ID: PMRREP35644| 178 Pages | 22 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

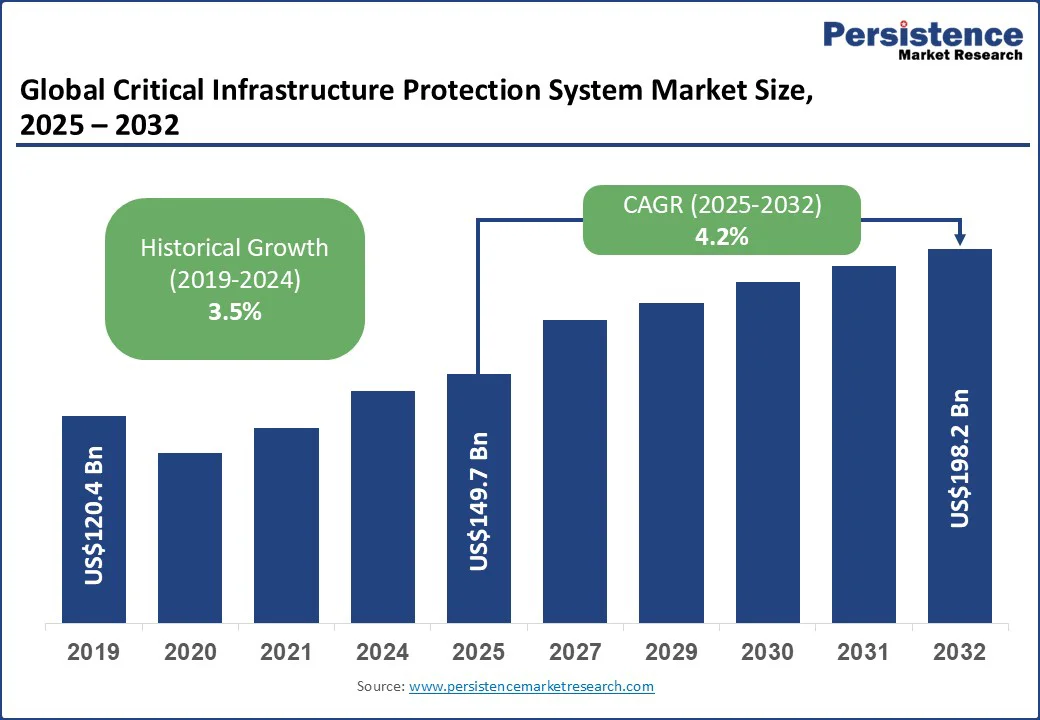

The global critical infrastructure protection system market size is likely to be valued at US$149.7 Bn in 2025. It is expected to reach US$198.2 Bn by 2032, growing at a CAGR of 4.2% during the forecast period from 2025 to 2032, driven by rising global security concerns and stringent regulatory and compliance requirements, which are accelerating investments in advanced security solutions.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

| Critical Infrastructure Protection System Market Size (2025E) | US$149.7 Bn |

| Market Value Forecast (2032F) | US$198.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.5% |

The increasing digitalization and interconnectedness of essential services have made critical infrastructure prime targets for cybercriminals, hacktivists, and state-sponsored actors. The consequences of such attacks extend beyond financial losses to include public safety risks, national security concerns, and disruptions to daily life. For example, ransomware attacks on healthcare systems paralyze hospitals, while breaches in power grids cause widespread blackouts, underscoring the urgent need for advanced solutions.

The FBI reported that Play ransomware affected ~900 entities worldwide by May 2025, while CISA warned that Interlock ransomware has hit multiple critical sectors since September 2024. ENISA’s Threat Landscape 2024 shows public administration (19%), transport (11.19%), digital infrastructure (8.16%), and energy (3.27%) are frequent targets, with smaller sectors such as drinking/wastewater (0.64%) still facing high-impact risks.

The U.K. Cyber Security Breaches Survey 2024 recorded ~7.78 million cybercrimes, and the U.S. IC3 reported US$1.571 Bn in losses in 2024, including 4,878 complaints from critical infrastructure organizations. These figures drive investments in 24×7 monitoring, incident response, network segmentation, and secure-by-design strategies, thereby boosting demand for CIP solutions.

Increasing reliance on digital and networked technologies exposes infrastructure to cyberattacks, yet a global shortage of skilled cybersecurity professionals limits the ability to detect, respond, and mitigate threats effectively.

For example, the U.S. Department of Defense reported a shortage of over 20,000 cyber-professionals department-wide in mid-2025. At the same time, the U.K.’s Department for Science, Innovation and Technology (DSIT) found that roughly 30% of cyber firms reported a technical skills gap in 2024. These shortages allow prolonged attacks, lateral movement, and unpatched vulnerabilities, directly undermining infrastructure integrity.

Limited skilled personnel also drive up operational costs and slow market growth. Governments and public-sector reviews in 2024-25 note that many agencies cannot perform routine monitoring, incident response, forensic analysis, or patching. Australia’s 2025 APS Data, Digital & Cyber Workforce Plan reported that over 50% of agencies experienced critical cyber skills shortages in 2023-24, leaving gaps that CIP systems alone cannot fill.

Rising compensation for scarce professionals forces infrastructure operators, especially public-sector and municipal entities, to allocate larger budgets, often delaying investments in tools, redundancy, or upgrades, which particularly restricts adoption among smaller operators and developing economies.

Increased public-sector funding and government initiatives are creating opportunities in the critical infrastructure protection (CIP) market. In the U.S., the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency (CISA) received a FY2025 budget request of approximately US$3 Bn, reflecting multi-billion-dollar public spending that fuels demand for CIP tools, services, and systems integration.

This increased funding generates numerous RFPs, grants, and procurement opportunities for vendors, integrators, and managed service providers.

Public-private partnerships (PPPs) and infrastructure modernization programs are creating additional avenues for market expansion. In January 2025, the U.S. Executive Branch launched PPPs focused on AI-driven cyber-defense for critical energy infrastructure, enabling vendors to commercialize AI detection, vulnerability discovery, and automated reporting solutions.

The U.S. programs under the Infrastructure Investment and Jobs Act (IIJA) and the EU’s Horizon civil-security work programmes provide funding for modernizing energy, transport, and telecom systems. Rising AI-enabled criminal techniques, highlighted by Europol’s EU-SOCTA 2025, are also increasing demand for counter-AI capabilities such as deepfake detection, attribution, and content analysis, presenting specialized opportunities for CIP vendors.

A rapid shift from siloed point solutions to integrated security platforms is reshaping the critical infrastructure protection (CIP) landscape. Rising incidents against critical infrastructure, including a notable increase in nationally significant events reported in 2024, are pushing operators and regulators to adopt unified stacks that integrate IT/OT security, physical security, identity management, threat intelligence, and incident response.

The U.K. National Cyber Security Centre’s 2024 review underscored this shift, noting a marked increase in significant incidents and highlighting the importance of platforms that deliver end-to-end visibility, coordinated response, and auditable frameworks for sectors such as airports, seaports, energy pipelines, and power plants.

The convergence of IT and OT systems, along with the growth of edge computing, is expanding the attack surface and driving demand for more advanced CIP solutions. Smart grids, industrial control systems, and traffic management networks now require edge-capable protection with features such as secure boot, remote attestation, device lifecycle management, and OT-aware XDR.

Regulatory momentum from NIST ZTA and CSF updates in late 2024, EU NIS2 enforcement, and ENISA guidance in 2025 is converting policy into procurement demand. Low-latency security at the edge has become essential, particularly in utilities and smart transportation, where delayed detection triggers cascading failures or safety hazards, reinforcing the adoption of integrated platforms that safeguard both edge and core infrastructure.

Based on security type, the market is divided into physical security and cybersecurity. Among general physical security, surveillance & monitoring are expected to account for more than 37% share in 2025 due to the rising need for real-time threat detection and rapid response to both physical and cyber risks. Increasing incidents of intrusions, sabotage, and system disruptions demand continuous observation and intelligence-driven security.

Advanced technologies such as AI-enabled cameras, drones, and integrated sensors enhance situational awareness, making surveillance a core requirement. The ability to prevent, predict, and mitigate potential disruptions drives its widespread adoption across critical assets.

Cloud security is expected to grow at a significant rate due to the widespread migration of sensitive data and critical operations to cloud platforms. The increasing demand for real-time monitoring and multi-layered protection in hybrid and public cloud environments is accelerating market growth.

It offers scalability and cost-efficiency, enabling organizations to maintain uninterrupted operations and safeguard data integrity. Advanced cloud security solutions are becoming essential to protect critical digital asset management, ensure operational resilience, and strengthen the overall CIP framework.

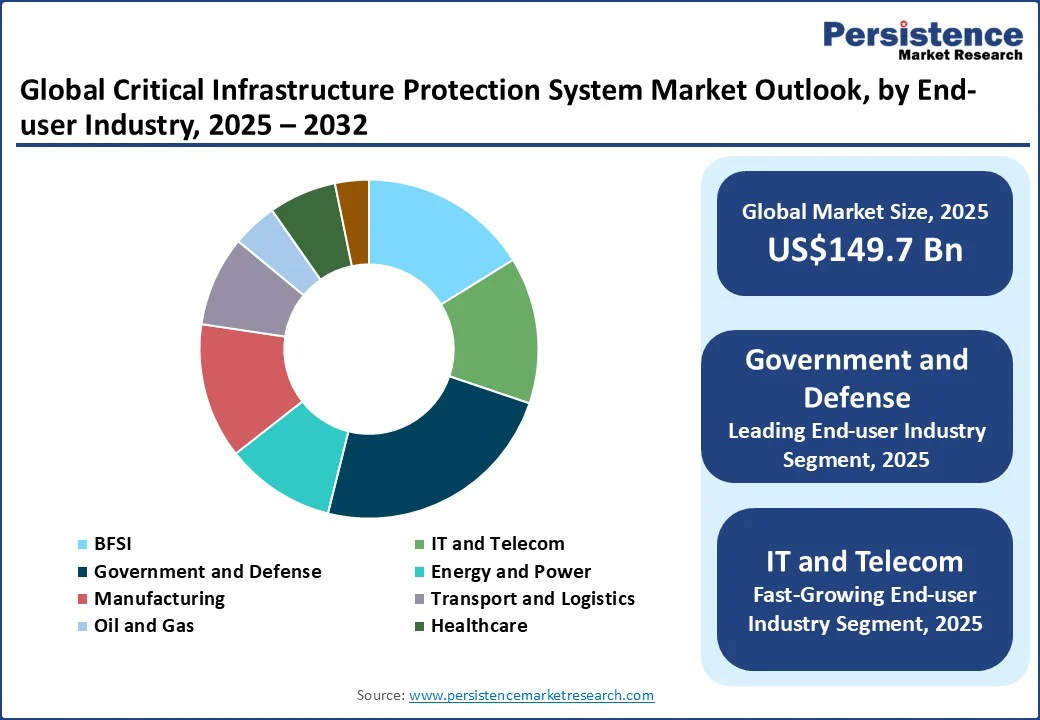

In terms of end-user industry, the market is segregated into BFSI, IT & telecom, government & defense, energy & power, manufacturing, transport & logistics, oil & gas, healthcare, and others. Out of these, government and defense are expected to account for more than 23% share in 2025 due to national security, intelligence, and defense operations requiring the highest level of protection against cyberattacks, terrorism, and espionage.

Protecting critical assets such as military installations, communication networks, and national data centers drives investments in advanced threat intelligence, real-time monitoring, and anti-terrorism solutions. Regulatory compliance and international defense collaborations further accelerate the adoption of cutting-edge security technologies.

The IT and telecommunications segment is expected to grow at a significant rate, due to increasing reliance on digital networks and data-driven operations. With the surge in 5G deployment, cloud computing, and IoT integration, these networks face higher exposure to cyberattacks, ransomware, and service disruptions. Protecting critical communication infrastructure is essential to ensure business continuity, secure sensitive customer data, and maintain national security.

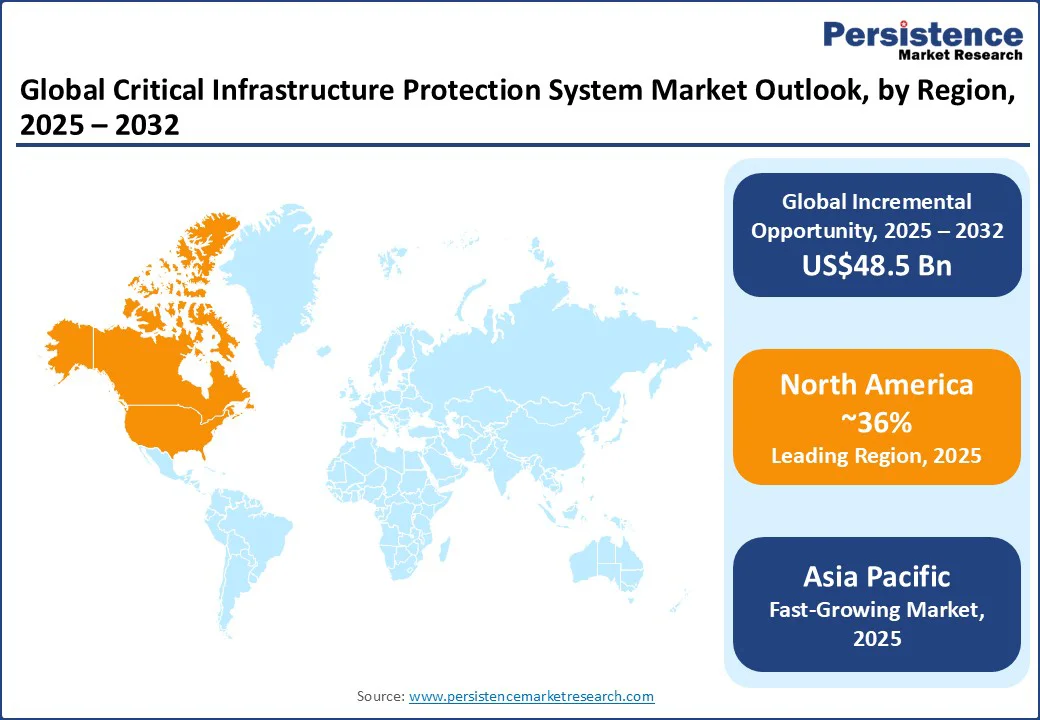

North America is expected to account for a share of more than 36% in 2025, driven by the escalating sophistication of cyber threats targeting essential systems such as energy grids, transportation networks, and financial services.

The prevalence of ransomware attacks, supply chain exploits, and infiltration campaigns by nation-state actors, including China, Russia, and Iran, has prompted governments and private sectors to strengthen defenses with zero-trust architectures and multi-factor authentication.

For instance, the market is under increasing pressure as the Department of Homeland Security (DHS) reported in 2025 that adversaries are targeting critical infrastructure, while the Chinese hacker group Volt Typhoon infiltrated U.S. aviation, rail, and maritime systems for over five years, underscoring vulnerabilities across vital sectors.

The North American Electric Reliability Corporation (NERC) has warned of critical reliability challenges facing the electricity grid due to rising demand from artificial intelligence (AI), coupled with coal plant closures and renewable project delays.

Canada’s Communications Security Establishment (CSE) also reported 2,561 cybersecurity incidents in 2024-2025, including 1,406 incidents affecting critical infrastructure partners, while the Cyber Centre issued 336 pre-ransomware alerts across healthcare and energy sectors.

The integration of advanced technologies such as AI, Internet of Things (IoT), and automation into smart grids and transportation networks, though enhancing efficiency, has introduced new vulnerabilities necessitating continuous innovation in cybersecurity protocols, regulatory frameworks, and cross-border collaboration between the U.S. and Canada.

Asia Pacific is expected to achieve a positive growth rate due to rapid urbanization, industrial growth, and digitalization. China is at the forefront, with its extensive energy and transport networks, the cybersecurity law, and data security regulations reinforcing infrastructure protection.

The Belt and Road Initiative has expanded the need for securing cross-border corridors. At the same time, the National Industrial Information Security Development Research Center projects China’s data elements market revenue to reach ¥198.9 Bn (US$27.3 Bn) by 2025, underlining large-scale investments in security governance.

Taiwan’s focus on green energy and territorial protection, Japan’s roadmap linking IoT/AI adoption to SBOMs, protective DNS, and resilience exercises, and India’s surge in demand from Digital India and Smart Cities Mission highlight the region’s diverse focus. India faces growing cyber incidents, with 99% of IoT exploitation attempts in 2024 leveraging known vulnerabilities, exposing gaps in digital and physical resilience.

Australia and New Zealand are pushing CIP demand through regulatory frameworks such as the updated Critical Infrastructure Security Act and Australia’s Cyber Security Bill 2024, which mandate ransomware reporting, IoT standards, and expanded SOCI Act obligations, ensuring advanced monitoring, SOC services, and resilience planning.

The European Union’s Critical Entities Resilience (CER) Directive, effective October 18, 2024, requires member states to adopt national strategies aimed at strengthening the resilience of critical entities. This initiative is reducing vulnerabilities to both natural and man-made disruptions while fostering the adoption of advanced technologies such as quantum key distribution (QKD) and AI.

For example, QKD enhances network integrity by preventing eavesdropping and sabotage, while collaborations such as the G7 cybersecurity working group promote international information-sharing on threats to critical infrastructure.

In Germany, the KRITIS law obliges operators in energy, transport, finance, health, and water to secure facilities, reflecting heightened threats after Russia’s 2022 invasion of Ukraine. The UK is focusing on financial sector resilience, with the U.K. Finance’s Annual Fraud Report 2025 revealing £1.17 Bn (US$1.43 Bn) stolen in 2024, 70% of which came from online authorized push payment (APP) fraud.

Spain recorded over 100,000 cyberattacks in 2024, including a serious case every three days, leading to stronger defensive measures. The EU’s Energy Highways initiative tackles grid bottlenecks and rising energy prices, while the transport sector expands cybersecurity to safeguard critical networks.

The global Critical Infrastructure Protection System Market is fragmented, comprising numerous specialized and regional players alongside a limited number of global leaders. Companies are emphasizing advanced cybersecurity measures, AI-enabled monitoring systems, and robust physical security solutions to establish a competitive edge. Strategic partnerships and alliances with government agencies and technology providers are being leveraged to enhance market reach and credibility.

The Critical Infrastructure Protection System Market is projected to be valued at US$149.7 Bn in 2025.

Rising threats from cyberattacks, physical security breaches, and the need to ensure resilience and continuity are key drivers of the market.

The Critical Infrastructure Protection System Market is poised to witness a CAGR of 4.2% from 2025 to 2032.

Growing adoption of IoT and smart grid technologies, along with increased investments in resilient transportation, energy, and water systems, is creating strong growth opportunities.

Siemens AG, Honeywell International Inc., Schneider Electric, Lockheed Martin, Cisco Systems, Inc., IBM Corporation, and Palo Alto Networks are among the leading key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Security Type

By Enterprise Size

By End-user Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author