ID: PMRREP3681| 0 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

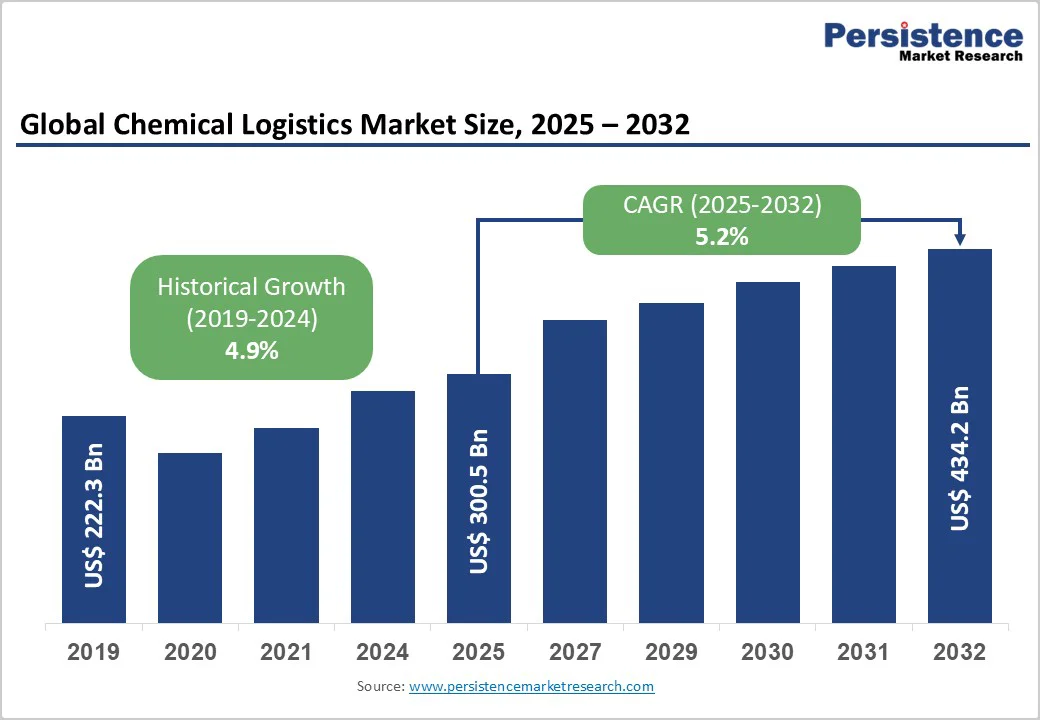

The global chemical logistics market size is likely to be valued at US$300.5 Billion in 2025, projected to reach US$434.2 Billion by 2032, growing at a CAGR of 5.2% during the forecast period from 2025 to 2032. The market is experiencing robust growth driven by increasing global chemical production, stringent safety, and compliance regulations, and rising demand for efficient supply chain solutions.

The market is further propelled by advancements in digital logistics platforms and cold chain technologies, catering to preferences for safe and traceable chemical handling. The growing acceptance of chemical logistics as a critical component for ensuring supply chain resilience and regulatory compliance is a key growth factor.

| Key Insights | Details |

|---|---|

| Chemical Logistics Market Size (2025E) | US$300.5 Bn |

| Market Value Forecast (2032F) | US$434.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.9% |

The increasing global chemical production and stringent safety regulations are primary driven by rising chemical production and increasingly stringent regulations governing their transport, storage, and handling. As global demand for industrial, specialty, and pharmaceutical chemicals grows, manufacturers are producing larger volumes across diverse regions, including Asia Pacific, Europe, and North America. This surge in production intensifies the need for efficient, safe, and scalable logistics networks capable of managing hazardous materials, temperature-sensitive compounds, and high-value specialty chemicals.

Efficient logistics systems ensure uninterrupted supply chains, optimized inventory management, and reduced risks of contamination or delays. Governments and international bodies have introduced stricter safety and environmental regulations to mitigate risks associated with chemical transport. Frameworks such as REACH (EU), OSHA (U.S.), and GHS compliance standards require precise labeling, documentation, and handling procedures.

High compliance costs and complex supply chains pose significant restraints on market growth. Stringent regulations governing the handling, storage, and transportation of chemicals—including hazardous, flammable, and temperature-sensitive substances—require companies to invest heavily in compliance measures. These include specialized packaging, safety training, certification, regular audits, and documentation to meet local, national, and international standards such as REACH, OSHA, CLP, and DOT regulations. Maintaining adherence to these regulations increases operational expenses and necessitates continuous monitoring and staff expertise.

Supply chain complexities further exacerbate these challenges. Chemical logistics often involve multi-modal transportation across global networks, requiring precise coordination between manufacturers, distributors, and end-users. Variations in regional infrastructure, port capacities, and customs procedures can create bottlenecks, delays, and higher operational risks. Temperature-sensitive or hazardous chemicals require specialized storage and handling at multiple points in the supply chain, adding to logistical complexity.

Advancements in digital tracking and cold chain technologies present significant growth opportunities for the chemical logistics market. Digital tracking systems, including GPS-enabled sensors, RFID tags, and IoT-based monitoring, provide real-time visibility of chemical shipments across the supply chain. These technologies allow logistics providers to monitor location, temperature, humidity, and handling conditions, reducing the risk of product loss, contamination, or regulatory breaches. Improved tracking also enables proactive decision-making, optimized routing, and timely delivery, which are critical for high-value and hazardous chemicals.

Cold chain logistics have become particularly important for temperature-sensitive products, such as pharmaceuticals, biologics, and specialty chemicals. Advanced refrigerated storage, insulated packaging, and temperature-controlled transportation solutions ensure product integrity and efficacy throughout transit. Integration of cold chain systems with digital monitoring allows continuous oversight, alerts for deviations, and automatic documentation for compliance with stringent regulatory standards, including FDA, EMA, and ISO requirements.

Petrochemicals dominate the market, accounting for 35% of the share in 2025, driven by strong demand from the oil and gas and manufacturing sectors. Efficient transportation and storage of large volumes of feedstocks and derivatives are essential for continuous industrial operations. Their widespread use in plastics, fuels, and industrial chemicals reinforces the segment’s market leadership.

Pharmaceutical Chemicals are the fastest-growing segment, driven by increasing global drug production and demand for vaccines, biologics, and specialty medications. Strict temperature control, secure handling, and timely delivery are essential to maintain product efficacy. Rising healthcare needs, advancements in biologics, and expanded global distribution networks further accelerate the adoption of specialized pharmaceutical chemical logistics services.

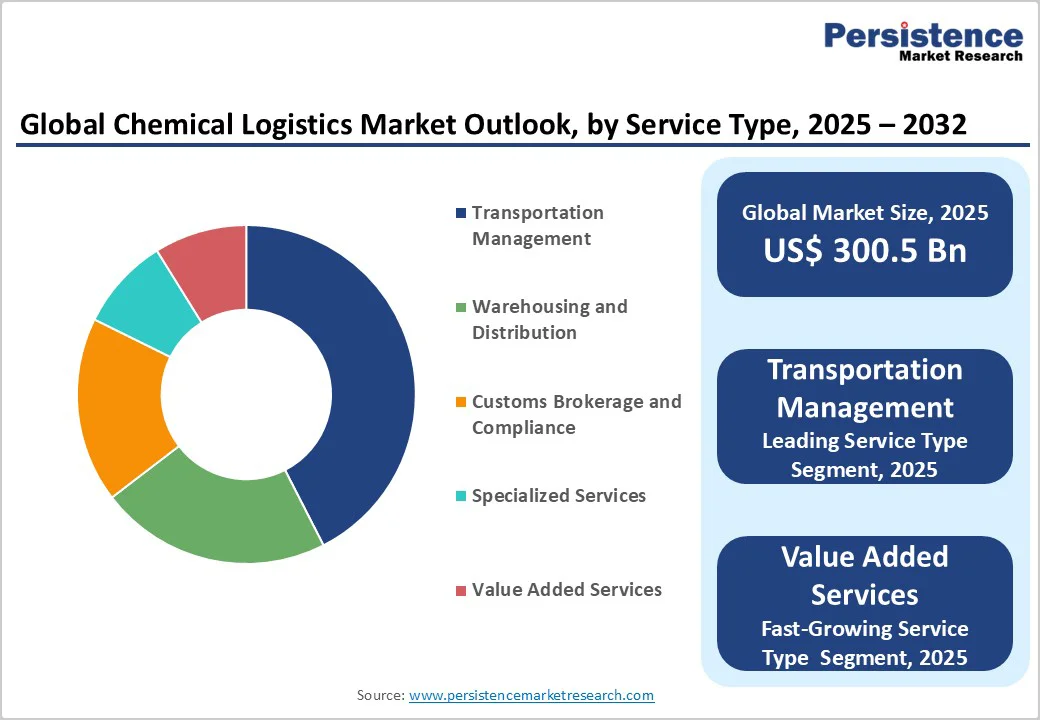

Transportation Management leads with a 45% share, driven by the critical need for safe and compliant handling of hazardous materials. Efficient transport solutions minimize risk, ensure regulatory adherence, and maintain chemical integrity. Logistics providers leverage specialized vehicles, routing, and tracking technologies to meet stringent safety standards and support reliable supply chains.

Value-added services are the fastest-growing, driven by increasing demand for customized packaging, labeling, and specialized handling. These services enhance safety, regulatory compliance, and operational efficiency, particularly for hazardous or specialty chemicals. Manufacturers and distributors rely on tailored solutions to meet client requirements, streamline supply chains, and support brand differentiation in competitive markets.

Manufacturing holds a 40% share, relying on efficient supply chains for raw materials such as solvents, polymers, and industrial chemicals. Timely and safe transportation ensures uninterrupted production processes, reduces operational risks, and supports large-scale industrial operations. Strong logistics capabilities enable manufacturers to optimize inventory management, maintain regulatory compliance, and meet market demand effectively.

Pharmaceuticals are the fastest-growing, driven by stringent cold chain requirements for temperature-sensitive drugs, vaccines, and biologics. Maintaining precise storage and transportation conditions is critical to ensure product efficacy and regulatory compliance. Rising demand for biologics, personalized medicines, and global distribution of vaccines further accelerates the adoption of specialized pharmaceutical logistics solutions.

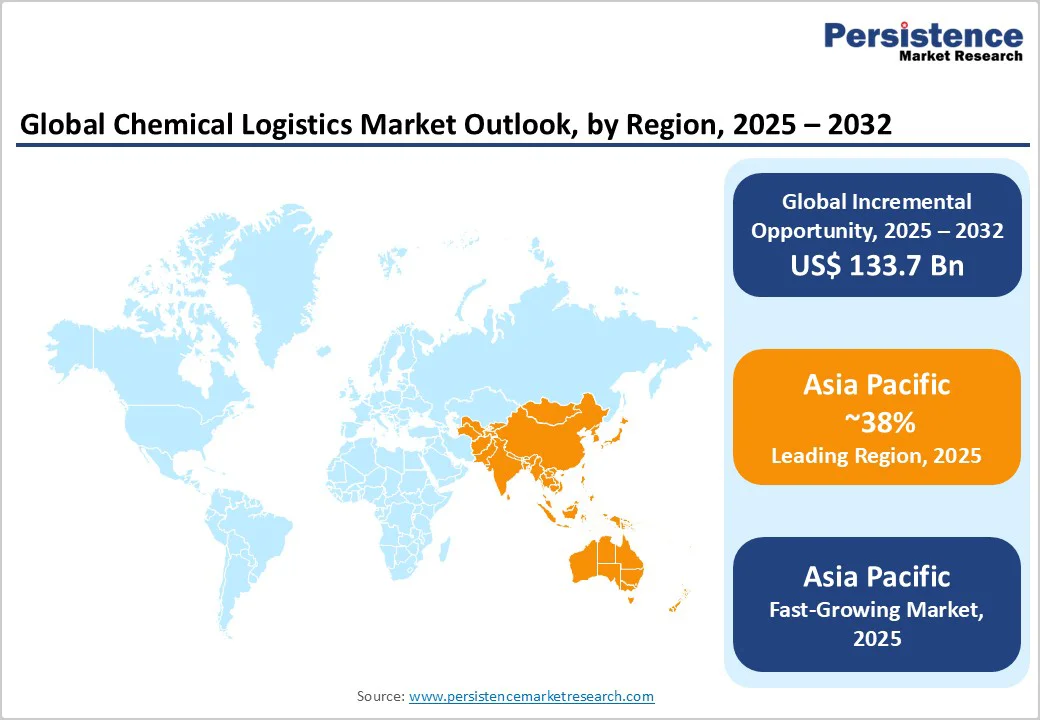

Asia Pacific commands around 38% share and is the fastest-growing region, riven by the region’s expanding chemical production and distribution needs. China, as a global leader in chemical manufacturing, contributes significantly to this growth. The country’s robust industrial base produces a wide range of chemicals, including specialty chemicals, petrochemicals, and industrial solvents, creating strong demand for efficient, safe, and compliant logistics services. Companies in China are increasingly investing in modern warehousing, digital tracking systems, and advanced transportation solutions to manage the large volumes of chemical shipments both domestically and for export.

India’s growing agricultural sector further fuels chemical logistics demand, particularly for fertilizers, pesticides, and crop-protection chemicals. Seasonal demand peaks during planting cycles require precise inventory management, timely distribution, and cold chain solutions for temperature-sensitive chemicals, highlighting the need for specialized logistics services.

North America accounts for 25% in 2025, driven primarily by the United States’ robust chemical manufacturing and export activities. The U.S. is a leading producer of petrochemicals, specialty chemicals, and industrial compounds, generating strong demand for reliable and efficient logistics services to ensure safe transportation and timely delivery to domestic and international markets. Advanced logistics infrastructure, including modern ports, rail networks, highways, and technologically integrated warehouses, supports the efficient handling of hazardous and high-value chemicals. Additionally, U.S. logistics providers are increasingly adopting digital tools, real-time tracking, and automated inventory management systems to improve operational efficiency, regulatory compliance, and supply chain visibility.

The U.K. market exhibits similar growth trends. Post-Brexit trade adjustments have created a need for more specialized and flexible chemical logistics solutions, particularly for imports, exports, and intra-European distribution. The growing demand for specialty chemical logistics is also reinforced by a focus on sustainability, including energy-efficient transportation, emission reduction, and environmentally compliant packaging and storage.

Europe holds about 30% market share, led by Germany and France, driven by stringent EU chemical safety and environmental regulations, which mandate secure storage, handling, and transportation of hazardous and non-hazardous chemicals. Compliance with regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and CLP (Classification, Labelling, and Packaging) has created strong demand for specialized logistics providers capable of ensuring safe and efficient chemical distribution.

Germany’s well-developed industrial and manufacturing base, including automotive, pharmaceuticals, and specialty chemicals, generates significant volumes of chemicals requiring reliable logistics services. Similarly, France’s diversified chemical sector, encompassing agrochemicals, polymers, and industrial chemicals, contributes to the region’s demand for advanced storage and transportation solutions.

The global chemical logistics market is highly competitive, characterized by the presence of several established players who dominate through technological innovation, sustainability initiatives, and specialized service offerings. Key logistics providers are increasingly adopting digital solutions, such as advanced tracking systems, warehouse management software, and data analytics, to enhance supply chain visibility, improve operational efficiency, and ensure compliance with complex chemical handling regulations. These technologies also help mitigate risks associated with hazardous materials, optimize inventory management, and streamline transportation processes.

Companies are implementing eco-friendly practices, including the use of low-emission vehicles, energy-efficient warehousing, and optimized transportation routes, to reduce carbon footprints and comply with environmental regulations. This aligns with growing industry and government pressure to adopt greener supply chain practices.

The global chemical logistics market is projected to reach US$ 300.5 Bn in 2025, driven by chemical production growth.

Strict international standards such as REACH, OSHA, and GHS drive the need for compliant storage, handling, and transport systems, pushing logistics providers to adopt advanced tracking and safety technologies.

The market is poised to witness a CAGR of 5.2% from 2025 to 2032, supported by digital logistics innovations.

Digital tracking and cold chain chemical logistics offer opportunities for pharmaceutical and specialty chemical transport.

DHL, BASF, C.H. Robinson, DB Schenker, and A&R Logistics lead through advanced chemical logistics solutions.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Chemical Type

By Service Type

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author