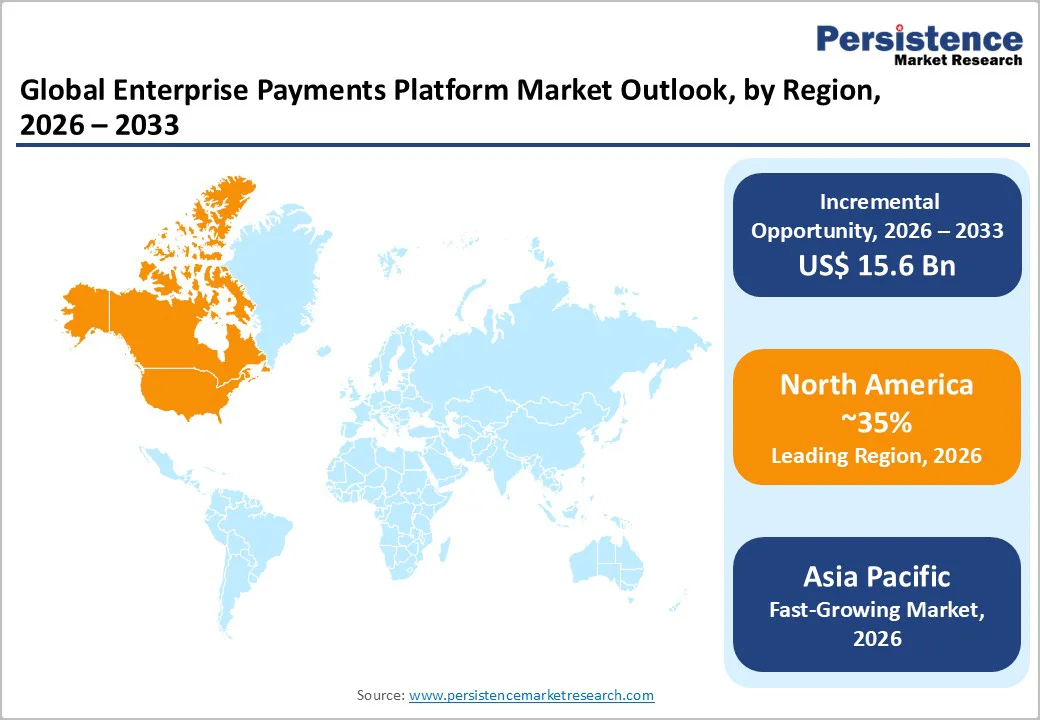

The North America region is anticipated to be the leading region in 2026, driven by organizations accelerating digital transformation across financial services, retail, and large enterprises.

The region’s mature payment infrastructure, combined with high adoption of real-time payment systems, drives the shift toward cloud-based and API-integrated payment platforms. Companies increasingly prioritize seamless multi-rail capabilities, enabling faster processing through card networks, instant payments, ACH, and digital wallets.

Rising demand for embedded finance and open-banking-enabled services also shapes market trends, pushing enterprises to modernize legacy systems. A strong example is PayPal’s expansion of enterprise-grade payment APIs, enabling businesses across the U.S. to integrate global payment acceptance and advanced fraud tools with faster onboarding.

North America is placing a growing emphasis on security, compliance automation, and AI-driven fraud detection. Enterprises face heightened regulatory expectations, prompting greater investment in platforms with real-time monitoring, tokenization, and risk analytics.

The rise of cross-border e-commerce further boosts demand for platforms capable of handling multi-currency settlements and localized compliance. Retailers and BFSI institutions in the region also adopt omnichannel payment solutions to enhance customer experience, with companies such as Fiserv and Global Payments leading adoption through unified commerce platforms.

Europe is likely to be a significant market for enterprise payments platforms in 2026, due to the region's accelerated digitalization, harmonized regulations, and modernization of legacy banking infrastructure. One of the most influential trends is the expansion of open banking and PSD2-driven innovation, which compels enterprises to adopt API-first payment platforms that support secure data sharing and real-time account-to-account payments.

The rise of instant payment schemes such as SEPA Instant is pushing organizations to upgrade to multi-rail platforms capable of handling high-speed, cross-border transactions across the EU. An example is Adyen, headquartered in the Netherlands, which is driving the adoption of unified enterprise payment solutions across major European markets.

Europe is the growing focus on compliance automation, fraud prevention, and data protection, influenced by stringent regulations such as GDPR and the European Payments Initiative. Enterprises invest heavily in AI-enabled risk analytics, tokenization, and authentication tools to strengthen security while maintaining seamless user experiences.

The region is also experiencing a surge in omnichannel payment adoption in sectors, such as retail, hospitality, and manufacturing, where integrated platforms support both online and in-store transactions. Companies such as Worldline are at the forefront of enabling real-time analytics and unified commerce solutions, reflecting Europe’s shift toward secure, intelligent, and interoperable enterprise payment ecosystems.

The Asia Pacific region is likely to be the fastest-growing region, driven by the explosive rise of digital payments, strong mobile adoption, and large-scale government initiatives promoting financial inclusion. Enterprises across BFSI, retail, telecom, and manufacturing are modernizing payment infrastructures to support high-volume, real-time, and multi-rail transactions.

The shift toward API-driven architectures is accelerating as businesses integrate UPI-like instant payment systems, QR-based payments, and digital wallets. An example is Alipay, which continues expanding enterprise-oriented payment APIs and cross-border capabilities across East and Southeast Asia, strengthening digital commerce ecosystems.

Rising emphasis on AI-enabled fraud detection, risk scoring, and automated compliance as transaction volumes surge. Countries, including India, China, and Singapore, are implementing stricter guidelines around data security, pushing enterprises to adopt platforms with advanced encryption, tokenization, and real-time anomaly monitoring.

The retail sector is also contributing significantly, with omnichannel payments becoming standard as brands support online, in-store, and social commerce transactions. Companies such as Tencent (WeChat Pay) are leading integrated payments for commerce, logistics, and lifestyle services, reflecting Asia Pacific’s shift toward unified, intelligent, and highly scalable enterprise payment solutions.

The global enterprise payments platform market exhibits a moderately fragmented structure, driven by a rapid digital transformation, proliferation of cloud-native architectures, and rising demand for multi-rail, API-first payment orchestration that can handle real-time and cross-border flows.

With key leaders including PayPal Holdings, Stripe, Adyen, Fiserv, Global Payments (Worldpay), Oracle, and ACI Worldwide, these vendors set product roadmaps, push integrations with ERP/CRM stacks, and lead investments in AI fraud detection and embedded-finance capabilities.

These players compete through differentiated product ecosystems, strategic partnerships, and platform extensibility, offering modular APIs, marketplace integrations, and managed services that lower time-to-value for large enterprises.

These competitive levers are reinforced by recent industry moves such as multiyear platform partnerships, expanded enterprise API suites, and targeted acquisitions to broaden cross-border and value-added services, all of which intensify competition while leaving room for specialized regional and vertical players to gain share.

The global enterprise payments platform market is projected to reach US$16.5 billion in 2026.

The enterprise payments platform market is driven by accelerated digital transformation, increasing adoption of real-time payments, and the rising demand for secure, API-enabled, multi-rail transaction processing.

The enterprise payments platform market is expected to grow at a CAGR of 10.0% from 2026 to 2033.

Key market opportunities include the expansion of AI-powered fraud prevention, growth in embedded finance, increasing demand for cloud-based payment orchestration, and wider adoption of real-time and cross-border digital payment solutions among enterprises.

Key players include PayPal Holdings, Inc., Stripe, Inc., Adyen N.V., Fiserv, Inc., Worldpay, LLC/Global Payments Inc., Oracle Corporation, and ACI Worldwide, Inc.

| Report Attribute | Details |

|---|---|

| Historical Data | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Deployment Mode

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author