ID: PMRREP35855| 197 Pages | 17 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

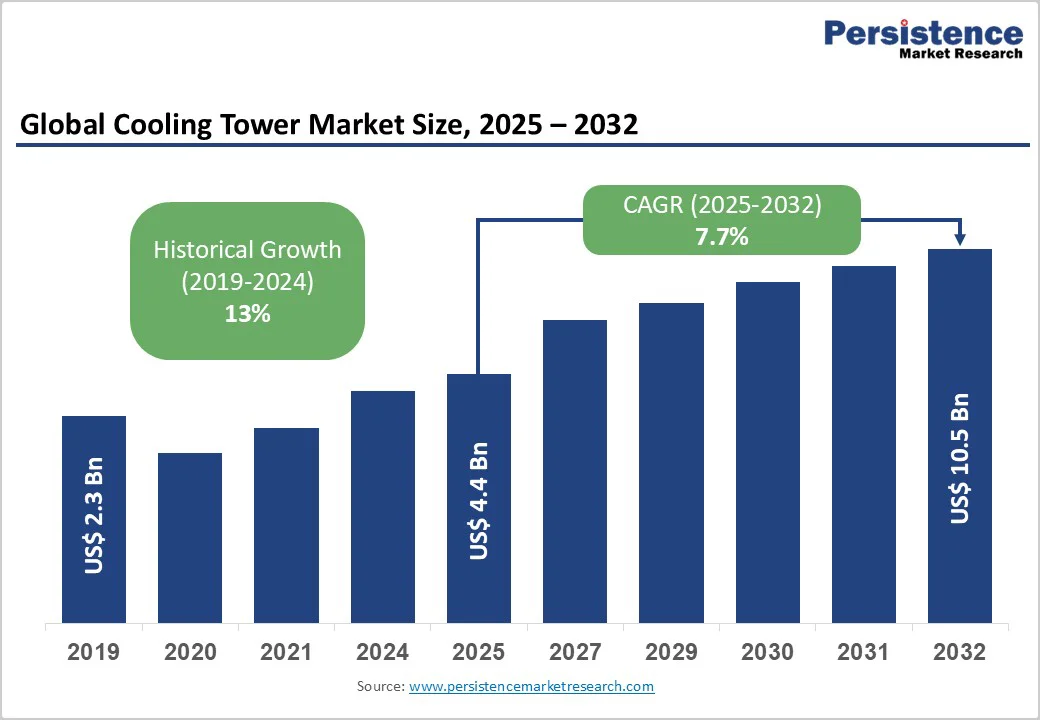

The global cooling tower market is expected to reach US$4.4 billion in 2025. It is estimated to reach US$10.5 billion by 2032, growing at a CAGR of 7.7% during the forecast period 2025 - 2032, driven by escalating demand for energy-efficient cooling across the industrial and commercial sectors.

Key growth drivers include rapid industrialization and urbanization in the Asia Pacific, led by the power and HVAC sectors. Regulatory focus on water conservation and emissions boosts adoption of hybrid cooling towers and IoT-enabled smart systems, while moderate market concentration and ongoing innovation ensure sustained investment and competition.

| Key Insights | Details |

|---|---|

| Cooling Tower Market Size (2025E) | US$4.4 Bn |

| Market Value Forecast (2032F) | US$10.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 13% |

Stringent environmental regulations worldwide, driven by agencies such as the U.S. Environmental Protection Agency (EPA) and European Environment Agency (EEA), are accelerating the shift toward energy-efficient cooling solutions.

These policies mandate reductions in water use and emissions from industrial processes, championing technologies such as hybrid and closed-circuit cooling towers. For instance, the EPA’s WaterSense program promotes water-efficient equipment, pushing industries to adopt cooling towers that minimize water loss and drift emissions. This is particularly critical in regions facing water scarcity.

Globally, the value of energy-efficient cooling solutions has soared, with HVAC systems accounting for over 30% of commercial energy consumption, as per the International Energy Agency (IEA).

Cooling tower innovations integrating IoT for predictive maintenance and real-time optimization are also increasing operational efficiency, enabling clients to reduce costs by up to 15%. Consequently, regulatory pressures, coupled with technological advancements, are driving rapid market expansion in water-sensitive and energy-conscious sectors.

One of the primary challenges restraining the cooling tower market's growth is the substantial water volume required for operation, particularly in evaporative towers used in large-scale industrial settings.

This high water demand conflicts with global sustainability goals and stricter regulations on water use enacted by governments and international entities such as the World Bank. In water-stressed regions, operational costs rise due to scarcity-driven pricing, making cooling towers less attractive than emerging alternatives such as dry cooling systems.

The increasing volatility in water availability also imposes supply chain risks and regulatory compliance costs that can markedly reduce profit margins in some cases. Addressing these challenges requires significant investments in water-saving technologies and alternative cooling methods, which may delay adoption rates and increase the total cost of ownership, particularly for small and medium enterprises.

Emerging economies in the Asia Pacific and the Middle East present lucrative growth opportunities due to rapid urbanization, industrial diversification, and government-led infrastructure investments. China, India, and ASEAN member-states are scaling power generation capacity and commercial infrastructure, driving demand for cooling towers tailored to high-capacity and energy-efficient requirements.

Policy initiatives such as India’s Smart Cities Mission and China’s 14th Five-Year Plan emphasize sustainable urban growth and energy efficiency, creating fertile ground for the adoption of hybrid cooling towers and smart HVAC systems.

Market sizing for this opportunity suggests potential incremental revenue exceeding US$2 billion by 2030, driven by technology convergence and unmet cooling needs in new industrial zones and data centers. Strategic investments in these markets by manufacturers, coupled with localized production and regulatory alignment, will be essential to capture this growth potential.

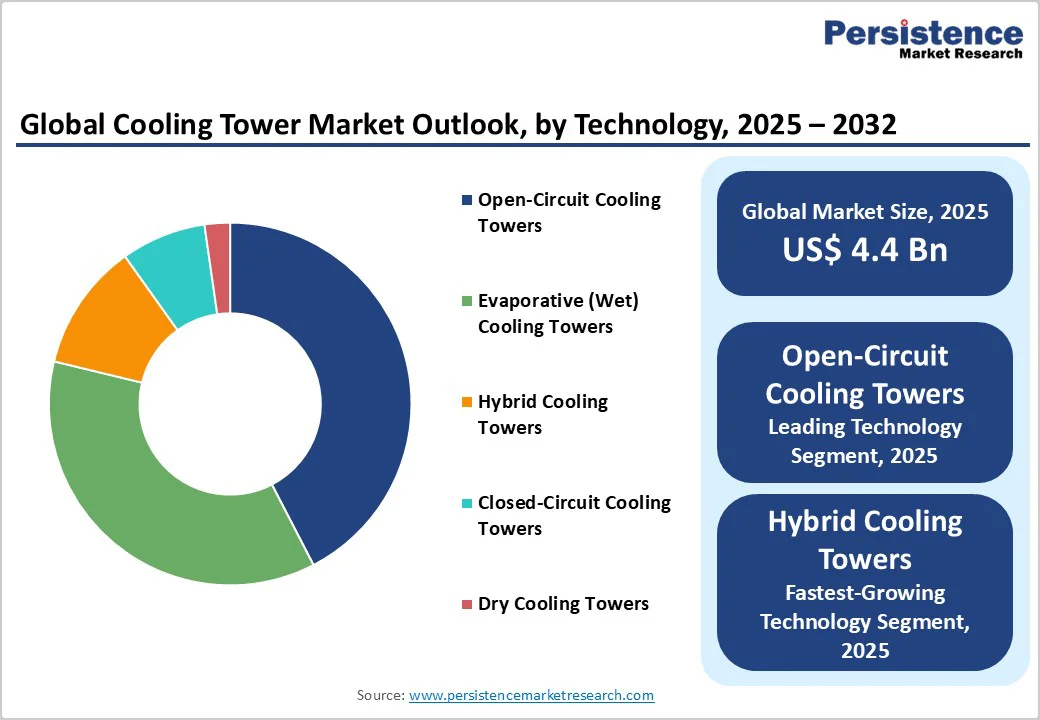

In 2025, the open-circuit cooling tower segment is likely to lead with an estimated 42.4% market share. Its dominance stems from its cost-effectiveness, operational simplicity, and robust ability to dissipate high thermal loads, making it the preferred choice across heavy industries such as power generation and manufacturing.

Open circuit systems also allow for high heat transfer rates with straightforward maintenance, which appeals to sectors prioritizing reliability over advanced features.

The fastest-growing technology segment from 2025 to 2032 is poised to be hybrid cooling towers, primarily driven by intensified regulatory pressures worldwide to conserve water and reduce emissions, which demand technologies that combine wet and dry cooling mechanisms to optimize water and energy use.

Rampant urbanization in the Asia Pacific and stringent environmental mandates in developed regions are catalyzing hybrid tower adoption. Their alignment with sustainability policies and ability to minimize plume emission while maintaining energy efficiency positions this segment as a future growth leader.

Fiber-reinforced plastic is slated to hold an estimated 29% of the cooling tower market revenue share in 2025, owing to its high corrosion resistance and durability in aggressive industrial environments such as chemical processing and petrochemicals. FRP’s low maintenance costs and resistance to biological fouling extend the lifespan of cooling towers, making it a cost-effective choice for asset-intensive industries.

In contrast, high-density polyethylene (HDPE) is set to be the fastest-growing material segment with the highest CAGR from 2025 to 2032. The popularity of HDPE stems from its lightweight nature, recyclability, and superior resistance to biological and chemical degradation.

These attributes meet the rising demand for sustainable and low-maintenance materials in new construction and retrofit projects, particularly in regions facing water quality challenges and stricter environmental scrutiny.

The power generation segment is slated to emerge as the leading application area for cooling towers, with around 33% market share in 2025, owing to its critical role in maintaining thermal efficiency across thermal and nuclear power plants.

The increasing demand for reliable, high-capacity cooling solutions is driven by global efforts to expand energy infrastructure, especially in emerging economies, where power capacity is rapidly being scaled to support industrialization and urbanization.

Regulatory mandates to reduce water and energy consumption are prompting upgrades to more efficient cooling technologies, including hybrid and intelligent cooling towers, which offer both environmental and operational benefits.

The HVAC segment is the fastest-growing application segment, with the highest CAGR over 2025 - 2032. This growth is powered by rapid urbanization, the expansion of commercial infrastructure, and the proliferation of data centers requiring advanced climate-control solutions.

HVAC applications increasingly demand cooling towers integrated with smart sensors and automation to enhance energy efficiency and comply with green building certifications, marking this segment as a significant driver of market innovation.

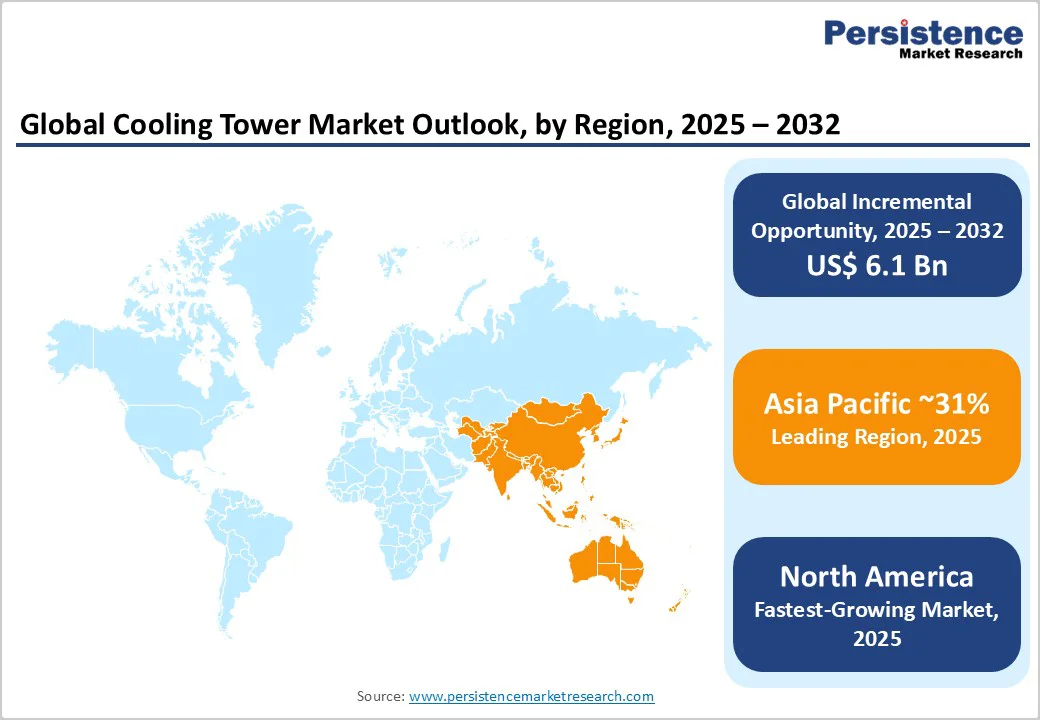

Asia Pacific dominates the cooling tower market with a 31.3% estimated share in 2025. China leads this growth through extensive industrialization, urban expansion, and ambitious governmental infrastructure programs, such as the Belt and Road Initiative and renewable energy investments.

India and ASEAN countries are also making significant contributions, aided by rapid urbanization, manufacturing growth, and policies such as India’s Smart Cities Mission, focusing on sustainable urban infrastructure.

The region’s large and expanding manufacturing base, alongside rising data center construction, generates heavy cooling demand. Regulatory frameworks are evolving to emphasize water conservation and emissions reduction, accelerating the adoption of hybrid and HDPE-based cooling towers.

The competitive landscape includes significant local players and multinational corporations adapting product portfolios to cost sensitivities and regulatory compliance within this dynamic environment.

North America is expected to hold an estimated 27% of the cooling tower market share in 2025, with the U.S. accounting for over 77% of the regional market volume. This leadership is grounded in the region’s mature industrial base, advanced technological ecosystem, and stringent environmental regulations enforced by bodies such as the EPA.

The regional market is predicted to expand the fastest through 2032, propelled by large-scale investments in power generation and HVAC infrastructure modernization.

Innovations integrating AI and IoT for operational optimization have gained traction, reducing energy consumption and supporting compliance with emissions standards. Regulatory incentives for retrofitting existing infrastructure and demand for high-efficiency systems foster opportunities for service-based business models and product upgrades.

The competitive landscape is marked by a strong emphasis on technological leadership and sustainability compliance, enabling North America to maintain its market prominence.

Europe is forecasted to command approximately 22% market share in 2025, primarily driven by Germany, France, the U.K., Italy, and Spain. Regional market growth is facilitated by directives of the European Union (EU) targeting energy efficiency and environmental performance harmonization. Germany’s strong manufacturing base and its leadership in green building initiatives boost demand for advanced cooling technologies.

The regulatory environment incentivizes renovation and replacement of aging cooling infrastructure, linking market growth to sustainability commitments within the European Green Deal framework. The market is relatively fragmented with numerous regional manufacturers participating alongside global players, creating a competitive environment focused on tailoring solutions to regulatory compliance and sustainability trends.

The global cooling tower market structure exhibits moderate concentration. Leading players, including Babcock & Wilcox Enterprises, Baltimore Aircoil Company, SPX Corporation, EVAPCO Inc., and Johnson Controls International Plc., collectively capture the lion’s share of the market through their technological innovations, comprehensive product lines, and extensive geographic reach.

These firms focus heavily on integrating smart technology and enhancing environmental sustainability, which is critical to maintaining competitiveness in increasingly regulated markets. However, the presence of numerous regional and niche manufacturers ensures a level of fragmentation that encourages innovation tailored to local market needs, price points, and regulatory environments.

The cooling tower market is projected to reach US$4.4 Billion in 2025.

Escalating demand for energy-efficient cooling across industrial and commercial sectors, and rapid industrialization and urban infrastructure expansion, particularly in Asia Pacific, where power consumption is surging, are driving the market.

The cooling tower market is poised to witness a CAGR of 7.7% from 2025 to 2032.

Heightened regulatory emphasis on water conservation and emissions control supports the development of advanced technologies such as hybrid cooling towers and IoT-enabled smart cooling systems, generating lucrative opportunities for market players.

Babcock & Wilcox Enterprises, Inc., Baltimore Aircoil Company, and SPX Corporation are a few of the key players in the cooling tower market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By Material

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author