ID: PMRREP35432| 198 Pages | 18 Jun 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

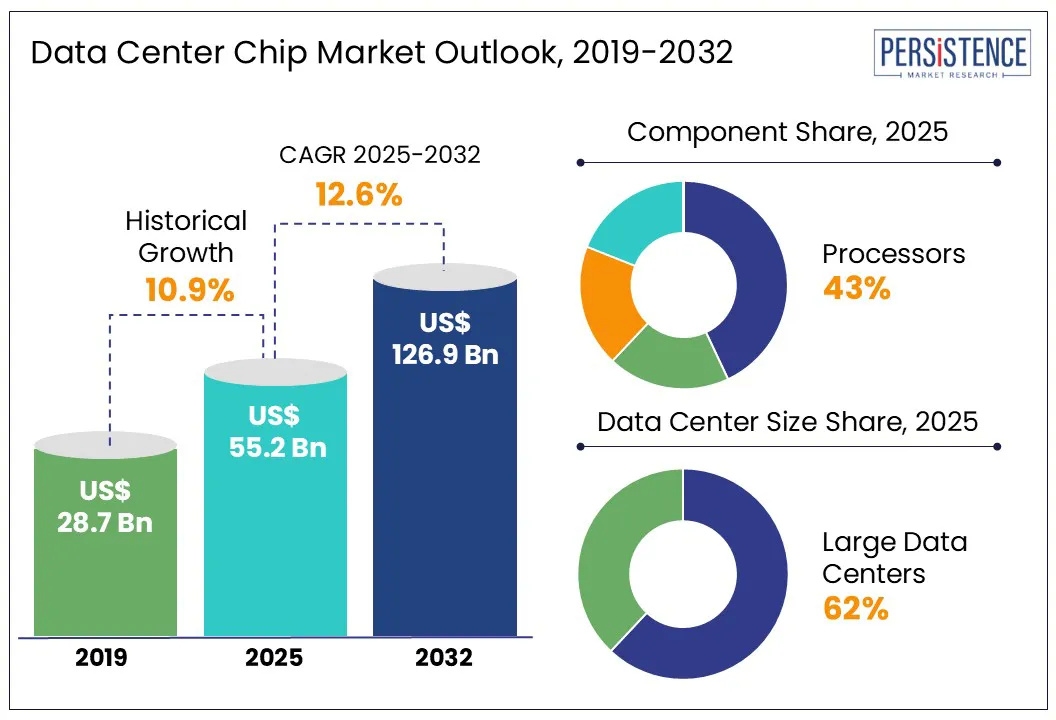

The global data center chip market size is projected to rise from US$ 55.2 Bn in 2025 to US$ 126.9 Bn by 2032. It is anticipated to witness a CAGR of 12.6% during the forecast period from 2025 to 2032.

Data center chips are the backbone of modern digital infrastructure, powering the computing, storage, and networking capabilities essential for enterprise operations, cloud services, AI workloads, and emerging technologies like edge computing. As data centers evolve to support growing workloads and real-time applications, the demand for more powerful, energy-efficient, and specialized chips is accelerating. The surge in data from users, devices, and digital services is driving the continuous expansion of data centers by cloud providers and hyperscalers, fueling strong demand for high-performance chips.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Data Center Chip Market Size (2025E) |

US$ 55.2 Bn |

|

Market Value Forecast (2032F) |

US$ 126.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

12.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.9% |

AI workloads, especially those involving large language models and deep learning algorithms, demand substantial computational power. This has driven a need for specialized chips such as graphics processing units (GPUs) and tensor processing units (TPUs), which are optimized for the parallel processing tasks typical of AI computations. While AI processing traditionally takes place in centralized cloud data centers, there is a growing shift toward executing AI workloads at the network edge, closer to where data is generated.

Data centers accounted for an estimated 1.5% of global electricity consumption in 2024, totalling approximately 415 terawatt-hours (TWh) annually. As AI adoption expands, energy demand is expected to increase, prompting a focus on developing more energy-efficient chips and advanced cooling solutions to manage thermal output. Major technology companies are leading this expansion, with Microsoft planning to invest US$80 billion in AI infrastructure in fiscal year 2025, and Meta projecting capital expenditures between US$64 billion and US$72 billion. These investments underscore the strategic importance of AI capabilities and the need for robust data center infrastructure powered by advanced chips.

The ongoing geopolitical tension, between the U.S. and China, has intensified the global chip war. Governments now view semiconductor technology as a strategic asset rather than just a commercial product. In 2024, the U.S. tightened export controls on advanced computing semiconductors and manufacturing equipment to China, aiming to curb its military capabilities. These restrictions have disrupted supply chains, impacting Chinese firms and the broader global market.

The U.S. increased tariffs on Chinese semiconductors in 2025. In May 2024, the Biden administration precisely announced that the tariff rate on semiconductors would double in 2025. On the other hand, the European Union is striving to reduce its dependency on external suppliers through the European Chips Act, mobilizing over US$ 49 billion in investments. Despite ambitions to capture 20% of the global chip market by 2030, experts consider this goal unrealistic amid ongoing global uncertainties.

The rising demand for AI, cloud computing, and digital services is driving data center expansion globally, creating strong opportunities for chipmakers and technology providers. In the U.S., data centers consumed approximately 4.4% of electricity in 2023, with projections reaching to 12% by 2028. This surge highlights the critical need for energy-efficient chips to reduce environmental impact and operational costs. In response, regions such as the EU are promoting sustainability through directives such as an 11.7% energy reduction target by 2030 and best practice frameworks such as the EU Code of Conduct for Data Centres.

At the same time, the rise of sovereign AI is reshaping global chip market dynamics, especially in sectors such as defense, public health, and national language processing. This trend encourages the customization of chip architecture through co-design with governments and local tech firms, enabling domain-specific ASICs and long-term supply agreements.

Chiplet design enables the integration of multiple smaller chips into a single package, overcoming limitations of monolithic chips. This modular approach improves energy efficiency and scalability in data centers by allowing specialized processing units to be combined across process nodes. As composable infrastructure gains traction, demand for flexible, DPU-enhanced chipsets is increasing, driving chipmakers to invest in next-gen silicon with programmable accelerators, network interfaces, and security engines.

DPUs (data processing units) are rising in prominence alongside CPUs and GPUs, offloading infrastructure tasks to boost throughput and reliability. Their role is critical in hyperscale data centers supporting Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS), where performance isolation and low latency are essential. With built-in encryption, firewalling, and traffic inspection, DPUs also align with zero-trust security models, accelerating deployment by enhancing compliance and cyber resilience for enterprise and government environments.

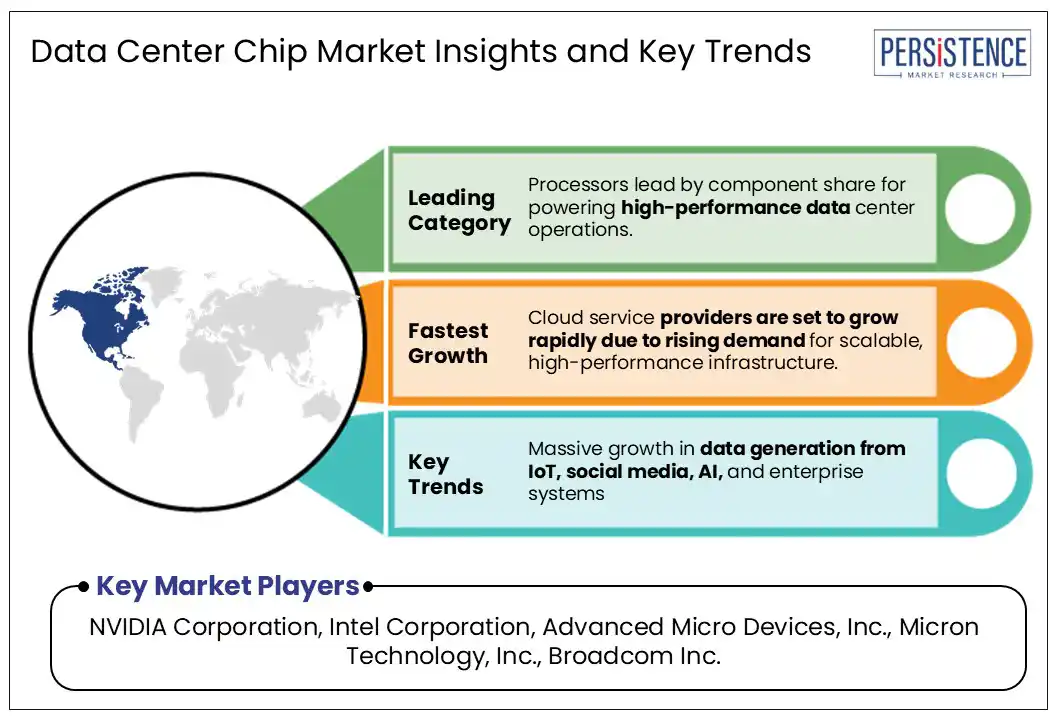

Based on component, the market is divided into processors, memory, networking, and others. Among these, processors are projected to generate a market share of over 43% in 2025 due to their critical role in handling complex computing tasks, the high demand for enhanced processing power, and the growing adoption of AI and machine learning workloads in data centers. Ongoing innovations in processor architecture, such as multi-core designs and improved energy efficiency, further boost their adoption in data centers.

Memory is projected to grow significantly owing to increasing demand for high-performance computing, AI/ML workloads, and big data analytics, all of which require faster and larger memory capacity. The shift toward hyperscale and cloud data centers further fuels the need for advanced DRAM and NAND solutions. Innovations like DDR5 and HBM (high bandwidth memory) are enhancing speed and efficiency, driving market expansion.

In terms of enterprises, the market is segregated into BFSI, healthcare, automotive, media & entertainment, IT & Telecom, retail & e-commerce, government, and others. Out of these, IT & telecom are expected to account for more than 27% share in 2025. This growth is driven by the surging demand for cloud computing, 5G infrastructure, and data-intensive applications. The expansion of data traffic fueled by video streaming, IoT, and AI workloads requires advanced chips for efficient processing and storage. Telecom operators are investing heavily in edge data centers to reduce latency and improve service delivery. The shift toward virtualization and software-defined networks is driving the need for high-performance, energy-efficient chips.

The BFSI sector is expected to grow at a substantial rate due to increasing digitization and the surge in online financial transactions. The need for high-speed data processing, real-time analytics, and enhanced cybersecurity drives demand for advanced chips. Regulatory compliance and risk management further push investments in robust, scalable data centers.

North America is predicted to generate a share of around 36.5% in 2025. In the United States, the surge in AI adoption is a key driver of rising demand for data center chips. Companies such as Nvidia have reported substantial growth in their data center segments, with Nvidia’s data center revenue reaching US$39.1 billion in Q1 2025, a 73% year-over-year increase. This reflects the growing need for GPUs and specialized chips to support AI workloads. The expansion of hyperscale data centers, essential for cloud services and big data analytics, is fueling demand for high-performance chip technologies.

Government policies are also shaping the market landscape. Tariffs on tech imports from countries such as China, Taiwan, and South Korea have introduced supply chain uncertainties, affecting component costs and availability. The U.S. CHIPS and Science Act, with US$52 billion in incentives and research funding, aims to boost domestic semiconductor manufacturing. In Canada, government-backed green data center initiatives are driving demand for energy-efficient chips that support sustainable operations.

China's data center chip demand is intensifying due to U.S. export restrictions on advanced chips such as Nvidia's H20. Major tech firms such as Alibaba, Tencent, and Baidu are shifting to domestic alternatives such as Huawei’s Ascend chips. This move aligns with China’s broader push for AI infrastructure self-reliance, although transitioning from Nvidia's CUDA to Huawei’s CANN may delay development by up to three months.

Japan is witnessing growth driven by AI and cloud adoption; in 2024, Oracle announced a commitment of over US$8 billion to sovereign-cloud infrastructure. South Korea is advancing high-performance chips to support AI growth. India’s digital push, backed by its US$ 760,000 million Semicon India program and Southeast Asia’s chip ambitions, evidenced by Malaysia’s US$250 million deal with Arm Holdings, underscore the region’s strategic focus on AI-ready infrastructure.

Germany leads Europe in data centers, with over 500 operational facilities. Its strategic location and robust IT ecosystem have fueled growth, driven by rising demand for digital infrastructure supporting cloud and AI applications. Compliance requirements under GDPR have increased the need for in-region storage, while German HPC centers are adopting heterogeneous hardware, advanced monitoring, high-temperature cooling, and energy-aware scheduling aligned with national energy policies.

The UK is investing significantly in its semiconductor sector, with up to US$271 million committed for 2023–25 and US$1 billion planned over the next decade. This move supports advancements in semiconductor technologies critical for data centers, focusing on R&D, design, and compound semiconductors. In the Benelux region, especially the Netherlands, mandate energy labeling regulations are pushing data centers to adopt energy-efficient technologies, boosting demand for sustainable semiconductor solutions.

The global data center chip market is consolidated, with a few major players holding a significant share due to their technological leadership, scale of operations, and deep integration with cloud service providers. They are heavily investing in R&D to develop chips with higher processing power, energy efficiency, and specialized capabilities such as AI acceleration or optimized networking. Companies are increasingly developing their in-house chips to optimize performance for their specific workloads.

The global market is projected to be valued at US$ 55.2 Bn in 2025.

Massive data generation from IoT, social media, AI, and enterprise systems is the key market drivers.

The market is poised to witness a CAGR of 12.6% from 2025 to 2032.

The rapid expansion of cloud services and hyperscale data centers presents a significant opportunity.

NVIDIA Corporation, Intel Corporation, Advanced Micro Devices, Inc., and Micron Technology, Inc. are among the leading key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis Units |

Value: USUS$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Component

By Data Center Size

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author