ID: PMRREP32595| 188 Pages | 9 Sep 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

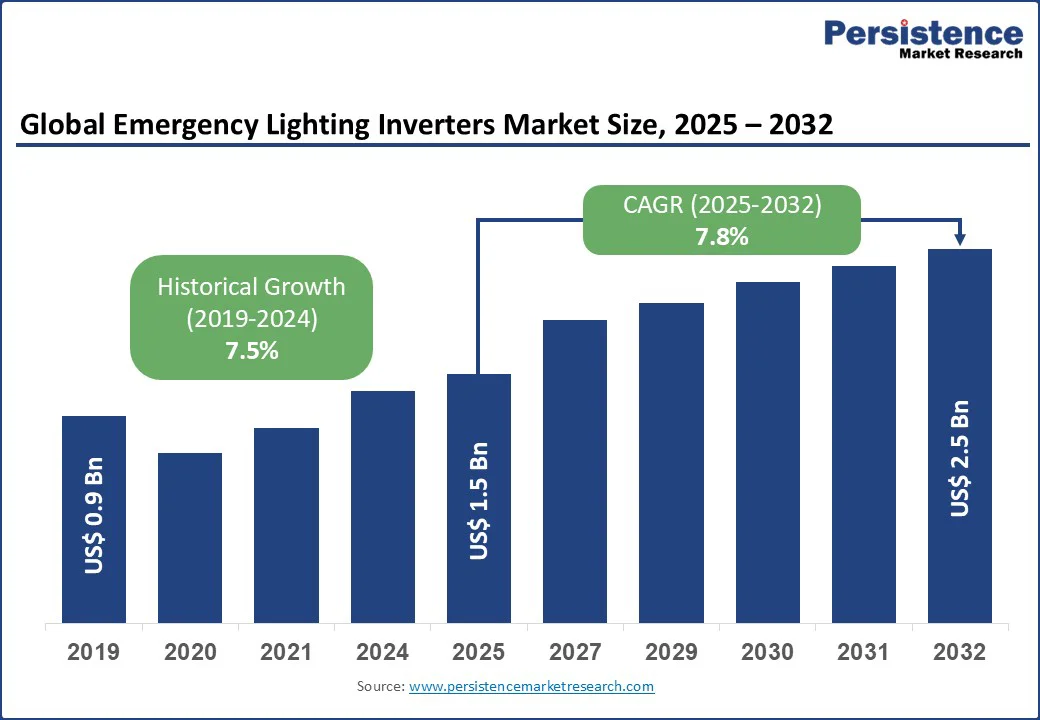

The global emergency lighting inverters market size is likely to be valued at US$1.5 Bn in 2025 and is estimated to reach US$2.5 Bn by 2032, growing at a CAGR of 7.8% during the forecast period from 2025 to 2032.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

|---|---|

| Emergency Lighting Inverters Market Size (2025E) | US$1.5 Bn |

| Market Value Forecast (2032F) | US$2.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 7.5% |

Rising demand for reliable backup solutions is a major growth factor in the emergency lighting inverters industry. Stringent safety regulations, frequent power outages, and the need for uninterrupted illumination in commercial, industrial, and healthcare facilities drive adoption. Organizations are increasingly investing in advanced inverter-based systems to ensure compliance, operational continuity, and enhanced safety across critical infrastructure.

Stringent safety regulations and standards such as NFPA 101, NEC 70, and UL 924 mandate that emergency lighting must activate within 10 seconds of a power outage and remain operational for at least 90 minutes. U.S. federal codes for marine vessels even require weekly inspections of emergency lighting and routine battery testing equipment to ensure reliability.

These mandates compel building owners, facility managers, and institutions to adopt certified inverter-based emergency lighting systems, thereby fueling demand for compliant and dependable solutions across commercial, industrial, and public infrastructure sectors.

The rising frequency of power outages further accelerates market expansion. For instance, the U.S. Nuclear Regulatory Commission reported cases where insufficient emergency lighting during power failures posed significant safety risks in critical facilities.

Such incidents highlight the need for inverter-backed systems to guarantee illumination during grid disruptions. With outages becoming more common worldwide, organizations are increasingly investing in emergency lighting inverters to ensure safety, compliance, and uninterrupted operations.

One of the major restraints in the emergency lighting inverters market is the high initial installation and equipment costs. Advanced inverter systems require substantial upfront investment for hardware, batteries, wiring, and integration with existing electrical infrastructure. For many small and medium-sized enterprises, this capital expense can be a significant barrier, especially in developing economies where cost sensitivity is high.

Another challenge lies in the limited awareness about the long-term benefits of emergency lighting inverters. While these systems ensure compliance, safety, and operational continuity, many facility managers and business owners still underestimate their importance, often relying on conventional backup solutions. This lack of knowledge slows adoption and hinders the sector’s full growth potential despite rising demand for reliable emergency lighting systems.

Rapid technological advancements are creating significant opportunities. Modern systems now integrate smart monitoring, IoT connectivity, and energy-efficient LED compatibility, allowing real-time performance tracking and predictive maintenance.

These innovations reduce operational costs, extend battery life, and ensure compliance with stringent safety standards. Additionally, manufacturers are developing compact, modular, and eco-friendly inverter designs, making adoption easier across commercial, industrial, and residential facilities.

Growing infrastructure development in emerging economies further fuels market potential. Expanding urbanization, rising commercial construction, and stricter building safety codes in regions such as the Asia Pacific, Latin America, and the Middle East are accelerating demand. With increasing investments in smart cities and reliable backup power solutions, these markets present strong growth avenues for suppliers of emergency lighting inverters, positioning them for long-term expansion.

High-power emergency lighting inverters, rated above 2000W, account for the largest market share, holding around 40% in 2025. Their dominance is driven by widespread use in commercial and industrial facilities where strong and reliable backup systems are essential. Large-scale operations such as hospitals, warehouses, and data centers increasingly depend on these high-capacity inverters to ensure uninterrupted lighting during outages, making them the preferred choice for critical infrastructure.

Medium power inverters represent the fastest-growing category, gaining traction in both medium-sized commercial facilities and residential applications. Their adaptability, cost efficiency, and suitability for urban settings are fueling adoption, with a notable rise in usage across offices, apartment complexes, and retail outlets. This versatility positions medium power inverters as a key growth driver.

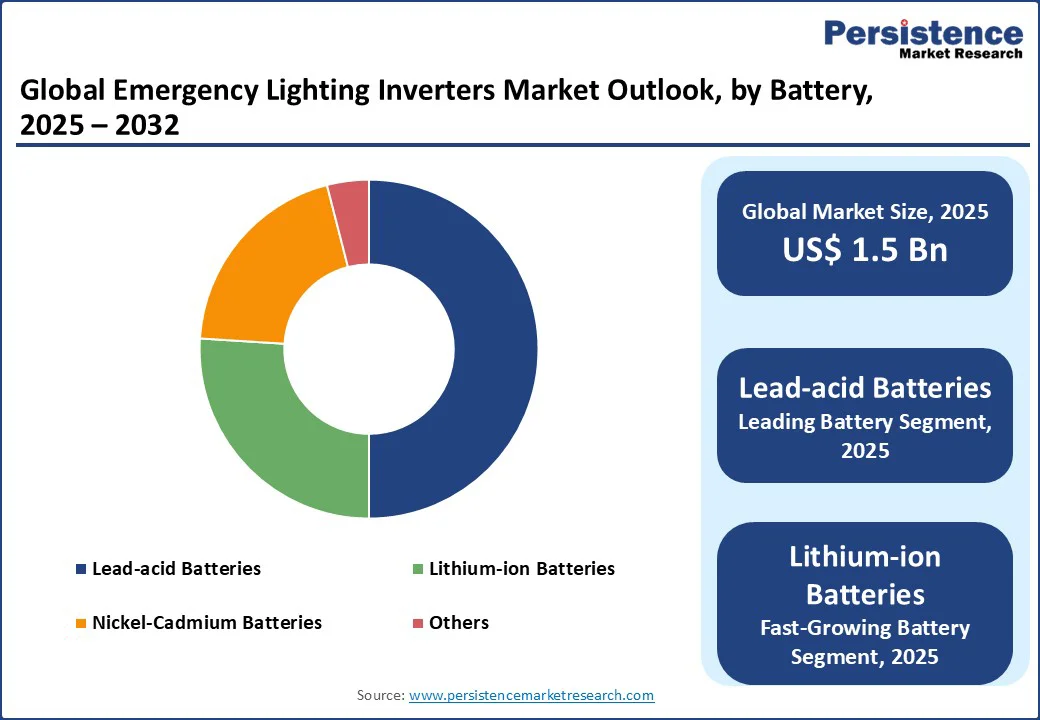

Lead-acid batteries dominate the emergency lighting inverters market, holding nearly 50% share in 2025. Their leadership stems from cost-effectiveness, proven reliability, and strong compatibility with high-power inverter systems. In 2024, a majority of commercial facilities, particularly large-scale operations such as warehouses and hospitals, relied on lead-acid batteries, underscoring their trustworthiness for critical applications where consistent performance is essential.

Lithium-ion batteries represent the fastest-growing segment, supported by their longer lifespan, higher energy efficiency, and suitability for smart building infrastructure. Offering around 30% longer service life and 20% greater efficiency compared to traditional alternatives, they are increasingly favored in modern urban facilities. In 2024, adoption rose steadily across offices, retail complexes, and residential projects, reflecting a strong shift toward advanced, sustainable, and performance-driven battery solutions in emergency lighting systems.

Centralized emergency lighting inverters hold the dominant position, accounting for around 45% share in 2025. Their popularity stems from high efficiency and suitability for large-scale applications, particularly in commercial and industrial facilities. In 2024, more than half of new commercial buildings adopted centralized systems, as they enable streamlined power management, simplified maintenance, and reliable performance across multiple lighting points.

Hybrid inverter systems are emerging as the fastest-growing category, driven by their flexibility and compatibility with advanced smart technologies. These systems integrate traditional backup capabilities with modern monitoring features, making them highly attractive for smart buildings and urban infrastructure projects. In 2024, adoption rose significantly in new-age commercial spaces and residential complexes, highlighting their role in enhancing energy efficiency and future-ready emergency lighting solutions.

The commercial sector dominates the emergency lighting inverters market, capturing around 50% share in 2025, driven by strict regulatory mandates, high safety standards, and growing emphasis on reliable backup solutions in offices, hospitals, educational institutions, and retail facilities. In 2024, nearly two-thirds of commercial establishments installed emergency lighting inverters to comply with building safety codes and ensure uninterrupted operations during power outages.

The industrial sector is the fastest-growing segment, fueled by rapid expansion in large-scale facilities and manufacturing plants. A notable rise in industrial infrastructure projects, especially across the Asia Pacific, is driving the demand for high-capacity inverters that provide robust backup during outages. In 2024, adoption accelerated as factories, warehouses, and production hubs prioritized safety, compliance, and operational continuity, positioning the industrial sector as a key growth driver in the global market.

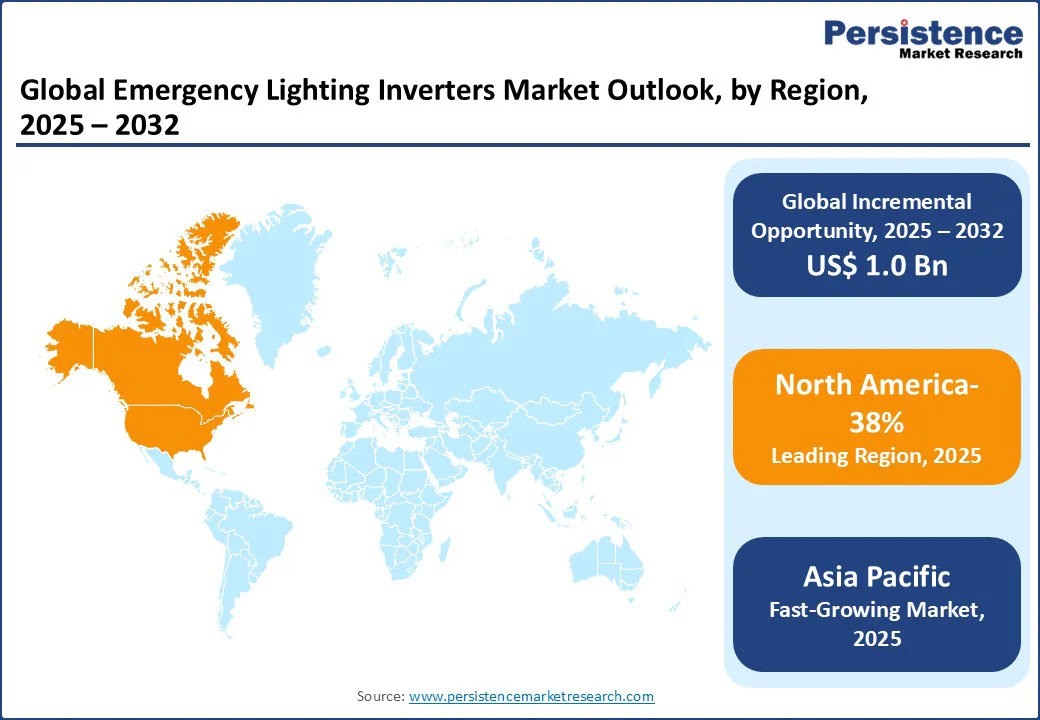

North America dominates the emergency lighting inverters market, accounting for nearly 38% share in 2025. This leadership is supported by stringent building safety codes, widespread enforcement of standards such as NFPA 101 and UL 924, and high awareness of workplace safety.

The region’s mature infrastructure, strong presence of leading manufacturers, and early adoption of advanced inverter technologies further strengthen its market position. Growing investments in healthcare, commercial complexes, and data centers also drive demand for reliable backup systems. Additionally, the rising frequency of weather-related power outages across the U.S. and Canada reinforces the need for robust emergency lighting solutions.

Europe holds a significant share in the emergency lighting inverters market, driven by strict safety regulations, energy efficiency directives, and widespread adoption of sustainable building solutions. Countries such as Germany, the UK, and France emphasize compliance with EN standards, ensuring that commercial and industrial facilities integrate reliable emergency lighting systems.

The region also benefits from strong infrastructure development, high awareness of workplace safety, and rapid modernization of public buildings and transport hubs. Growing investments in smart cities and renewable-powered facilities further boost the demand for advanced inverter-based emergency lighting across Europe.

Asia Pacific is the fastest-growing region in the emergency lighting inverters market, supported by rapid urbanization, large-scale infrastructure projects, and increasing investments in commercial and industrial facilities. Countries such as China, India, and Japan are witnessing strong demand as governments implement stricter building safety regulations and promote energy-efficient solutions.

Expanding healthcare infrastructure, smart city initiatives, and rising construction of high-rise buildings further accelerate the adoption of inverter-based emergency lighting systems. Additionally, frequent power outages in developing economies highlight the need for reliable backup solutions, positioning the Asia Pacific as the key growth engine for global market expansion in the coming years.

The global emergency lighting inverters market is moderately consolidated, with competition shaped by continuous innovation and regulatory compliance. Companies focus on developing energy-efficient, compact, and smart inverter solutions that integrate seamlessly with modern building systems.

Strategic priorities include expanding product portfolios, enhancing battery performance, and offering customized solutions for commercial, industrial, and residential sectors. Partnerships, mergers, and investments in emerging markets are common strategies, while strong emphasis on meeting global safety standards positions leading manufacturers to maintain a competitive edge

The emergency lighting inverters market is projected to reach US$1.5 bn in 2025, driven by safety regulations and infrastructure growth.

Stringent building codes, frequent power outages, and smart building technologies fuel market growth.

The emergency lighting inverters market will grow from US$1.5 bn in 2025 to US$2.5 bn by 2032, with a CAGR of 7.8%.

Technological advancements in smart inverters and expansion in emerging markets

Leading players include Signify (Cooper Lighting), Hubbell, Vertiv, ABB, and Acuity Brands.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Power Rating

By Battery

By Installation Type

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author