ID: PMRREP33062| 190 Pages | 14 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

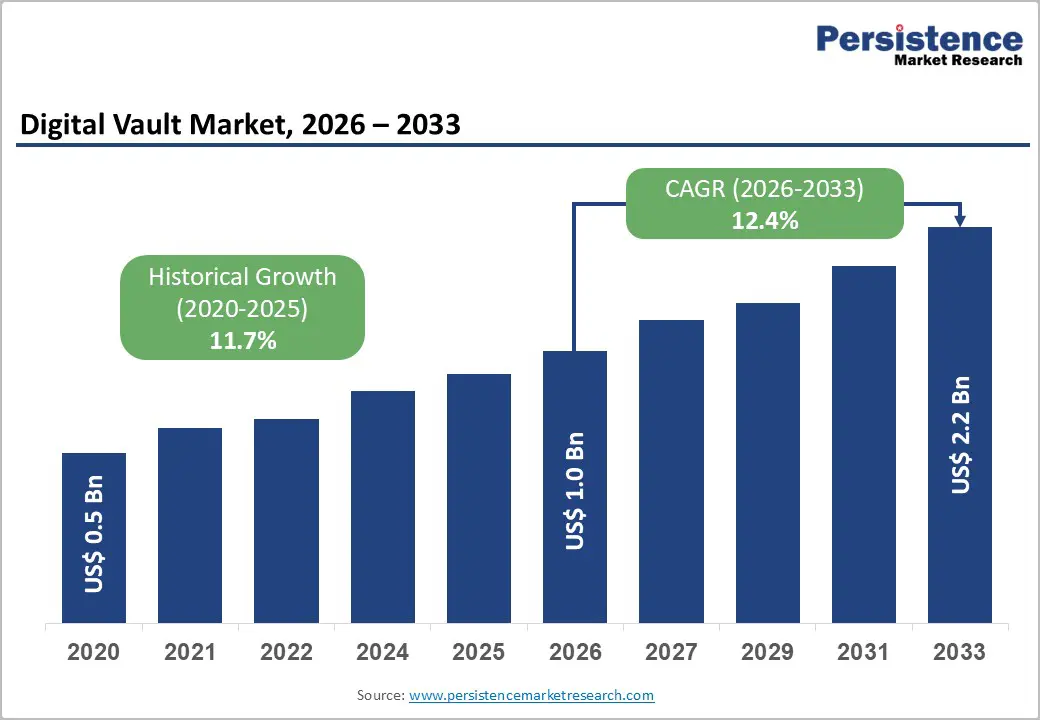

The global digital vault market size is likely to be valued at US$ 1.0 billion in 2026 and is projected to reach US$ 2.2 billion by 2033, growing at a CAGR of 12.4% between 2026 and 2033. This expansion is anchored by mounting concerns over data breaches, with cybersecurity threats costing American businesses an estimated US$1.9 million per breach on average, and evolving regulatory mandates such as GDPR, the CCPA, and emerging data privacy frameworks worldwide.

The proliferation of digital assets, cloud migration, and multi-generational wealth transfer pressures are driving demand across BFSI, government, healthcare, and professional services sectors, with organizations increasingly adopting digital vaults to secure sensitive records, financial accounts, and confidential documents. Real-world deployments-from Prismm's wealth management platform addressing US$ 84.4 trillion in projected multigenerational wealth transfer by 2045, to DigiLocker's nationwide adoption across Indian government services, to Europe's digital guarantee infrastructure initiatives-demonstrate accelerating market maturation and cross-sector penetration.

| Key Insights | Details |

|---|---|

| Digital Vault Market Size (2026E) | US$ 1.0 Bn |

| Market Value Forecast (2033F) | US$ 2.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 12.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 11.7% |

The Market is driven by exponential growth in data generation and a parallel surge in cybersecurity incidents, compelling organizations to implement robust protection strategies. According to the International Data Corporation (IDC), the global datasphere is expected to reach 175 zettabytes by 2025, up from 33 zettabytes in 2018, necessitating secure, scalable storage and archiving solutions.

The U.S. National Institute of Standards and Technology (NIST) reports that cybercrime and data breaches cost businesses approximately US$2 trillion globally in 2021, creating systemic demand for encrypted, access-controlled digital vaults to prevent unauthorised data exposure. Enterprise implementations-such as Morgan Stanley's collaboration with Box on a wealth management digital vault platform storing wills, estate plans, and financial statements-exemplify how financial institutions are addressing these threats through secure cloud-based archiving and client collaboration tools.

As data generation accelerates across IoT, cloud computing, and digital transformation initiatives, the Digital Vault Market captures organizations' imperative to segment sensitive assets into isolated, immutable repositories with cryptographic seals and granular access controls.

Government regulations and data protection legislation drive structural demand for the Digital Vault Market by mandating encryption, audit logging, and long-term retention.

The European Union's General Data Protection Regulation (GDPR) mandates that organizations implement robust security measures, including encryption and access controls, establishing compliance as a non-negotiable business driver. Similarly, the California Consumer Privacy Act (CCPA) and emerging privacy laws across jurisdictions create a global regulatory imperative for organizations to demonstrate data protection through certified digital vault solutions aligned with NIST SP 800-53, ISO/IEC 27001, SOC 2, and sector-specific frameworks such as HIPAA, FINRA, and Sarbanes-Oxley.

In India, the Aadhaar Data Vault, launched on September 2, 2025, emerged as a transformative solution addressing privacy concerns, encrypting and tokenizing Aadhaar data while maintaining UIDAI compliance and enabling 1.86 billion authentications and millions of eKYC verifications across Odisha and Bihar. FutureVault's integration of AI and private Large Language Models into its Digital Vault Platform in August 2024 demonstrates how vendors are automating compliance workflows, reducing manual documentation burden, and enhancing audit-ready capabilities for enterprises navigating complex multi-jurisdictional regulatory environments.

The digital vault market benefits substantially from enterprises' shift toward cloud-native and hybrid architectures that require secure, encrypted storage isolated from standard data environments. Quadient's launch of Inspire Digital Vault in October 2024-a cloud-native, SaaS-based platform designed for secure, regulatory-compliant document archiving-reflects how digital vault solutions are being embedded into modern cloud-first infrastructure.

BMI Imaging Systems' Digital Vault platform, launched in October 2025, implements write-once storage and independent verification to ensure long-term authenticity and integrity of digital files, addressing organisations' need for probative archiving within cloud and hybrid deployments.

As organizations prioritize business continuity, disaster recovery, and multi-region redundancy, digital vaults-with their immutable audit trails and zero-knowledge encryption architectures-integrate seamlessly into hybrid cloud stacks, enabling secure data isolation without sacrificing accessibility or operational efficiency.

Restraint - High implementation costs and resource constraints

Digital vault solutions entail significant upfront capital investment in infrastructure, licensing, professional services, and ongoing maintenance, creating barriers particularly for mid-market and resource-constrained organizations. Enterprise-grade digital vaults with advanced encryption, key management, audit logging, and compliance certification command premium pricing, while integration with legacy systems requires specialised expertise and extended deployment timelines.

Smaller enterprises and organizations in developing markets often lack the IT capacity and budget to adopt sophisticated digital vault platforms, particularly when lower-cost alternatives exist. This cost barrier slows market penetration in emerging economies and constrains adoption within public sector agencies operating under fiscal constraints, limiting overall market growth velocity.

Government and defense agencies are prioritising digital vault adoption to protect classified documents, biometric credentials, surveillance data, and national security infrastructure from cyber threats and unauthorised disclosure. Datavault AI Inc. has been appointed to the White House Experience Advisory Council to help preserve and modernise national heritage digitally, positioning the company as a strategic partner in government digital identity and credentialing infrastructure. Its VerifyU™ platform enables secure, blockchain-based credentialing for lifelong academic, professional, and sports credentials, demonstrating how digital vaults integrate with advanced identity verification and credential management systems serving the government, education, and sports sectors.

MonetaGo's partnership with Digital Vault Services GmbH (DVS), announced April 29, 2025, combines DVS's digital guarantee solutions with MonetaGo's financial infrastructure and fraud prevention expertise, enabling financial institutions to improve transaction security and regulatory compliance across global markets, initially targeting the Middle East, Africa, and Southeast Asia.

Clearstream's strategic investment in DVS to enhance its Guarantee Vault platform for issuing and safekeeping digital bank guarantees, integrated with Deutsche Börse's D7 digital post-trade platform, illustrates how critical financial infrastructure operators are adopting digital vaults to modernize trade finance, expand digital asset services, and strengthen market infrastructure resilience. These strategic investments signal that government and defense institutions view digital vaults as essential infrastructure for protecting sensitive state assets, modernizing legacy systems, and supporting secure, auditable governance processes across jurisdiction.

Digital vaults are catalysing the development of broader ecosystems for digital identity, credentialing, and asset tokenization, particularly in emerging markets where secure, scalable digital identity infrastructure is absent or fragmented. India's Vault-Based Tokenization adoption, highlighted June 20, 2025, emerged as a robust solution securing digital payment data by replacing sensitive information with one-time tokens stored in a centralized vault, ensuring PCI DSS compliance and fraud reduction across

India's rapidly growing cashless transaction ecosystem. The National Conference on DigiLocker showcased DigiLocker's evolution into a cornerstone of India's Digital Trust infrastructure, enabling citizens and government departments to securely access, verify, and share digital credentials across governance, education, and financial services, with seven states recognized as DigiLocker Accelerators for scalable implementations across pension, treasury, education, and banking systems

Datavault AI's collaborations with LifeGenix Institute to integrate diagnostics, credentialing, and digital identity into unified healthcare and wellness systems, combined with participation in major conferences such as the ALA Annual Conference, demonstrate how digital vaults are becoming foundational platforms for federated identity ecosystems, secure credential exchange, and data monetization across multiple sectors. As emerging markets leapfrog legacy infrastructure toward cloud-native, blockchain-enabled digital identity ecosystems, digital vault providers positioned to offer interoperable, standards-based solutions compatible with government digital ID programs, blockchain networks, and decentralized identity frameworks stand to capture substantial growth as these markets transition from cash-based to digital economies.

Solutions constitute the leading segment of the Digital Vault Market, holding approximately 64% of demand in 2026. This dominance reflects organisations' prioritisation of platform-based digital vault deployments over service-based implementations, driven by the need for standardised, scalable, and customisable software solutions to address diverse data protection and compliance scenarios.

Solutions-focused platforms-such as Prismm's transaction-enabled wealth management vault, AARP's cloud-based personal document storage, Morgan Stanley's encrypted collaboration platform with Box, and Fiduciary Trust International's estate planning and document management system-exemplify how enterprises and consumer-facing institutions are investing in purpose-built digital vault solutions aligned with their specific operational workflows, industry regulations, and customer engagement strategies.

Services represent the fastest-advancing segment, encompassing implementation, integration, managed services, compliance consulting, and ongoing support for digital vault deployments. As organizations deploy digital vaults across hybrid cloud and on-premises environments, demand for professional services-including architecture design, system integration with existing identity and access management infrastructure, security audit and certification, and continuous monitoring and compliance reporting-continues to expand.

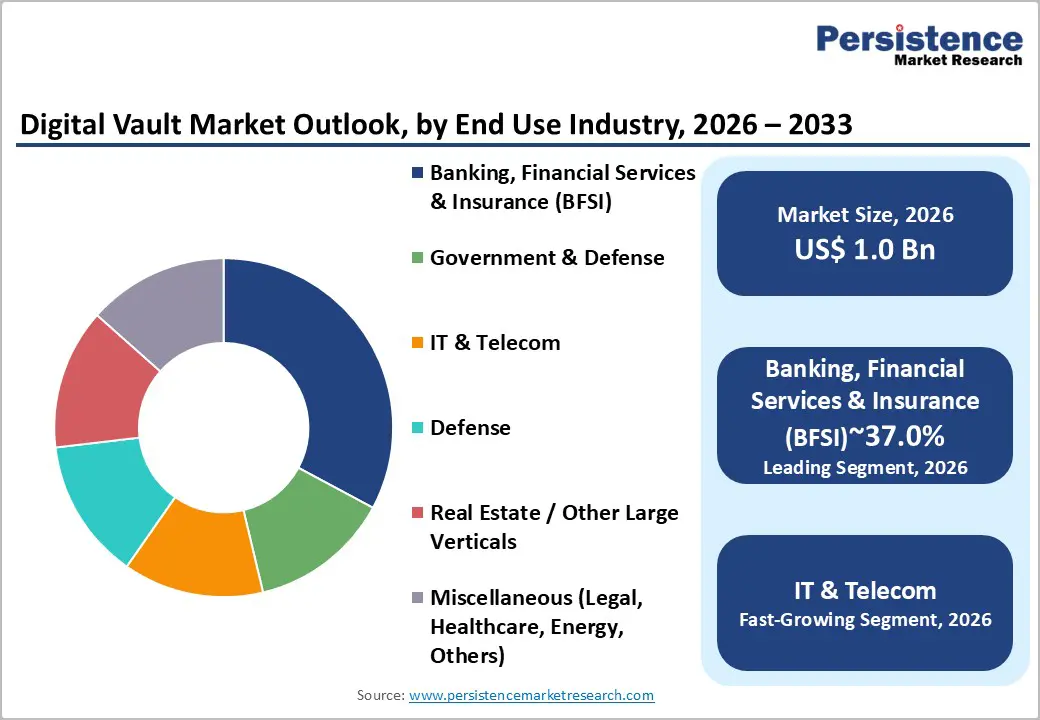

Banking, Financial Services & Insurance (BFSI) is the leading end-use segment, commanding approximately 31% of the Digital Vault Market in 2026. This dominance reflects the sector's acute exposure to data breaches, regulatory mandates such as FINRA, Sarbanes-Oxley, and GDPR, and customer expectations for secure financial record management and support for wealth inheritance. Prismm's wealth management vault addressing multigenerational wealth transfer, Morgan Stanley's encrypted document collaboration platform, Fiduciary Trust International's estate planning and account statement archiving, and FutureVault's Personal Life Management Vault-all specifically targeting BFSI workflows-underscore the sector's critical need for integrated digital vault solutions that combine security, compliance, and customer engagement.

Government & Defense represents the fastest-advancing end-use segment, driven by national security imperatives, digital transformation mandates, and the need to protect classified information, biometric credentials, and critical infrastructure from escalating cyber threats. Datavault AI's appointment to the White House Experience Advisory Council and its VerifyU™ blockchain-based credentialing platform for government and defense agencies, combined with Clearstream's investments in digital vault infrastructure supporting government and institutional digital asset services, demonstrate how government bodies are prioritizing secure digital identity and classified document preservation as strategic infrastructure investments.

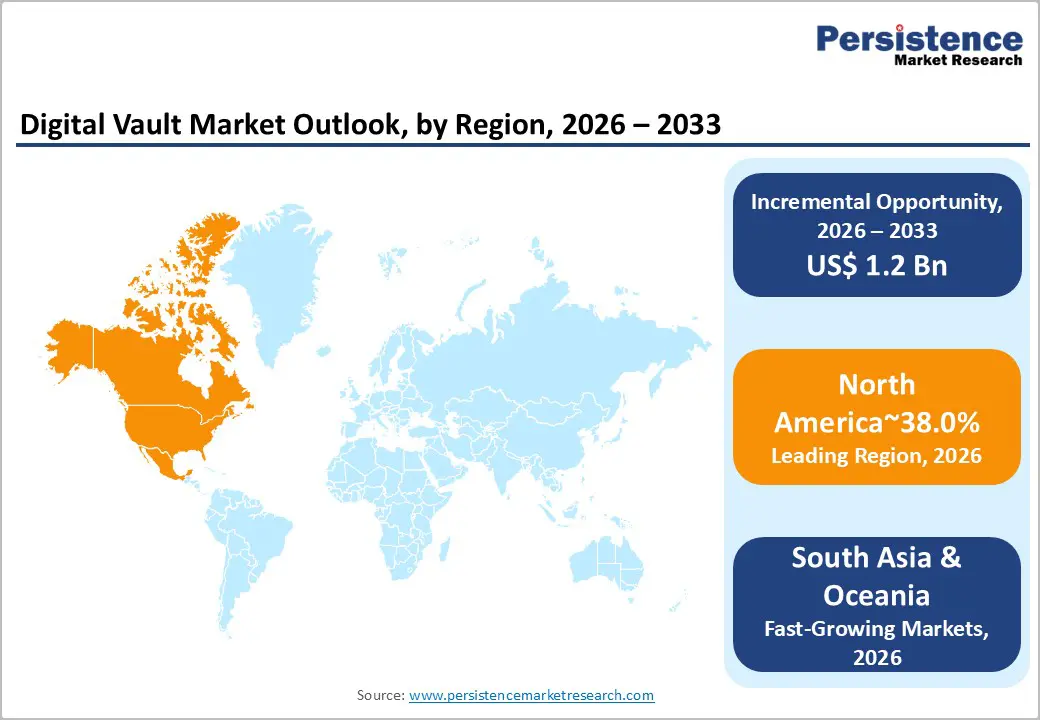

North America accounts for approximately 38% of the Global Digital Vault Market, anchored by advanced cybersecurity infrastructure, stringent data privacy regulations (particularly CCPA and state-level privacy laws), and high enterprise investment in digital transformation

The U.S. Department of Commerce reports that cybersecurity threats cost American businesses an estimated US$ 1.9 million per breach on average, creating persistent demand for enterprise-grade digital vault solutions aligned with NIST frameworks and SOC 2 certifications. Morgan Stanley's partnership with Box on encrypted cloud-based storage and sharing of financial documents, including wills, estate plans, and tax filings, exemplifies how major financial services firms are embedding digital vaults into their operational and customer-engagement workflows to enhance data privacy and operational efficiency.

North American regulatory compliance drivers-including HIPAA for healthcare, FINRA for financial advisory, and sector-specific frameworks-continue to sustain demand for certified digital vault solutions. Investment trends emphasize cloud-native, API-first platforms that integrate seamlessly with existing enterprise identity systems and support hybrid multi-cloud deployments. The competitive landscape features established providers such as IBM, Microsoft, Oracle, and CyberArk, alongside specialized vendors like Keeper Security and emerging FinTech firms focused on wealth management and personal data vaults.

East Asia accounts for approximately 24% of the global market, with rapid growth driven by digital transformation in BFSI, expanding government digitalization initiatives, and rising cybersecurity awareness.

China's banking and insurance sectors demonstrated robust growth as of Q2 2025, with total banking assets reaching RMB 467.3 trillion (up 7.9% year-on-year) and insurance assets growing 9.2% to RMB 39.2 trillion, creating substantial demand for secure digital asset management and compliance-focused vault solutions. Government and institutional investments in digital identity, blockchain-based credentialing, and secure asset tokenization position East Asia as a high-growth region for digital vault adoption across BFSI, government, and emerging fintech ecosystems.

Europe accounts for approximately 27% of the Global Digital Vault Market, characterised by stringent GDPR compliance requirements, advanced digital financial services infrastructure, and substantial government investment in digital trust infrastructure.

The European Union's financial and insurance sector generated €0.9 trillion in value added and employed nearly 5 million people across 867,000 enterprises in 2022, with high productivity and profitability metrics that enable substantial investment in digital vault and data security infrastructure. The European banking sector held €43.6 trillion in total assets in 2023, with €26.8 trillion in loans outstanding and €17.3 trillion in deposits, underscoring significant demand for secure digital vault solutions that address financial data protection, regulatory compliance, and operational efficiency.

The global digital vault market is currently consolidated in nature, dominated by a few established players offering advanced, enterprise-grade solutions that focus on security, compliance, and digital asset management. Leading companies such as CyberArk Software Ltd., IBM, Oracle Corporation, Hitachi Ltd., Micro Focus International plc, and Fiserv, Inc. have established strong footholds through continuous innovation, strategic partnerships, and extensive client networks. These players leverage robust encryption technologies, tokenization, cloud-native architectures, and AI-driven features to provide secure, scalable, and compliant digital vault solutions across banking, BFSI, government, healthcare, and enterprise sectors.

The market’s consolidated nature is reinforced by high entry barriers, including technological expertise, regulatory compliance requirements, and the critical need for data security and integrity, which makes it challenging for smaller vendors to compete at scale. Strategic investments, mergers, and acquisitions by these key players further strengthen their competitive positions and expand their global reach, enabling them to cater to large-scale digital vault deployments such as secure identity management, document archiving, and tokenized transaction data storage.

The global Digital Vault market is projected to be valued at US$ 1.0 Bn in 2026.

The Banking, Financial Services & Insurance (BFSI) segment is expected to account for approximately 31.0% of the global Digital Vault market by End- Use Industry in 2026.

The market is expected to witness a CAGR of 12.4% from 2026 to 2033.

The Digital Vault market is driven by rapid data volume growth and escalating cyber threats, reinforced by stringent regulatory compliance requirements and accelerating adoption of cloud and hybrid IT infrastructures.

Key opportunities in the Digital Vault market arise from rising adoption across government, defense, and critical infrastructure security, alongside expanding use in digital identity, credentialing, and tokenization platforms supporting emerging-market digital economies.

Key players in the Digital Vault market include CyberArk Software Ltd., International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Hitachi, Ltd., and Micro Focus International plc.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2026 to 2033 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Component Type

By Organization Size

By Deployment Mode

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author