ID: PMRREP36032| 210 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

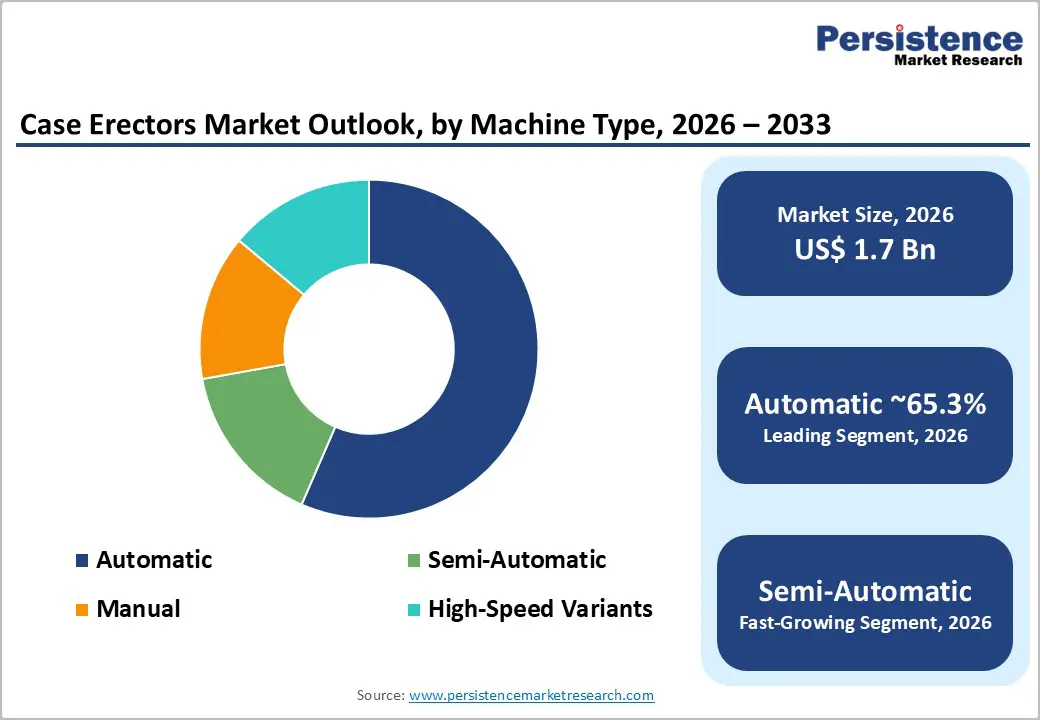

The global case erectors market size is likely to be valued at US$1.7 billion in 2026 and is expected to reach US$2.5 billion by 2033, growing at a CAGR of 5.5% between 2026 and 2033, driven by accelerating end-of-line automation investments, rapid growth in e-commerce parcel volumes, and increasingly stringent food and pharmaceutical packaging regulations that require consistent and validated case formation.

Volatility in corrugated material quality and supply chains further strengthens demand for advanced case erectors that minimize waste, improve first-pass yields, and ensure operational reliability across high-mix production environments.

| Key Insights | Details |

|---|---|

| Case Erectors Market Size (2026E) | US$1.7 Bn |

| Market Value Forecast (2033F) | US$2.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.0% |

Investments in packaging automation continue to rise as manufacturers seek higher throughput, operational flexibility, and resilience against supply chain and labor disruptions. Growth in e-commerce has significantly increased SKU complexity and order variability, requiring secondary packaging lines capable of rapid changeovers and consistent output quality. Integration of smart sensors, robotics, and Industry 4.0 connectivity into case erecting systems enables predictive maintenance, reduces unplanned downtime, and improves overall equipment effectiveness. As a result, manufacturers are allocating a larger share of capital expenditure toward end-of-line automation, accelerating the adoption of automatic and servo-driven case erectors and shortening payback periods for companies transitioning from semi-automatic platforms.

Persistent labor shortages across manufacturing and distribution facilities are creating a strong economic case for reducing manual case handling. Rising labor costs and workforce turnover increase the total cost of ownership of manual packaging operations while also elevating workplace safety risks. Automated and robotic case erectors enable manufacturers to maintain throughput with fewer operators, improve ergonomics, and reduce repetitive-motion injuries. These advantages are particularly relevant for multi-SKU and random-sequence production environments such as co-packing facilities and distribution centers. Demand is therefore shifting toward robotic and auto-adjusting case erectors that minimize operator intervention and support scalable production.

Automatic, robotic, and servo-driven case erectors require significantly higher upfront investment than manual or semi-automatic alternatives. For small and many mid-sized manufacturers, the complexity of retrofitting these systems into existing production lines presents additional cost and integration challenges. Compatibility with upstream fillers and downstream sealers or palletizers often necessitates the involvement of system integrators, extending installation timelines and delaying returns on investment. Adoption is commonly postponed when automation investments exceed approximately 20-25% of a facility’s total capital budget.

Inconsistencies in corrugated board strength, moisture levels, and blank tolerances can negatively affect case erector performance, increasing jam rates and downtime if machines lack advanced sensing and handling capabilities. Supply disruptions in pulp and linerboard markets often force manufacturers to substitute materials, requiring additional tuning and maintenance. These recurring operational adjustments raise service costs and can reduce perceived automation benefits, particularly for manufacturers operating in cost-sensitive or high-volume environments.

A large installed base of manual and semi-automatic case erecting stations presents a near-term growth opportunity through modular upgrades. Retrofit solutions such as robotic add-ons, automatic adjustment kits, and IoT-enabled monitoring systems allow manufacturers to enhance performance without full line replacement. In mature markets, retrofit spending can represent approximately 20-30% of annual packaging equipment investment. Offering standardized, plug-and-play upgrades, supported by remote diagnostics and flexible financing models, enables faster sales cycles and lowers customer capital barriers.

Manufacturers increasingly prioritize uptime, creating demand for service-based business models. Cloud-enabled monitoring, predictive maintenance, and remote troubleshooting transform case erectors from one-time capital assets into long-term value platforms. Subscription-based services reduce the total cost of ownership for end users while generating recurring revenue for equipment suppliers. Over the lifecycle of installed machines, service subscriptions and spare-parts programs can contribute an additional 5-8% in cumulative revenue per unit.

Automatic case erectors are anticipated to account for approximately 65.3% of market share in 2026, reflecting their dominant role in high-throughput and large-scale packaging operations. Their ability to deliver consistent output with minimal operator intervention makes them the preferred choice for medium-to-large manufacturers seeking efficiency, reliability, and rapid payback on automation investments. Food and beverage producers, pharmaceutical manufacturers, and large e-commerce fulfillment centers favor automatic systems for continuous operation, precise case forming, and seamless integration with conveyors, sealers, and robotic packaging cells. Modern automatic case erectors increasingly incorporate robotic arms for random-sequence case erecting, vision systems for blank detection, and auto-adjust mechanisms capable of format changes in under 30 seconds. These capabilities are particularly valuable in high-mix, low-volume environments where frequent SKU changes are common. For example, beverage bottlers handling multiple pack sizes and e-commerce warehouses processing diverse order profiles rely on automatic erectors to maintain throughput while reducing corrugated waste and first-pass rejects.

Semi-automatic case erectors represent the fastest-growing machine type, driven by adoption among mid-sized manufacturers and facilities in emerging markets that are transitioning toward higher levels of automation. These systems require lower upfront capital investment, simpler line integration, and minimal floor-space modifications while still delivering meaningful improvements in productivity and labor efficiency. As a result, they are well-suited for companies seeking incremental automation rather than full line replacement. Features such as assisted bottom folding, automatic tape or glue application, and ergonomic case loading enable semi-automatic machines to reduce manual effort and improve consistency. They are commonly adopted by regional food processors, contract packers, and consumer goods manufacturers as an intermediate step toward fully automatic lines. Growth in this segment is supported by rising labor costs, expanding manufacturing capacity in the Asia Pacific, and the increasing availability of leasing and equipment-financing programs, which lower adoption barriers for small and mid-sized enterprises.

The food and beverage industry is anticipated to maintain its position as the largest end-use segment, accounting for approximately 37.6% of the market share in 2026. Consistent and reliable case formation is critical in this sector to meet food safety regulations, preserve cold-chain integrity, and ensure uniform retail presentation. High SKU proliferation across beverages, packaged foods, dairy, and frozen products places significant demands on packaging lines, driving sustained investment in advanced case erecting solutions. Case erectors used in food and beverage applications are often designed with hygienic construction, stainless-steel components, wash-down capability, and validated sealing systems to support traceability and compliance requirements. For example, beverage manufacturers running multiple bottle and can formats rely on quick-change case erectors to maintain line efficiency, while frozen food producers depend on robust case forming to withstand cold-chain handling and distribution stresses.

E-commerce and retail are the fastest-growing end-use industries for case erectors, fueled by rising parcel volumes, shorter delivery timelines, and increasingly decentralized fulfillment networks. Distribution centers and third-party logistics providers are rapidly adopting robotic, random-sequence case erectors capable of forming multiple case sizes on demand, enabling right-sized packaging that reduces void fill and dimensional-weight shipping costs. Demand in this segment strongly favors flexible, quick-change solutions that integrate seamlessly with inline printing, labeling, and coding systems. For example, large omnichannel retailers and regional fulfillment hubs deploy automated case erecting systems to handle mixed-SKU orders while maintaining throughput during peak seasons. As same-day and next-day delivery models expand, e-commerce operators continue to invest in case erectors that support high variability, scalability, and operational resilience.

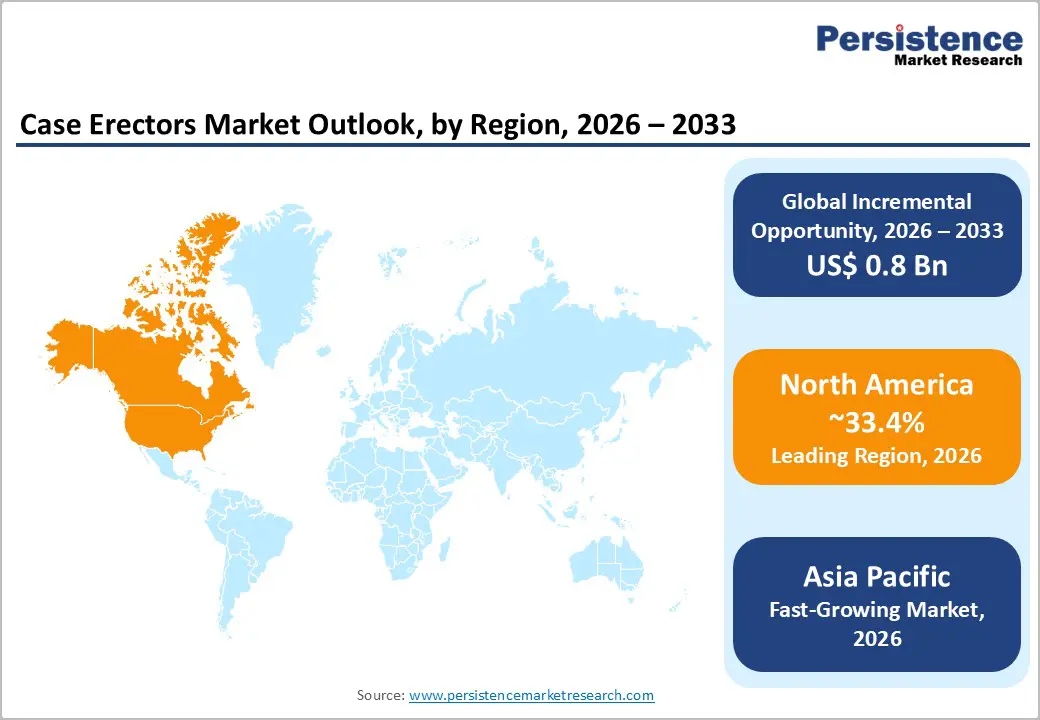

North America is projected to remain the largest regional market, accounting for over 33.4% of global demand in 2026, supported by high automation maturity and sustained capital investment in end-of-line packaging systems. The U.S. dominates regional performance due to its large consumer packaged goods (CPG) manufacturing base, advanced logistics infrastructure, and deep penetration of e-commerce and omnichannel retail. Major food and beverage players such as PepsiCo, Coca-Cola, and General Mills continue to upgrade end-of-line operations, driving demand for high-speed automatic case erectors that integrate seamlessly with robotic palletizing and warehouse automation systems.

Key growth drivers include rapid expansion of omnichannel fulfillment, persistent labor shortages, and rising wage levels, particularly in warehousing and food processing. These dynamics have accelerated the adoption of robotic and servo-driven case erecting systems supplied by companies such as ProMach, BW Packaging, and Massman Automation, which offer fully integrated end-of-line solutions and strong aftermarket support. Regulatory emphasis on food safety, pharmaceutical serialization, and equipment energy efficiency, reinforced by FDA and OSHA guidelines, continues to favor modern, enclosed, and traceable packaging machinery. Investment trends also show ongoing consolidation among OEMs and system integrators, exemplified by ProMach’s continued portfolio expansion, enabling broader turnkey capabilities and long-term service contracts across the region.

Europe represents a mature but steadily growing market, characterized by strong engineering capabilities and high regulatory compliance requirements. Demand is concentrated in Germany, the U.K., France, Italy, and Spain, where food processing, pharmaceuticals, and industrial goods manufacturing remain resilient. Germany leads the region in high-precision automation and Industry 4.0 adoption, with companies such as KHS, Syntegon Technology, and SOMIC Packaging supplying advanced case erecting and end-of-line solutions optimized for speed, reliability, and digital connectivity.

Sustainability and regulatory harmonization across the European Union are key demand drivers, encouraging investments in machines that minimize corrugated board usage, reduce energy consumption, and support recyclability targets. Case erectors capable of right-sizing cases and reducing void fill align closely with EU circular economy objectives and Extended Producer Responsibility (EPR) regulations. In the U.K., growth in e-commerce and third-party logistics has driven demand for flexible, modular systems, while Southern European markets increasingly favor retrofit and mid-speed solutions to modernize existing lines. Strategic partnerships between OEMs and local system integrators help ensure compliance with regional standards while supporting multi-country deployments and service coverage.

Asia Pacific is likely to be the fastest-growing regional market, driven by rapid industrialization, expanding domestic consumption, and accelerating automation adoption among small- and mid-sized manufacturers. China leads the region in absolute demand, supported by large-scale food, beverage, and consumer goods production, as well as a highly developed e-commerce ecosystem. Local and international suppliers such as Shanghai Electric, Youngsun Machinery, and Krones China are expanding offerings of cost-competitive automatic and semi-automatic case erectors tailored to high-volume operations.

Japan continues to emphasize high-precision, high-speed systems, with manufacturers such as Ishida and Fuji Machinery focusing on compact designs and advanced control systems suited for space-constrained facilities. India and ASEAN countries are experiencing strong growth in mid-speed and semi-automatic machines as manufacturers transition from manual packing toward incremental automation. This trend is reinforced by rising labor costs, government-led manufacturing initiatives, and increasing availability of locally manufactured equipment. Growth is further supported by nearshoring strategies, expanding fulfillment infrastructure, and flexible financing models, positioning Asia Pacific as a critical long-term growth engine for case erector suppliers that invest in regional service networks and adaptable product portfolios.

The global case erectors market is moderately fragmented. Global equipment manufacturers dominate the automatic and robotic segments, while numerous regional suppliers serve semi-automatic and manual applications. Competitive differentiation is based on throughput capacity, changeover speed, integration with robotics and digital systems, and strength of aftermarket service offerings. Partnerships with system integrators play a critical role in delivering turnkey packaging solutions.

Recent years have seen increased emphasis on robotic case erecting solutions with automatic adjustment features, enabling high-mix and random-sequence operations. Industry consolidation through acquisitions has expanded product portfolios and strengthened service capabilities. Incremental innovations focused on assisted changeovers and operator support continue to lower skill requirements and improve deployment across diverse production environments.

Leading companies emphasize modular product design, robotics integration, digital connectivity, and recurring service models. Financing options, retrofit programs, and targeted acquisitions are widely used to expand market reach. Key differentiators include fast format changeovers, high equipment uptime, and robust regional service networks.

The global case erectors market is valued at US$1.7 billion in 2026.

By 2033, the case erectors market is projected to reach US$2.5 billion.

Key trends include rising adoption of fully automatic and servo-driven case erectors, growing demand for robotic and random-sequence case forming, increased focus on labor reduction and throughput optimization, and expanding use of flexible, quick-change machines to support high SKU diversity, particularly in food, beverage, and e-commerce fulfillment operations.

By machine type, automatic case erectors lead the market, accounting for approximately 65.3% of total demand, driven by high-speed performance, consistent case quality, and strong ROI in medium-to-large-scale manufacturing and distribution facilities.

The case erectors market is expected to grow at a CAGR of 5.5% between 2026 and 2033.

Major players include Cama Group, Marchesini Group, A-B-C Packaging Machine Corporation, Brenton (ProMach), and Econocorp.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Machine Type

By Operation Speed

By End-Use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author